Chapter 2

Understanding the Modern Banking Landscape

"In banking, the real challenge is orchestrating a technological symphony that resonates with regulators, delights customers, and secures executive buy-in—all without missing a beat." — Jim Marous, Co-Publisher of The Financial Brand and Renowned Banking Futurist

This chapter explores the diverse pressures that shape IT agendas in the banking sector, from top-level management demands to evolving customer needs and stringent regulatory frameworks. Readers discover how these interconnected forces can either constrain or propel strategic innovation, depending on the bank’s perspective and readiness. Concrete examples illustrate how fintech competition and heightened customer expectations underscore the need for robust digital solutions, while regulatory compliance and cybersecurity concerns demand meticulous oversight. By weaving together these factors, the chapter highlights the ever-present tension between risk mitigation and value creation, urging IT professionals to craft balanced, future-proof roadmaps that satisfy multiple stakeholder groups.

2.1. Understanding the Stakeholder Landscape

In modern banking, IT leaders must navigate a complex web of internal and external stakeholders—each with distinct priorities and degrees of influence. Whether it is executives seeking tangible returns on investment, regulators enforcing strict compliance, customers demanding seamless digital services, or fintech collaborators pushing the boundaries of innovation, the success of any technology initiative hinges on recognizing and balancing these intersecting interests. By adopting a multifaceted approach that encompasses philosophical awareness, conceptual mapping of power dynamics, and structured engagement methods, banks can foster cohesive, future-oriented decision-making.

From a philosophical standpoint, every IT choice made within banking is shaped by an interplay of perspectives—executive committees who prioritize return on investment and strategic alignment, regulatory agencies safeguarding financial stability, customers who expect intuitive digital experiences, and fintech partners seeking rapid innovation (KPMG 2023). Viewing these perspectives as interdependent rather than isolated helps IT teams move beyond insular, technology-focused thinking. It also underscores the social responsibility inherent in banking, wherein even small technological shifts can have significant market and societal repercussions.

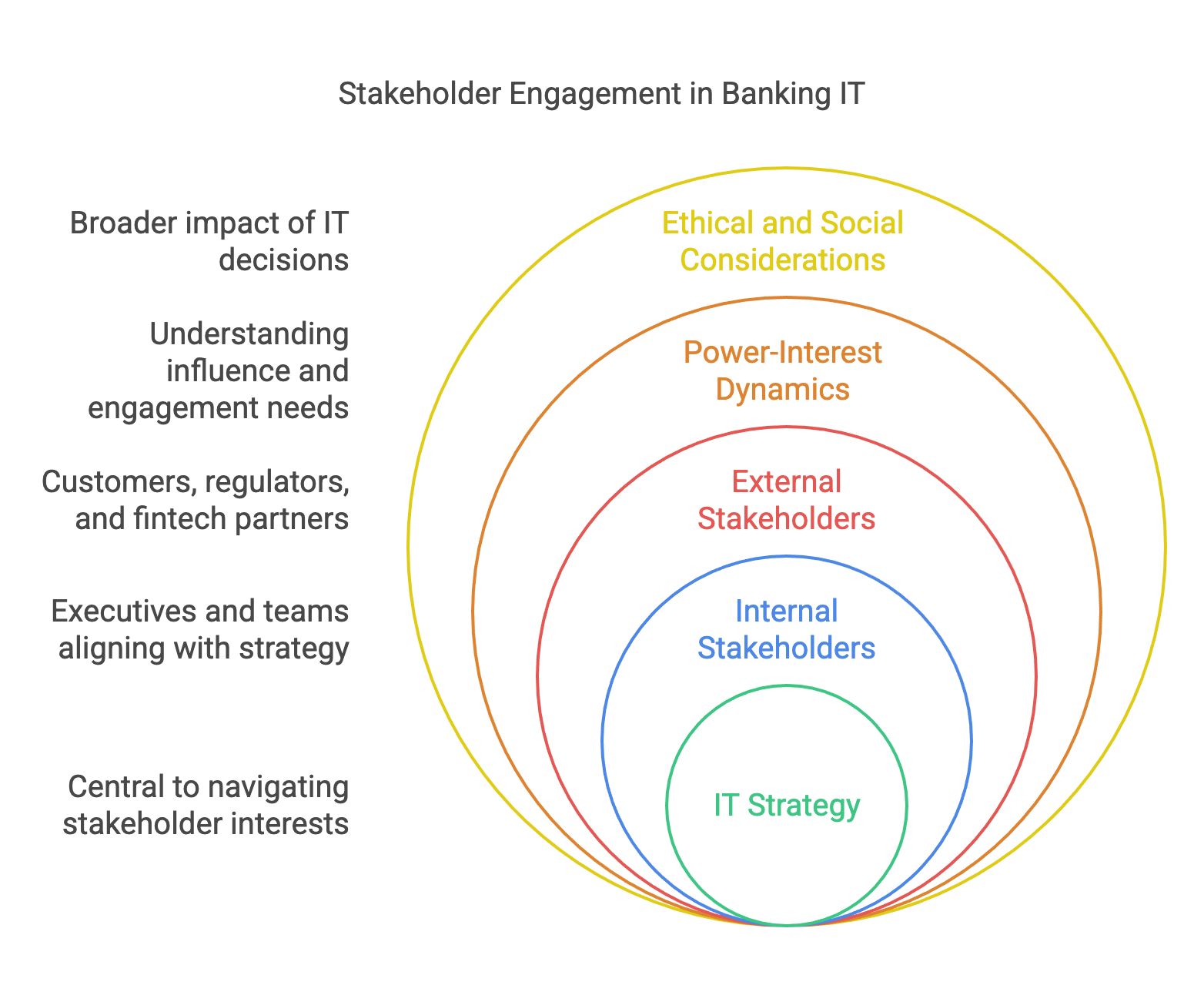

Figure 1: IT strategy is central to navigate stakeholder interests.

Because banks sit at the heart of financial ecosystems, IT strategies carry ethical consequences that extend beyond balance sheets—touching on data privacy, security, and broader social inclusion (PwC 2023). Acknowledging the viewpoints of diverse stakeholders acts as a safeguard against narrowly focusing on short-term gains. Instead, decisions are tempered by considerations of public trust, brand reputation, and compliance with evolving regulatory frameworks. Philosophically, this entails embracing the idea that technology investments can and should contribute to societal welfare, such as promoting financial literacy or minimizing environmental footprints through efficient data center practices.

Sincere understanding of stakeholder needs calls for empathetic engagement. Rather than viewing regulators as adversaries, for example, banks can develop collaborative dialogues that align supervisory interests with industry innovation (Deloitte 2022). Similarly, by actively listening to customers’ pain points—from a cumbersome online loan application process to security anxieties—IT leaders can design user-centered solutions. Empathy thus becomes the cornerstone of a more cooperative, trust-based environment, encouraging solutions that benefit all parties rather than prioritizing one group at the expense of others.

Because consumer behaviors, regulatory guidelines, and executive goals evolve over time, any static assumption about stakeholder preferences is likely to become obsolete (Smith and Johnson 2022). Philosophically, then, banks must adopt a learning mindset that remains adaptable to shifting needs. This includes regularly seeking feedback, monitoring industry trends, and maintaining open lines of communication. In doing so, IT teams can realign priorities to reflect the most current and pressing concerns, ensuring sustained relevance amid dynamic market forces.

Conceptual clarity emerges when banks systematically categorize stakeholders. Internal groups—such as executives, risk teams, and front-line staff—focus on strategic alignment, risk management, and operational feasibility. External stakeholders, meanwhile, include customers seeking reliable and convenient services, fintech partners introducing agility and fresh ideas, and regulators enforcing compliance (McKinsey 2021). Each group has unique motivations, and mapping them clarifies how they interact with the technology roadmap—whether by setting strategic objectives, shaping end-user requirements, or imposing regulatory guardrails.

A commonly used conceptual tool is the power-interest matrix, which plots stakeholders based on their ability to influence outcomes (power) and their level of vested interest in the initiative. For instance, high-power, high-interest stakeholders—such as executive sponsors and major regulators—require direct, frequent engagement, while lower-interest groups might only need periodic updates (KPMG 2023). This structured visualization helps IT leaders allocate resources effectively, ensuring that critical voices are heard early and consistently throughout the project lifecycle.

Different stakeholders assert the greatest influence at various project stages. Regulators often need engagement at the outset to clarify compliance parameters, whereas customers play a pivotal role in beta testing phases (PwC 2023). Executives, meanwhile, typically make final budget decisions and have authority to re-scope or accelerate initiatives. Conceptually, identifying these touchpoints guards against miscommunication and late-stage derailments, as the right stakeholders are looped in at the right moments.

A robust stakeholder map also reveals connections between different groups. For example, if fintech partners require rapid prototyping cycles, this could raise compliance concerns that regulators need to address early (Smith and Johnson 2022). By illuminating such dependencies, banks can proactively manage potential friction points—coordinating design sprints with regulatory consultations or scheduling executive sign-offs alongside user testing. Such orchestration ensures smoother project flow and minimizes bottlenecks.

Organizations are not static. Shifting economic climates or competitive pressures can reshape executive agendas, while new regulatory mandates may alter compliance priorities. Conceptually, stakeholder mapping should be iterative, with periodic reviews that update each group’s position in the matrix. This ensures that the IT roadmap remains in sync with any realignment in stakeholder power, interest, or both (Deloitte 2022).

Banks benefit from formal methods—such as stakeholder matrices, RACI charts (Responsible, Accountable, Consulted, Informed), or influence-interest grids—to identify key individuals and clarify their roles (KPMG 2023). These tools help avoid guesswork, ensuring every stakeholder’s influence and objectives are understood and systematically addressed. By documenting each party’s responsibilities and decision-making authority, IT leaders can better navigate complexities, especially in large-scale projects involving multiple departments.

Because resources are finite, not every stakeholder can receive the same level of attention at every stage. A scoring mechanism can help, assigning values to stakeholders based on their criticality to project success (PwC 2023). High-scoring stakeholders—such as major regulators or executive sponsors—receive intense, ongoing engagement, while others are managed via periodic updates or as-needed consultations. This prioritization ensures that the most impactful voices guide key milestones, mitigating the risk of last-minute surprises.

