Chapter 1

From Operational Excellence to Strategic Vision

"As technology transforms banking from the inside out, IT teams must step beyond operational roles to become strategic navigators of innovation." — Brett King, Banking Futurist and Founder of Moven

This opening chapter underscores the critical shift IT professionals in banking must make from a purely operational role—focused on service uptime and cost efficiency—to a visionary one that drives long-term business value. By examining the philosophical roots of strategic thinking, readers will understand how mindset, culture, and leadership each play a part in fueling innovation. The chapter also unveils conceptual frameworks that blend operational excellence with strategic ambition, offering specific, real-world examples of banks that have successfully bridged the gap. Through practical insights on aligning with corporate goals, cultivating a culture of forward thinking, and anticipating emerging trends, this chapter sets the stage for the broader transformation journey discussed in subsequent chapters.

1.1. Reexamining the Role of IT in Banking

The role of Information Technology (IT) in the banking sector is undergoing a transformative shift—from merely enabling operations to actively shaping strategic vision. This evolution challenges traditional notions of IT as a support function and places it at the forefront of innovation, cultural change, and societal advancement. By examining philosophical, conceptual, and practical dimensions, banks can reimagine how IT drives value creation, fosters organizational growth, and aligns with broader ethical and social imperatives.

IT has historically been viewed as a supportive element, tasked with ensuring systems run smoothly. However, an emerging perspective positions IT as central to developing business models and shaping competitive strategies. Far from merely automating tasks, modern IT initiatives elevate human potential by unlocking new avenues for creativity and strategic differentiation (Smith and Johnson 2020). Philosophically, this transition aligns with a broader understanding of technology as a transformative force that fosters progress, rather than a background utility.

Figure 1: IT transformation from support to strategy for continuous innovation.

When IT is recognized as a strategic enabler, it can profoundly influence the culture within banking institutions. Leaders who champion IT in strategic dialogues encourage experimentation, interdepartmental collaboration, and a willingness to question traditional ways of doing business (Deloitte 2022). This cultural shift empowers IT teams to challenge outdated processes, introduce agile methods, and position the bank as an innovator in a rapidly evolving financial landscape.

Elevating IT to a strategic level also brings heightened responsibility. As banks deploy digital solutions that reach a broad spectrum of customers, the potential for ethical pitfalls increases. Data privacy, financial inclusion, and responsible AI usage become central considerations in the deployment of new technologies (PwC 2023). By acknowledging this moral imperative, banks can maintain public trust, contribute to equitable financial services, and uphold transparent practices that serve diverse communities responsibly.

In academic discourse, technology adoption in banking is frequently linked to economic growth and the reduction of inequality, suggesting that progressive IT-driven initiatives can enhance societal well-being (Smith and Johnson 2020). From microfinance platforms to digital wallet solutions, these innovations enable underserved populations to participate in the financial ecosystem. By viewing IT as a catalyst for societal progress, banks can look beyond immediate profitability and invest in solutions that generate long-term, inclusive value.

A decade ago, IT expenditures were often perceived as overhead costs, aimed primarily at maintaining core systems. Today, extensive research indicates that banks with robust digital strategies see higher profitability, improved customer retention, and enhanced brand reputation (McKinsey 2021). Consequently, IT is moving from a “back-office expense” into an active contributor to revenue generation, with its value measured not only in cost savings but also in customer lifetime value, cross-selling opportunities, and innovation-led growth.

Modern banking value chains involve complex interactions across product development, risk management, compliance, and customer experience. Rather than being siloed, IT now permeates each step, enhancing operational efficiency and informing strategic decisions (Morgan Stanley 2023). From onboarding and personalized customer servicing to predictive analytics and real-time compliance, the systemic influence of IT underscores its role as a critical connective tissue within banks.

Academic and industry thought leaders emphasize the need for IT and business strategies to be tightly intertwined. Effective alignment requires IT to be part of high-level decision-making forums, enabling the technology agenda to evolve alongside the bank’s core objectives (Deloitte 2022; Smith and Johnson 2020). This necessitates new governance structures where Chief Information Officers (CIOs) and Chief Technology Officers (CTOs) actively contribute to setting growth targets, shaping product portfolios, and determining risk appetites.

Another conceptual evolution is the pivot to customer-centric design. Banks are increasingly leveraging real-time data analytics and AI-powered personalization to deliver more relevant products and services (McKinsey 2021). By placing customers at the heart of technological innovation, IT groups help create seamless, engaging experiences, from mobile banking apps with intuitive interfaces to tailored financial recommendations powered by machine learning.

Despite collecting large volumes of transactional and customer data, many banks underutilize these resources. Advanced analytics—ranging from machine learning to predictive modeling—can generate valuable insights for personalized product development, proactive fraud detection, and real-time credit risk assessment (PwC 2023). By embedding analytics into everyday decision-making processes, banks can differentiate themselves in a crowded marketplace.

IT departments can lead the development of digital-first products such as mobile wallets, automated advisory platforms, and customized investment solutions. These innovations resonate with a clientele that values convenience, speed, and personalization (Morgan Stanley 2023). Moreover, chatbot and robo-advisor technologies offer around-the-clock support, lowering operational costs while boosting customer engagement.

Routine and repetitive tasks can be automated through Robotic Process Automation (RPA) and AI-driven workflows. This frees up talent for strategic initiatives and improves the overall agility of the bank (Deloitte 2022). By systematically identifying and automating the most labor-intensive processes, IT teams can unlock cost savings and enhance customer responsiveness—key factors in an intensely competitive environment.

Many banks grapple with legacy systems that are functionally stable but technologically outdated. Transitioning to modern, cloud-based architectures requires careful planning to ensure that critical functions remain uninterrupted (Smith and Johnson 2020). By devising phased migration strategies, using secure application programming interfaces (APIs), and leveraging modular design principles, IT can help banks maintain operational continuity while transforming their technological core.

In an era of heightened regulatory scrutiny, IT must evolve from being a defensive mechanism to a proactive force in risk management. Advanced analytics enable real-time monitoring of transactions, while RegTech solutions streamline compliance reporting and reduce the burden of manual checks (PwC 2023). By staying ahead of regulatory changes and leveraging predictive insights, banks can transform compliance from a necessary cost into a strategic advantage.

Finally, the potential for IT-led transformation is maximized when technology teams work hand-in-hand with other critical functions such as marketing, risk, compliance, and product development. This cross-functional synergy promotes data-driven insights and shared performance indicators, ensuring that strategic goals are advanced cohesively across the institution (McKinsey 2021). It also underscores the need for IT leadership that fosters open dialogue, champions interdisciplinary teams, and drives a collective commitment to innovation.

By reframing IT’s role from a behind-the-scenes facilitator to a prominent strategic driver, banks can unlock new forms of value creation and customer engagement. This shift is underpinned by a philosophical recognition of technology’s transformative power, a conceptual realignment of IT within the banking value chain, and practical solutions that address immediate operational gaps. Embracing this expanded perspective on IT in banking not only benefits financial institutions in terms of profitability and market positioning, but also aligns with broader societal goals of inclusion, transparency, and responsible innovation.

1.2. Operational Excellence vs. Strategic Vision

Successfully navigating the interplay between day-to-day operational stability and long-term visionary initiatives is a core challenge for contemporary banking IT. While operational excellence ensures reliability, security, and regulatory compliance, an overarching strategic vision propels banks toward innovation and market leadership. Striking this balance is not merely a matter of resource allocation; it demands a philosophical, conceptual, and practical framework that acknowledges the importance of both short-term imperatives and far-reaching aspirations.

IT leaders in banking operate under a dual mandate: ensuring uninterrupted mission-critical operations—such as transaction processing and core system stability—while boldly advancing new technological frontiers (Deloitte 2022). Philosophically, this tension extends beyond operational tasks and compels a shift in thinking from doing things right (efficiency, compliance) to doing the right things (innovation, future-proofing). Managing this dual imperative means acknowledging that every incremental improvement to existing systems can either constrain or catalyze transformative change.

Figure 2: Foundations to balance the operational excellence with a compelling strategic vision.

The ethos of balance entails upholding customer trust through reliable systems while still taking measured risks to explore new markets and product offerings (KPMG 2023). An unwavering commitment to transparency and security is central to sustaining public confidence in banking institutions. Yet, the pursuit of new technologies—be it AI-driven customer insights or blockchain-based settlements—reflects an equally critical ethical imperative to remain adaptive and beneficial to society. This dual focus underscores that operational stability and progressive innovation must coexist harmoniously, grounded in the banking sector’s fiduciary responsibilities.

Achieving operational excellence without stifling creativity hinges on leadership that values both day-to-day execution and visionary thinking. A culture where efficiency is celebrated alongside “out-of-the-box” experimentation signals that reliability and innovation are equally vital (Deloitte 2022). Leaders who embody this mindset encourage cross-functional collaboration, support agile pilot projects, and embed continuous improvement practices into every layer of the organization. This dual emphasis ensures that operational teams do not become complacent, and innovators do not lose sight of regulatory and customer-service fundamentals.

Overemphasizing daily operational metrics can lead to “maintenance myopia”—a tunnel vision focused on incremental improvements at the cost of strategic renewal. Conversely, disproportionate attention to futuristic visions can undermine core stability and, in turn, erode trust. Philosophically, the task is to integrate these horizons: ensuring financial institutions remain robust and ethically grounded today, while actively shaping the banking landscape of tomorrow (KPMG 2023). Rather than viewing operational and strategic aims as competing priorities, successful IT leaders see them as complementary dimensions of sustainable growth.

On a conceptual level, IT work spans a broad spectrum—from highly tactical concerns, such as incident response and patch management, to expansive strategic endeavors, including digital transformation and customer-driven innovation (McKinsey 2021). Each point on this continuum requires distinct resource allocation, governance structures, and skill sets. Effectively balancing these varied demands highlights the need for flexible frameworks that respond to both immediate necessities and evolving marketplace opportunities.

