Chapter 3

Pressures from Management and Stakeholder Expectations

"When management sees IT solely as an operational workhorse, innovation gets stifled. The real impact is unlocked when leadership embraces technology as a strategic partner driving new business horizons." — Chris Skinner, Author of “Digital Bank” and Global Fintech Commentator

This chapter offers a deep dive into the dual pressures IT leaders face from management and various internal stakeholders, highlighting the tension between reliable operations and ambitious revenue-generating projects. By dissecting real-world scenarios and drawing on proven frameworks, the chapter demonstrates how IT can satisfy these often-competing demands. Readers discover ways to articulate clear value propositions to C-suite executives, align resources more effectively, and collaborate cross-functionally to ensure that critical systems remain stable while innovation also flourishes. Ultimately, the guidance provided helps IT professionals navigate the complexities of budget constraints, legacy technology, and cultural roadblocks, enabling them to build robust strategies that cater to both the immediate needs of the organization and its future aspirations.

3.1. The Evolving Role of IT in the Eyes of Senior Management

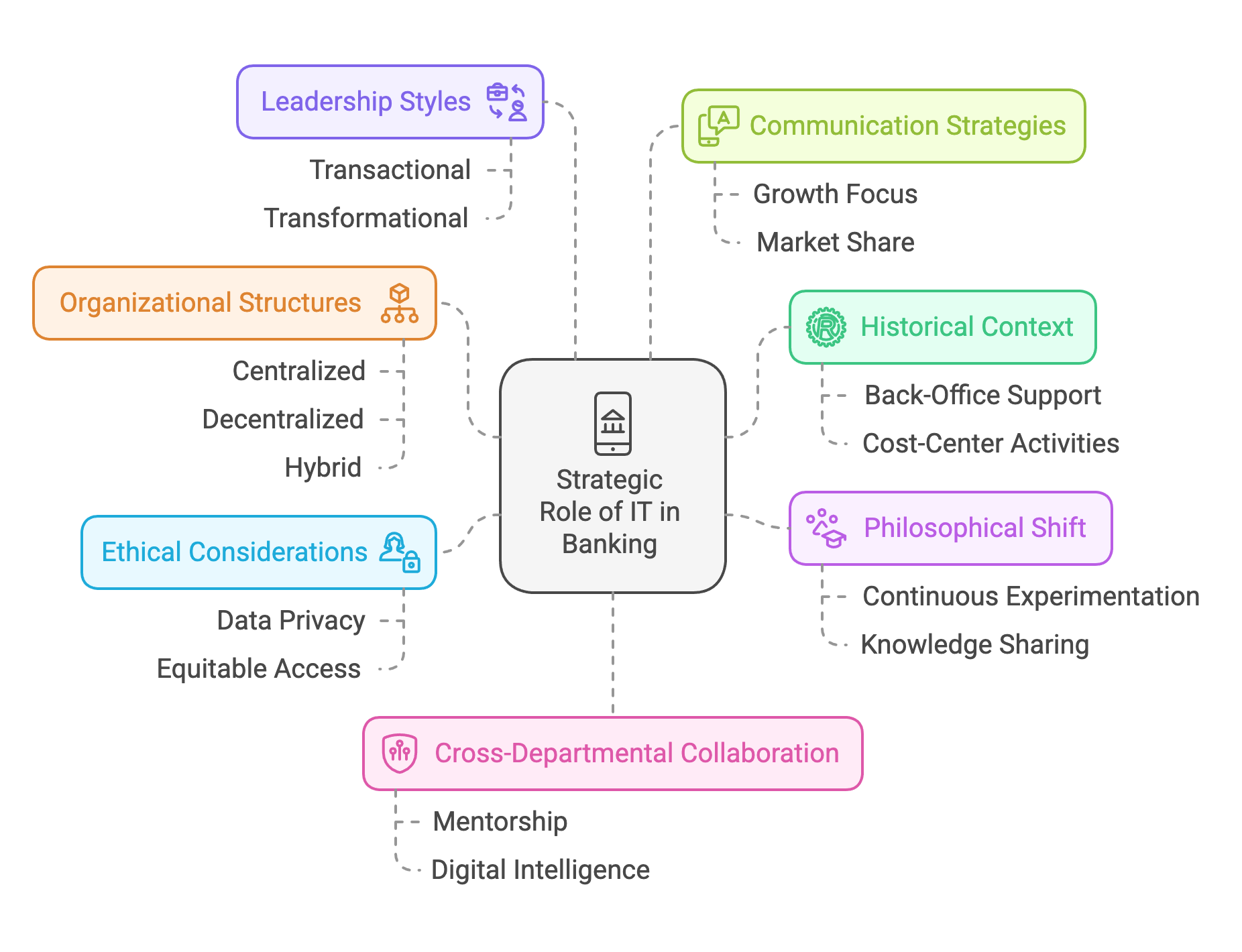

In recent years, senior management in banking institutions has increasingly recognized that IT is no longer confined to back-office support and cost-center activities. Instead, technology has become a strategic enabler capable of driving revenue, shaping customer experiences, and fostering innovation (Deloitte 2023). This evolution represents both a philosophical and practical shift in how IT’s contributions are perceived and leveraged at the highest levels of organizational decision-making.

Historically, IT teams were relegated to maintaining servers, troubleshooting software, and ensuring system uptime. This perspective cast technology as a necessary expense, rather than a driver of value creation. However, the current climate—fueled by rapid digital transformations and changing customer expectations—highlights technology’s potential to open new markets, create novel financial products, and enhance user experiences (McKinsey 2024). By reframing IT as a strategic function, senior management not only expects operational stability but also anticipates tangible contributions to the bank’s growth, competitiveness, and profitability.

Philosophically, this shift in perception is closely tied to the concept of the “learning organization,” in which continuous experimentation and knowledge sharing pave the way for innovation (Senge 2022). In such environments, IT professionals are encouraged to proactively engage with emerging technologies and test new ideas that can be scaled across the enterprise. Risk-taking is considered a necessary part of exploration, fostering a culture where technology teams are not simply order-takers but are integral to driving strategic initiatives and business evolution.

As IT grows in prominence, questions of ethics, inclusivity, and societal impact become more urgent. The banking sector handles vast amounts of sensitive customer data, and decisions about digital engagement or new financial products have far-reaching social implications (Smith and Johnson 2023). A philosophical commitment to data privacy, transparency, and equitable access underlines the emerging role of IT as a steward of public trust. This view compels IT leaders to integrate ethical considerations into every stage of technology deployment, ensuring that the pursuit of innovation is aligned with responsible corporate citizenship.

Figure 1: IT strategic roles are central to Bank operation.

Rather than viewing technology purely as a means to automate tasks or reduce costs, many banks are embracing a human-centric vision where technology is designed to serve employees, customers, and the broader community. This orientation transforms IT from a back-office tool to a catalyst for transformative change, elevating it to a core component of strategic planning. By prioritizing user experience, well-being, and societal impact, senior management signals that IT is central not just for efficiency but also for shaping a bank’s purpose and social license to operate (KPMG 2023).

The formal structure of IT within a bank critically affects how technology insights are integrated into top-level decisions. In a centralized model, technology standards and governance are uniform, but decision-making can become slow and bureaucratic. Decentralized structures offer agility and faster innovation cycles but risk fragmentation of processes and technologies. Hybrid approaches—where a central governance layer sets guidelines and localized teams drive innovation—are increasingly popular because they balance control with creativity (Deloitte 2023).

Senior management attitudes towards IT are also shaped by their leadership styles. Transactional leaders emphasize efficiency, cost control, and stable operations, potentially limiting the scope of IT’s strategic involvement. In contrast, transformational leaders encourage visionary projects, experiment with new technologies, and champion cross-functional collaboration. These leaders view IT as not merely a service provider but a key partner in achieving innovative and disruptive business outcomes (McKinsey 2024). As a result, transformational leadership often correlates with deeper integration of IT within strategic discussions.

Modern banks increasingly rely on C-level technologists—CIOs, CTOs, Chief Data Officers, and even Chief Digital Officers—to advocate for how technology can fulfill corporate objectives. Conceptual frameworks suggest these roles are pivotal in bridging boardroom expectations and operational realities (Smith and Johnson 2023). By communicating both the technical feasibility and strategic potential of new technologies, these leaders ensure IT perspectives inform product development, risk assessment, and competitive positioning at an enterprise level.

One of the most tangible ways to embed IT in strategic decision-making is through multidisciplinary teams or committees that include IT, marketing, operations, compliance, and risk management. These committees pool diverse expertise, ensuring that technology considerations are part of every major business decision (KPMG 2023). This cross-functional model helps banks avoid siloed thinking, aligns technology initiatives with corporate goals, and fuels cohesive innovation.

As banks progress in their digital maturity, IT increasingly claims an active role at the executive table. The organizational hierarchy evolves to position technology executives as integral contributors rather than back-office support. This transition typically involves redefining performance metrics, revising reporting lines, and updating communication structures to reflect the heightened strategic relevance of technology. Consequently, IT leaders are empowered to co-create corporate strategies, rather than merely react to them.

IT leaders who present ideas in terms of competitive advantage, customer engagement, and return on investment gain greater traction with senior management. Whether proposing new artificial intelligence solutions for credit scoring or sophisticated customer analytics platforms, placing the focus on tangible outcomes—such as cost savings, revenue growth, or risk mitigation—validates IT’s central role in meeting strategic objectives (Deloitte 2023).

Small-scale pilot projects serve as powerful proofs of concept. By rapidly delivering measurable benefits, such as reduced operational overhead or improved customer satisfaction, IT teams can demonstrate their capacity for strategic impact. These early successes not only build momentum but also establish credibility that fuels support for larger and more transformative initiatives (Senge 2022).

Regular interaction with C-suite executives through steering committees, innovation councils, or project review boards ensures IT remains visible and influential. Structured communication points—where updates on milestones, risks, and opportunities are systematically shared—reinforce IT’s strategic alignment with broader business goals. This transparency encourages executives to view IT leaders as trusted advisors rather than peripheral specialists (KPMG 2023).

One of the most critical skills for IT professionals seeking leadership buy-in is the ability to translate technical details into language that resonates with senior management. By framing proposals around growth, market share, efficiency gains, or customer loyalty, IT leaders highlight the direct value to the bank’s strategic imperatives. This business-centric communication approach narrows the gap between technical realities and executive decision-making (McKinsey 2024).

Balanced key performance indicators (KPIs) that measure both the operational health of IT (e.g., system uptime, incident resolution times) and innovation outcomes (e.g., successful product launches, user adoption rates) provide a holistic view of the technology function. Regularly presenting these metrics at executive forums underlines IT’s dual role as both guardian of infrastructure stability and engine of business growth (Smith and Johnson 2023).