Maintaining trust across stakeholder groups requires intentional communication strategies. Executive briefs might occur monthly, while customer and fintech partner forums could be scheduled at sprint boundaries to gather user feedback (Deloitte 2022). Regular check-ins foster transparency, allowing issues to surface early and building collective ownership of the initiative. Moreover, making results and metrics—such as project timelines, budget usage, or customer satisfaction scores—visible to all stakeholders amplifies accountability and alignment.

Conflicts are inevitable when diverse interests converge. Whether it is a regulator wary of fast-tracked releases or a fintech team frustrated by bureaucratic inertia, structured conflict resolution mechanisms help avoid stalemates. Steering committees or executive panels can mediate disputes, while targeted solution sprints can reconcile differing viewpoints through prototyping (McKinsey 2021). Importantly, having a predetermined method for escalation ensures that disputes do not fester and derail broader project goals.

The stakeholder environment evolves, and so should engagement strategies. Banks can schedule quarterly or biannual reviews to reassess who holds the most influence, whether project scope has shifted, and how stakeholder needs have changed (Smith and Johnson 2022). Portals and collaboration tools—like SharePoint or Slack channels—offer real-time visibility into project status, enabling continuous interaction rather than sporadic one-way reporting. This iterative, transparent approach cements trust and keeps all parties moving toward shared objectives.

Once a project concludes or reaches a major milestone, structured reviews can highlight the success or shortcomings of stakeholder management. Were expectations met? Did conflicts slow down deliverables, and how effectively were they resolved? (PwC 2023). By identifying lessons learned—both positive and negative—banks can refine their stakeholder engagement models, reinforcing practices that foster collaboration and correcting those that hinder innovation.

By adopting a philosophical awareness of the multifaceted role of IT in banking, employing conceptual mappings to understand power and interest dynamics, and implementing practical stakeholder engagement techniques, IT leaders can navigate the intricate landscape of management pressures and varied stakeholder expectations. This nuanced, stakeholder-centric approach not only reduces friction and accelerates project timelines but also positions IT as a strategic, value-generating force in a rapidly evolving financial ecosystem.

2.2. Regulatory Pressures and Compliance

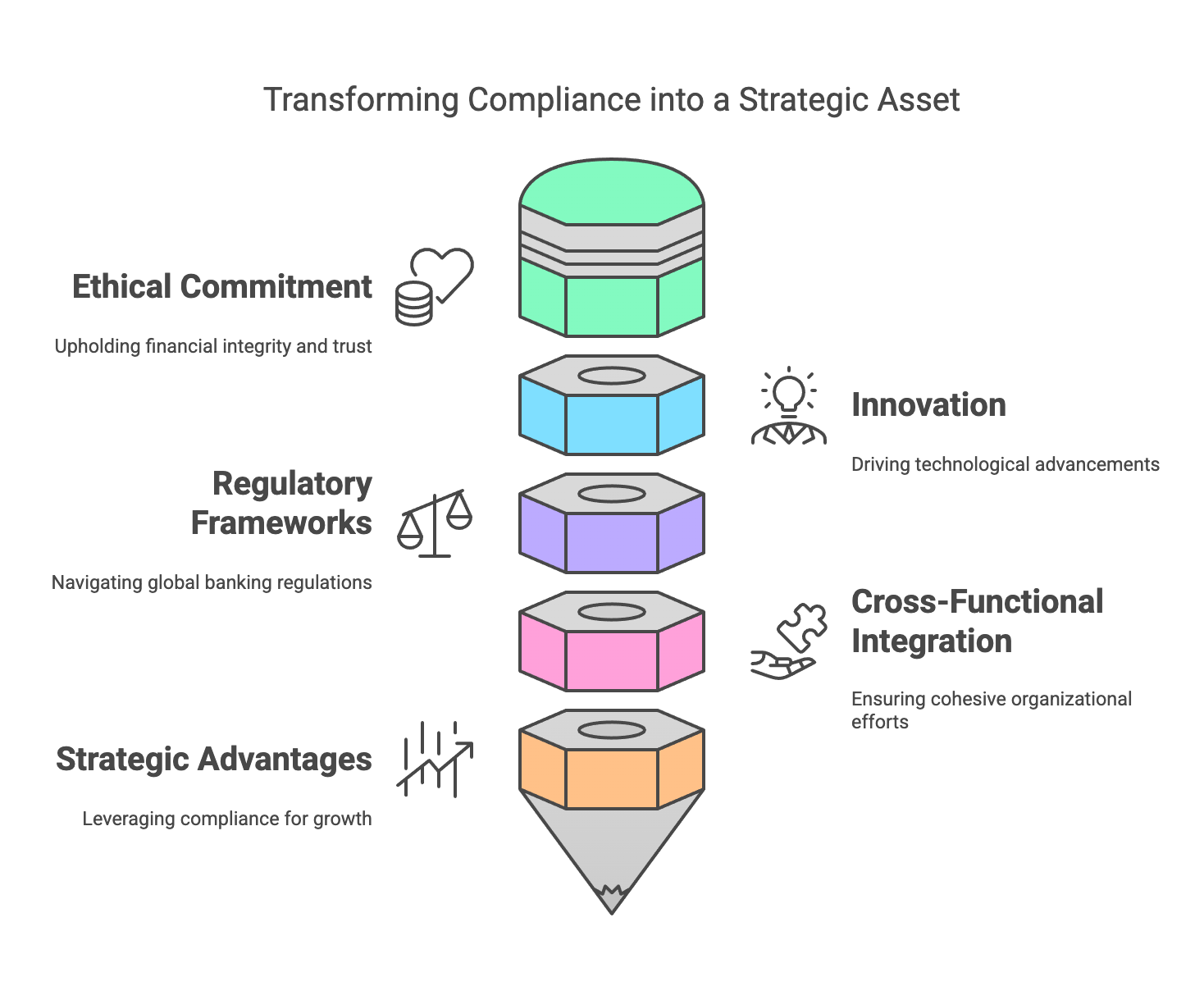

Regulations have long been a cornerstone of the banking industry, shaping how institutions handle capital requirements, data protection, and customer transactions. However, for modern IT teams, compliance signifies more than just legal boxes to be ticked—it embodies an ethical commitment to uphold financial integrity and customer trust. By reframing compliance as a moral and social obligation, linking evolving regulatory frameworks to broader industry trends, and implementing structured, technology-driven solutions, banks can transform their regulatory stance from a burdensome duty into a strategic differentiator.

In a rapidly evolving financial landscape, regulation can easily be dismissed as bureaucratic red tape. Philosophically, however, these mandates serve a more profound role, providing the moral framework needed to safeguard trust and stability in the banking ecosystem (PwC 2023). From ensuring fair market practices to protecting depositors against systemic shocks, compliance reflects an ethical commitment to maintain societal well-being. By adopting this perspective, IT leaders recognize that their work underpins not only bank operations but also public confidence in financial institutions.

Compliance culture extends beyond avoiding penalties. It fosters responsible decision-making and risk assessment at every layer of the organization (Smith and Johnson 2022). When executives and frontline IT personnel alike internalize the importance of ethical standards, they help build reputational capital. Over time, ethical conduct cements a bank’s credibility, mitigating crises and promoting loyalty among customers, investors, and regulators.

Figure 2: Compliance should be considered as strategic advantages and assets of the Bank.

One of the most significant philosophical shifts is moving from a “compliance department owns it” mindset to a collective sense of responsibility. Every member of the IT function, from software developers to system architects, must be attuned to compliance implications (KPMG 2023). This heightened awareness encourages secure coding practices, stringent data management, and the proactive identification of vulnerabilities—thereby reducing the likelihood of breaches or fraud.

Far from stifling technological advancement, a moral lens on compliance can inspire innovations that serve both the bottom line and the public good. Whether adopting AI-powered anti-fraud systems or championing green data center strategies, proactive compliance choices can bolster trust and market leadership (Deloitte 2022). Such measures reflect a deeper ethical conviction: that banks can pioneer new technologies without compromising core principles of fairness, transparency, and consumer protection.

Banks operating internationally must juggle multiple regulations, including Basel III for capital adequacy, PSD2 (Payment Services Directive 2) for open banking in the EU, and GDPR for data privacy (McKinsey 2021). Conceptually, aligning these diverse frameworks ensures consistent compliance and paves the way for cross-border partnerships. For instance, a European bank expanding to Asia might reconcile home-country open banking policies with local risk assessment protocols, fostering a unified operational approach.

Contrary to popular belief, regulations can spur innovation. PSD2’s mandate for open APIs has spurred banks to collaborate with fintechs, creating new revenue possibilities through data analytics and premium financial services (PwC 2023). Viewing compliance as an opportunity rather than a burden enables banks to explore strategic advantages—launching new payment solutions or expanding into uncharted customer segments.

Societal norms increasingly demand robust data protection and transparent user consent, exemplified by GDPR’s stringent privacy requirements. Banks that fail to meet these expectations risk both reputational damage and financial penalties (KPMG 2023). Conceptually, embedding data privacy into system design—through encryption, secure data lakes, and granular access controls—not only meets legal obligations but also elevates the customer experience. It reassures users that their information is secure, fostering deeper trust in digital channels.

Basel III’s focus on capital and liquidity resonates with the broader goal of ensuring financial stability. From an IT standpoint, integrating compliance into real-time risk dashboards offers a holistic view that spans capital adequacy, fraud monitoring, and operational continuity (Smith and Johnson 2022). Such capabilities empower banks to detect anomalies early, respond swiftly to market shocks, and maintain customer confidence during periods of volatility.

As consumer attitudes and regulatory landscapes evolve, banks must be nimble in their compliance strategies. Conceptually, this means adopting dynamic governance structures that continuously scan for upcoming regulatory shifts—whether new data localization rules or expansions to open banking. This proactive stance helps banks adapt well before deadlines, minimizing disruptions to both operations and innovation pipelines (Deloitte 2022).

Banks can use standardized checklists—covering data handling, privacy directives, or financial reporting—to operationalize regulatory mandates across IT processes (PwC 2023). Tools like ISO 27001 offer robust guidelines on information security management, serving as a baseline for methodically embedding compliance within project lifecycles. By translating broad regulations into digestible checklists, IT teams avoid ambiguity and maintain consistency in execution.

Systematic risk assessments, bolstered by penetration testing or vulnerability scanning, help identify potential lapses in compliance or security (KPMG 2023). By simulating data breaches or transaction anomalies, banks can refine incident response strategies, plugging gaps before they escalate into real-world crises. These scenario tests cultivate a culture of preparedness, ensuring that compliance isn’t merely reactive but anticipatory.