Academic literature describes “organizational ambidexterity” as the capacity to excel at both incremental improvements (exploitation) and radical innovation (exploration) (Smith and Johnson 2022). For banking IT, exploitation translates to optimizing current systems—enhancing performance, reliability, and security—while exploration involves experimenting with emerging technologies and potentially disruptive business models. The challenge lies in simultaneously refining existing infrastructures and devising new avenues for growth, ensuring neither aspect diminishes the other.

Conceptually, the IT function intersects every stage of the banking value chain, from front-end customer onboarding to back-end settlement processes. Balancing operational tasks with growth-focused initiatives requires that each segment of this chain remains stable while adopting iterative enhancements and new functionalities (Deloitte 2022). Such integration allows financial institutions to implement robust solutions that serve present needs while laying the groundwork for AI-driven analytics, real-time fraud detection, or blockchain-based settlements in the near future.

Fintech disruptors, changing customer expectations, and global economic shifts press banks to continuously update service delivery. As these external pressures mount, banks must weigh the imperative for immediate operational reliability against the need for continuous innovation (McKinsey 2021). Thus, IT strategies must be fluid enough to anticipate and adapt to market forces—whether that entails launching mobile-first platforms, leveraging cloud-based solutions, or partnering with external fintechs.

Many banks formalize this balance by creating separate structures for “run the bank” (operations, maintenance, compliance) and “change the bank” (innovation, transformation). While these dedicated teams clarify priorities, they also require strong governance to avoid silos that hinder collaboration (Smith and Johnson 2022). Steering committees, portfolio management techniques, and agile project methodologies can help unify these diverse focuses under a coherent strategic vision.

Translating philosophical and conceptual insights into tangible action requires measurement. A dual KPI model encompasses both operational and innovation metrics (PwC 2023). Operational KPIs may include system uptime, incident resolution time, transaction speed, and regulatory compliance scores. Innovation KPIs might track pilot launches, new product adoption rates, time-to-market for emerging services, and revenue from digital channels. This approach ensures that operational excellence is maintained without eclipsing the pursuit of transformative initiatives.

Leading institutions employ balanced scorecards that align operational reliability with strategic growth targets (McKinsey 2021). Real-time dashboards enable continuous monitoring of critical systems, while also tracking the progress of innovation projects. By visualizing these two domains side by side, decision-makers can quickly identify bottlenecks—such as excessive incident rates that delay innovation timelines—and recalibrate resources as needed.

Banks that excel at harmonizing operational excellence and strategic innovation frequently rely on iterative feedback loops. Monthly or quarterly reviews inform the reallocation of budgets, the reprioritization of projects, and the refinement of strategic goals (PwC 2023). Agile ceremonies, including sprints and retrospectives, integrate operational data to highlight areas needing immediate attention and strategic data to gauge the viability of new ventures. This cyclical approach ensures continuous alignment with both current demands and future objectives.

Empowering employees to manage operational tasks while engaging in cutting-edge initiatives requires robust skill development programs. Practical metrics include proficiency in emerging technologies (e.g., AI, DevOps) and adherence to service level agreements (SLAs) for daily operations (Smith and Johnson 2022). Linking performance incentives to a dual metric system—one that rewards both stability and creativity—fosters an organizational culture in which routine excellence and transformative thinking are equally esteemed.

Any practical KPI framework must be sensitive to the stringent regulations governing the banking sector. While operational measures often focus on compliance and risk mitigation, innovation metrics must account for regulatory boundaries and the bank’s defined risk appetite (KPMG 2023). Incorporating “compliance by design” principles in new product development ensures that progress does not jeopardize the institution’s legal standing or customer trust. Ultimately, this underscores the necessity of a balanced approach that respects both the security of present systems and the promise of future technologies.

A dual KPI model is not static. As new technologies emerge and market conditions shift, banks must revisit and refine their operational and innovation measures. Periodic reviews that compare measured outcomes against strategic ambitions promote a cycle of learning and adaptation (PwC 2023). Operational glitches inform process enhancements, while unsuccessful pilot initiatives guide the recalibration of innovation strategies. Such a continuous improvement mindset enables banks to thrive in fast-evolving landscapes, solidifying their position as both reliable and forward-thinking institutions.

Balancing operational excellence with a compelling strategic vision is pivotal for banks seeking sustainable growth. Philosophically, it involves reconciling daily reliability with bold experimentation. Conceptually, it requires embracing organizational ambidexterity, integrating IT across the value chain, and responding swiftly to competitive pressures. Practically, it hinges on a robust measurement framework that values continuity and creativity equally. By weaving these threads together, banking institutions can maintain the trust of today’s customers while preparing to meet the demands of tomorrow’s digital finance ecosystem.

1.3. Philosophical Underpinnings of Strategic Thinking in IT

Strategic thinking in banking IT extends beyond adopting new technologies or streamlining operations; it involves a deeper philosophical shift that positions technology as a catalyst for growth, transformation, and societal impact. By embracing a growth mindset and reimagining technology’s role, IT leaders can drive sustainable innovation that benefits both their organizations and the communities they serve.

Historically, many IT departments in banks have been relegated to reactive roles, solving immediate technical issues as they arise. However, a growth mindset redefines IT as a forward-thinking function, one that anticipates market trends and identifies new opportunities to create value (Smith and Johnson 2021). In this paradigm, learning becomes a continuous, organization-wide activity, reflecting the principles of “learning organizations” that view adaptation and knowledge-sharing as cornerstones of long-term resilience.

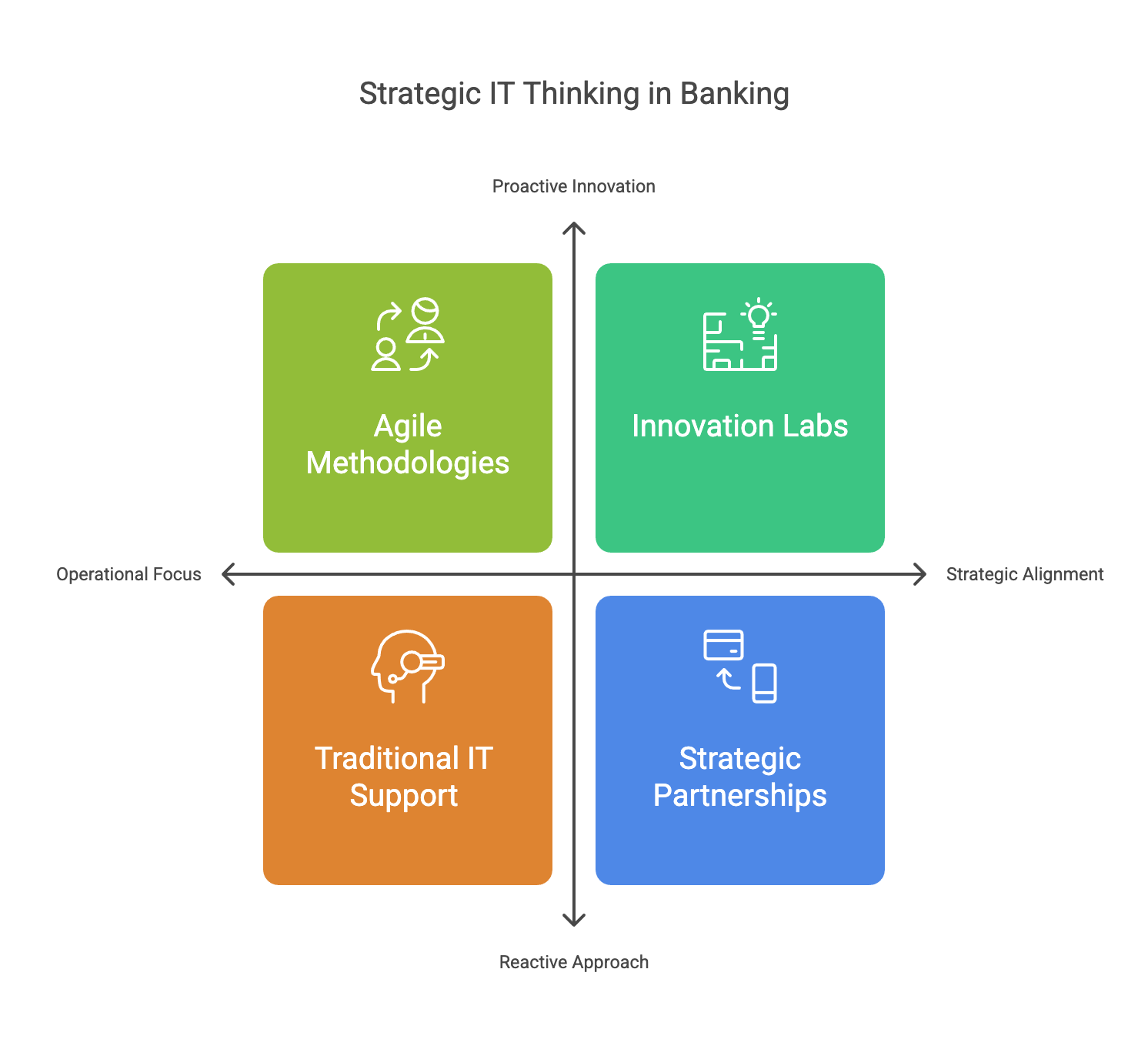

Figure 3: Strategic thinking in IT proactive innovation and strategic alignment.

Viewing technology purely as a tool underestimates its potential to radically reshape banking models. When leadership regards IT as the “engine” driving business transformation, technology initiatives become central to strategic planning rather than peripheral support tasks (Deloitte 2022). This philosophical stance also foregrounds ethical considerations: if technology can enable financial inclusion, enhance customer experiences, and streamline regulatory compliance, then banks are morally compelled to deploy it responsibly and equitably.