Finally, IT leaders can bolster their strategic standing by nurturing cross-departmental collaboration. Offering mentorship to managers in areas such as data analytics or cybersecurity elevates the entire organization’s digital intelligence. These efforts further cement the perception of IT as a transformative force, essential for guiding the institution toward innovation and long-term success (Deloitte 2023).

By reframing IT from a purely operational cost center to a strategic value creator, organizations embrace a philosophy where technology is central to corporate vision and societal impact. The conceptual underpinnings of leadership style, organizational structure, and cross-functional integration determine whether IT is merely reactive or a proactive participant in strategic deliberations. Practically, techniques such as presenting compelling business cases, accumulating early wins, and maintaining open governance channels allow IT leaders to secure visibility and guide initiatives critical to the bank’s competitive future. As the industry continues to evolve, banks that wholeheartedly integrate IT into core strategic planning will be better positioned to navigate disruptions, create customer-centric innovations, and uphold ethical and sustainable business practices.

3.2. Achieving Equilibrium: Stability vs. Transformation

In today’s dynamic banking environment, IT leaders often find themselves juggling two pressing mandates: the need for rock-solid operational stability and the imperative to drive innovation. Balancing these distinct yet interdependent priorities can be particularly challenging, given the high stakes of both safeguarding core services and exploring new digital frontiers. As the industry shifts toward more customer-centric and technology-driven models, achieving this equilibrium becomes crucial for sustaining competitiveness and trust in the market.

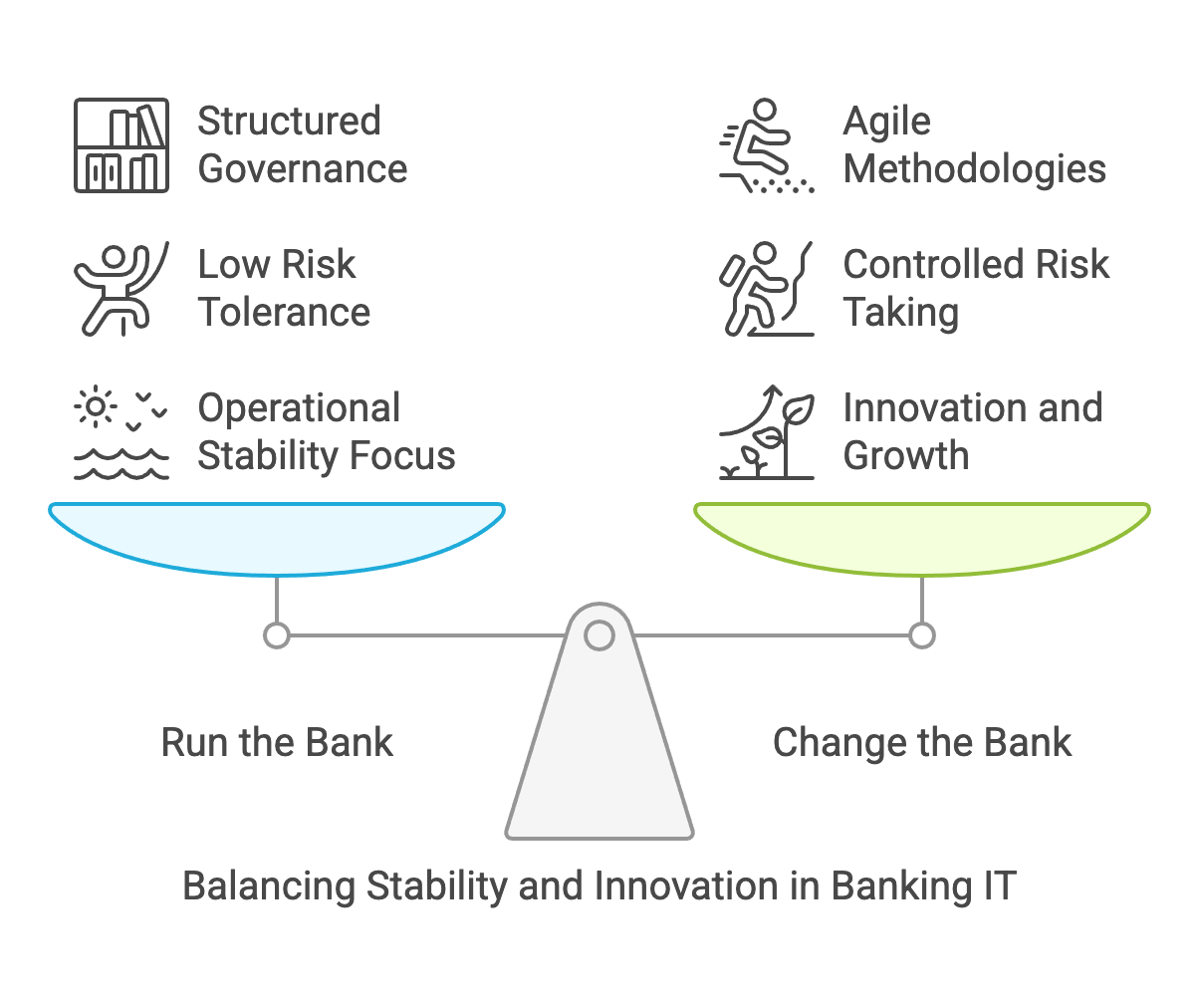

Philosophically, IT in banking must perform consistently at the highest level when maintaining everyday operations—ranging from systems uptime to ensuring data integrity—while simultaneously championing forward-looking projects and products (KPMG 2022). This notion of “running” and “changing” the bank is deeply rooted in ambidexterity theory, which advocates for excelling at the exploitation of existing capabilities while exploring novel opportunities (Zhang and Li 2023). Striking this delicate balance ensures that the organization remains robust in the face of current demands while remaining open to transformative ideas.

Figure 2: IT play important roles to balance stability and innovation in Bank.

A culture that values operational reliability and cutting-edge exploration in equal measure underpins this dual mandate. When staff recognize that both stability and innovation are critical to success, it helps dismantle potential silos between “maintenance” and “breakthrough” teams (Deloitte 2023). Encouraging teams to view reliability as non-negotiable and innovation as a continuous process fosters a holistic mindset, where each member of the organization understands their role in contributing to both short-term performance and long-term growth.

Philosophically, overemphasizing stability can result in organizational complacency. In a rapidly evolving financial landscape, stagnation invites competition from agile fintech start-ups or tech giants looking to disrupt traditional banking (PwC 2023). On the other hand, reckless innovation—unanchored by rigorous operational protocols—risks undermining customer trust through service outages or compliance failures. A deliberate commitment to balancing both imperatives ensures the bank remains resilient and forward-thinking.

From an ethical standpoint, the pursuit of cutting-edge products or solutions must also account for data privacy, regulatory obligations, and social impact. Rapid experimentation with emerging technologies—such as AI-driven services or blockchain-based platforms—can yield tremendous benefits but must be managed responsibly (McKinsey 2024). By embedding ethical considerations into each step of the innovation process, banks safeguard public trust and align their evolution with societal expectations.

Conceptually, IT work in banking is often grouped into two main categories: “Run the Bank” and “Change the Bank.” The former encompasses activities dedicated to upholding and enhancing existing systems—everything from routine maintenance to performance tuning. In contrast, “Change the Bank” initiatives focus on creating new digital products, integrating emerging technologies, and envisioning next-generation banking experiences (Zhang and Li 2023). This clear delineation helps clarify priorities and resource allocation.

To effectively manage both streams, many organizations allot separate budgets, leadership structures, and governance processes. This partitioning provides transparency around how resources are distributed, enabling senior executives to track ROI, define risk thresholds, and establish distinct success metrics for each domain (KPMG 2022). It also allows for agile reallocation when critical market shifts or regulatory changes occur.

Within scholarly discourse, ambidexterity can be structural—where dedicated teams independently focus on either maintenance or innovation—or contextual—where a shared cultural context empowers employees to adapt between roles as needed (Zhang and Li 2023). Banks can deploy the approach that best aligns with their size, culture, and strategic objectives. For instance, a large, established bank may prefer structural ambidexterity with distinct teams, whereas a mid-sized organization might adopt contextual ambidexterity, embedding adaptive behaviors into daily workflows.

Conceptual frameworks also emphasize aligning each stream with the appropriate life cycle. “Run” activities typically leverage established processes such as ITIL or COBIT for service management, ensuring consistent service quality. Meanwhile, “Change” initiatives often employ agile or lean methodologies, which encourage iteration and speed to market (Deloitte 2023). By mapping each stream to a well-defined operational blueprint, organizations reduce friction and manage stakeholder expectations.

Risk tolerance naturally differs between “Run” and “Change” functions. Routine operations may have near-zero tolerance for downtime or security breaches, while innovation projects can afford a degree of controlled risk to foster learning and breakthrough discoveries (PwC 2023). Clear governance frameworks that differentiate these risk profiles guide decision-makers in resource deployment and strategic oversight.

One of the most straightforward ways to manage the “run vs. change” divide is through resource allocation matrices. By visually mapping out how time, budget, and personnel are split across maintenance and innovation, stakeholders can see where imbalances may impede strategic goals. This transparency helps senior leaders adjust allocations, perhaps diverting more resources to a promising pilot or shoring up mission-critical operations (McKinsey 2024).

A dual governance model combines agile methods for exploratory, fast-turnaround initiatives with more structured stage-gate processes for capital-intensive or high-risk projects. Short sprints, frequent user feedback, and iterative releases help “change” teams maintain momentum, while stage-gate checkpoints ensure that big investments receive the oversight and risk mitigation they require (Deloitte 2023). The result is a governance structure that adapts to the distinct demands of stability and transformation.

For both streams, advanced DevOps and continuous integration/continuous delivery (CI/CD) pipelines can streamline releases. On the “run” side, automation reduces human error, ensuring stable deployments and reliable service performance (KPMG 2022). Simultaneously, these pipelines empower “change” teams to push updates rapidly, experiment with minimal downtime, and pivot in response to user feedback—all without undercutting core operations.

Establishing innovation labs or “skunkworks” teams creates a safe environment for risk-taking and experimentation. By isolating high-stakes projects from day-to-day operations, banks minimize disruptions and can swiftly iterate on emerging tech concepts like AI-driven advisory tools or blockchain-based settlement systems (PwC 2023). Successful prototypes can then be integrated back into mainstream operations once proven stable and aligned with compliance requirements.

Balanced scorecards or consolidated dashboards that track both “run” and “change” KPIs enable continuous monitoring of overall IT performance. Typical “run” metrics might include uptime, mean time to repair, and compliance adherence. Meanwhile, “change” metrics could measure product launch frequency, user adoption rates, or incremental revenue from newly introduced services (Zhang and Li 2023). Regularly reviewing these metrics allows leadership to make timely adjustments and maintain strategic harmony.