RegTech solutions, which leverage AI and advanced analytics, streamline ongoing compliance efforts by automating tasks like suspicious activity detection and real-time KYC checks (McKinsey 2021). Automated dashboards can pull data from multiple sources—customer transactions, market feeds, internal logs—to flag irregularities instantly. This reduces manual labor and errors, allowing compliance teams to focus on strategic oversight rather than repetitive administrative tasks.

A single “source of truth” for data across the enterprise simplifies auditing, speeds up regulatory reporting, and enhances security (Smith and Johnson 2022). Centralized data lakes or warehouses, layered with encryption and role-based access, help ensure that data is consistent, complete, and protected. When regulators request specific transaction histories or evidence of compliance, banks can generate detailed reports swiftly, improving both transparency and accountability.

Successful compliance hinges on cross-functional integration. From the earliest design phases, IT teams should coordinate with legal and audit units to interpret regulations and shape technology solutions (Deloitte 2022). Frequent sync-ups can preempt misalignments—such as building a cloud-based platform that later fails local data sovereignty rules—and reinforce an integrated approach to risk management.

Rather than treating compliance as a final gate review, effective banks embed iterative feedback mechanisms. Post-audit findings or minor regulatory infractions offer lessons that can refine processes and technologies (PwC 2023). This cycle of “plan, execute, review, and adjust” ensures that compliance remains an evolving discipline, aligned with both external changes in regulation and internal shifts in strategy.

By reframing compliance as an ethical foundation, connecting key regulations to industry-wide trends and societal expectations, and deploying practical methodologies that encompass checklists, risk assessments, and automation, IT leaders in banking can convert regulatory pressures into catalysts for innovation. This paradigm not only strengthens the integrity of the financial system but also propels banks toward a more resilient, customer-centric, and future-ready state.

2.3. Competition from Fintech and Non-Traditional Players

The financial services landscape has been disrupted by a wave of new entrants ranging from fintech startups to global tech conglomerates. These non-traditional players—unencumbered by legacy systems—have quickly introduced innovative products that challenge conventional banking models. To remain competitive, established institutions must adapt their strategies, reimagining not only the nature of financial services but also the ethical, conceptual, and practical frameworks that guide their operations.

Philosophically, the rise of fintech disruptors and global tech giants demonstrates that revolutionary ideas can sprout from beyond the traditional confines of finance (Deloitte 2022). E-commerce, social media, and software development have all become fertile grounds for innovation, compelling banks to look outward for best practices and novel solutions. By acknowledging this cross-industry reality, financial institutions can overcome insular thinking and gain inspiration from diverse fields, enhancing their capacity to innovate.

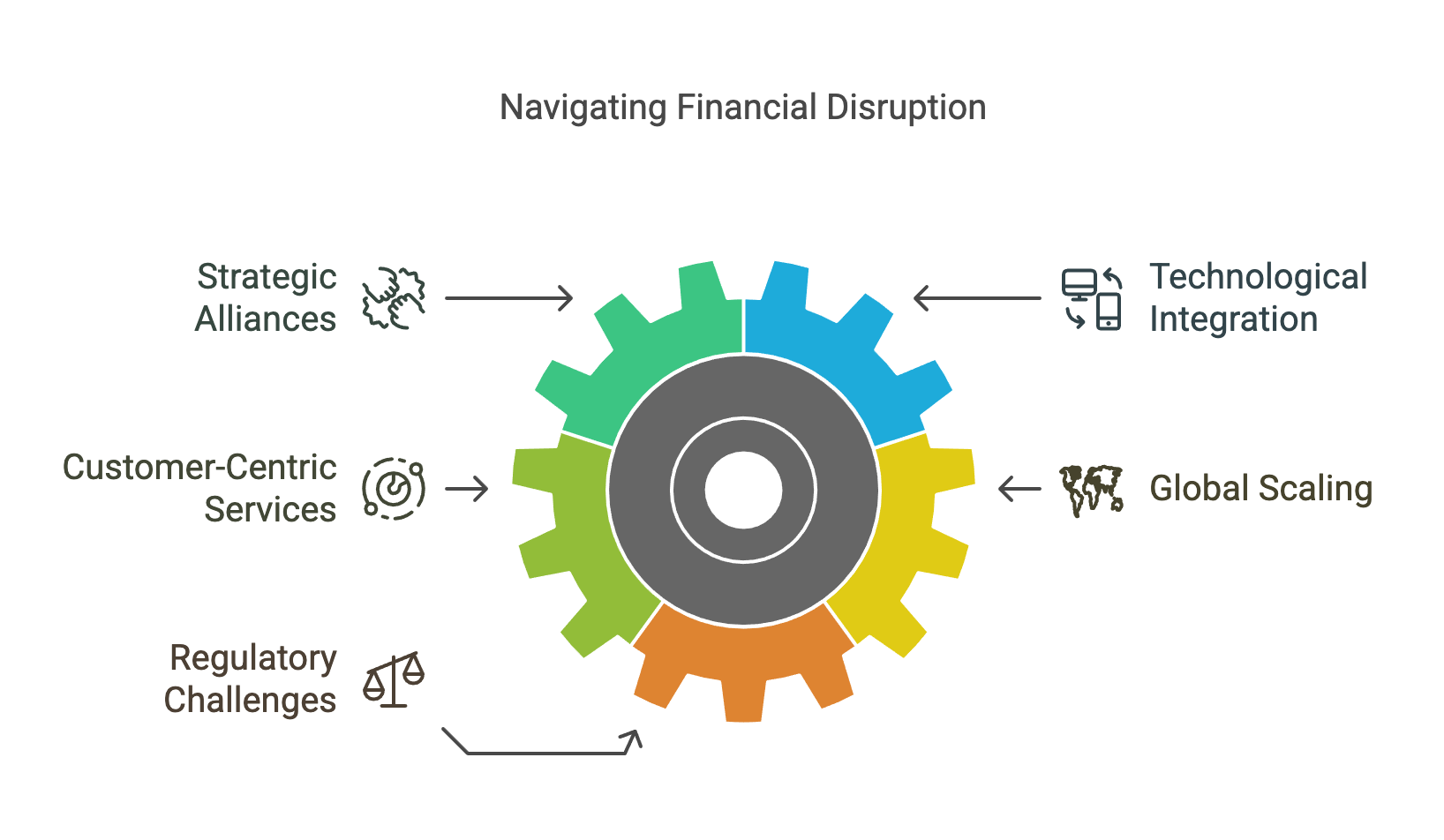

Figure 3: Key aspects on navigating disruption in financial industry.

When viewed through a forward-thinking lens, the threat posed by fintechs can become an impetus for reinvention rather than a looming danger. Leaders who adopt this mindset see competition not as a zero-sum game but as a push to modernize core systems, improve customer experiences, and streamline processes (PwC 2023). This philosophical reorientation helps banks respond proactively, spurring them to act as dynamic market participants rather than stagnant incumbents.

Fintechs often target specific pain points—be it simplifying payments, facilitating low-cost remittances, or opening new avenues for financial inclusion. By studying these ventures, banks can re-examine their own missions and expand from mere deposit-taking and lending to holistic, customer-centric service models (KPMG 2023). Philosophically, this perspective encourages institutions to align technological advances with the deeper goal of democratizing finance, resonating with broader societal imperatives.

Emerging digital platforms frequently aim to empower underserved segments through micro-lending or peer-to-peer investment channels, illuminating the transformative potential of financial services. Embracing such models can bolster a bank’s social impact and ethical standing (Smith and Johnson 2022). From a philosophical viewpoint, serving community needs becomes more than just a regulatory or philanthropic footnote—rather, it is a core component of a competitive strategy that uplifts brand reputation and trust.

Fintech firms typically excel by targeting specific niches—like mobile payments, robo-advisory, or digital wallets—and refining user experiences to deliver rapid, intuitive interactions (McKinsey 2021). Their lean organizational structures enable them to pivot swiftly and embrace agile development cycles, setting a pace that traditional banks often struggle to match. Conceptually, this hyper-focus on particular customer segments or functionalities allows fintechs to outperform larger competitors in terms of speed and personalization.

Whether by leveraging cloud platforms, artificial intelligence, or open APIs, fintech startups reduce fixed overheads and manual processes. Conceptually, this efficiency translates into competitive pricing strategies that can disrupt traditional banking revenue streams, such as higher-yield savings accounts or fee-free foreign exchange (Deloitte 2022). By recognizing fintechs’ ability to strip away unnecessary complexity, incumbents can explore similar efficiencies through process reengineering and technology upgrades.

The fintech ethos is often grounded in delivering seamless user experiences—from intuitive sign-up flows to real-time chatbot support. Data analytics drive hyper-personalization, predicting customer needs and offering tailored product recommendations (PwC 2023). This shift away from rigid, one-size-fits-all services to dynamic, individually relevant solutions represents a critical competitive edge for newcomers. Conceptually, banks must adapt by integrating advanced analytics and user-centric design into their foundational strategies.

Fintechs thrive by weaving financial services into broader ecosystems—like ride-hailing apps, e-commerce marketplaces, or messaging platforms—to reach customers in the flow of daily life (KPMG 2023). Conceptually, these ecosystem partnerships expand revenue channels, reinforcing the idea that finance should be integrated seamlessly into everyday activities. For traditional banks, replicating this model may involve developing or joining platforms that unify services, from payments to loyalty programs, under a single digital umbrella.

Fintechs often scale internationally from inception, leveraging online infrastructures and borderless payment networks to rapidly gain market share (Smith and Johnson 2022). Conceptually, this global ambition highlights the potential for banks to rethink geographic constraints, offering cross-border products and tapping into international customer bases with more agility than ever before.

Rather than attempting to out-innovate every fintech on the market, many banks form alliances that capitalize on mutual strengths. Through revenue-sharing agreements and joint R&D initiatives, incumbents contribute regulatory expertise and established customer bases, while fintechs offer cutting-edge technology stacks and development speed (McKinsey 2021). These symbiotic partnerships help banks fill capability gaps quickly, while fintechs gain scale and credibility.

In cases where synergy is particularly high, banks might opt to acquire fintech startups outright. This strategy can accelerate digital transformation by bringing specialized talent and product lines under one roof (Deloitte 2022). However, effective due diligence includes assessing technology compatibility and cultural fit to ensure that the post-acquisition integration does not undermine the fintech’s innovative core.