A growth mindset encourages teams to treat setbacks not as failures but as learning opportunities. This mindset shift requires challenging deeply ingrained norms and established comfort zones, a process that can often be met with resistance (Smith and Johnson 2021). Yet, embracing technologies such as blockchain, artificial intelligence, or open APIs demands a willingness to step into uncharted territory. Philosophically, IT professionals must cultivate resilience, curiosity, and a tolerance for calculated risk—all of which fuel ongoing innovation.

Banks adopting a growth mindset balance economic imperatives with broader societal objectives. Whether that involves developing microfinance platforms for underserved markets or introducing gamified financial literacy apps, these endeavors enhance both brand loyalty and organizational adaptability (PwC 2023). By aligning technology investments with social good, banks can create stronger community ties, reaffirm their ethical commitments, and ultimately thrive in volatile economic landscapes.

Conceptually, IT leaders need a seat at the highest decision-making tables to effectively shape corporate strategy. In many advanced institutions, CIOs and CTOs participate in executive committees to advocate for technology roadmaps that align with overarching business goals (KPMG 2023). This structural integration prevents siloed planning and positions technology as an essential driver of revenue growth, operational efficiency, and risk mitigation.

The creation of a unified vision across leadership teams clarifies how digital transformation, data analytics, and next-generation platforms support the bank’s core objectives (Smith and Johnson 2021). When IT strategies are co-developed with business units, risk managers, and marketing leaders, potential conflicts around resources, timelines, and risk appetites are identified early. This alignment streamlines execution and ensures that each initiative contributes to a cohesive transformation agenda.

From onboarding to settlement, every facet of the banking value chain now depends on digital enablement (Deloitte 2022). Conceptually, effective synergy means treating IT as the linchpin that connects diverse operational and strategic components. Real-time data analytics in retail banking can inform wholesale lending practices, while insights from compliance systems can guide product innovation. By weaving technology seamlessly through the value chain, banks boost agility and sharpen their competitive edge.

In an era of fintech disruptors and rapidly shifting customer expectations, corporate strategies increasingly depend on the ability to innovate. Many institutions formalize this approach through internal “centers of excellence,” innovation labs, or strategic partnerships with technology startups (McKinsey 2021). Embedding IT within these vehicles of innovation ensures that prototypes are technically sound, swiftly tested, and aligned with compliance requirements—thus accelerating the pace from conceptual design to full deployment.

Aligning IT and corporate strategy also involves advanced risk management frameworks. Launching AI-driven underwriting models or blockchain-based settlements, for instance, demands rigorous review of regulatory, operational, and reputational risks (KPMG 2023). Conceptually, synergy between IT governance and corporate strategy guarantees that innovation proceeds at a pace that balances market opportunities with security, trust, and legal obligations.

Design thinking offers a structured, human-centric approach to product development, encouraging empathy with end users, rapid prototyping, and continuous iteration. By transforming lofty strategic objectives into tangible prototypes, banks can quickly gauge what resonates with customers—whether reimagined mobile apps, integrated payment solutions, or reconfigured branch experiences (PwC 2023). This shift from abstract to concrete not only mitigates risk but also expedites time-to-market.

Traditional waterfall methodologies often struggle to keep pace with evolving technologies and market demands. Agile approaches like Scrum or Kanban empower banks to release incremental updates, gather customer feedback, and refine services in real time (Smith and Johnson 2021). By managing projects in smaller sprints, IT teams can pivot swiftly in response to new regulations, emerging technologies, or shifts in consumer behavior.

Increasingly, banks are establishing “innovation pods” or labs to incubate disruptive ideas without compromising daily operations. Operating under lean budgets and flexible hierarchies, these teams experiment with cutting-edge technologies—such as AI-driven chatbots or blockchain-based smart contracts—in a controlled environment (Deloitte 2022). With a fail-fast mentality, these pods filter out unviable concepts early, and successful pilots can then be scaled across the institution.

Whether experimenting with new analytics tools or redesigning digital channels, collaboration between compliance, risk management, marketing, and IT is critical (KPMG 2023). Bringing diverse expertise to the table ensures that prototypes meet regulatory standards, align with brand messaging, and integrate seamlessly into existing systems. Cross-functional squads reduce silos and foster ownership, accelerating the transition from proof-of-concept to full deployment.

Effective experimentation hinges on clear metrics that gauge the value and viability of pilots. Examples include the number of Minimum Viable Products (MVPs) launched, time-to-market metrics, and customer satisfaction scores for new features (McKinsey 2021). By reviewing these indicators regularly, banks can decide which ventures to invest in further and which to discontinue, creating a feedback loop that fuels ongoing learning and resource optimization.

Converting promising pilots into large-scale implementations requires robust frameworks for budget allocation, risk assessment, and resource planning. Without formal escalation paths, innovative concepts can languish in “pilot purgatory,” failing to deliver meaningful returns (PwC 2023). By standardizing how successful experiments are transferred from the lab to the core business, banks can rapidly integrate new capabilities into mainstream operations, thereby maximizing their innovation investments.

In sum, the philosophical underpinnings of strategic thinking in IT are grounded in a growth mindset and the recognition that technology can be a profound agent of change. Conceptually, this translates into tighter alignment between IT leadership and corporate strategy, enabling banks to foster a culture that values continuous innovation. Practically, frameworks such as design thinking and agile methodologies serve as tangible tools for experimenting, measuring outcomes, and scaling successes. By weaving these threads together, IT professionals and banking executives can develop robust, future-focused ecosystems that deliver both operational excellence and transformative impact.

1.4. Conceptual Framework for Transition

Transitioning from operationally focused IT to a model that embraces strategic vision and ambidextrous innovation requires a structured, multidimensional approach. By reimagining IT as a strategic partner, adopting organizational ambidexterity, and setting up cross-functional frameworks, banks can ensure they remain competitive and future-ready. This section explores the philosophical reorientation of IT as a strategic contributor, outlines the conceptual underpinnings of ambidexterity, and provides practical steps for embedding these ideas within banking operations.

For decades, banks have perceived their IT departments predominantly as cost centers. Reducing overhead was often the primary objective, with limited recognition of technology’s capacity to propel innovation (PwC 2023). Philosophically, reframing IT as a strategic partner alters this narrative by demonstrating how technology can stimulate revenue generation, competitive differentiation, and market expansion (Deloitte 2022). Achieving this shift often begins at the executive level, where leaders must not only endorse but also actively advocate for IT’s central role in delivering long-term growth.

Elevating IT from a back-office function to the “engine” of strategic development involves cultivating a culture that celebrates technological investment as a driver of both customer and shareholder value (KPMG 2023). This perspective demands a forward-looking mindset where every technology spend is tied to broader strategic objectives, whether that is improving customer satisfaction, accelerating product launches, or strengthening operational resilience. Such a cultural reset ensures IT initiatives are no longer viewed in isolation but are integral to the bank’s overarching mission.

When IT is seen strictly as a cost center, success is typically measured by uptime and issue resolution. As a strategic partner, the scope of accountability broadens to include revenue growth, margin improvement, and elevated customer experiences (Smith and Johnson 2022). This philosophical stance promotes greater transparency in budgeting, resource allocation, and performance tracking. IT teams become co-stakeholders in business outcomes, driving them to work more closely with marketing, product, and finance units to generate synergistic results.

Finally, reframing IT’s role also extends its moral and societal responsibilities. Strategic IT functions often prioritize initiatives that foster financial inclusion, protect consumer data, and contribute to sustainable development (PwC 2023). Rather than simply maintaining systems, IT professionals become advocates for ethical innovation, embedding principles of integrity, privacy, and inclusivity into the very fabric of technology projects.

In academic discourse, “ambidexterity” describes an organization’s ability to simultaneously optimize existing processes (exploitation) while exploring new opportunities (exploration). Banks exemplify this need: they must ensure daily operations remain stable, compliant, and cost-effective even as they invest in forward-looking technologies like AI-driven lending or blockchain-based settlements (Deloitte 2022). Conceptually, ambidexterity underscores the necessity of managing these dual objectives in harmony.

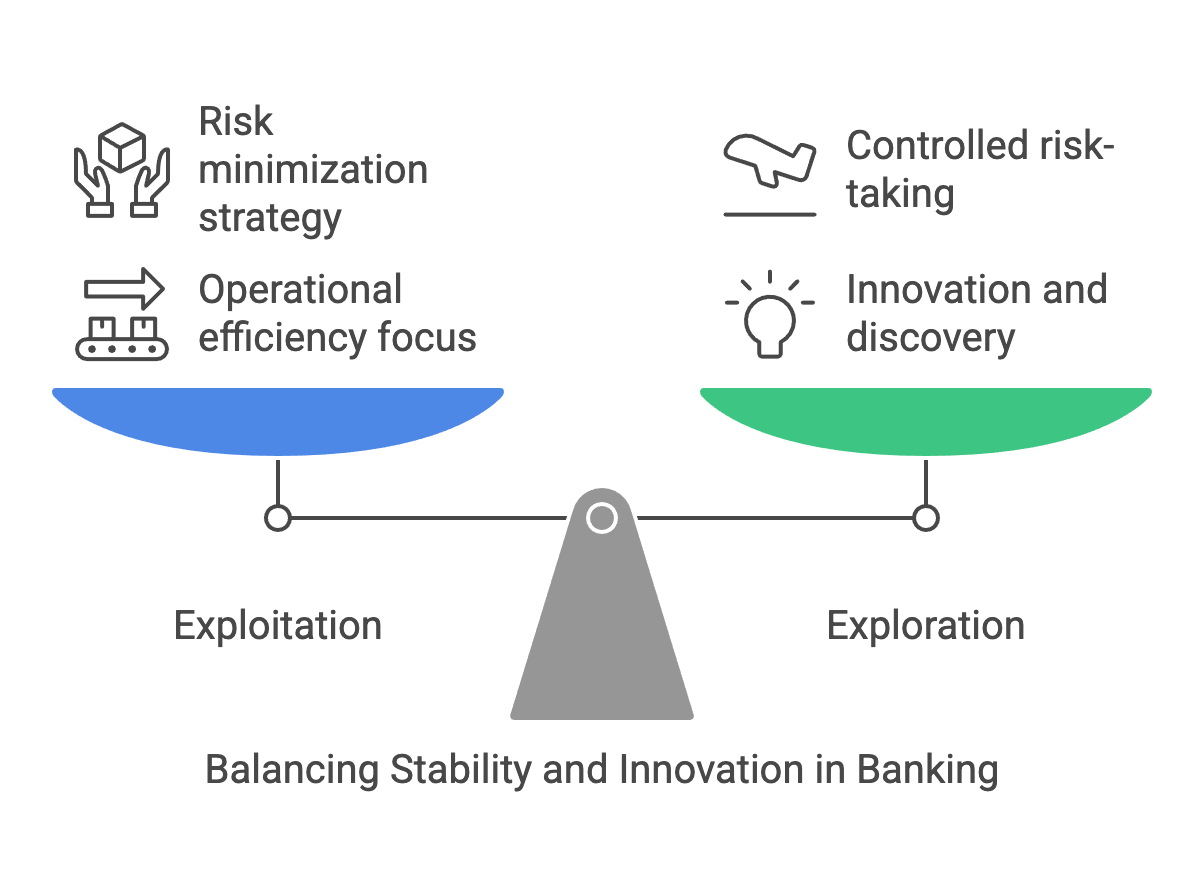

Figure 4: Balancing stability (exploitation) and innovation (exploration) in Banking.