Periodic roadmap reviews serve as an additional mechanism for ensuring equilibrium. If operational demands surge—for instance, during regulatory audits or new security threats—resources can be temporarily re-routed to “run” efforts. Conversely, if the organization identifies an emerging market opportunity, it can shift attention and capital back to “change” endeavors (McKinsey 2024). This cyclical re-evaluation keeps both streams adaptable and resilient to shifting business environments.

3.3. Overcoming Resource Constraints and Budget Pressures

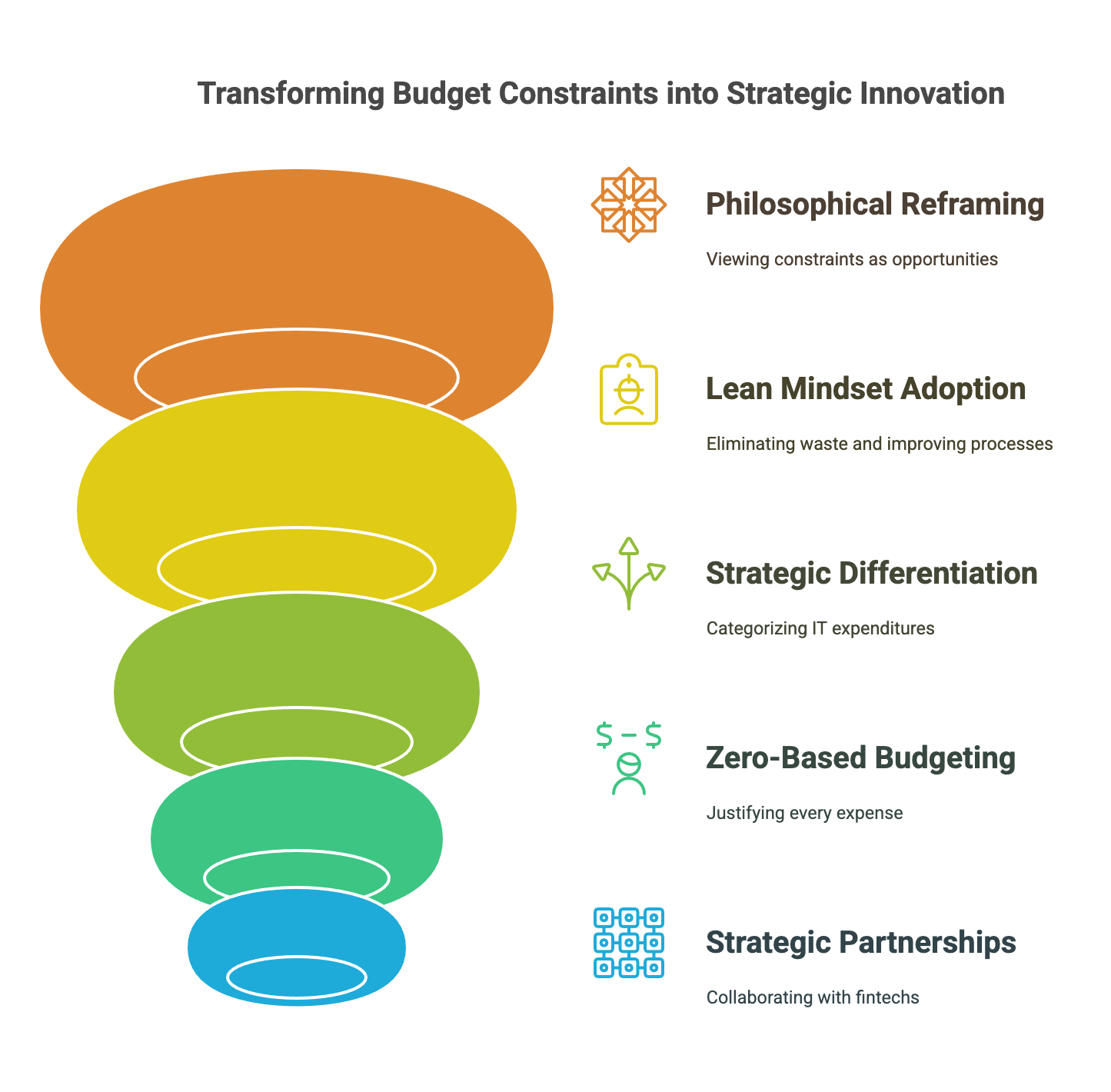

In an era defined by economic uncertainty, regulatory complexities, and evolving market dynamics, banks increasingly face budget pressures that can threaten their capacity to innovate. For IT leaders, these financial constraints often feel like daunting roadblocks. Yet, when viewed through a more expansive philosophical, conceptual, and practical lens, resource limitations can serve as potent catalysts for creativity, pushing organizations to operate with greater precision, collaboration, and foresight.

From a philosophical standpoint, budget constraints need not signal stagnation. On the contrary, limited resources often compel IT teams to question established processes, prioritize only high-impact projects, and adopt more efficient technologies (KPMG 2022). By reframing constraints as motivation for rethinking business as usual, teams become more open to creative problem-solving techniques that streamline workflows and reveal untapped opportunities.

Figure 3: Strategic partnership is required to transform budget constraints into strategic innovation.

A lean mindset promotes the continuous elimination of waste while focusing on incremental, meaningful improvements. This cultural orientation emphasizes small, rapid experiments that can deliver value without large capital outlays (Li and Taylor 2022). As staff become accustomed to scrutinizing each process and expenditure, they foster a collective identity rooted in resourcefulness. Even within large, complex banking environments, this ethos can spark grassroots innovation and a willingness to challenge legacy assumptions.

Open communication about budget realities plays a pivotal role in galvanizing teams around prudent spending. By clearly articulating cost-cutting needs and the rationale behind each budgetary decision, leaders encourage employees to look for efficiencies that might otherwise remain hidden (Deloitte 2023). This inclusive approach engenders a sense of shared accountability, turning cost management into a collective mission rather than a top-down edict.

Tighter budgets also prompt deeper reflection on ethical and societal outcomes. With fewer resources at their disposal, banks may choose to prioritize projects that align with broader societal goals—such as financial inclusion, data privacy safeguards, or environmental sustainability (PwC 2023). Under these conditions, budget pressures push institutions to re-evaluate not just how money is spent, but also why certain initiatives deserve support over others.

Conceptually, it is crucial for banks to differentiate between strategic and non-strategic (tactical) IT expenditures (McKinsey 2024). Strategic investments often target long-term growth opportunities, such as cloud transformation, artificial intelligence, or digital customer engagement platforms. Conversely, tactical spending keeps existing systems running but offers limited competitive advantage or revenue potential.

To systematically distinguish these categories, organizations can adopt a value-based budgeting framework. Here, each proposed IT initiative is evaluated against clearly defined business metrics—revenue potential, operational efficiencies, customer experience enhancements (PwC 2023). By quantifying anticipated outcomes, leaders can rapidly identify high-value projects that merit continued funding and lower-priority efforts that might be deferred or discontinued.

One effective conceptual tool is a project portfolio matrix, such as McFarlan’s Strategic Grid, which categorizes initiatives into four areas: strategic, high potential, key operational, and support (Li and Taylor 2022). This classification system helps banks visualize where IT resources are currently allocated. By systematically assessing the grid, executives gain clarity on where to reallocate funds—from lower-value maintenance to higher-potential digital innovation, for instance.

Legacy infrastructures, although central to daily operations, can consume disproportionate amounts of budget without driving meaningful differentiation or new income streams. Conceptually, banks may consider phased migration or modernization strategies, gradually retiring outdated platforms to redirect both capital and talent into more innovative pursuits (KPMG 2022). This incremental approach balances the need to maintain mission-critical services with the goal of freeing resources for transformative projects.

IT spending is also shaped by regulatory and security imperatives. Mandatory outlays—such as those for patching, auditing, or cybersecurity—cannot be ignored, even if they appear non-strategic at first glance. Conceptual frameworks recognize that balancing these compliance demands with strategic innovation is integral to sustaining trust, reputation, and long-term viability (Deloitte 2023). Careful prioritization ensures that essential risk mitigation does not entirely crowd out the capacity for forward-looking initiatives.

One of the most direct methods for controlling costs is zero-based budgeting, where every line item must be fully justified each fiscal cycle rather than simply receiving last year’s budget plus adjustments (McKinsey 2024). This approach forces project teams to articulate clear business cases and demonstrate tangible value. While ZBB can be demanding to implement, it often reveals redundant or legacy expenditures that are no longer mission-critical.

Banks increasingly use specialized portfolio management tools—such as Planview or Microsoft Project—to systematically rank and review IT initiatives. By analyzing potential ROI, strategic alignment, and risk exposure, these tools enable leaders to make data-driven funding decisions (KPMG 2022). Regularly scheduled portfolio reviews then allow for dynamic reallocation: underperforming projects can be curtailed, while promising pilots may receive additional resources to expand.

Rather than investing heavily in large-scale, single-phase transformations, a phased rollout strategy emphasizes smaller, iterative releases. By focusing on minimum viable products (MVPs), IT teams can test solutions in real-world conditions without committing extensive upfront budgets (Deloitte 2023). If initial feedback is positive, incremental funding can accelerate progress; if not, course corrections can be made early, limiting sunk costs and preserving capital for alternative projects.

Beyond internal budgetary reforms, banks can forge strategic partnerships with fintechs or technology vendors, distributing costs and risks. These models may include co-development arrangements or revenue-sharing agreements that tie investment to measurable outcomes (PwC 2023). Such alliances can bring cutting-edge capabilities within reach, even when internal capital is constrained, while simultaneously fostering a culture of collaborative innovation.

A practical way to stretch limited budgets is to redeploy existing staff rather than consistently hiring new talent. By training employees in areas like AI, cloud computing, or advanced cybersecurity, banks increase their internal skill set and agility (Li and Taylor 2022). This approach often proves more cost-effective over time and underscores a commitment to professional growth, boosting employee engagement and retention.

Finally, robust metrics are essential to gauging whether budget allocations are meeting strategic objectives. Key Performance Indicators (KPIs) that track cost savings, ROI, customer satisfaction, or speed to market help IT and business leaders identify which projects warrant continued investment (McKinsey 2024). Quarterly or even monthly reviews ensure that decisions remain grounded in current data, enabling agile responses to evolving market conditions.