To foster a culture of experimentation without disrupting mission-critical operations, some banks establish in-house labs dedicated to testing new ideas under real-time market conditions. These labs often employ agile practices and cross-functional teams, drawing on AI, blockchain, and other emerging technologies (KPMG 2023). By operating in a “fail-fast” mode, labs can quickly validate or discard concepts, speeding time-to-market for promising solutions.

A growing number of banks invite fintechs to co-create digital offerings that the bank can then white-label and present to its customer base. This arrangement pairs the fintech’s innovation capabilities with the bank’s brand recognition, creating a faster route to product launch (PwC 2023). Banks retain control over customer relationships and data, while fintechs gain revenue and exposure—an outcome that aligns both parties’ interests.

To fully leverage fintech partnerships, banks need an architecture—both technical and strategic—that supports ecosystem integration. This could involve modernizing core banking systems, adopting microservices, or building APIs that enable secure data sharing (Smith and Johnson 2022). By positioning themselves as orchestrators of multiple services, banks can generate new revenue streams and deepen customer engagement beyond standalone products.

Regardless of the chosen approach—partnership, acquisition, or in-house lab—up-to-date infrastructure is essential for seamless collaboration. Integrating fintech platforms often requires robust API gateways, cloud-based systems, and real-time data processing (McKinsey 2021). Simultaneously, banks must invest in skill development, recruiting data scientists, DevOps engineers, and product managers who can shepherd these collaborations toward sustainable success.

While fintech partnerships offer agility, they also introduce regulatory complexities. Banks must align compliance, risk oversight, and security protocols with any third-party collaborations (KPMG 2023). Establishing clear guidelines for data handling, consumer protection, and business continuity ensures that these ventures uphold the bank’s standards and satisfy legal obligations.

2.4. Evolving Customer Expectations for Digital Engagement

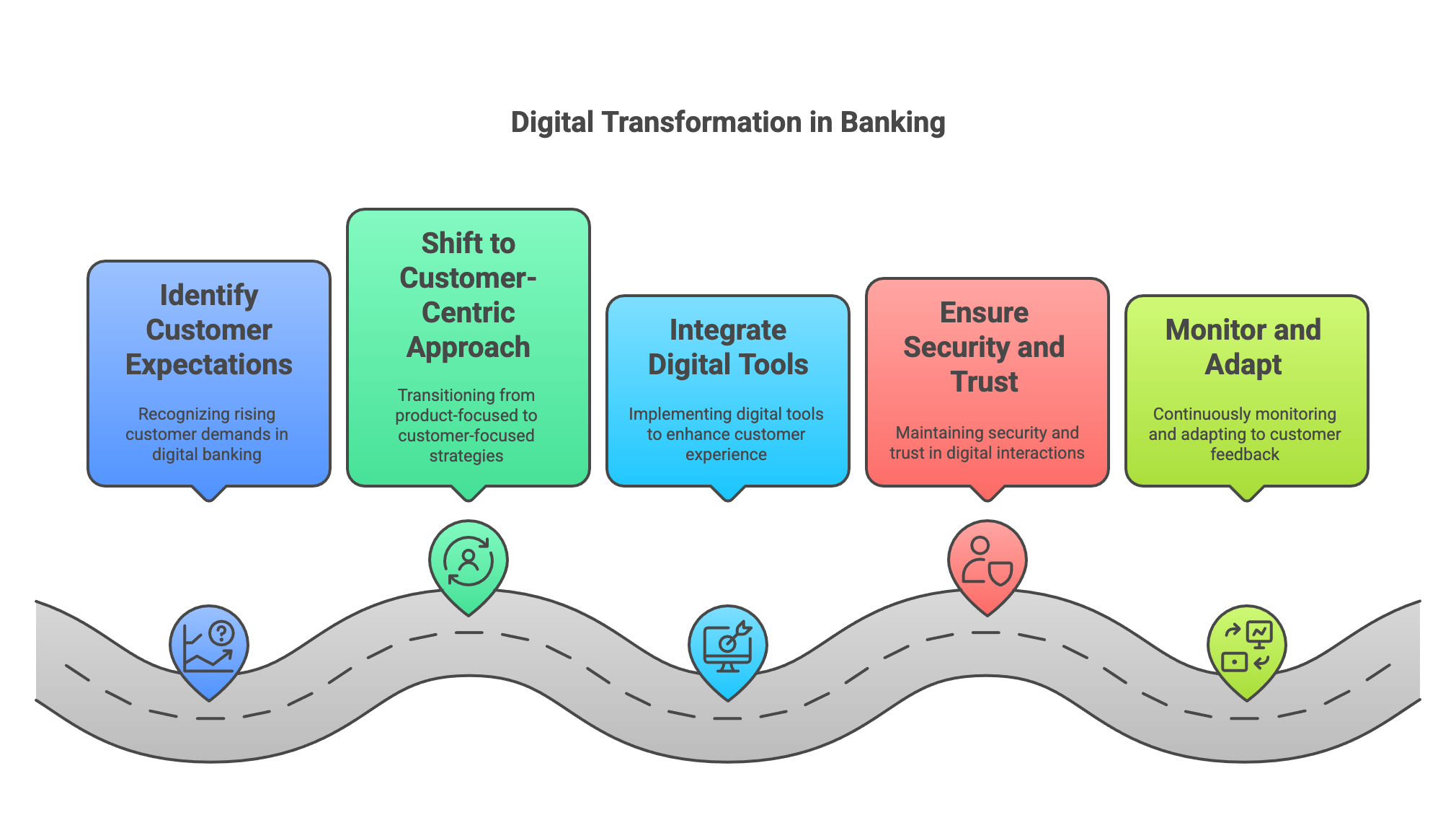

As digital channels become the primary interface between banks and their clients, customer expectations continue to rise in both depth and breadth. In this new environment, convenience, personalization, and seamless omnichannel experiences are no longer optional; they form the bedrock of customer loyalty and long-term profitability. Banks must adopt a philosophical shift from product-centric to customer-centric thinking, harness conceptual frameworks that illuminate the power of digital channels, and apply practical strategies that leverage data analytics and agile methodologies to continuously refine the customer journey.

Historically, banks designed products—loans, savings accounts, mortgages—with a focus on broad, standardized offerings that drove margin and volume (KPMG 2023). However, the growing emphasis on digital engagement requires a more nuanced view. Philosophically, this entails understanding that the true measure of value lies in how effectively products and services address customer pain points. Features like streamlined loan applications, instant alerts, and intuitive online navigation transform abstract financial products into tangible solutions that resonate with individual user needs.

A digital transformation strategy gains traction when banks see customers not as mere transaction endpoints but as partners in a deeper, ongoing relationship (Deloitte 2022). By fostering empathy-driven design, financial institutions can craft digital tools that truly solve everyday challenges—be it simplified financial planning or real-time fraud alerts—rather than simply automating existing processes. This approach cultivates stronger emotional connections, as customers feel valued and understood.

Figure 4: The digital transformation journey in Banking is initiated by customer expectations.

Even in an era of AI chatbots and automated workflows, customers still seek reassurance that their money is safe and their concerns matter (PwC 2023). Personalized messages, proactive outreach, and transparent explanations of new digital features can humanize otherwise impersonal tech-driven interactions. Trust emerges as a key differentiator; banks that succeed in maintaining a human touch alongside digital efficiency gain a competitive edge in loyalty and retention.

An expanded digital presence also amplifies questions of equitable access. Not all customers possess the same level of tech-savviness or access to high-speed internet—particularly in rural or underbanked communities (Smith and Johnson 2022). Philosophically, a genuinely customer-centric lens compels banks to develop inclusive designs and alternate access points that accommodate diverse demographics, ensuring no group is left behind as digital becomes the default.

Customers now expect a fluid experience across mobile apps, web portals, branches, and even call centers. Conceptually, integrating these channels into a cohesive ecosystem enhances brand consistency and user satisfaction (McKinsey 2021). It also allows for a unified data view, ensuring that when a customer switches channels—say, from a mobile app to an in-branch conversation—their context and preferences remain visible, facilitating seamless service.

A core conceptual tool involves mapping the complete end-to-end journey customers undertake, from account opening to dispute resolution (Deloitte 2022). By zooming in on key touchpoints—like the moment a prospective client explores loan rates or a longtime customer seeks investment advice—banks can pinpoint friction areas and opportunities to delight. This systematic approach harnesses design thinking to eliminate inefficiencies and amplify positive experiences.

With smartphone usage skyrocketing, the mobile app often becomes the focal point of day-to-day banking. Conceptually, this high-frequency engagement channel allows banks to push timely updates and offers—like automated savings prompts or location-based rewards (KPMG 2023). Frequent touchpoints also help banks capture a richer data set on user behaviors, fueling more accurate personalization and fostering habitual use.

Modern analytics tools can parse transaction logs, geolocation data, and browsing histories to tailor product recommendations, enhance fraud detection, and optimize cross-selling (PwC 2023). From a conceptual standpoint, this personalization translates into a virtuous cycle: the more relevant the interactions, the more likely customers are to share additional data, which in turn refines the personalization engine. This feedback loop powers loyalty, while also opening new revenue streams.

Numerous studies show that well-designed digital experiences significantly reduce churn and increase customer spend (Smith and Johnson 2022). By correlating net promoter scores or satisfaction indices with tangible metrics like average revenue per user (ARPU), banks demonstrate the tangible benefits of a robust digital ecosystem. This data-driven validation justifies further investment into UX enhancements, analytics upgrades, and omnichannel integration efforts.

In practice, banks must prioritize user testing and iterative design to create interfaces that minimize friction. Wireframing, beta launches, and focus groups help uncover pain points before a full-scale rollout (Deloitte 2022). Details such as streamlined navigation, clear iconography, and consistent branding across platforms foster intuitive usage, encouraging customers to adopt and remain within digital channels.

Implementing advanced analytics platforms—incorporating machine learning and real-time data processing—enables banks to segment audiences rapidly and serve targeted offers (McKinsey 2021). For instance, predictive models might identify customers nearing overdraft conditions and provide tailored alerts or pre-approved credit lines. This level of specificity distinguishes banks from competitors that still rely on broad, generic marketing campaigns.