Exploitation emphasizes operational efficiency, process refinement, and cost containment. Exploration, on the other hand, focuses on discovery—whether through pilot projects, minimum viable products (MVPs), or partnerships with fintech startups (KPMG 2023). Conceptual frameworks for ambidexterity often describe these as separate “streams” within the same organization, each with its own objectives, timelines, and risk profiles. The key is to ensure these streams remain aligned to prevent destructive competition for resources and attention.

Ambidexterity requires intentional resource distribution. Banks often earmark specific budgets for operational continuity and others for future-focused R&D (Smith and Johnson 2022). While the “run” budget covers daily system upkeep, cybersecurity, and compliance, the “change” budget funds experimentation with emerging technologies. Governance structures, such as steering committees, can arbitrate resource decisions and recalibrate allocations as market conditions evolve.

Ambidexterity thrives under leadership that actively supports both present-day excellence and radical innovation. Leaders must champion operational rigor while celebrating controlled risk-taking (PwC 2023). Incentive systems, such as balanced scorecards, can reinforce these twin priorities by rewarding managers who excel at both maintaining existing service levels and launching transformative products.

Exploration inevitably entails risk, including failed pilots or unproven technologies. Conversely, exploitation demands minimizing risk to protect established revenue streams (Deloitte 2022). Conceptually, ambidexterity frameworks advocate for iterative feedback loops—so leaders can quickly gauge project viability, pivot away from less promising experiments, and reallocate resources to higher-impact opportunities without imperiling core operations.

Implementing ambidexterity often starts with assembling dedicated squads that bring together IT, business, operations, risk, and compliance experts (KPMG 2023). These cross-functional teams break down departmental silos and ensure that potential solutions are evaluated through multiple lenses—technical feasibility, regulatory compliance, market viability, and customer satisfaction. Regular checkpoints, collaborative planning sessions, and shared KPIs help maintain alignment.

Many banks establish a Portfolio Management Office (PMO) or steering committees to oversee project distribution between exploitation and exploration. Using prioritization frameworks such as MoSCoW (Must-have, Should-have, Could-have, Won’t-have) or ROI-versus-risk matrices helps ensure that resources flow to initiatives that support the bank’s strategic vision (Smith and Johnson 2022). This structured approach also prevents promising exploratory pilots from languishing due to lack of executive visibility.

Scrum, Kanban, and design thinking methodologies provide practical vehicles for rapidly iterating and validating new ideas (PwC 2023). Sprints enable frequent stakeholder feedback, while design thinking techniques offer a human-centered lens on product development. These methodologies are particularly effective in reducing time-to-market for innovative banking solutions, as they enable quick pivots based on real-world testing and user feedback.

Balancing exploitation and exploration requires performance tracking that captures both operational reliability and innovation momentum (Deloitte 2022). Key metrics might include uptime, cost per transaction, incident resolution times (for exploitation), coupled with MVP launch frequency, user adoption rates for new products, and profitability of pilot ventures (for exploration). Regular reviews—monthly or quarterly—allow leadership to reallocate budgets, adjust project scopes, or refine target metrics as conditions change.

Transitioning to a more ambidextrous model often triggers organizational shifts, requiring employees to broaden their skill sets. Training in emerging technologies—ranging from data analytics to user experience design—helps teams stay agile (KPMG 2023). Equally important is transparent communication about why changes are happening, how they benefit both employees and customers, and how risks are being managed. Such clarity promotes buy-in and reduces resistance.

Once exploratory initiatives demonstrate tangible value, banks must have well-defined pathways for scaling them into mainstream operations. This stage demands robust resource planning, executive sponsorship, and thorough risk assessments to ensure that innovative concepts do not become mired in bureaucratic slowdowns (Smith and Johnson 2022). By integrating pilot successes into the broader enterprise, banks can quickly translate fresh ideas into revenue-generating or customer-enhancing offerings.

Viewed holistically, the transition from operational focus to a more expansive strategic vision rests on three pillars: a philosophical reorientation that sees IT as a value-creating partner, a conceptual embrace of ambidexterity to balance stability with innovation, and a practical toolkit for cross-functional collaboration, agile delivery, and iterative improvement. By systematically addressing these dimensions, banks can unlock the transformative potential of IT, securing both near-term operational excellence and long-term strategic growth.

1.5. Practical Considerations for IT Teams

The day-to-day realities of banking IT rarely occur in a vacuum. Instead, they unfold within complex environments shaped by corporate culture, regulatory demands, and market pressures. To foster the ambidexterity required for both operational excellence and strategic innovation, IT teams must adopt approaches that integrate philosophical commitment, conceptual clarity, and practical, silo-breaking actions. This section explores how cultivating a culture of learning, defining strategic roles, and employing collaborative frameworks can pave the way for sustained success.

Innovation in banking IT extends beyond merely implementing advanced technologies; it involves embracing an environment where ongoing experimentation is a core principle. Philosophically, this requires establishing “learning loops”—feedback mechanisms that capture insights from every project, successful or not (Smith and Johnson 2021). Whether piloting a new AI-driven credit tool or refining an existing mobile application, each initiative is viewed as an opportunity to evolve methodologies, refine processes, and challenge assumptions.

A culture of innovation can only flourish if team members feel safe to question established norms and propose novel ideas. Academic research correlates psychological safety with higher innovation output, as employees are more likely to share untested hypotheses or report concerns without fear of retribution (McKinsey 2021). In practice, this means leaders must champion open dialogue, celebrate lessons learned from failures, and maintain transparent channels for feedback. Such an environment not only drives creativity but also bolsters team morale and cohesion.

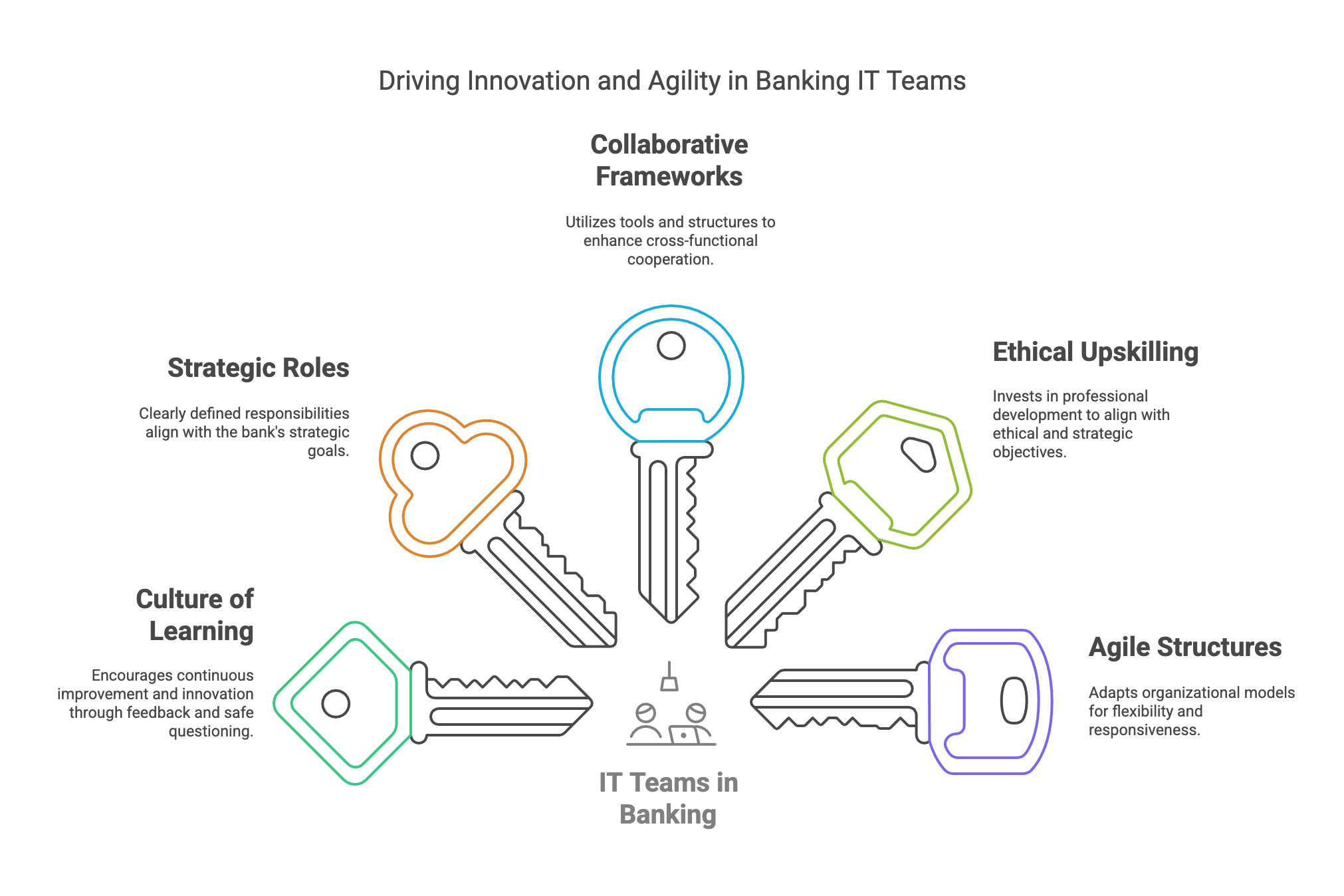

Figure 5: Key strategies to drive innovation and agility in Banking IT teams.