3.4. Building Credibility and Influence with the C-Suite

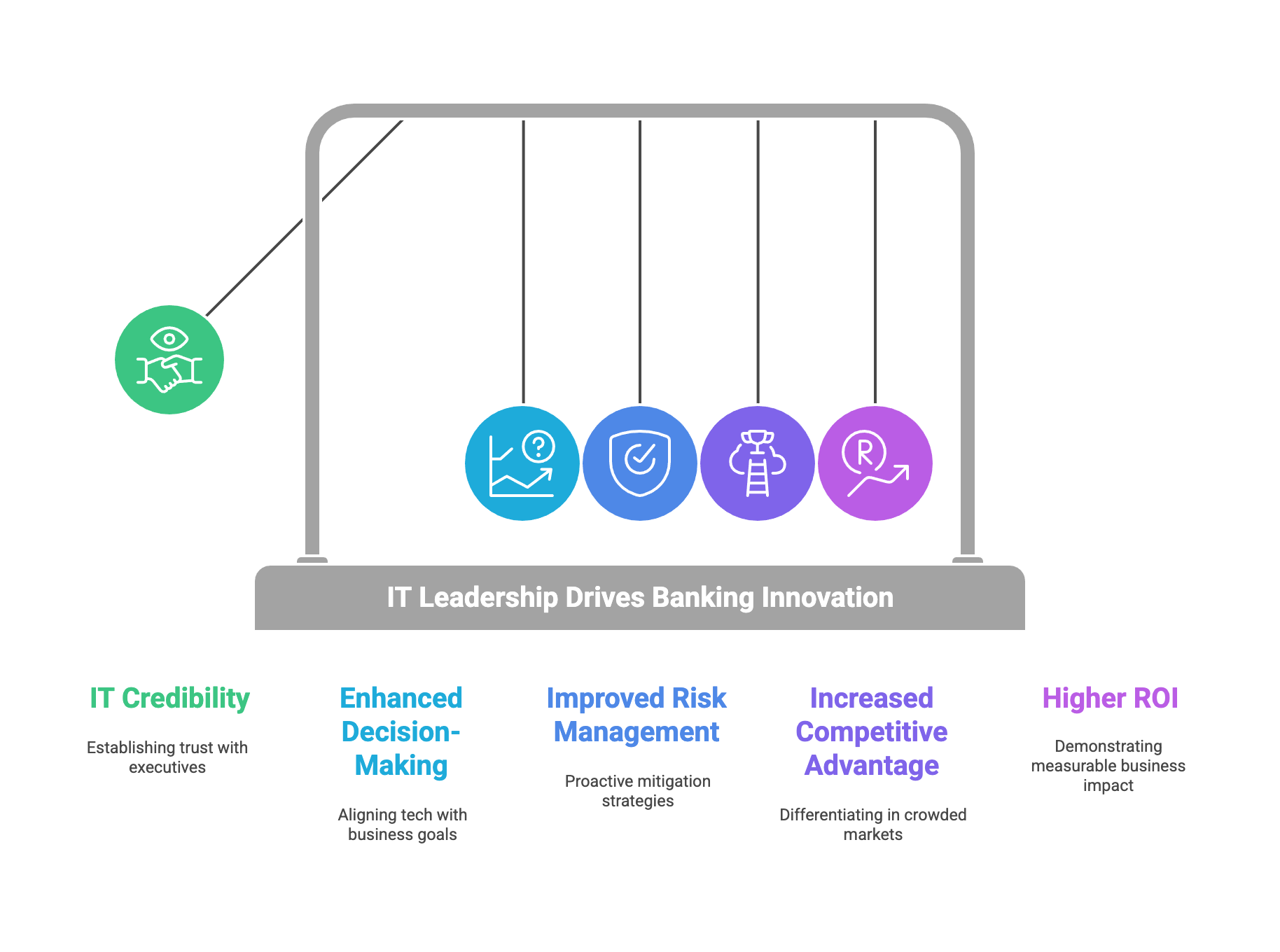

In most banking institutions, the C-suite wields decisive authority over where resources are allocated, how risk is managed, and how strategic priorities are shaped. For IT professionals aiming to secure buy-in for transformational initiatives, establishing credibility with senior leaders is paramount. By understanding executive priorities, articulating proposals in business terms, and showcasing tangible results, IT leaders can align technology initiatives with organizational imperatives, earning both trust and influence in the process.

From a philosophical perspective, senior executives continually evaluate whether the potential rewards of an initiative justify the inherent risks. For IT leaders, acknowledging this focus on risk tolerance means articulating not only the technical viability of projects but also how they might affect the bank’s reputation or customer trust if something goes wrong (KPMG 2022). Demonstrating that IT can foresee and mitigate these challenges—through robust compliance structures or phased deployment—shows that technology teams understand the broader implications of innovation.

At the heart of many C-suite decisions is the pursuit of shareholder value, driven by indicators such as market share and revenue growth (Deloitte 2023). IT projects that reduce operational costs, elevate customer satisfaction, or accelerate time-to-market directly contribute to these metrics. By clearly tying a proposed solution to measurable ROI, IT leaders align themselves with executive decision-making frameworks, reinforcing the notion that technology investments fuel overall business performance rather than merely solving isolated technical issues.

Figure 4: IT credibility can impact decisions, risk, competitiveness and ROI at the end.

Banking executives increasingly view technology as a way to differentiate in crowded markets, whether through personalized customer experiences, advanced analytics, or seamless omni-channel engagement (Smith and Taylor 2022). By framing IT innovations as sources of competitive advantage—enabling faster entry into new segments or streamlined internal processes—IT professionals can paint a vivid picture of how technology fosters long-term relevance in the face of disruptors and fintech competitors.

While quarterly results are often a driving force for the C-suite, many leaders also plan for long-term resilience. Philosophically, positioning IT initiatives to deliver short-term wins (e.g., immediate cost savings or operational efficiency) while laying foundations for future growth (e.g., establishing data infrastructure for advanced AI applications) resonates with executives who must balance present-day profitability against a multi-year horizon (PwC 2023). Showcasing both incremental gains and transformative potential encourages the C-suite to view IT as a strategic pillar rather than a transactional cost center.

Conceptually, translating technical outputs—such as improved infrastructure or new system architectures—into business outcomes (e.g., X% reduction in customer service wait times, improved regulatory compliance metrics) bridges the gap between IT and executive priorities. Aligning IT goals with Key Performance Indicators (KPIs) that the C-suite values, such as customer retention or net promoter score (NPS), provides a clear justification for why a technology investment matters (McKinsey 2024).

A compelling narrative supported by data—benchmarks, case studies, or projected time-to-value—can significantly influence executive approval. By framing the current pain points, proposed solutions, and expected outcomes within a coherent story, IT leaders emphasize not only the numerical gains but also the human and strategic impacts (KPMG 2022). Visual tools such as infographics and concise data charts often resonate more powerfully than technical jargon, helping executives grasp the magnitude and relevance of the opportunity.

Banks operate in a highly competitive ecosystem. Anchoring IT proposals in market realities—such as how top competitors or fintech disruptors have harnessed similar technologies—places the initiative within a strategic context (Deloitte 2023). By highlighting evolving customer expectations and regulatory pressures, IT leaders can illustrate a clear sense of urgency, reinforcing the idea that timely adoption of new solutions can preserve or enhance the bank’s market position.

Given the heightened sensitivity to risk in financial services, demonstrating a clear plan for mitigating potential pitfalls can be more persuasive than merely showcasing upside potential. Outlining fallback scenarios, compliance safeguards, and incremental rollout approaches signals that the IT team has thoroughly vetted challenges and integrated robust governance mechanisms (PwC 2023). By proactively addressing risk, IT leaders reassure the C-suite that adopting innovative solutions does not equate to reckless experimentation.

Executive attention spans are limited; a pitch deck that quickly orients the C-suite to the pain point, solution, expected ROI, and next steps can yield swift buy-in (McKinsey 2024). High-level visuals—graphs, timelines, and bullet points—tend to be more effective than text-heavy slides. By distilling complex IT proposals into executive-friendly summaries, technology leaders demonstrate empathy for their audience’s time and decision-making style.

Once a project is greenlit, dashboards that provide real-time insights into progress, budget usage, and performance metrics help maintain leadership engagement. Regularly sharing these dashboards fosters a transparent environment, minimizing surprises and continually reinforcing the value IT initiatives bring to the business. Simple visual indicators of milestones or risk levels enable executives to understand where the project stands and how their investment is unfolding (Smith and Taylor 2022).

To mitigate large-scale risk and gather early feedback, many banks employ pilot programs or minimum viable products (MVPs). Even a modest pilot—such as a chatbot that reduces customer support queries—can validate assumptions, refine implementation strategies, and build a compelling case for broader investment. These quick wins not only bolster internal confidence but also offer tangible proof of how technology can solve real business challenges (KPMG 2022).

Formalizing periodic check-ins—monthly, quarterly, or milestone-based—keeps the C-suite in the loop on incremental achievements and upcoming challenges (Deloitte 2023). Open communication channels allow IT leaders to report setbacks candidly, turning potential failure points into learning experiences. This builds trust, as executives perceive the IT function as transparent and adaptive, rather than rigid or defensive in the face of roadblocks.

When proposed IT solutions solve pain points for various departments—marketing, operations, or compliance—inviting those teams to co-present enhances credibility. This signals that the initiative has broad internal support and is not merely “an IT project,” but rather a cross-functional effort to advance the bank’s strategic objectives (PwC 2023). Collaboration across the enterprise underscores that technology investments drive wide-ranging benefits, from enhanced customer journeys to streamlined operational workflows.

Although ROI frequently tops the executive agenda, advanced metrics such as brand reputation, employee satisfaction, and customer loyalty can further enrich the narrative around an IT proposal’s value. For example, demonstrating how a new digital platform both lowers transaction costs and boosts customer retention rates highlights multi-dimensional returns (McKinsey 2024). Emphasizing these extended benefits cements the idea that IT is integral to maintaining a competitive edge in an ever-evolving industry.