Large, monolithic releases often lag behind fast-changing market demands. Instead, banks can adopt agile frameworks—like Scrum or Kanban—to deploy incremental updates and gather immediate feedback (KPMG 2023). Each development sprint refines a set of features, from AI-driven chatbots to user-friendly dashboards, ensuring digital services remain aligned with evolving customer preferences and regulatory guidelines.

Practical scalability hinges on open APIs that allow banks to plug into broader ecosystems—ranging from fintech services to retail loyalty programs (PwC 2023). By consolidating account data in a single dashboard or enabling frictionless e-commerce checkouts, banks can extend their utility far beyond traditional boundaries. This also lays the groundwork for open banking partnerships, further expanding product offerings and customer touchpoints.

Every new digital feature—be it mobile bill payments or AI-based account recommendations—must be undergirded by robust security protocols, including multi-factor authentication and predictive fraud analytics (Smith and Johnson 2022). Striking a balance between convenience and security is essential; overly cumbersome checks can frustrate users, but insufficient safeguards erode trust. An optimal blend of encryption, authentication, and monitoring underpins sustainable digital engagement.

Banks should continuously monitor metrics like session time, click-through rates, bounce rates, and feature adoption. By synthesizing these analytics with direct customer feedback—through surveys or direct in-app channels—IT and product teams can quickly gauge the success of new functionalities (KPMG 2023). Frequent sprint retrospectives or quarterly reviews fine-tune feature roadmaps, ensuring the digital experience evolves in lockstep with user needs.

Embracing a customer-centric philosophy, leveraging conceptual models such as omnichannel engagement and data-driven personalization, and applying practical techniques—from agile design to API integrations—forms the essential triad for banks aiming to thrive in the digital age. By recognizing customers as active participants in a personalized, emotionally resonant financial journey, institutions can build lasting loyalty, enhance operational efficiencies, and secure their competitive edge.

2.5. Cybersecurity Threats and Risk Management

In the ever-evolving financial services industry, robust cybersecurity measures serve as the bedrock of trust between banks and their customers. As cyber threats become more sophisticated, banks must treat security not merely as a technical necessity but as an ethical cornerstone that underpins every transaction and service. By adopting a philosophical commitment to safeguarding trust, mapping the myriad threat vectors conceptually, and deploying practical frameworks that encompass training, incident response, and proactive monitoring, banks can fortify themselves against a rapidly shifting cyber threat landscape.

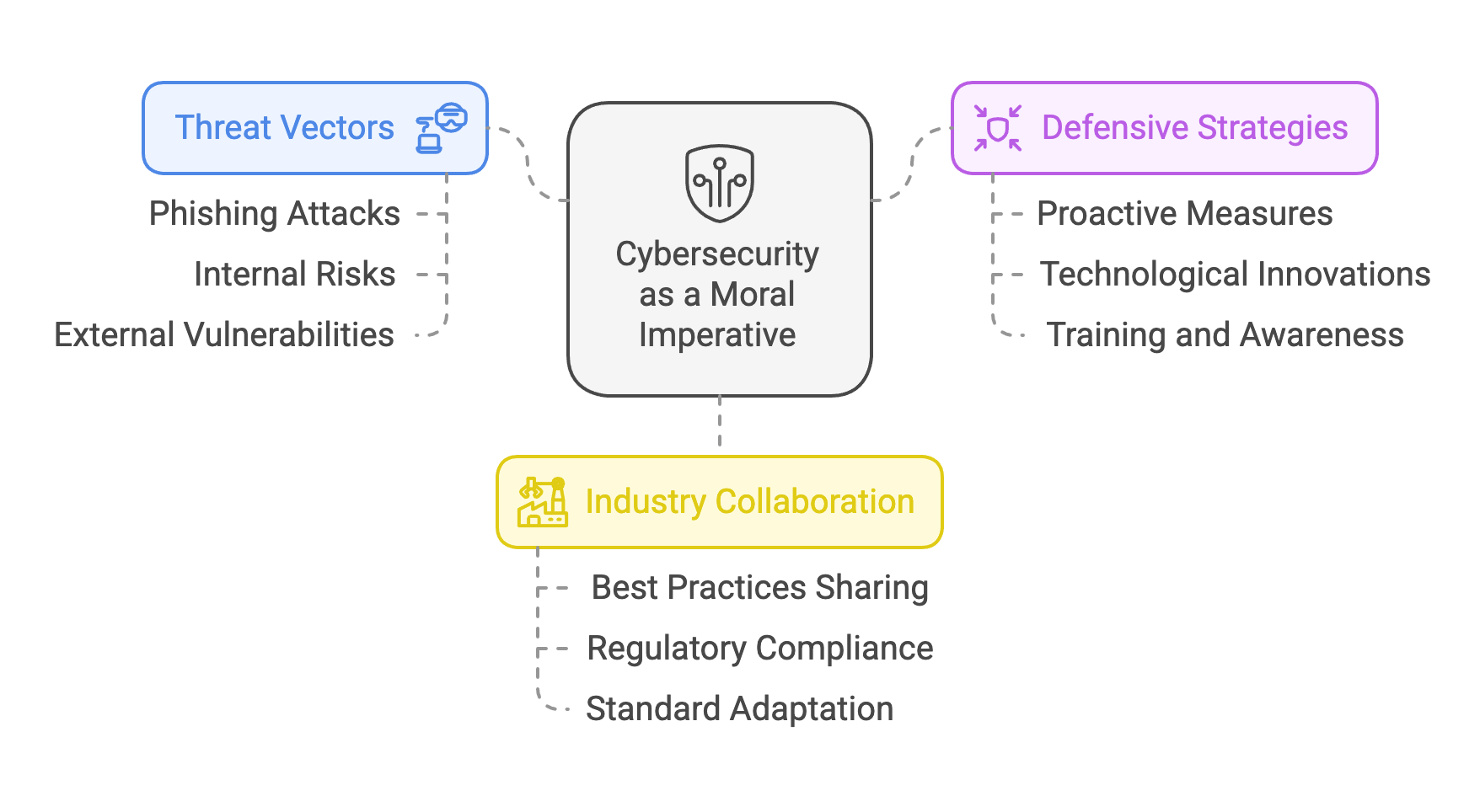

Cybersecurity transcends the technical realm; it embodies the moral and social contract banks uphold to protect client assets and sensitive data (PwC 2023). Customers entrust their life savings, personal details, and financial aspirations to their bank’s care. By positioning cybersecurity as an ethical imperative—rather than a compliance hurdle—banks reinforce the idea that trust is the nexus of every financial interaction, fostering long-term loyalty and brand reputation.

Contrary to the notion that stringent security measures hinder creativity, a well-secured environment can catalyze bold experimentation (Deloitte 2022). When banks invest in advanced encryption, real-time monitoring, and robust authentication, they create “safe zones” where emerging technologies—such as AI-driven advisory tools or blockchain-based settlements—can be explored without jeopardizing data integrity.

A philosophical commitment to security recognizes that cyber threats are inevitable. The difference lies in readiness: banks that integrate security from the earliest stages of product design and operational planning can mitigate risks more effectively than those relying on ad-hoc, post-incident fixes (KPMG 2023). By fostering a proactive ethos, banks embed defense mechanisms throughout their technology stack, reducing the need for emergency patches that disrupt customer experiences.

Figure 5: Cybersecurity strategy as a moral imperative.

Banks occupy a pivotal role in global economic ecosystems, handling everything from individual checking accounts to multinational corporate cash flows (Smith and Johnson 2022). A major breach can ripple through local economies, disrupt supply chains, and shake public confidence in financial institutions. This broader perspective positions cybersecurity as a public good, where banks share best practices and collaborate with peers and regulators to bolster industry-wide resilience.

Phishing attacks leverage human psychology, baiting users into clicking malicious links or disclosing credentials under false pretenses (McKinsey 2021). Conceptually, this emphasizes the importance of layered defenses that combine technical barriers—like email filters and URL inspection—with ongoing training to instill vigilance among employees and customers.

In these attacks, cybercriminals seize bank data or critical systems and demand payment to restore access. Conceptually, robust backup practices and network segmentation can significantly reduce downtime and data loss. Banks that regularly test their resilience through simulated “lockdown” scenarios stand a better chance of limiting damage if a real incident occurs.

Not all risks come from external hackers; employees, whether acting maliciously or unintentionally, can compromise security. Conceptually, banks need role-based access controls, regular user activity monitoring, and clear whistleblower policies to mitigate internal vulnerabilities. A culture that encourages responsible behavior and transparent escalation of concerns further minimizes insider risks (KPMG 2023).

Banks frequently outsource services—be it cloud hosting, payment processing, or software development. Each partnership introduces new risks if vendors lack comparable security standards (Deloitte 2022). Conceptually, robust third-party risk management entails due diligence, contractual obligations for data protection, and ongoing audits to ensure compliance throughout the supply chain.

Cyber adversaries perpetually seek novel attack surfaces, sometimes exploiting undisclosed (zero-day) software vulnerabilities. Conceptually, adaptive security architectures—featuring real-time threat intelligence and zero-trust frameworks—equip banks to adjust quickly to newly discovered risks, minimizing the window of opportunity for attackers (Smith and Johnson 2022).

Internationally recognized models like ISO 27001, the NIST Cybersecurity Framework, and PCI DSS offer structured guidance for governance, risk assessment, and policy enforcement (PwC 2023). Adapting these standards to align with a bank’s operational realities ensures a consistent, organization-wide baseline for security, bridging any gaps between IT silos and compliance teams.

Frequent vulnerability scans and penetration tests uncover gaps before malicious actors can exploit them (McKinsey 2021). In practice, these assessments must be integrated into deployment cycles, ensuring that newly launched apps or system updates undergo rigorous security validation. Continuous auditing fosters a culture of accountability, keeping teams ever mindful of potential weaknesses.

Because human error remains a leading cause of breaches, banks must invest in programs that teach employees to recognize suspicious emails, handle sensitive data securely, and report anomalies (KPMG 2023). Simulated phishing exercises and periodic “lunch and learn” sessions can keep security top-of-mind, transforming staff from potential liabilities into vigilant defenders.

Meticulous response plans detailing roles, communication protocols, and escalation pathways allow for swift containment if a breach occurs (Deloitte 2022). By conducting tabletop exercises and “fire drills,” banks can refine these playbooks, minimizing confusion during a real attack. Clear guidelines for customer notification, regulatory reporting, and technical remediation hasten recovery and limit reputational damage.