From an ethical standpoint, continuous upskilling is both a responsibility and an investment. Banks that fund certifications, host knowledge-sharing sessions, or sponsor attendance at industry conferences see tangible returns in the form of higher employee engagement and expanded innovation capacity (PwC 2023). Aligning professional development with the bank’s strategic goals also allows IT personnel to recognize how their growth contributes to broader objectives—such as improving financial inclusion or enhancing customer satisfaction.

Fostering a deeper sense of purpose—where employees see how their technical achievements support larger societal outcomes—further energizes strategic thinking. By explicitly connecting IT deliverables to the bank’s mission, such as enabling microfinance platforms or enhancing cybersecurity for vulnerable communities, IT professionals gain a more holistic perspective (KPMG 2023). This alignment resonates with the philosophy that technology should serve both business and societal interests, thereby infusing daily tasks with a sense of greater meaning.

Clarity of ownership forms the bedrock of effective teams. Conceptually, each IT professional should understand their domain—be it cloud infrastructure, DevOps, data analytics, or cybersecurity—and how it aligns with the bank’s strategic imperatives (Smith and Johnson 2021). This clear delineation of responsibilities encourages accountability and empowers IT staff to make informed decisions that advance the bank’s objectives, whether improving cost-efficiency or launching a new digital product line.

Leading banks often adopt hybrid organizational models that accommodate both deep specialization and cross-functional collaboration. Specialized teams (e.g., cybersecurity units, data science centers) maintain technical excellence, while other squads blend business analysts, developers, and risk officers to tackle strategic projects end to end (Deloitte 2022). This dual structure ensures that the bank retains core domain expertise without losing the broader perspective necessary for nimble, market-responsive innovation.

Traditional IT hierarchies, characterized by multiple layers of approval and rigid reporting structures, can limit agility. Conceptually, many modern frameworks advocate a shift toward “networked” or “matrix” models, where empowered teams operate more autonomously (PwC 2023). Such models reduce bottlenecks, accelerate decision-making, and promote a culture in which innovative ideas can ascend quickly. For instance, instead of navigating a lengthy chain of command, a cross-functional team might directly propose new features to an executive steering committee in a quarterly strategy session.

Emergent roles like “Head of Digital Transformation” or “Innovation Catalyst” symbolize a bank’s commitment to strategic evolution. While these positions focus explicitly on shaping the bank’s future trajectory, more traditional IT roles—network engineers, application support specialists, database administrators—must also increasingly think strategically (McKinsey 2021). For example, application support teams that monitor system performance metrics might identify user behavior trends, informing the design of next-generation service enhancements.

Practical mechanisms for reinforcing strategic thinking include regularly scheduled “strategy sprints” or quarterly “innovation stand-ups.” These sessions provide a structured forum for teams to step away from operational details and re-examine overarching goals (KPMG 2023). Beyond discussing ongoing projects, participants can review upcoming market shifts, recent regulatory updates, and emerging tech trends—aligning immediate tasks with long-term aims.

Adopting collaborative toolsets—ranging from project management software (e.g., Jira, Trello) to communication platforms (e.g., Slack, Microsoft Teams)—facilitates transparency and real-time information sharing (Deloitte 2022). Version control systems and continuous integration/continuous delivery (CI/CD) pipelines further enhance synergy between developers and operations teams, reducing friction in software release cycles. By streamlining workflows, these tools make it easier to pivot based on feedback, whether from internal stakeholders or end-users.

Drawing on best practices from both academia and the tech industry, banks increasingly establish “fusion teams” that blend diverse skill sets and perspectives under a single mission (McKinsey 2021). Typically composed of product managers, UX designers, data scientists, risk analysts, and compliance officers, these teams tackle specific challenges—like launching a new mobile wallet or improving fraud detection—under an agile framework. Such cross-pollination minimizes handoffs, speeds up delivery, and ensures each project is robustly vetted through multiple lenses.

Periodic innovation days or hackathons encourage IT staff to brainstorm and prototype solutions that transcend their usual remits (PwC 2023). These events often generate unexpected synergies as employees from different departments collaborate in novel ways. Promising concepts, whether they relate to AI-driven customer service or next-gen security protocols, can then be fast-tracked into more formal pilot programs. This “bottom-up” approach to strategy energizes teams and highlights creative potential across the organization.

Designating subject matter experts (SMEs) as “champions” in areas such as cloud, DevOps, or analytics fosters deeper competence and accelerates internal skill-building. Mentorship programs further reinforce strategic capabilities, pairing less experienced IT professionals with seasoned leaders who can offer guidance on best practices, career development, and emerging trends (Smith and Johnson 2021). Such structured knowledge transfer not only enhances technical proficiency but also nurtures a forward-thinking mindset.

To solidify silo-breaking efforts, banks can integrate collaboration metrics into performance reviews, linking them to incentives like bonuses or career advancement (KPMG 2023). KPIs might include the number of cross-departmental projects completed, the speed of product development cycles, or overall satisfaction scores from internal and external stakeholders. By quantifying and rewarding cooperative achievements, organizations make explicit that collaboration is integral to strategic success.

In sum, the practical considerations for IT teams hinge on cultivating a culture of learning, delineating strategic roles, and leveraging tangible frameworks to encourage collaboration. Philosophically, it is about embedding a growth mindset and ethical awareness into the core of IT operations. Conceptually, defining clear responsibilities and adopting flexible structures enables banks to harness both specialized expertise and cross-functional agility. Practically, regular strategy sessions, collaborative toolsets, fusion teams, and strategic incentive systems all converge to demolish silos and stimulate transformative thinking. By weaving these threads together, banks create IT environments that not only maintain daily excellence but also actively shape the future of financial services.

1.6. Real-World Case Studies Showcasing Successful Shifts

Real-world examples of banks that have successfully transitioned from an operationally focused IT stance to a strategically driven, innovation-centric approach offer powerful lessons. By examining how these institutions recalibrated their philosophical outlook, aligned conceptual frameworks, and implemented practical solutions, aspiring organizations can glean essential insights. The following sections highlight the ways in which industry pioneers embraced transformation, the critical success factors they deployed, and the tangible outcomes that resulted from leveraging advanced analytics, AI, and cloud technologies.

Observing leading banks that have successfully reinvented their IT functions—from basic infrastructure managers to strategic growth engines—provides both inspiration and concrete lessons (PwC 2023). These trailblazers showcase how a willingness to take measured risks, explore new technologies, and invest in human capital can fundamentally disrupt traditional banking models. The philosophical takeaway is that IT can transcend its legacy role and fuel transformation if given the right mandate, resources, and cultural backing.

Industry leaders often articulate a vision of technology as a force for social and economic change (Smith and Johnson 2022). Rather than viewing IT primarily as a cost-reduction lever, they regard it as a driver of value creation—one that can expand financial inclusion, improve customer empowerment, and enhance societal well-being. This philosophical shift reframes transformation initiatives from short-term tasks to long-term imperatives, embedding ethical considerations and stakeholder impact into core decision-making.

Case studies of successful transformations emphasize that aspiration alone is insufficient; it must be reinforced by concrete, day-to-day behaviors (McKinsey 2021). Leadership that communicates a compelling vision and models the behaviors required—such as interdepartmental collaboration and iterative learning—sets the tone for the entire organization. Philosophically, these stories validate that even established banks can overcome inertia and embed a culture of innovation, provided they maintain clarity around strategic goals and align resources accordingly.

Banks that have internalized a growth mindset treat each new technology deployment, partnership, or prototype as an opportunity to evolve. Over time, this commitment fosters an organizational “muscle memory” for adaptation, ensuring that change becomes a continuous process rather than a one-off project (Deloitte 2022). Philosophically, these institutions demonstrate how strategic thinking and operational agility can coexist, yielding long-lasting cultural benefits that promote experimentation at all levels.

In nearly every success story, active sponsorship from top executives—CEOs, CIOs, and even Board-level stakeholders—served as the catalyst for transformation (KPMG 2023). Without visible leadership support, initiatives often lack the organizational momentum and legitimacy needed to influence entrenched processes. Conceptually, this top-down endorsement removes barriers to cross-departmental collaboration, secures the necessary budget, and underscores the urgency of meeting disruptive market demands.

Transformative banks adopt clear, quantifiable goals to steer their IT modernization efforts. These might include targets such as increasing revenue from digital channels, decreasing operational costs through automation, or boosting customer loyalty scores (PwC 2023). By linking objectives to specific metrics—e.g., cross-sell ratios, product launch velocity, or net promoter scores—leaders can track progress in real time, pivot as needed, and maintain accountability at every tier of the organization.

Another recurring success factor is the presence of structured governance bodies, such as steering committees or Project Management Offices (PMOs), that provide oversight and direction for transformation projects (Deloitte 2022). These entities ensure that IT initiatives are in harmony with corporate strategy, clarify reporting relationships, and allocate resources effectively. By providing a formal mechanism for conflict resolution and priority-setting, governance frameworks help prevent siloed thinking and keep the organization aligned.