3.5. Strategies for Cross-Functional Collaboration

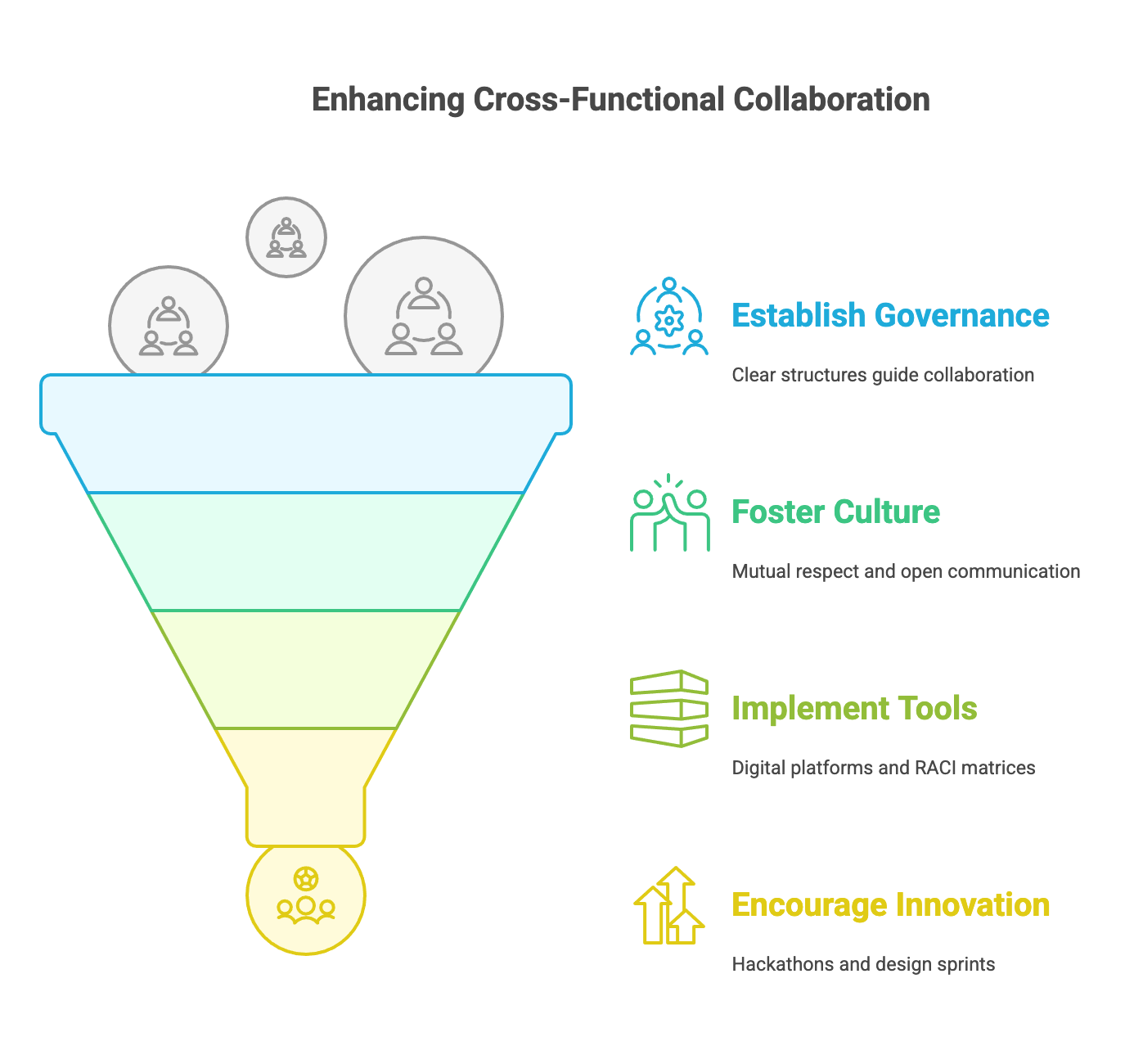

In many financial institutions, cross-functional collaboration forms the bedrock of successful transformation—bridging the gaps between departments like IT, operations, marketing, compliance, and risk management. When collaboration flourishes, banks can accelerate innovation, balance operational stability with strategic growth, and respond more nimbly to changing market and regulatory pressures. By cultivating a cohesive culture, establishing clear governance structures, and adopting practical tools, IT leaders can encourage meaningful cooperation that drives enterprise-wide impact.

Philosophically, transformative endeavors—such as rolling out new digital channels or enhancing predictive analytics—thrive when seen through the lens of collective intelligence (KPMG 2022). When different teams converge around shared objectives, they can integrate customer satisfaction, compliance obligations, and financial performance into a unified approach. This holistic stance ensures that strategic decisions do not favor one dimension—like cost savings—at the expense of essential areas such as security or customer experience.

Effective collaboration is anchored in mutual respect, with each department’s expertise duly recognized (McKinsey 2024). Instead of viewing competing agendas as roadblocks, a collaborative culture treats them as valuable inputs that spark creative solutions. Philosophically, conflict becomes a catalyst for innovation rather than a barrier, so long as every participant values open communication over territorial thinking.

Figure 5: Enhanced cross-functional collaboration encourages innovation.

Moving from knowledge-hoarding to knowledge-sharing demands a shift in mindset, one that embraces transparency, empathy, and sincere feedback loops. When employees feel safe to question assumptions or propose alternative ideas, issues are identified earlier, and projects benefit from broader viewpoints (Deloitte 2023). Such a culture not only prevents silo-based duplications but also fosters an environment where collective learning accelerates strategic outcomes.

Strong collaboration requires a unifying narrative: a purpose that transcends individual departmental goals. Whether that vision emphasizes superior customer experiences, cutting-edge fintech partnerships, or sustainability commitments, a common banner motivates teams to align their efforts (Jones and Ramirez 2022). When all participants view themselves as contributors to a larger mission, boundaries between departments become more porous, enabling smoother coordination and richer innovation.

Many organizations now employ squad or pod structures, wherein each team comprises diverse skill sets—IT architects, data analysts, legal advisors, and product owners—to hasten decision-making and reduce bureaucratic lag (PwC 2023). Conceptually, these squads operate with a collective mandate, distributing expertise in a way that resolves bottlenecks. Rather than passing tasks between departments in a linear fashion, squads tackle them in parallel, enhancing both speed and synergy.

Steering committees typically include senior leaders from various functions who shape high-level direction, oversee resource allocation, and mediate conflicts (KPMG 2022). By monitoring progress against strategic objectives, these committees act as a unifying force, ensuring that day-to-day activities align with the bank’s overall trajectory. Conceptually, the steering committee’s authority and oversight prevent isolated decision-making that might detract from enterprise goals.

An integrated roadmap—a single source of truth for project milestones—can prevent teams from working at cross purposes. Aligning on clear key performance indicators (KPIs) ensures that each department recognizes how its efforts feed into the broader organizational strategy (McKinsey 2024). Whether the metric is time-to-market for a new digital product or a reduction in compliance violations, shared targets unify stakeholder efforts and maintain accountability across the board.

When operational continuity competes with exploratory initiatives, silos can resurface if conflicts remain unresolved. A formalized escalation process, overseen by the steering committee, swiftly addresses disagreements, balancing prudent risk management against the need for agility (Deloitte 2023). This conceptual clarity keeps critical projects moving forward and prevents deadlocks caused by departmental rivalries or differing priorities.

Leaders who actively encourage knowledge exchange, recognize team achievements, and champion transparency engender a collaborative ethos (PwC 2023). Conceptually, “servant leadership” or “transformational leadership” styles create an atmosphere where cross-functional collaboration is not an episodic effort but a daily practice. Leaders who model these behaviors invite teams to emulate them, resulting in deeper, more organic collaboration over time.

At the practical level, a RACI matrix delineates who is responsible for each task, who holds ultimate accountability, who must be consulted, and who should remain informed (Jones and Ramirez 2022). This visible breakdown of responsibilities can mitigate confusion, eliminate duplicate efforts, and clarify decision-making hierarchies. Particularly in complex banking environments, RACI charts ensure that no critical function—like risk management or customer experience—is overlooked.

Stand-up meetings and sprint reviews, drawn from Agile and DevOps methodologies, enable real-time communication about ongoing tasks, bottlenecks, and next steps (Deloitte 2023). By regularly convening—often in brief sessions—teams can quickly surface issues, coordinate schedules, and ensure that all stakeholders remain aligned with project goals. Sprint reviews further enable immediate feedback, allowing adjustments before minor misalignments become major setbacks.

Digital collaboration platforms (e.g., Jira, [Monday.com](http://Monday.com), Asana, Trello, Confluence, Microsoft Teams) provide a transparent workspace where updates, documents, and timelines are centralized (KPMG 2022). This single source of truth keeps everyone aligned without frequent “status update” meetings. Departments with different time zones or working styles can easily access the same repositories, fostering inclusivity and reducing communication gaps.

Periodic collaborative events break down formal barriers and spark creative solutions. Hackathons or design sprints bring teams together to tackle specific challenges—like process bottlenecks or customer pain points—under time constraints (McKinsey 2024). These high-intensity sessions often generate rapid prototypes, fresh perspectives, and build camaraderie, reinforcing the tangible benefits of interdisciplinary teamwork.

When departments share credit for successes, collaboration becomes more appealing. Whether via financial incentives, public acknowledgments, or celebratory events, recognizing cross-departmental wins fosters a sense of collective accomplishment (PwC 2023). This shift from rewarding individual silos to celebrating group achievements encourages ongoing cooperation, as teams see that working together garners tangible rewards.

Finally, structured retrospectives—conducted after a project phase or major milestone—enable continuous learning. By critically examining what worked well and where improvements are necessary, teams refine both their technical approaches and their collaborative dynamics (Jones and Ramirez 2022). These reflective sessions build institutional memory and facilitate incremental adjustments, ensuring that collaboration processes evolve alongside the bank’s strategic needs.

3.6. Case Studies: IT Teams That Balanced Operations and Innovation

In today’s fast-evolving banking landscape, achieving the dual objective of operational stability and forward-leaning innovation demands more than mere technical prowess; it requires visionary leadership, strategic collaboration, and an adaptive corporate culture. Numerous banks have showcased this balance through successful transformations that simultaneously protect core operations and explore new frontiers in digital services. By examining these case studies, IT professionals gain insights into how to harmonize day-to-day efficiency with breakthrough ventures—ultimately fostering sustainable growth and differentiation.

Many transformative case studies highlight leaders who redefine IT’s role—shifting it from a cost center to a cornerstone of competitive advantage (PwC 2023). These leaders articulate a compelling narrative that envisions technology as integral to the bank’s future, inspiring employees to move beyond routine maintenance and participate in dynamic innovation. When leaders frame IT’s mission in terms of broader societal or market impact, teams recognize that their work extends beyond internal processes, resonating with a larger strategic vision.

Central to these narratives is the idea that effective change often begins with leadership actions. Executives who champion collaboration, cross-functional dialogue, and prudent risk-taking set the tone for the entire organization (Deloitte 2023). Rather than enforcing innovation from the top down, they exhibit behaviors—transparency, responsiveness, and open-mindedness—that employees emulate. This philosophical stance encourages grassroots innovation, fostering trust and making it easier to integrate novel ideas without the inertia of departmental silos.

High-impact IT transformations consistently demonstrate a commitment to customer well-being. Whether by deploying advanced data privacy measures or designing inclusive digital services for underserved segments, these success stories place ethical concerns and user experience at the heart of innovation (Baker and Simons 2022). Philosophically, leaders in such environments view technology as a conduit for societal good, ensuring that upgrades in efficiency or profitability do not overshadow fundamental values like security, transparency, and accessibility.

Banking institutions often grapple with entrenched practices and technology stacks. Visionary leaders confront the “we’ve always done it this way” mindset, promoting a culture where experimentation is encouraged, and continual learning is the norm (KPMG 2022). This philosophical departure from rigid legacy systems paves the way for agile frameworks, modular architectures, and more rapid digital product deployments, ultimately broadening the scope of what is possible within the bank’s operational landscape.