Deploying layers of defense—from firewalls and intrusion detection to endpoint protection and encryption—frustrates attackers by removing single points of failure (Smith and Johnson 2022). Banks can also bolster access controls with Multi-Factor Authentication (MFA) and biometric verification, ensuring only verified personnel can interact with sensitive systems.

Artificial intelligence and machine learning can help analyze network logs in real time, flagging unusual behaviors—such as suspicious login patterns or sudden spikes in data transfers (McKinsey 2021). Automated alerts enable security teams to isolate threats early, preventing lateral movement and large-scale compromises. As the volume of data grows, advanced analytics serve as an indispensable shield.

Even the best defenses can be breached. Disaster recovery (DR) and business continuity (BCP) strategies ensure services resume quickly, maintaining customer confidence. Practical measures include geo-redundant backups, failover data centers, and transparent communications that outline steps taken to rectify issues and prevent recurrence (PwC 2023).

By framing cybersecurity as a moral and foundational pillar of trust, identifying and monitoring diverse threat vectors, and implementing practical, multi-layered defenses, banks can remain resilient in a landscape of escalating cyber risks. This integrated approach—combining ethical conviction, rigorous conceptual mapping, and hands-on techniques—delivers robust protections for both institutional integrity and customer assets, ensuring that innovation can thrive under the safeguard of a secure digital infrastructure.

2.6. Impact on IT Priorities and Strategic Roadmaps

External pressures—ranging from stringent regulations and evolving customer demands to looming cybersecurity concerns—shape the strategic agendas of banking IT teams. To remain competitive, banks must balance urgent operational requirements with future-focused initiatives, building a dynamic roadmap that adapts to new challenges and opportunities. By weaving together a philosophical commitment to continuous evolution, conceptual frameworks for managing parallel priorities, and practical processes that foster agility, IT can assert itself as a strategic accelerator rather than a mere service provider.

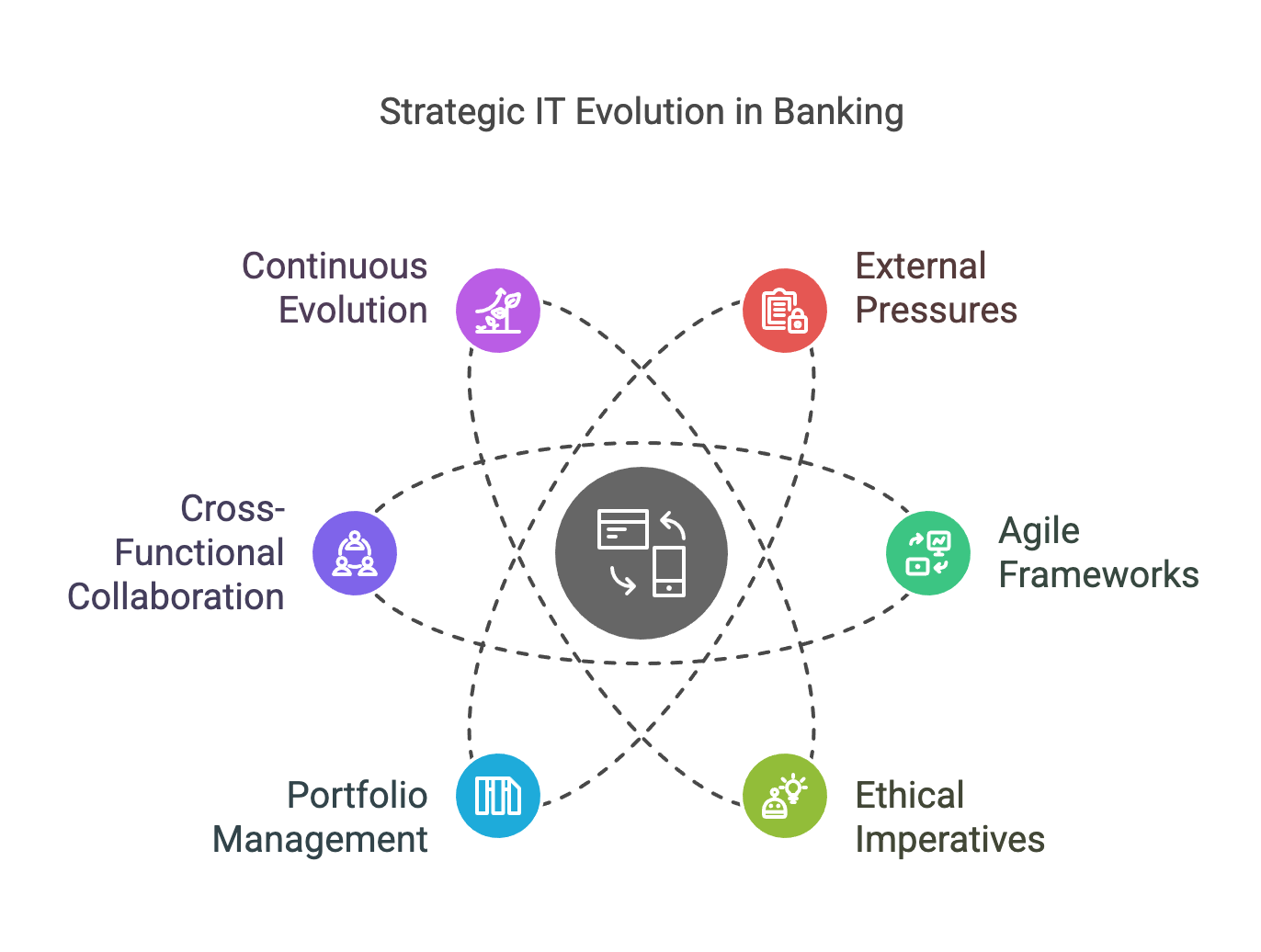

As fintech innovations, regulatory obligations, and emerging technologies gather speed, banking IT must remain in a state of “perpetual beta” (Deloitte 2022). This philosophical stance views systems and services as continually evolving entities rather than static deliverables. Embracing adaptability encourages a proactive search for improvements, ensuring that legacy solutions do not become obstacles to strategic progress.

Figure 6: Elements of strategic IT evolution in banking.

IT departments often face the temptation to respond only when disruptions—like a new compliance requirement or competitive pressure—arise. A more forward-thinking outlook employs foresight exercises, market trend analysis, and scenario planning to spot shifts in customer behavior or regulatory landscapes before they become acute pain points (KPMG 2023). This approach frames turmoil as a gateway to innovation rather than a crisis to be managed.

Banks that pivot IT priorities solely to fix immediate issues may inadvertently sacrifice long-term resilience and competitiveness. By contemplating societal trends and potential market evolutions, IT teams can craft solutions that generate lasting benefits—for customers, employees, and shareholders (PwC 2023). Such an outlook transcends point-in-time metrics, reinforcing the bank’s reputation and stakeholder trust even amid cyclical downturns.

Modern IT roadmaps are shaped not only by profitability but also by ethical imperatives, including digital inclusivity and responsible AI usage (Smith and Johnson 2022). These societal considerations underscore that innovation should align with the public good. Philosophically, prioritizing ethical dimensions can set a bank apart, particularly in an era when consumers scrutinize data practices and environmental footprints with greater vigilance.

To handle the tension between day-to-day operations and pioneering advancements, banks frequently adopt an ambidextrous approach (McKinsey 2021). One stream focuses on immediate imperatives—like compliance enhancements—while the other invests in emerging technologies poised to define the future. This conceptual separation prevents urgent tasks from consuming all resources, ensuring that strategic innovation remains an ongoing priority.

Structured portfolio management tools can help categorize projects by factors such as return on investment (ROI), risk appetite, and alignment with overarching strategic goals (Deloitte 2022). Regulatory mandates often command priority due to hard deadlines, but equally important are innovation endeavors—like next-generation data analytics or AI-driven customer experiences—that secure the bank’s long-term market position.

Short-term compliance projects might unlock capabilities that also propel larger modernization efforts. For example, building a robust data governance layer in response to privacy laws could lay the groundwork for advanced analytics in fraud detection or personalized services (PwC 2023). Identifying and strategically leveraging such overlaps eases resource strain and harmonizes immediate needs with forward-looking transformations.

Unlike regulatory deadlines, whose timeframes are rigid, innovation work benefits from iterative schedules and agile methodologies (KPMG 2023). Staggered timelines accommodate the trial-and-error nature of emerging tech. This conceptual division enables banks to simultaneously satisfy non-negotiable compliance milestones while adapting R&D priorities based on user feedback and market signals.

Deploying agile or hybrid frameworks—Scrum, Kanban—facilitates incremental releases and the swift reprioritization of features (McKinsey 2021). Regular sprint reviews empower stakeholders to provide feedback early and often, ensuring the roadmap remains relevant as conditions evolve. By collecting real-time insights, banks can pivot more effortlessly when faced with unexpected external shifts.

Breaking systems into microservices and exposing functionalities via APIs fosters resilience and adaptability (PwC 2023). In practice, this modular blueprint lets teams upgrade or replace specific components—like payment gateways or KYC modules—without overhauling the entire infrastructure. Such agility supports both rapid compliance updates and the integration of new, innovative services like open banking tools or partner fintech solutions.

Comprehensive dashboards tracking system performance, user adoption rates, and compliance metrics provide ongoing transparency (Smith and Johnson 2022). By analyzing this data, IT leaders can detect emerging bottlenecks, reallocate resources, or fine-tune application performance in near real time. This continuous loop of monitoring and adaptation prevents minor issues from escalating into critical failures.

Cross-functional steering committees ensure that competing priorities—like urgent security patches and strategic AI pilots—are evaluated through a unified lens (KPMG 2023). Periodic checkpoints validate that resource allocations align with the bank’s goals, while facilitating timely decision-making when reassigning budgets or shifting timelines becomes necessary.

Regular retrospective sessions—monthly or quarterly—evaluate progress, confirm business value, and refresh assumptions about the competitive landscape (Deloitte 2022). These reviews keep the roadmap agile, encouraging teams to retire underperforming projects, scale successful pilots, or adjust milestones in response to ongoing learnings. In essence, the roadmap becomes a living document that evolves alongside both external market demands and internal organizational insights.