A strategic transformation often demands behavioral shifts across all levels, from frontline staff to executives. Effective change management efforts—encompassing regular updates, role clarity, and ongoing training—feature prominently in successful case studies (Smith and Johnson 2022). Consistent communication about the “why” behind technological changes helps overcome resistance, fosters employee buy-in, and translates high-level strategies into everyday actions.

Crucially, pioneering banks differentiate between reckless risk-taking and calculated experimentation. They adopt pilot programs or phased rollouts to test emerging concepts, from AI-driven personalization to blockchain-based settlements, while maintaining core operational stability (KPMG 2023). These incremental approaches allow banks to validate new technologies, gather feedback, and scale up once confidence in feasibility and ROI has been established.

DBS Bank in Singapore harnessed artificial intelligence to analyze transaction patterns and customer behaviors. This enabled the institution to present individualized product recommendations, real-time spending alerts, and tailored financial advice. The initiative not only increased cross-sell ratios but also boosted overall digital engagement, illustrating how advanced analytics can evolve a bank’s core proposition (McKinsey 2021). The takeaway for other institutions is that data-driven insights can be a primary engine for revenue growth when integrated seamlessly with customer-facing applications.

Capital One’s bold migration to cloud platforms underscores how large-scale infrastructure modernization can spark continuous innovation. By decoupling from traditional data centers, the bank significantly shortened its product development cycles and improved scalability for data analytics (Deloitte 2022). This shift also enabled rapid prototyping of services, such as real-time credit decisioning and personalized offers, reinforcing how cloud infrastructures support agility and operational resilience.

Santander’s pilot with Ripple’s blockchain network demonstrated near-instant international transfers at significantly reduced transaction costs. By leveraging distributed ledger technology, the bank tested how decentralized networks might streamline global banking services while remaining compliant with local regulations (PwC 2023). This example highlights the growing role of blockchain in facilitating cross-border financial flows, hinting at future applications in remittances, trade finance, and beyond.

JPMorgan Chase integrated machine learning models into its fraud surveillance systems, enabling faster and more accurate identification of suspicious activities. This led to fewer false positives, quicker response times, and enhanced customer trust (Smith and Johnson 2022). The practical lesson is that AI’s capabilities extend beyond front-end personalization to areas like risk management and regulatory compliance, where it can substantially reduce costs and protect a bank’s brand reputation.

ING created an omnichannel experience by adopting cloud-based microservices and seamless integration across mobile, web, and physical branches. Customers could initiate a process in one channel and complete it in another without losing context, elevating convenience and satisfaction (KPMG 2023). This cohesive approach exemplifies how a strategic emphasis on user experience can break down channel silos, attract digital-savvy customers, and differentiate a bank from less agile competitors.

BBVA’s move to open APIs allowed third-party fintechs to integrate their solutions, thus expanding BBVA’s reach and accelerating new product launches. This open banking model cultivated an ecosystem that spurred innovation while retaining the bank’s role as a trusted financial services provider (Deloitte 2022). For other institutions, BBVA’s case underscores how strategic collaborations can generate revenue streams and customer engagement previously unattainable within closed systems.

By analyzing these real-world case studies, banks can derive both the philosophical conviction and practical blueprints needed to embark on transformative journeys. Across all examples, active executive sponsorship, defined strategic metrics, robust governance, and an openness to risk feature as critical elements. Philosophically, these success stories illuminate how a “big picture” orientation—one that values continuous learning and social impact—propels banks beyond mere operational efficiency. Conceptually, they highlight the necessity of clear objectives, coherent governance, and change management strategies. Practically, they demonstrate the potency of advanced analytics, AI, cloud architectures, and open banking platforms in forging competitive, customer-centric financial services.

1.7. Challenges and Misconceptions

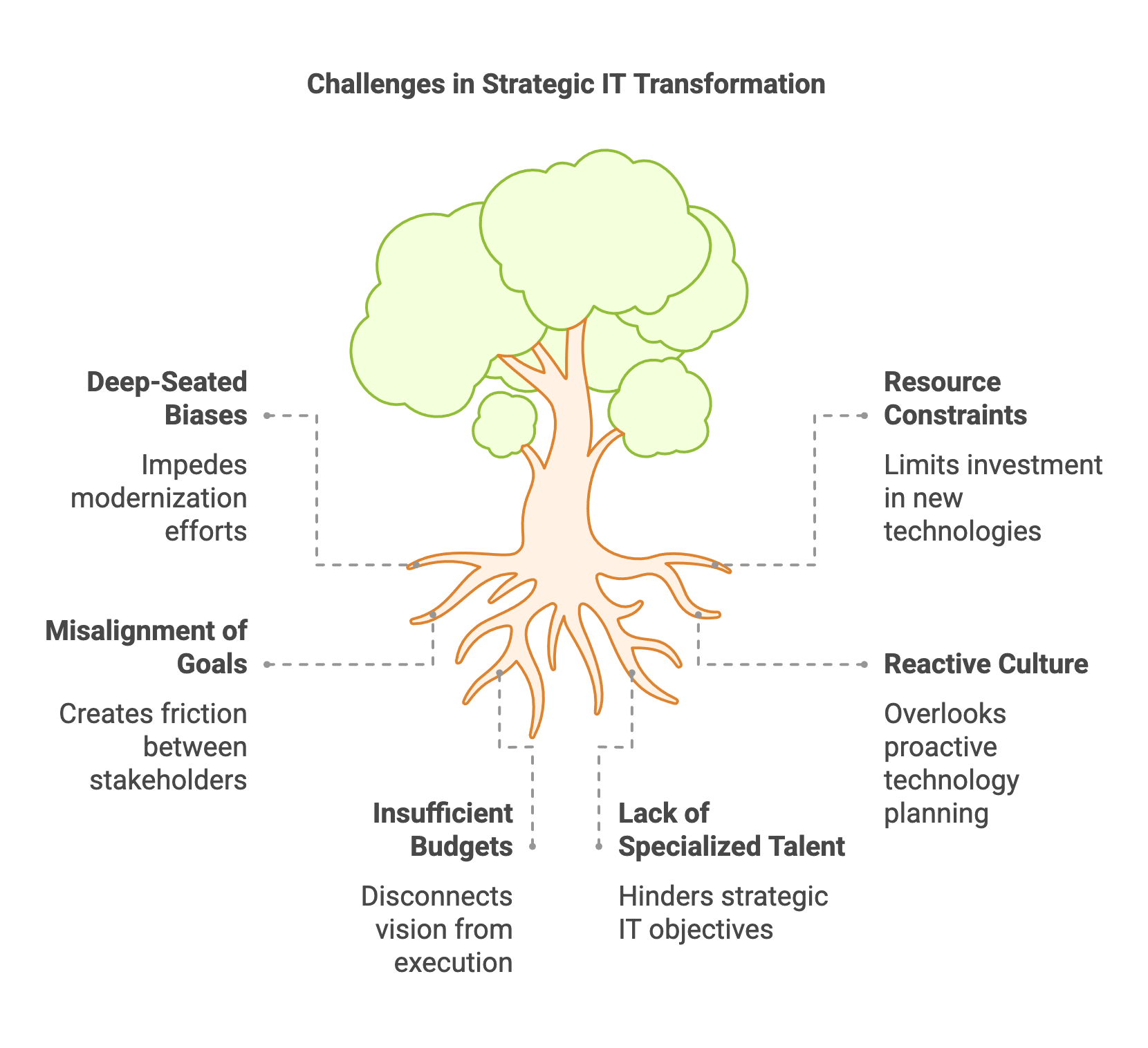

In the pursuit of strategic IT transformation, banks frequently encounter a range of obstacles that can stall or derail progress. These challenges and misconceptions often stem from deep-seated biases, resource constraints, and misalignments between organizational aspirations and practical realities. Recognizing and addressing these hurdles is critical for shifting IT’s role from reactive problem-solver to proactive strategic partner.

A widespread sentiment in banking IT is encapsulated by the motto “if it isn’t broken, don’t fix it.” Though such caution arises naturally in an industry where stability is paramount, it can impede modernization and strategic thinking (PwC 2023). This bias often manifests in reluctance to invest in new technologies or processes, as the perceived risks of change overshadow potential long-term gains. Breaking free from this mindset requires leadership that articulates a vision of technology as a driver of competitive edge and sustainable growth.

Figure 6: Key challenges in strategic IT transformation - biases, misalignment, budget, culture and resources.

Despite advancements in AI, blockchain, and advanced analytics, some leaders still regard IT as a purely operational or support-oriented function (KPMG 2023). This view neglects the transformative power of technology to reshape customer experiences, optimize risk management, and open new revenue streams. Philosophically, acknowledging IT’s potential to enable radical innovation helps shift the narrative from “cost center” to “value creator,” fueling investments in research and development that can reshape traditional banking paradigms.

In many financial institutions, IT resources and attention spike only when systems fail or cybersecurity threats loom, reinforcing a reactive culture (Deloitte 2022). This narrow focus on crisis management overlooks the broader benefits of proactive technology planning—such as improved operational resilience, enhanced customer engagement, and readiness for future disruptions. A more holistic stance values continual innovation and strategic roadmapping, recognizing that consistent, long-range investment in technology often yields sustainable competitive advantages.

As a heavily regulated sector, banking tends to exhibit risk-averse behavior. While caution safeguards customer trust and regulatory compliance, it can also stunt the experimentation required for meaningful breakthroughs (McKinsey 2021). Employees who fear punitive measures for mistakes are less likely to propose novel ideas or challenge outmoded processes. From a philosophical perspective, balancing prudent risk management with a willingness to explore emerging technologies is essential for cultivating a truly innovative culture.

Top management may demand rapid digital transformation while allocating insufficient budgets or manpower. This creates a disconnect between visionary goals and practical execution, leading to missed deadlines, scope creep, and project burnout (Smith and Johnson 2022). Conceptually, strategic initiatives must be accompanied by realistic funding and staffing levels that align with the complexity of the tasks at hand.