Case studies typically pinpoint critical junctures—whether investing in cutting-edge analytics versus enhancing established legacy tools or opting for a wholesale replatforming rather than incremental modernization (Deloitte 2023). Successful outcomes hinge on transparent, evidence-based deliberations that weigh technical feasibility, regulatory implications, and market trends. By openly discussing these trade-offs, leaders harness collective insight and align decisions with both short-term gains and long-term strategic goals.

Robust stakeholder engagement emerges as a unifying theme. Securing buy-in from the board, forging alliances with external fintechs, and rallying mid-level managers around the initiative are common hallmarks of effective transformations (KPMG 2022). Steering committees, supplemented by agile governance frameworks, keep executive priorities and operational realities in lockstep, ensuring that run-the-bank activities and change-the-bank initiatives do not drift into conflict.

A recurring conceptual thread is the significance of cultivating a learning-oriented culture. Institutions that excel at balancing operational demands with innovation often employ agile methodologies, dedicated innovation labs, and a practice of celebrating small wins (PwC 2023). These cultural elements encourage employees to iterate quickly, embrace failures as learning experiences, and engage in continual skill development—driving an evolution that is organic rather than forced.

Balanced success stories illustrate a nuanced approach to risk, neither stifling innovation nor exposing the bank to reckless experimentation. Tools like sandbox environments, phased pilot rollouts, and structured stage-gate processes enable organizations to manage potential pitfalls while preserving creative momentum (Baker and Simons 2022). By systematically weighing risk against reward, banks can expedite market launches for promising services without undermining the stability of core systems.

One of the most widely adopted strategies is to test new initiatives—ranging from AI-based lending solutions to blockchain settlements—in controlled, smaller-scale contexts. This practical approach offers a low-risk avenue for proving value, collecting user feedback, and refining deployment strategies before rolling out to the full customer base (Deloitte 2023). Incremental successes help build internal support and showcase tangible metrics—like reduced loan processing time or diminished fraud incidents—bolstering momentum for broader adoption.

Banks in leading case studies often seek external collaborations, whether with fintechs, startups, or academic institutions. These partnerships bring niche expertise, innovative mindsets, and resource-sharing models that reduce the financial and developmental burdens on individual banks (KPMG 2022). For example, a co-developed digital wallet project allows a bank to harness specialized encryption knowledge while the fintech partner gains access to a robust customer base—resulting in a win-win scenario.

Sustaining executive commitment is paramount for any transformation, and regular updates through dashboards, KPIs, and demos keep C-suite leaders engaged. These reporting tools emphasize not only operational milestones (e.g., uptime, transaction accuracy) but also innovation metrics (e.g., pilot project ROI, user satisfaction) (PwC 2023). By clearly linking progress back to strategic imperatives, IT teams maintain visibility and secure the required resources to scale successful pilots or pivot away from underperforming ideas.

A recurring theme is the transformation of operational teams into hubs for incremental innovations. When routine tasks—like account reconciliation or document processing—are automated, staff members can reallocate time to more creative endeavors (Baker and Simons 2022). This practical strategy not only raises morale but also creates a virtuous cycle: as employees see their own day-to-day burdens eased, they become more receptive to additional technological advancements, fueling continuous operational refinement.

Rather than relying on anecdotes or gut instincts, successful banks systematically measure pilot outcomes using metrics such as cost savings, user adoption, or revenue gains. If results prove favorable, leaders rapidly scale the initiative organization-wide (Deloitte 2023). If not, they analyze the data to determine whether a pivot or discontinuation is warranted. This disciplined approach ensures that only the highest-potential concepts garner further investment, preventing resource drain.

Finally, banks that master the balance of operations and innovation often create structured mechanisms—playbooks, internal wikis, or knowledge bases—to capture insights gleaned from each initiative (KPMG 2022). Post-project retrospectives identify recurring pain points and craft solutions that can be applied to future endeavors, driving continuous improvement. These living documents serve as a collective memory, helping the institution avoid reinventing the wheel with each new project.

3.7. Overcoming Common Roadblocks

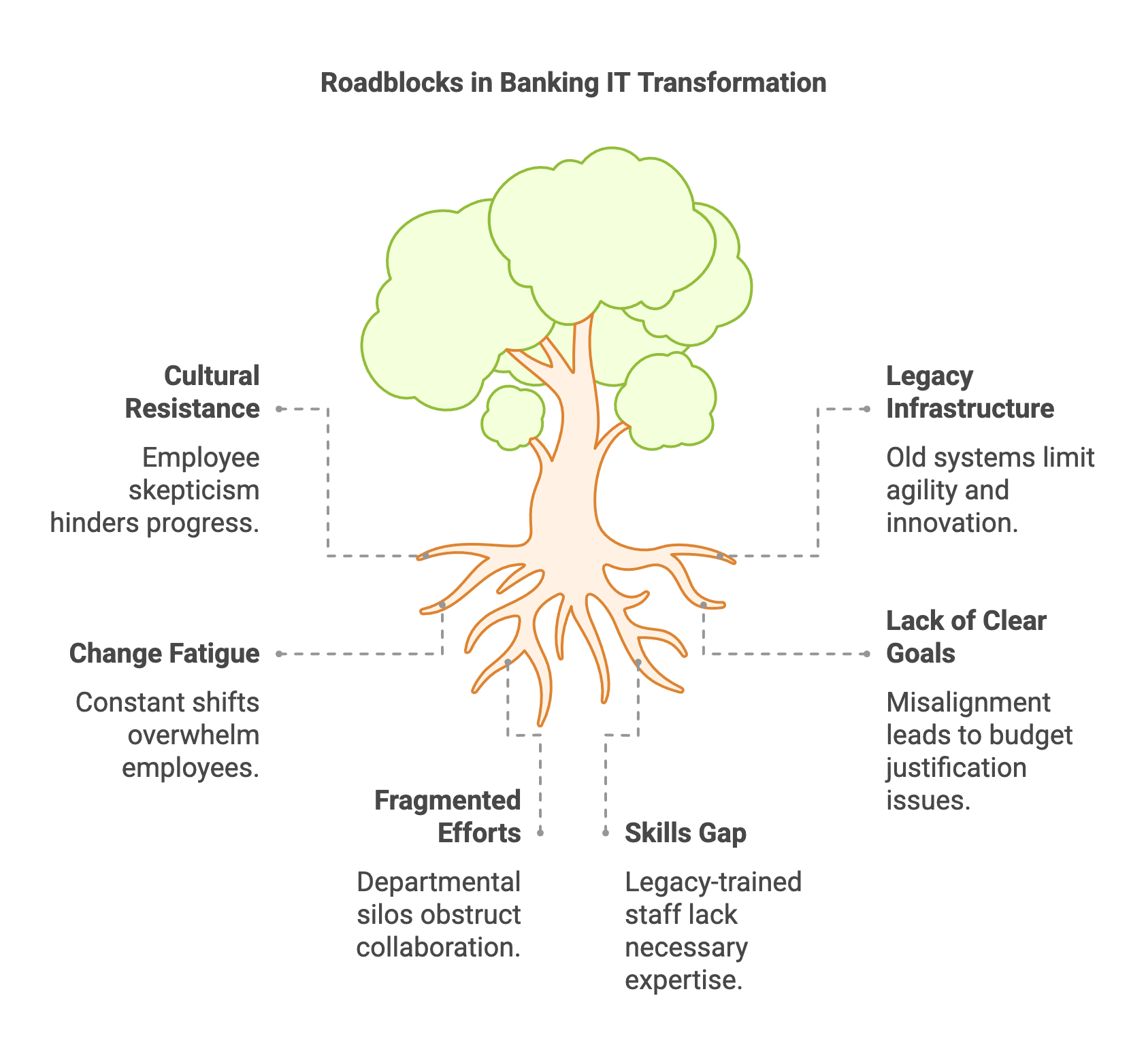

Transformative efforts in banking IT frequently encounter an array of obstacles—ranging from entrenched cultural resistance to rigid legacy infrastructures. While these challenges can stall progress, they also present opportunities for refining strategies, aligning stakeholders, and building more resilient organizational structures. By approaching these hurdles from philosophical, conceptual, and practical standpoints, IT leaders can navigate complexities while preserving the bank’s operational stability and customer trust.

From a philosophical perspective, transformation initiatives naturally provoke skepticism and anxiety—especially when new technologies or reengineered processes threaten familiar routines. Rather than dismissing employee reluctance as obstructionist, IT leaders can treat this feedback as a valuable lens through which they identify hidden risks or misalignments (KPMG 2022). By engaging in open dialogue, leadership can surface legitimate concerns, integrate diverse viewpoints, and ultimately strengthen the initiative’s design and execution.

Figure 6: Key challenges in IT transformation - culture, change fatigue, legacy, skills gap and fragmentations.

Rapid, iterative waves of transformation can lead to “change fatigue,” where employees feel overwhelmed by constantly shifting priorities. Acknowledging these human reactions is critical for compassionate leadership, signaling that success hinges as much on emotional resilience as on technical excellence (Deloitte 2023). When leaders encourage active listening and promote mental well-being, they reinforce the idea that change is a step-by-step journey rather than a forced march toward an uncertain future.

At the heart of any successful transformation lies a moral responsibility to equip staff with the skills, context, and resources needed to adapt. When employees are trained, informed, and supported in times of upheaval, they evolve from passive recipients of change into active co-creators (McKinsey 2024). Such a philosophy also acknowledges the broader impact on family, community, and society, underscoring that responsible innovation prioritizes both efficiency and empathy.

Despite the urge to overhaul archaic systems and processes, not all “old ways” are obsolete. Often, legacy frameworks carry institutional wisdom and have proven operational reliability. Philosophically, approaching modernization with respect for established methods can ease tension and embed a spirit of inclusion (PwC 2023). Rather than viewing legacy elements as barriers, leaders can adapt them thoughtfully—merging the old with the new to ensure that historical strengths inform future progress.

On one hand, legacy architectures provide stable core banking functions that customers trust. On the other, they may hamper agility, preventing the quick deployment of digital enhancements like mobile loan approvals or advanced fraud analytics (Deloitte 2023). Conceptually, banks must assess where incremental modernization suffices versus where a larger, potentially disruptive overhaul is required—balancing immediate operational needs with long-term strategic ambitions.

The financial services sector is inherently cautious, shaped by strict regulatory standards and high stakes for data protection. This cultural backdrop can stall innovation, as stakeholders worry about compliance missteps or reputational fallout (KPMG 2022). Conceptually, robust governance frameworks—complete with clear risk thresholds, sandboxed experimentation, and contingency plans—can help dispel these fears, reassuring leadership that new solutions won’t endanger the bank’s foundational stability.

When IT initiatives lack a clear linkage to key business goals—be it revenue enhancement, cost reduction, or customer satisfaction—departments may struggle to justify budget requests or resource allocation (PwC 2023). Conceptually, mapping each project to explicit, measurable outcomes addresses this gap. By framing proposed technologies in terms of tangible benefits (e.g., improved cross-sell opportunities or faster customer onboarding), IT leaders bolster buy-in from both executives and frontline teams.