By adopting a mindset of perpetual evolution, conceptually distinguishing between urgent fixes and far-reaching innovations, and practically establishing agile pipelines underpinned by real-time metrics and governance, banking IT can address the industry’s multifaceted pressures. In doing so, IT transitions from a reactive role to a strategic enabler, bolstering not only operational stability but also the bank’s capacity to shape its future in an unpredictable, fast-moving financial ecosystem.

2.7. Aligning Stakeholder Needs with IT Strategy

As banks navigate the complex interplay of business targets, regulatory constraints, and customer demands, alignment across diverse stakeholder groups becomes a critical determinant of IT success. Achieving this alignment entails a philosophical acceptance of stakeholder pressures as opportunities for innovation, a conceptual framework that weaves together business goals, user insights, and compliance requirements, and a practical methodology for governance and metrics. When IT operates in close dialogue with executives, regulators, and end-users, it transcends reactive task execution to become a proactive force shaping the organization’s future.

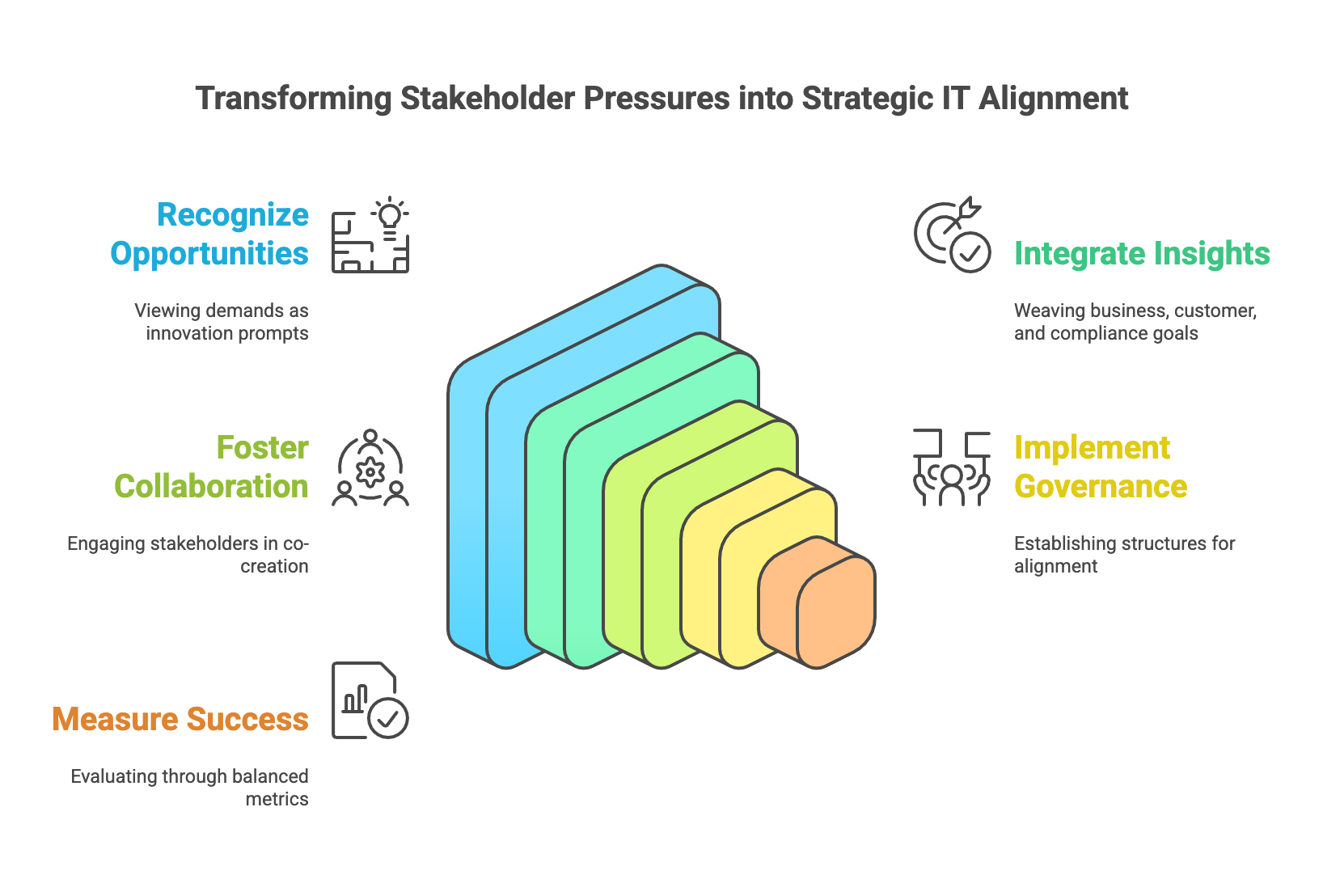

Often, banks regard stakeholder demands—be they driven by executive mandates, regulatory shifts, or evolving customer behaviors—as obstacles that complicate the IT agenda. A more constructive philosophical stance recognizes these pressures as important signals that can enhance IT’s strategic direction (KPMG 2023). By reframing external demands as prompts for innovation, teams remain vigilant to unexplored technologies or process improvements, channeling constraints into competitive advantages.

Rather than simply complying with incoming requests, IT can assume a co-creative role, partnering with stakeholders to design solutions that add value across the organization (Deloitte 2022). This collaborative posture diminishes the friction commonly associated with reactive task management, fostering an environment where feedback loops and iterative development are integral to daily routines. As a result, stakeholder engagement evolves from top-down directives into meaningful cooperation.

Figure 7: Transforming pressures into strategic alignments and collaborations.

Alignment efforts that prioritize mutual trust can yield lasting relationships even when external circumstances—like market downturns or new regulations—change drastically (PwC 2023). Each stakeholder requirement—no matter how demanding—can be viewed as a chance to demonstrate reliability and foresight. This perspective positions IT as a strategic ally that transcends short-term project objectives to champion broader institutional resilience and agility.

Genuine stakeholder engagement also assures that technology initiatives remain anchored in real human or societal needs. Whether it is optimizing products for underserved communities or ensuring robust data privacy, IT teams that heed stakeholder concerns enact a moral commitment that extends beyond mere checkbox compliance (Smith and Johnson 2022). This human-centric ethos bolsters the bank’s public reputation and signals a commitment to responsible innovation.

Aligning stakeholder expectations necessitates weaving together three primary elements—business drivers (profitability, market expansion), customer insights (user experience, loyalty), and compliance mandates (risk management, legal obligations) (McKinsey 2021). A unified strategic framework ensures that IT roadmaps address each dimension consistently, minimizing conflicting priorities. For instance, a new digital onboarding initiative can serve both operational efficiency and user-centric imperatives while adhering to KYC regulations.

Achieving alignment calls for regular interaction among IT, marketing, compliance, and other key business units (KPMG 2023). Conceptual structures like steering committees or cross-functional councils help capture a panoramic organizational perspective, pre-empting siloed development. This integrated approach recognizes that IT strategy is inseparable from broader corporate goals and risk appetites.

Methods such as RACI charts or power-interest grids clarify which stakeholders possess decision-making authority, budget control, or reputational influence (Deloitte 2022). Conceptually, such mappings guide IT departments to invest resources—be they technical expertise or financial capital—where they can yield the greatest strategic benefit first. By systematically identifying stakeholder power levels, teams can also anticipate potential bottlenecks and tailor communication strategies accordingly.

Because customer preferences, regulatory frameworks, and market conditions shift over time, alignment must be an iterative process (PwC 2023). Regular reviews at predetermined intervals—monthly, quarterly, or triggered by external events—help reconcile the IT roadmap with changing realities. This dynamic alignment ensures that the bank remains both compliant and competitively agile.

Success in alignment is measured through a blend of operational, regulatory, and innovation metrics: operational KPIs (like system uptime), regulatory KPIs (audit scores, compliance incident counts), and innovation KPIs (prototype adoption rates, new product time-to-market) (Smith and Johnson 2022). Transparent reporting of these indicators fosters collective ownership, allowing stakeholders to track progress and highlight areas needing recalibration.

In practice, cross-functional steering committees or executive councils function as arbiters that reconcile diverse stakeholder interests with IT priorities (KPMG 2023). By convening regularly, these bodies ensure emerging concerns—such as a new regulatory policy or a fresh competitor’s market entry—integrate swiftly into the IT roadmap. Swift adaptation averts project derailments and sustains organizational cohesion.

Applying agile methodologies—sprints, daily stand-ups, retrospective meetings—provides a structured forum for continual engagement with stakeholder representatives (Deloitte 2022). Rapid prototyping and iterative feedback reveal whether new features satisfy needs like compliance or user experience, minimizing the risk of late-stage pivots. This incremental approach aligns IT deliverables with stakeholder expectations at every milestone.

To balance the dual emphasis on regulatory adherence and innovative growth, many banks adopt balanced scorecards that track both “run the bank” and “change the bank” metrics (McKinsey 2021). For instance, a single dashboard might combine compliance status (Basel or GDPR adherence) with measures of innovation success (pilot completion rate, cross-selling revenue from new digital channels). This visibility empowers decision-makers to weigh trade-offs between near-term obligations and long-term opportunities.

Software solutions like Jira Portfolio, Trello, or customized project management suites can categorize initiatives by priority, complexity, and stakeholder impact (PwC 2023). By offering real-time insights into resource allocation and project backlogs, these tools surface potential overlaps or delays. IT leaders, in turn, can proactively resolve conflicts, ensuring that major stakeholders remain informed and supportive of shifting priorities.

Despite careful planning, stakeholder demands may occasionally clash. Establishing an escalation path—where unresolved issues move to higher-level committees or impartial boards—prevents subjective lobbying from derailing the broader IT strategy (Smith and Johnson 2022). Clear protocols for conflict resolution maintain project momentum and safeguard against fragmentation caused by competing agendas.

To minimize confusion, each project or milestone should have a defined owner who serves as the primary liaison for stakeholder communication (KPMG 2023). This individual orchestrates cross-team efforts, ensuring decisions are not bogged down by indecision. By consolidating accountability, banks enhance efficiency and bolster stakeholder confidence in IT’s ability to meet agreed timelines and quality benchmarks.

By embracing stakeholder pressures as drivers of creativity, integrating diverse requirements into a cohesive strategic plan, and deploying governance methods that capture both compliance and innovation goals, banks can forge a deeply aligned IT strategy. This synergy not only streamlines project delivery but also cultivates trust, ensuring that IT initiatives anticipate stakeholder needs and deliver sustainable, value-driven results in the dynamic financial sector.