Discrepancies in how different stakeholders define “strategic” can derail collaboration. Senior executives might prioritize revenue growth or brand differentiation, while IT departments focus on system stability, cybersecurity, or compliance (Deloitte 2022). Aligning these perspectives under a shared set of objectives and key performance indicators (KPIs) clarifies how technology serves broader business goals, reducing friction and siloed thinking.

Without a structured roadmap that delineates timelines, responsibilities, and milestones, even the most well-intentioned transformation efforts can lose momentum. Ambiguities in ownership lead to overlapping tasks, bottlenecks, and fragmented progress (PwC 2023). By contrast, a clearly articulated roadmap—endorsed by top management—provides a consistent reference point that keeps all parties focused on the same long-term targets.

When operational metrics like uptime and ticket resolutions dominate performance evaluations, IT remains confined to a support role rather than a strategic asset (KPMG 2023). Conceptually, expanding KPI frameworks to include innovation metrics—such as product launch frequency, user adoption rates, or partnership-driven revenue—signals that management values creative contributions as much as operational excellence. This alignment fosters a sense of shared ownership in pioneering new solutions.

Budget constraints and complex legacy infrastructures often deter banks from undertaking all-encompassing modernization projects. A phased approach—starting with critical workloads or pilot programs—allows institutions to test new technologies like microservices or containerization in a controlled environment (McKinsey 2021). By gradually retiring outdated systems and layering modern services, banks can maintain operational continuity while moving toward future-ready architectures.

Financial limitations can be mitigated through partnerships with fintechs, shared initiatives across multiple business units, or outcome-based budgets that link project funding to measurable success. Collaborative funding approaches align costs and benefits, ensuring that operational and strategic teams jointly invest in—and gain from—technological advancements (PwC 2023). This model emphasizes that innovative outcomes are the collective responsibility of the entire organization, not just IT.

A shortage of specialized talent in areas like AI, blockchain, and cloud engineering frequently impedes strategic IT objectives. Targeted learning initiatives—such as internal academies, certification partnerships, hackathons, and rotation programs—expand the skill sets of existing staff (Smith and Johnson 2022). These initiatives not only address immediate capability gaps but also foster a culture where continuous learning is the norm.

Replacing all legacy systems simultaneously can be risk-laden and prohibitively expensive. Instead, banks can deploy middleware, APIs, or other integration layers to bridge older platforms with modern digital channels (KPMG 2023). This tactic preserves existing investments while allowing innovative services—like real-time analytics dashboards or customer-facing apps—to access and manipulate core banking data in a more agile manner.

Implementing a sandbox approach, where new ideas are tested on a small scale, mitigates the potential fallout of failures. Banks can explore emerging technologies—blockchain-based remittances, AI-driven personal finance tools—without disrupting mission-critical operations (Deloitte 2022). Once viability is proven, these concepts can be rolled out gradually, fostering a disciplined yet forward-thinking environment.

Revising performance incentives ensures that both efficiency and innovation are rewarded. Bonuses could be partly tied to the successful launch of a pilot product, increased customer engagement with a new digital channel, or significant cost savings achieved through automation (PwC 2023). By recognizing and rewarding employees who spearhead transformative projects, banks institutionalize an ethos of progress and agility.

Cross-functional collaboration flourishes when all stakeholders have real-time visibility into project milestones, budgets, and challenges (KPMG 2023). Regular updates and transparent governance not only foster trust but also empower leaders to reallocate resources or adjust timelines as conditions evolve. Steering committees or innovation councils can oversee these communications, ensuring that strategic initiatives stay on track and respond agilely to regulatory or market shifts.

Addressing the challenges and misconceptions inherent in the quest for strategic IT excellence demands both cultural transformation and pragmatic execution. Philosophically, leadership must grapple with entrenched biases, acknowledging technology’s far-reaching strategic potential. Conceptually, aligning top management’s expectations with IT’s capacities requires clear roadmaps, balanced KPIs, and robust governance. Practically, phased modernization, collaborative funding, skills development, and transparent communication frameworks can help banks navigate resource constraints, legacy complexities, and the fear of failure. By systematically tackling these hurdles, financial institutions can move beyond mere operations, embracing the strategic possibilities that modern IT can unlock.

1.8. Emerging Trends to Watch

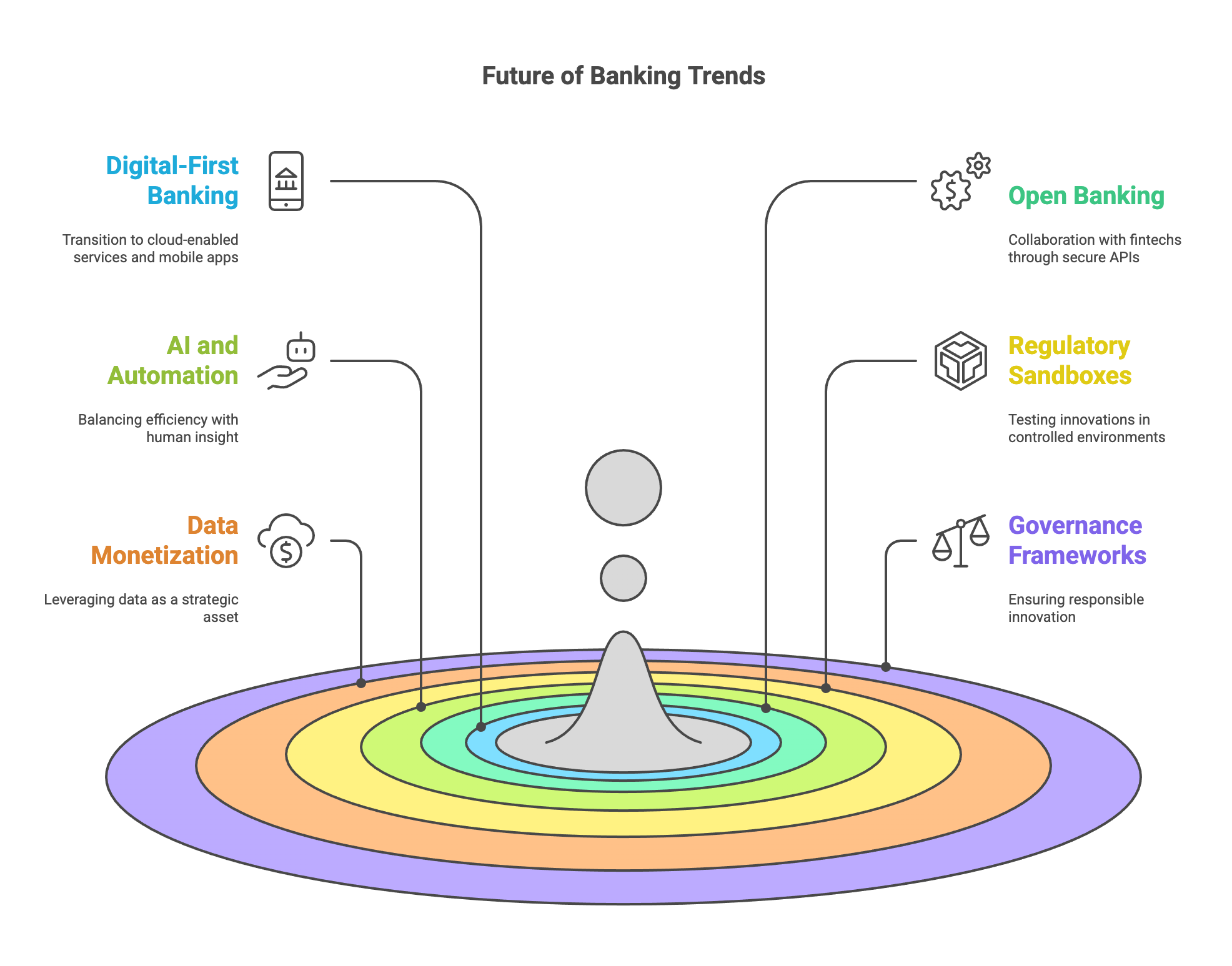

The future of banking is being shaped by powerful currents in technology, regulation, and customer expectation. As banks transition from operational efficiency to strategic foresight, they must remain vigilant to emerging trends that can redefine the competitive landscape. This section explores how digital-first paradigms are transforming traditional banking relationships, the conceptual opportunities arising from open banking and fintech partnerships, and the practical governance frameworks that banks can deploy to systematically evaluate and integrate new technologies.

Digital-first banking marks a significant philosophical shift: branches are no longer the primary touchpoints for customer engagement. Instead, cloud-enabled mobile apps and web portals deliver instant, on-demand services (KPMG 2023). This transition reframes banking from a transaction-based relationship to a holistic customer experience journey, where user interactions can occur seamlessly across devices and platforms. By embracing a digital mindset, banks move closer to customers’ daily routines, potentially becoming embedded within every phase of financial decision-making.

Beyond immediate commercial gains, digital banking can also advance financial inclusion. Online account opening, mobile payments, and micro-lending platforms reduce barriers that have traditionally excluded underserved populations (PwC 2023). Recognizing technology’s capacity to bridge economic gaps introduces an ethical dimension to digital transformation—one in which banks see themselves as enablers of broader societal well-being, not just profit-oriented entities. This outlook can guide strategic investment decisions and public policy collaborations alike.

Figure 7: Emerging trends on future of Banking operations. Technology plays critical roles to innovate in future Banking.

As consumer interactions migrate to virtual platforms, the nature of trust transforms. Rather than relying on face-to-face rapport, customers look for easy-to-use digital interfaces backed by robust security protocols (Smith and Johnson 2022). Trust becomes a function of transparency—clarity around data usage and privacy—plus the reliability of advanced authentication measures. To earn and maintain this trust, banks must integrate top-tier cybersecurity tools and uphold transparent communication regarding risk and data handling.