Tight fiscal constraints and departmental silos often fragment transformation efforts. Each unit may guard its budget for its own priorities, undermining collaboration and larger strategic objectives (McKinsey 2024). Conceptually, unified portfolio management and leadership oversight can reconcile these conflicts—aligning spending toward cross-departmental targets like digitizing end-to-end customer journeys or enhancing omni-channel engagement platforms.

Emerging technologies such as AI, blockchain, and advanced analytics demand expertise that legacy-trained staff may not possess. Conceptually, banks can develop a holistic workforce plan—anticipating which skills will be critical and structuring upskilling paths accordingly (KPMG 2022). This forward-thinking approach ensures that innovation isn’t stalled by a lack of internal capabilities, while also signaling long-term commitment to employee growth.

Launching small-scale pilots or proofs-of-concept allows teams to test emerging technologies (e.g., AI-based risk scoring, chatbot-based customer service) without fully committing to a large-scale rollout. Showcasing measurable wins—for instance, a 30% reduction in response times—builds confidence among skeptics and secures leadership’s support for broader implementation (Deloitte 2023).

Robust employee development initiatives—like internal academies, mentoring, or workshops—close competency gaps and build a shared understanding of why transformation matters (McKinsey 2024). Combined with structured change management models (such as Kotter’s 8-Step or ADKAR), these programs ensure that staff understand not only how to adopt new tools but also how such changes contribute to the bank’s overarching vision.

Rather than rushing into an all-in replacement of core platforms, banks can adopt a gradual strategy—integrating microservices, APIs, or modular components that coexist with legacy systems (PwC 2023). This phased approach contains operational risk, avoids massive capital outlays, and enables continuous progress. Over time, the bank incrementally transitions its infrastructure without jeopardizing day-to-day reliability.

Engaging risk and compliance officers early in pilot projects ensures that new tools adhere to regulatory guidelines. Establishing “innovation sandboxes” provides a structured environment where small-scale experiments can proceed, with oversight baked in to prevent compliance breaches (KPMG 2022). This collaborative, preemptive strategy helps neutralize the cultural aversion to risk by demonstrating robust safety nets.

High-level governance bodies—comprising leaders from IT, operations, compliance, and other departments—cultivate holistic ownership. Using shared accountability tools such as RACI matrices or balanced scorecards clarifies responsibilities and fosters open communication (Deloitte 2023). By viewing transformation as a collective endeavor, the bank minimizes departmental rivalries and keeps every stakeholder aligned with the same strategic north star.

Frequent updates—through newsletters, town halls, or Q&A sessions—help employees and external partners stay informed about project timelines, successes, and potential pivots. This transparency reduces rumor-mongering and heightens the sense of shared ownership, as individuals at every level of the organization see their feedback incorporated into ongoing initiatives (McKinsey 2024). Trust and receptivity to change increase when stakeholders feel their voices are genuinely valued.

3.8. Lessons Learned and Key Takeaways

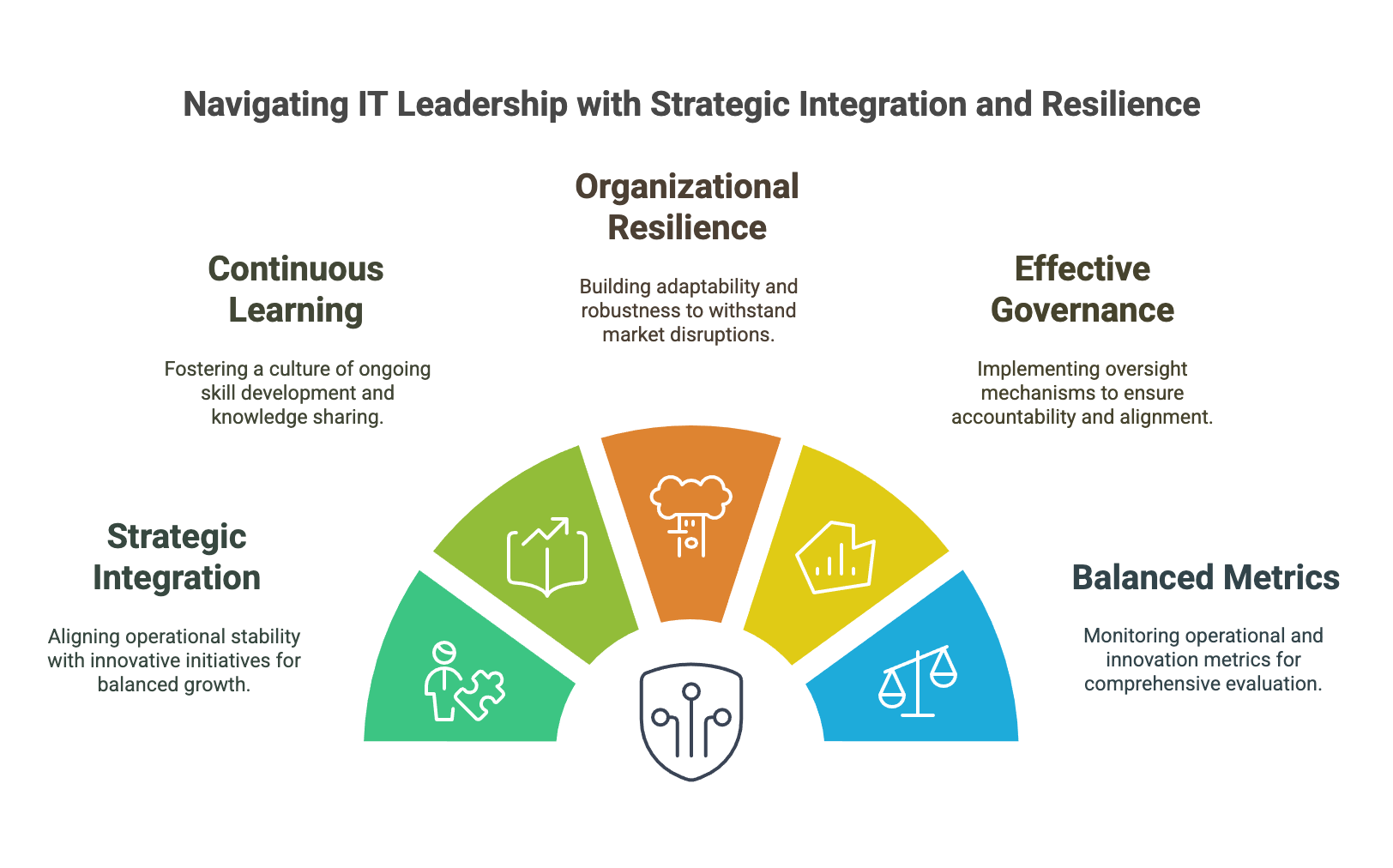

Over the course of this chapter, we have explored the multifaceted pressures IT professionals face—from maintaining impeccable operational stability to delivering transformative innovations that propel the business forward. Balancing these priorities demands a strategic approach that integrates philosophical insights, conceptual frameworks, and practical solutions. By weaving together a culture of continuous learning, robust governance mechanisms, and data-driven decision-making, IT leaders can navigate the complexities of modern banking while positioning their organizations for sustained success.

Rather than viewing transformation as a singular event, a continuous journey that embraces iterative learning and flexible thinking lies at the heart of successful IT leadership (KPMG 2022). Philosophically, maintaining a growth mindset fuels proactive adaptation to shifting market demands, regulatory changes, and evolving customer expectations. This perpetual evolution ensures that technology initiatives remain relevant and robust.

Banks that embed adaptability into their organizational DNA are better equipped to weather disruptions—whether these stem from economic cycles, emerging technologies like artificial intelligence, or sudden market shifts (Deloitte 2023). This resilience emerges from a philosophical commitment to experimentation, iterative feedback loops, and a willingness to pivot rapidly when conditions change, helping to safeguard both operational continuity and innovation objectives.

Figure 7: Elements of IT strategic integration and resilience.

Ongoing skill development not only enhances institutional capabilities but also signifies a deeper ethical responsibility to the workforce (Li and Brown 2022). By investing in continuous training programs, banks demonstrate their commitment to employee growth and welfare. This approach not only benefits internal operations—through cross-functional collaboration and improved retention—but also bolsters the organization’s reputation for responsible innovation.

Regular reflection—through retrospectives, post-mortems, and strategic reviews—elevates daily tasks into invaluable learning opportunities (PwC 2023). This practice ensures that both successes and failures inform future decisions, creating a culture where incremental improvements accumulate into significant long-term advantages. Philosophically, reflection underscores the importance of introspection, humility, and adaptability in any robust transformation process.

Organizational ambidexterity, with its “run” (operational excellence) and “change” (breakthrough innovation) dichotomy, remains a guiding concept for banks aiming to thrive in volatile markets (KPMG 2022). Success emerges from striking a careful balance: neither operational stability nor forward-looking initiatives can monopolize resources or attention. Instead, well-orchestrated synergy between these domains guarantees sustainable growth.

Conceptually, effective portfolio management—whether through stage-gate, agile, or hybrid models—enables strategic allocation of capital and talent across both maintenance projects and high-impact innovation efforts (McKinsey 2024). Steering committees and cross-functional working groups provide ongoing oversight, ensuring that each project aligns with broader corporate goals while maintaining accountability for timelines and deliverables.

A balanced scorecard that integrates operational metrics (e.g., system uptime, incident resolution times) alongside innovation KPIs (e.g., product launch velocity, revenue derived from new services) helps leadership monitor the bank’s dual objectives (Deloitte 2023). When these metrics are reviewed systematically, they serve as clear signals for when to ramp up exploration or refocus on stabilizing core services.

Embedding frequent checkpoints—monthly or quarterly strategic reviews—provides a mechanism for real-time recalibration. As new market intelligence emerges, banks can swiftly adjust resource allocation, revisit project prioritization, or introduce new initiatives (PwC 2023). This cycle of ongoing feedback offers a structured path for refining the delicate equilibrium between day-to-day operational excellence and future-proof innovation.

The operational-innovation checklist begins with pinpointing essential systems that demand uninterrupted stability, especially in areas like core banking or regulatory functions. In parallel, identifying innovation opportunities ensures the organization continually explores new revenue streams, improved customer experiences, or efficiency gains derived from emerging technologies such as AI, cloud platforms, or blockchain. Once these possibilities are mapped out, it becomes crucial to chart any dependencies between “run” and “change” initiatives. This involves using collaboration tools to visualize timelines, resource needs, and potential conflicts, thereby mitigating risks associated with overlapping priorities or limited budgets. Clarifying roles and responsibilities stands as another core element of the checklist, where RACI (Responsible, Accountable, Consulted, Informed) matrices help confirm who owns each task, who makes the final call, who must be consulted, and who simply needs to stay informed. By addressing these factors systematically, IT leaders can harmonize operational reliability with ongoing innovation pursuits.