2.8. Conclusion

Pressures from management and stakeholder expectations are not merely obstacles; they represent opportunities for IT leaders to demonstrate strategic acumen. By understanding the complex demands of regulators, customers, and competitive disruptors, IT teams can position themselves as proactive innovators rather than reactive caretakers. The onus is on every IT professional to master stakeholder engagement, adopt an adaptable mindset, and ensure that technology initiatives align with broader organizational goals. Now is the time to act: deepen your awareness of these pressures, communicate effectively with diverse stakeholders, and develop solutions that are both secure and innovative, paving the way for long-term success in a rapidly evolving banking landscape.

2.8.1. Further Learning with GenAI

Below are prompts crafted to elicit in-depth, multifaceted responses from GenAI, covering regulatory compliance, competitive pressures, cybersecurity, and stakeholder dynamics.

Analyze the critical regulatory frameworks (e.g., Basel III, PSD2, GDPR) that govern banking operations. In your answer, detail how IT leaders can turn these compliance obligations into strategic advantages by leveraging technology (e.g., RegTech solutions, automated reporting) and how this might affect organizational culture, risk management, and budgeting priorities.

Explain how the demand for seamless digital engagement—from mobile banking apps to chatbot-assisted interactions—collides with traditional bank infrastructure and legacy systems. Propose a phased roadmap that balances immediate customer experience improvements with the longer-term modernization of core banking platforms.

Evaluate how and why fintech startups or big tech entrants (e.g., Google, Apple, Amazon) pose both threats and opportunities for established banks. Recommend specific partnership or acquisition strategies, and discuss how cultural, operational, and regulatory barriers can be overcome to achieve mutually beneficial outcomes.

Propose a robust stakeholder mapping methodology for a mid-sized retail bank undergoing digital transformation. Demonstrate how to identify power dynamics and conflicting interests between executives, regulators, customers, and operational teams. Suggest approaches—like agile governance committees or cross-functional councils—to mitigate conflicts and align diverse stakeholders.

Dive deep into how banks can seamlessly integrate agile and DevOps methodologies within a compliance-heavy environment. Address common pitfalls—like change management resistance, regulatory bottlenecks, or limited cross-department communication—and propose solutions to maintain speed, quality, and regulatory adherence simultaneously.

Outline a comprehensive framework for measuring both tangible and intangible returns on investment (ROI) for IT projects focused on meeting or exceeding regulatory standards. Include cost avoidance, reputation management, and customer trust metrics, and discuss how these ROI metrics can be communicated effectively to senior management and the board.

Critically assess how cybersecurity threats—ranging from phishing attacks to sophisticated ransomware—shape the expectations of regulators, executive leaders, and customers. Provide a multi-layered security strategy (including people, process, and technology) that not only protects data but also reinforces stakeholder trust in the bank.

Discuss how emerging technologies like AI-driven credit scoring or behavioral analytics for anti-fraud measures intersect with ethical and privacy considerations in banking. Propose guidelines that IT teams can adopt to ensure compliance, preserve customer trust, and prevent potential reputational damage.

Analyze the cultural barriers that can arise in a bank’s IT division when shifting from a ‘risk-averse, maintenance-first’ mindset to an ‘innovation-ready, strategic partner’ mindset. Suggest targeted leadership development programs, incentive structures, and internal communication strategies to facilitate this cultural shift.

Imagine you are the CIO of a regional bank planning the next five-year IT roadmap. Describe how you would proactively incorporate anticipated changes in regulations, fintech competition, and digital customer experience demands. Include methods for gathering market intelligence and agile pivoting when unexpected shifts occur.

Examine a high-profile failure in the banking industry where stakeholder misalignment or inadequate regulatory planning led to the collapse of a major IT project. Pinpoint root causes such as insufficient budget, cultural resistance, or flawed governance, and extract actionable lessons for modern IT leaders.

Present a communication plan aimed at securing C-suite and board-level support for an ambitious tech overhaul (e.g., transitioning to cloud-based core systems). Emphasize how to articulate risk mitigation, financial upside, compliance alignment, and customer benefits in language that resonates with top management.

Predict how emerging players like digital-only neobanks or tech giants offering payment and lending services might erode traditional banks’ market share. Propose a defense and growth strategy that leverages the bank’s existing customer base, regulatory knowledge, and IT capabilities to create differentiated offerings.

Explore how real-time analytics can be leveraged to enhance risk management (e.g., fraud detection, liquidity management) in a heavily regulated banking environment. Detail the technical prerequisites (cloud infrastructure, big data architecture), compliance considerations, and cultural changes needed for success.

Detail how banks can effectively coordinate multiple vendors—ranging from established tech providers to smaller fintech startups—while meeting diverse regulatory, security, and performance standards. Include strategies for contract management, ongoing vendor assessments, and shared accountability structures.

Describe the concept of ‘ambidexterity’ in a banking context, where IT must deliver near-flawless operations and also innovate rapidly. Propose an organizational or team structure that facilitates both, ensuring minimal disruption to mission-critical systems while still nurturing forward-looking initiatives.

Propose a tiered investment strategy to drive digital transformation in a bank with limited capital expenditure. Outline how to allocate funds among regulatory compliance, foundational modernization, and innovative experiments (e.g., AI pilots), and how to secure stakeholder commitment for each tier.

Analyze how open banking APIs and data-sharing requirements are reshaping the traditional bank-customer relationship. Discuss potential collaboration models (bank-fintech co-creation, developer portals) and the technical, legal, and ethical safeguards required for successful and secure data integration.

Delve into methods for running large-scale digital transformation projects at speed while preserving operational stability. Examine the role of phased rollouts, parallel production environments, sandbox testing, and user-focused pilot programs, ensuring neither regulatory compliance nor existing customer services are jeopardized.

Propose a ‘continuous compliance’ framework wherein a bank’s IT department stays perpetually aligned with changing regulations and industry standards. Detail the automation tools, governance bodies, and cross-functional collaboration mechanisms necessary for real-time policy adaptations, and illustrate how this approach enhances stakeholder confidence.

These prompts are designed to facilitate deep exploration of the complex forces and stakeholder expectations impacting banking IT, yielding comprehensive, advanced discussions that blend strategic, operational, cultural, and technological perspectives.

2.8.2. Workshop Assignments

These workshop assignments provide participants with hands-on exercises to effectively navigate the interplay of stakeholder expectations, regulatory constraints, and competitive pressures within the banking sector.

Workshop Assignment 1: Stakeholder Analysis and Engagement Planning

Objective: Participants will learn to systematically identify and map all relevant stakeholders—executive leadership, regulators, customers, fintech partners, and internal departments—and analyze their influence on IT initiatives. This exercise highlights how conflicting requirements can be reconciled or strategically leveraged to support IT roadmaps in a banking environment.

Expected Deliverables:

A completed stakeholder matrix indicating priorities, pain points, and power levels

A high-level engagement plan outlining communication strategies and feedback loops

A short reflection document on potential conflicts and resolutions

Guidance:

Use real-world examples from participants’ current or past projects

Encourage open dialogue about tensions between stakeholders, focusing on root causes

Emphasize iterative engagement: refine the matrix and plan as new insights emerge

Workshop Assignment 2: Compliance Meets Innovation

Objective: This workshop simulates the delicate balance between adhering to strict regulatory requirements and driving innovative customer solutions. Participants must propose a new digital banking service, then integrate compliance checkpoints throughout its lifecycle—from conceptualization to pilot launch—showing how these can either constrain or enhance innovation.

Expected Deliverables:

A draft product concept specifying target customers and unique value proposition

A compliance checklist aligned with industry regulations

An implementation timeline identifying potential friction points and mitigation strategies

Guidance:

Highlight recent regulatory changes or guidelines relevant to digital banking

Encourage brainstorming on creative solutions that turn compliance into a competitive advantage

Use role-playing exercises (e.g., IT lead, compliance officer, business sponsor) to mirror real decision-making

Workshop Assignment 3: Cybersecurity Strategy Simulation

Objective: Teams will design a comprehensive cybersecurity plan in response to a simulated data breach scenario. By exploring threat vectors, stakeholder impacts, and immediate response protocols, participants gain practical experience in balancing urgent remediation needs with the expectations of regulators, customers, and executive leadership.

Expected Deliverables:

A rapid response protocol detailing critical actions within the first 72 hours

A stakeholder communication plan addressing internal teams, regulators, and customers

A risk assessment framework for preventing future breaches

Guidance:

Integrate incident detection, escalation procedures, and external communication best practices

Encourage discussion on how to preserve brand reputation while adhering to compliance reporting deadlines

Invite participants to reflect on the interplay between transparency, liability, and operational continuity

Workshop Assignment 4: Competitive Landscape Analysis

Objective: This assignment challenges participants to evaluate the fintech and big tech competitive landscape, identifying specific offerings that threaten traditional banking models. By analyzing key strengths and weaknesses, teams propose strategic responses—ranging from partnership opportunities to in-house R&D—that position the bank’s IT capabilities to stay ahead.

Expected Deliverables:

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis of competing fintech solutions

A shortlist of potential collaborations or acquisitions with rationale

Recommendations for internal innovation or product upgrades aligned with market gaps

Guidance:

Urge teams to consider both near-term and long-term competitive pressures

Incorporate customer feedback or market research data if available

Encourage creative approaches like joint ventures or sandbox environments to test new ideas

Workshop Assignment 5: Customer-Centric Digital Transformation

Objective: Participants will craft a multi-channel digital transformation strategy aimed at enhancing customer satisfaction and loyalty. Drawing on real or hypothetical user personas, they develop a roadmap covering mobile app enhancements, personalized product offerings, and data-driven customer insights, all while addressing regulatory concerns and security considerations.

Expected Deliverables:

User journey maps illustrating pain points and improvement strategies

A prioritized list of digital transformation initiatives, complete with timelines and ROI estimates

A framework for ongoing feedback and iterative feature development

Guidance:

Emphasize empathy and user research when defining personas and needs

Align each initiative with specific compliance standards to ensure feasibility

Highlight the importance of metrics like user adoption, NPS (Net Promoter Score), and regulatory adherence in measuring success

By completing these focused activities, IT professionals will refine their strategic thinking, enhance collaboration, and position themselves as proactive leaders driving innovation in a complex financial landscape.

Comments