While AI chatbots and automated workflows can offer efficiency and around-the-clock availability, certain banking services—like complex loan consultations or wealth management—still benefit from human insight and empathy (McKinsey 2021). Striking the right balance between algorithm-driven speed and personalized guidance is crucial. Philosophically, banks should determine the boundaries of automation, reserving human interaction for moments when emotional intelligence and nuanced judgment provide the greatest value.

Conceptually, open banking lays the groundwork for data sharing between financial institutions and third-party providers through secure application programming interfaces (APIs). This phenomenon, fueled by regulations like PSD2 in Europe, prompts banks to collaborate with fintech firms on novel products, ranging from budgeting apps to cross-border remittances (Deloitte 2022). By merging their established trust and infrastructure with fintechs’ agility and creativity, banks can diversify offerings and maintain relevance in a rapidly evolving market.

Traditional banks often struggle to adopt new technologies at the same pace as fintech startups. Forming strategic partnerships allows them to access cutting-edge solutions—such as AI-driven underwriting or blockchain-powered supply chain financing—without fully developing those capabilities in-house (PwC 2023). Conceptually, this approach redefines the financial value chain: banks provide compliance frameworks and customer bases, while fintechs contribute specialized expertise, speed, and innovation.

In response to the need for controlled experimentation, regulators worldwide are introducing “sandboxes” where banks can test emerging technologies under relaxed constraints. These environments reduce compliance friction, enabling faster proof-of-concept validation for blockchain-based settlements, AI-led risk assessments, or alternative credit-scoring models (KPMG 2023). Sandboxes thus serve as crucial catalysts, allowing institutions to innovate responsibly while mitigating risks through early feedback from regulators and consumers.

Open banking also opens pathways for data-driven revenue streams. Banks can transform anonymized transaction records into valuable analytics insights sold to third parties or used internally for hyper-personalized offerings (Smith and Johnson 2022). Conceptually, this shift elevates data as a strategic asset, prompting banks to consider new partnerships, platform models, and revenue-sharing deals. Success in this domain hinges on robust privacy measures and transparent data governance practices.

Given the rapid influx of innovations—quantum computing, edge AI, real-time fraud detection—banks need formal methodologies to assess each technology’s viability and relevance (McKinsey 2021). Tools such as innovation scorecards and technology radars help decision-makers consider potential return on investment, technical feasibility, regulatory impacts, and alignment with overall business strategy. This structured approach fosters consistency and objectivity, preventing subjective biases from skewing resource allocation.

Rather than confining technology evaluations to IT silos, forward-looking banks establish multidisciplinary committees comprising representatives from compliance, legal, risk management, marketing, and product teams (Deloitte 2022). These committees jointly assess proposed solutions, ensuring comprehensive risk assessment and alignment with brand positioning. By integrating diverse viewpoints early, banks minimize blind spots—be they legal, operational, or reputational.

Before launching a new technology at scale, sandbox environments allow banks to test real-world performance and gauge regulatory fit. This approach not only identifies potential vulnerabilities or user experience issues but also clarifies success criteria, such as transaction throughput, user satisfaction, and operational cost savings (KPMG 2023). If a pilot underperforms, banks can pivot quickly or suspend the project, preserving capital and learning valuable lessons for future initiatives.

Embracing agile methodologies, banks can deploy minimal viable products (MVPs) to gather customer feedback and operational metrics. Through iterative sprints, teams refine functionalities based on empirical data rather than assumptions (PwC 2023). This cycle of build-measure-learn reduces the risk of large-scale, resource-intensive failures, allowing institutions to course-correct in near real-time and continuously optimize offerings.

To keep pace with technology’s rapid evolution, banks must commit to upskilling their workforce. Internal digital academies, external certifications, and targeted mentorship programs equip employees to leverage new tools effectively (Smith and Johnson 2022). Simultaneously, communication strategies that articulate the “why” behind technology decisions foster employee buy-in and streamline adoption. By embedding training into governance frameworks, organizations ensure that transformations are technically sound and culturally supported.

Even after a successful rollout, governance requires ongoing oversight to confirm that the technology remains aligned with business goals, user needs, and security standards (McKinsey 2021). Regular post-implementation evaluations track metrics such as system performance, operational costs, customer satisfaction, and ROI. This feedback loop informs subsequent projects, cultivating an organizational habit of iterative learning and adaptive strategy.

In sum, the emergence of digital-first banking, open ecosystems, and advanced technologies like AI and blockchain offers both opportunities and responsibilities for financial institutions. Philosophically, banks must recognize technology as a powerful force for societal benefit, while also navigating the complexities of virtual trust and human-automation balance. Conceptually, frameworks such as open banking and regulatory sandboxes pave the way for agile partnerships and robust data monetization models. Practically, governance mechanisms—including cross-functional committees, phased pilots, and continuous skill development—ensure that innovation is both responsible and effective. By keeping these emerging trends in focus, banks can maintain a forward-leaning stance, ensuring their IT strategies are primed for both current challenges and future possibilities.

1.9. Conclusion

In conclusion, Chapter 1 establishes why the role of IT in banking can no longer remain confined to operational tasks. With market conditions evolving rapidly and new technologies reshaping customer expectations, the potential for IT to serve as a catalyst for transformation has never been greater. This chapter challenges IT professionals to embrace a strategic mindset—one that proactively seeks opportunities for growth and drives competitive advantage. As you proceed through the upcoming chapters, remember that your capacity to innovate, collaborate, and strategize will determine both your personal career trajectory and the bank’s success. Now is the time to act: engage with leadership, champion new ideas, and begin laying the groundwork for a future-ready IT organization.

1.9.1. Further Learning with GenAI

Each prompt incorporates additional layers—people, process, technology, culture, risk, compliance, and more—to ensure a truly advanced and comprehensive exploration of the themes introduced in Chapter 1.

Detail the most critical competencies—spanning technical expertise, leadership, design thinking, and cross-functional collaboration—that an IT professional in the banking industry must develop to shift from an operational to a strategic role. How should these skills evolve in response to emerging technologies and changing regulatory landscapes?

Propose a multi-layered framework (including governance, stakeholder analysis, cost-benefit assessment, and risk management) for identifying and prioritizing strategic IT initiatives in a bank. How can this framework integrate both near-term operational needs and long-term innovation goals?

Construct a comprehensive balanced scorecard for an IT department in a banking environment. Include both operational KPIs (e.g., availability, incident resolution time) and innovation KPIs (e.g., time-to-market, revenue contribution). Discuss how to track these metrics over time and communicate results to executive leadership.

Explain how agile and DevOps methodologies can be adapted for highly regulated banking environments. What governance structures, compliance checkpoints, and stakeholder engagement models are necessary to ensure both speed and adherence to regulatory requirements?

Discuss the most effective methods for quantifying and demonstrating the return on investment (ROI) of strategic IT initiatives—such as AI-based fraud detection or blockchain-based settlements—in a risk-averse banking context. How can intangible benefits (e.g., customer experience, brand reputation) be factored into these calculations?

Examine common cultural and organizational barriers within banking IT departments that might hinder the shift from operational to strategic thinking. Suggest change management techniques, leadership development approaches, and communication strategies to overcome resistance and foster a forward-thinking culture.”

Propose a multi-phase roadmap to modernize a legacy core banking system into a future-ready platform. Address key considerations such as data migration, regulatory constraints, customer impact, talent acquisition, and the balance between operational stability and innovation.

Analyze the concept of organizational ambidexterity—balancing exploitation of current assets with exploration of new opportunities—specifically for a bank’s IT division. How can team structures, resource allocation, and performance incentives be designed to support ambidexterity in practice?

Recommend concrete strategies, tools, and communication frameworks to foster cross-functional collaboration between IT, compliance, marketing, and product development teams in a banking institution. How do these collaborations accelerate strategic outcomes and minimize operational risks?

Critically evaluate how strict regulatory requirements can be leveraged as a catalyst for IT-driven innovation in banking. Provide examples of where compliance mandates (e.g., PSD2, Open Banking, GDPR) can spur new product development, partnerships, or customer-centric solutions.

Outline a step-by-step plan for integrating disruptive technologies like AI, Blockchain, or Quantum Computing into a bank’s IT infrastructure. Consider aspects like proof-of-concept (PoC) design, risk assessment, compliance alignment, workforce re-skilling, and stakeholder engagement.

Identify common misconceptions among non-technical executives about IT’s role in strategic planning. Propose techniques—such as workshops, data-driven storytelling, or pilot projects—that IT leaders can use to realign executive expectations and secure sponsorship for transformative initiatives.

In a scenario where the IT budget is constrained, detail how to prioritize strategic projects without compromising critical operations. Discuss approaches like lean innovation, co-development with fintechs, vendor partnerships, and phased investment strategies to get the most out of limited resources.

Design a concise but impactful communication plan for presenting IT’s strategic roadmap to a bank’s board of directors. How can you tie technology initiatives to key board-level concerns—such as profitability, risk mitigation, and customer satisfaction—to secure top-level buy-in?

Analyze a high-profile failure of a strategic IT project within a banking or financial services context. Identify root causes—spanning governance, technology choice, stakeholder alignment, or change management—and articulate key lessons that modern IT leaders can learn from such a misstep.

Propose a comprehensive upskilling and professional development program aimed at transitioning operationally focused IT employees into strategic thinkers. Detail the role of mentorship, rotational assignments, certifications, and experiential learning in fostering long-term cultural change.

Illustrate how implementing real-time analytics platforms can support rapid, data-driven decision-making in a banking environment. Include technical considerations (e.g., data architecture, cloud vs. on-prem), governance policies (e.g., access controls, data quality), and strategic outcomes (e.g., personalized services, quicker risk assessment).

Discuss how forming alliances with fintech startups can accelerate a bank’s shift from operational to strategic IT. Analyze the operational, financial, and cultural risks of such partnerships and propose best practices for governance, intellectual property handling, and collaborative innovation.