Measuring the effectiveness of a balanced operational and innovation strategy requires tracking several categories of metrics. On the operational side, consistent uptime, swift incident resolution, and monitoring for cybersecurity threats ensure reliable services and maintain customer trust. Meanwhile, innovation metrics such as the frequency of pilot project launches, the adoption rates of new features, and improvements in time-to-market illuminate whether strategic initiatives are bearing fruit. Equally important are cross-functional performance indicators, which assess the degree of collaboration among different departments, the satisfaction of relevant stakeholders, and how frequently multi-department projects reach completion. Lastly, cultural indicators capture the human dimension, including employee engagement, the availability of professional development opportunities, and the retention of critical talent. Together, these metrics provide a comprehensive view of whether an organization is thriving in both operational excellence and transformative endeavors.

To embed this balanced leadership approach into daily practice, several concrete steps can be taken. Instituting regular innovation reviews—conducted monthly or quarterly—allows decision-makers to examine recent pilot outcomes, reallocate resources where necessary, and champion any emerging quick wins. A dynamic IT roadmap that integrates both stable operational tasks and ongoing transformation projects offers a living view of priorities and timelines, requiring continuous updates to remain aligned with evolving business objectives. Equally crucial is establishing continuous learning programs, such as in-house tech academies, to ensure that employees stay current with new technologies like AI or cloud computing, reducing the need for external hires. Refining governance structures through well-represented steering committees, which include perspectives from IT, risk, compliance, and various business units, supports unified decision-making and guides resource distribution. Finally, presenting iterative scorecards that blend operational metrics with innovation indicators keeps the executive leadership informed about progress in each dimension, reinforcing accountability and promoting alignment toward a shared strategic vision.

Cultivating an open, psychologically safe environment encourages teams to report system vulnerabilities or pitch disruptive ideas without fear of reprisal (Li and Brown 2022). Equally important is facilitating knowledge-sharing—whether via hackathons, lunch-and-learn sessions, or digital collaboration platforms—so operational and innovation-focused groups can cross-pollinate expertise. Finally, conducting thorough post-initiative retrospectives ensures that each project’s lessons, both triumphs and setbacks, feed into a cycle of perpetual improvement.

3.9. Conclusion

In conclusion, the pressures from management and stakeholder expectations need not be a hindrance; instead, they can serve as catalysts for meaningful transformation. By thoughtfully balancing system reliability with visionary projects, IT professionals can demonstrate their indispensable role in shaping the organization’s future. The key lies in clear communication, sound governance, and continuous stakeholder engagement—factors that make IT not just a service provider but a strategic ally for growth. Now is the time to step up: embrace these pressures, champion cross-functional collaboration, and architect solutions that drive both operational excellence and breakthrough innovation.

3.9.1. Further Learning with GenAI

These comprehensive prompts delve into the nuanced challenges faced by IT leaders in banking, offering in-depth explorations of topics such as budget management, C-suite communication, legacy system upgrades, and innovation strategies.

Explore how IT leaders can shift from a service provider mindset to a strategic partner in the eyes of the C-Suite. Include communication tactics, metrics, and examples of quick wins that build long-term credibility.

Explain how to design an IT roadmap that upholds mission-critical stability while simultaneously making room for ‘disruptive’ pilot projects. What frameworks or governance models can facilitate this dual focus?

Propose a comprehensive approach to prioritize IT expenditures under tight budgets, ensuring that both operational and innovation-driven initiatives receive appropriate funding. How can IT leaders best articulate ROI and strategic alignment to executive sponsors?

Discuss best practices for translating complex technical solutions into compelling business narratives that resonate with senior leadership. How should IT leaders adapt their language and metrics?

Provide a structured blueprint for incrementally modernizing legacy banking systems while preserving essential functions. Consider organizational resistance, regulatory factors, and budget constraints.

Examine how establishing ‘IT-Business Fusion Teams’ can drive alignment and accelerate innovation. What roles, processes, and communication tools are necessary for cohesive collaboration across diverse departments?

Analyze a successful banking IT case where robust operational performance coexisted with groundbreaking digital initiatives. Break down the critical success factors, stakeholder engagement tactics, and cultural elements that made it possible.

Propose a conflict resolution framework for IT leaders who face competing priorities from multiple business units. Include methods for trade-off analysis, stakeholder negotiation, and transparent reporting.

Outline how IT organizations can cultivate teams that are equally adept at maintaining day-to-day infrastructure and pioneering new solutions. Focus on skill development programs, rotational opportunities, and performance incentives.

Describe strategies for identifying and cultivating executive sponsors who understand the dual nature of IT’s mandate. Discuss how to maintain their support through evolving business climates and project setbacks.

Illustrate how banks can use small-scale pilots to test cutting-edge technologies (e.g., AI-based customer profiling) while minimizing operational risks. How does this approach help manage stakeholder expectations?

Propose a KPI framework that captures both operational efficiency (uptime, ticket resolution) and strategic innovation (new product uptake, revenue contribution). How can these metrics be reported meaningfully to different stakeholder groups?

Explain how to craft concise but impactful reports or presentations for the board of directors that illuminate IT’s role in supporting the bank’s strategic vision. Discuss the balance between technical detail and high-level insight.

Evaluate common cultural challenges when shifting an IT department from a strictly operational role to a strategic driver. What leadership behaviors, reward systems, or training programs can encourage an innovation-friendly mindset?

Describe how IT leaders can gauge and align with the organization’s overall risk appetite, particularly when proposing transformative initiatives. How can frameworks like risk-adjusted return on capital (RAROC) apply to IT planning?

Investigate methods for achieving consensus among executives, middle managers, and frontline staff regarding digital transformation priorities. How does inclusive decision-making accelerate change adoption?

Detail a phased plan for integrating disruptive technologies—such as blockchain or quantum computing—into existing IT workflows without jeopardizing ongoing operations. Include stakeholder buy-in and regulatory considerations.

Propose a cycle of continuous improvement for banking IT that interlaces operation reviews with innovation sprints. How does this help address evolving customer needs and keep executive leadership informed?

Explain how IT leaders can handle failures of bold initiatives in a way that preserves morale, retains management support, and extracts valuable lessons. Include risk planning, post-mortem analysis, and stakeholder communications.

Discuss how to build flexible governance structures capable of adapting to new technologies, shifting market conditions, and evolving stakeholder expectations. What long-term governance principles should guide IT leaders in banks?

Engaging with these prompts empowers IT professionals to uncover transformative insights and develop cutting-edge solutions that balance operational excellence with bold, future-focused initiatives.

3.9.2. Workshop Assignments

These five collaborative workshops guide participants in balancing operational needs with strategic innovation, honing their ability to satisfy both executive mandates and frontline realities in banking IT.

Workshop Assignment 1: Balancing the Operational-Innovation Spectrum

Objective: Participants will classify their current IT projects or processes into two categories—operational (maintenance and support) and innovative (new revenue streams, advanced technology pilots)—to gauge their organization’s balance. By identifying potential gaps or overemphasis in one area, teams can design an action plan that better aligns with both senior management’s demand for stability and ambition for growth.

Expected Deliverables:

A categorized project portfolio illustrating operational and innovation initiatives

A set of proposed re-prioritizations to better align with business objectives

A roadmap that includes immediate, mid-term, and long-term action steps

Guidance:

Encourage open discussion on the rationale behind current allocations

Use matrix tools (e.g., impact vs. effort, cost vs. strategic value) to visualize where adjustments are needed

Emphasize alignment with actual budgetary constraints and stakeholder expectations

Workshop Assignment 2: Crafting the Perfect Executive Pitch

Objective: Teams work on translating a complex technical solution (e.g., a new data analytics platform) into an “executive pitch” that highlights tangible business impacts, ROI, and strategic alignment. Through role-playing exercises, participants learn to communicate with senior leaders, focusing on clarity, brevity, and relevance to overarching corporate goals.

Expected Deliverables:

A concise one-page pitch or slide deck summarizing the project’s high-level benefits

A risk and opportunity matrix, including compliance and operational continuity considerations

Scripts or talking points geared toward executive audiences

Guidance:

Emphasize value-driven language, reducing unnecessary technical jargon

Offer frameworks for linking IT projects to cost savings, revenue growth, or competitive differentiation

Encourage peer feedback sessions to refine messaging and delivery style

Workshop Assignment 3: Resource Allocation Simulation

Objective: Participants simulate a budget planning cycle, making critical decisions on allocating limited funds between operational imperatives (e.g., system upgrades, security enhancements) and strategic projects (e.g., new digital products). This exercise highlights the complexity of satisfying both the need for stability and the push for innovation under real-world constraints.

Expected Deliverables:

A simplified budget plan that outlines discretionary vs. mandatory spending

Rationale statements explaining priority selections and trade-offs

Risk assessments for underfunding operational or strategic initiatives

Guidance:

Provide hypothetical financial data, including unexpected cost increases or regulatory fines

Encourage teams to defend their spending choices to a mock executive panel

Facilitate post-exercise reflection on how different priorities shape short-term reliability and long-term growth

Workshop Assignment 4: Cross-Functional Collaboration Lab

Objective: By forming temporary, cross-functional teams (IT, operations, compliance, marketing), participants plan an end-to-end project aimed at delivering a new banking service (e.g., a credit-scoring tool). This lab-style session underscores the importance of interdisciplinary input to satisfy the multiple demands placed on IT, from uptime guarantees to innovative customer offerings.

Expected Deliverables:

A collaborative project charter detailing objectives, stakeholders, and success metrics

Clear role and responsibility assignments for each function

A communication plan outlining cross-department feedback loops and approvals

Guidance:

Encourage open brainstorming, then converge on a single feasible concept

Use quick user stories or personas to keep the project customer-centric

Allocate time for teams to highlight potential interdepartmental friction points and propose remedies

Workshop Assignment 5: Post-Mortem and Lessons Learned

Objective: Participants reflect on a fictional or real failed IT initiative, analyzing what went wrong in terms of stakeholder alignment, budget oversight, or technical missteps. They then construct a “lessons learned” framework that can help future projects avoid repeating similar pitfalls when balancing operational stability with new tech rollouts.

Expected Deliverables:

A root-cause analysis identifying specific shortcomings (e.g., unclear requirements, inadequate risk management)

A set of actionable recommendations on how to mitigate similar failures

A revised project lifecycle checklist that embeds these lessons into planning and execution stages

Guidance:

Encourage candid, blame-free discussion to uncover systemic rather than individual errors

Provide a structured format (e.g., timeline of events, stakeholder involvement log) for clarity

Emphasize how lessons can be institutionalized through updated governance or documentation practices

Through hands-on practice and real-world simulations, participants will develop the confidence, communication skills, and strategic mindset needed to excel in a complex, demand-heavy environment.

Comments