Chapter 4

‘Navigating Disruptive Technologies: AI, Blockchain, and Beyond’

"Disruptive tech in banking is no longer optional; it’s a strategic lever. Banks that harness AI, Blockchain, or even quantum computing effectively will outpace those clinging to legacy models." — Dave Birch, Global Fintech Commentator and Author of “Before Babylon, Beyond Bitcoin”

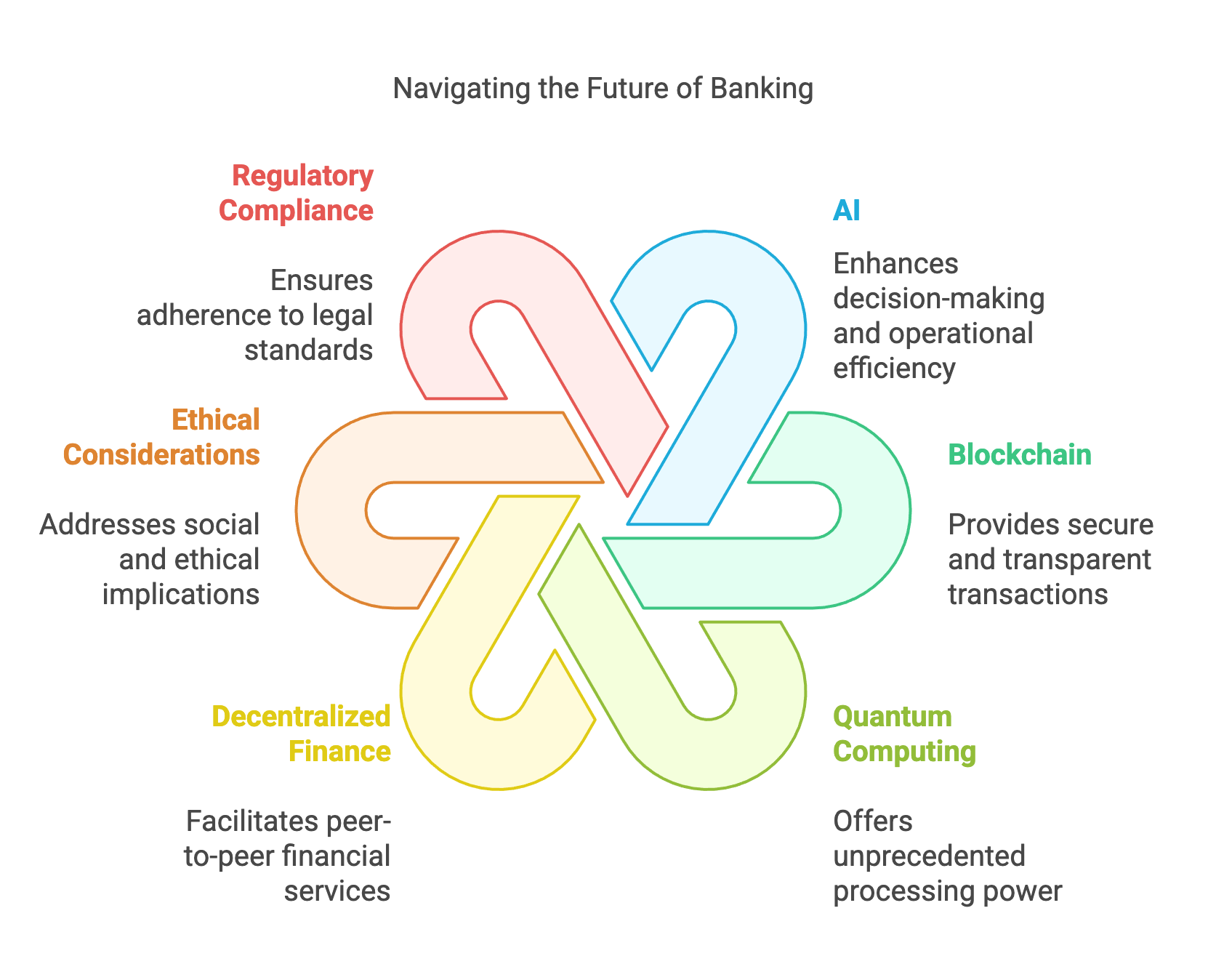

Chapter 4 addresses the transformative potential of emerging technologies, with AI and Blockchain as prime examples of how disruption can simultaneously pose challenges and unlock new opportunities in banking. By offering a structured roadmap—from initial technology scanning and strategic evaluation to hands-on implementation and risk management—this chapter aims to demystify the process of adopting disruptive innovations. Through real-world applications such as AI-powered fraud detection and blockchain-based secure transactions, it showcases how these tools can help reduce costs, improve operational efficiency, and open fresh revenue streams. The chapter’s overarching theme is that, with the right frameworks, governance models, and cultural mindset, IT leaders can confidently chart a course through fast-evolving tech landscapes.

4.1. The Nature of Disruptive Technologies in Banking

Disruptive technologies have rapidly reshaped the banking landscape, compelling institutions to reevaluate traditional models and embrace novel opportunities. As financial services become increasingly digital, banks that proactively adapt and strategically integrate emerging technologies stand poised to enhance customer experiences and pioneer new forms of value creation (Accenture 2022; Johnson 2023). The following sections explore philosophical, conceptual, and practical perspectives on disruption, illustrating how banks can use these technologies not merely to stay afloat but to steer the future of the industry.

From a philosophical standpoint, disruptions such as artificial intelligence (AI), blockchain, and quantum computing are best viewed not as existential threats but as catalysts for industry renewal (Chang 2022). Embracing technology-led transformation enables banks to cultivate a forward-focused mindset, where each innovation wave is leveraged to improve customer offerings and unlock new avenues of revenue. When banks recognize the positive potential of disruptions, they can pivot swiftly amidst market volatility and remain resilient in the face of emergent challenges.

Fostering a culture of exploration within IT teams is essential to thriving in a disruptive environment. Encouraging experimentation—where occasional failures are accepted as part of the learning process—promotes creativity and intellectual curiosity (Accenture 2022). This “discovery mindset” often leads to innovations that increase operational efficiency or provide distinctive customer experiences. By celebrating experimentation, banks embed a self-sustaining cycle of innovation that transforms challenges into opportunities.

Technological disruptions in banking extend far beyond internal processes, impacting customers, regulators, partners, and employees alike. Philosophically, this places a moral and ethical responsibility on financial institutions to ensure emerging innovations serve society equitably (KPMG 2024). When banks position themselves as stewards of fair and secure financial services, they prioritize inclusive growth—offering newly enabled benefits to underserved demographics and reinforcing public trust in the process.

Balancing near-term profitability with sustainable, long-term strategies is crucial in periods of massive technological shifts (Deloitte 2023). While immediate cost reductions are attractive, focusing solely on short-term returns may lead banks to miss broader, transformational opportunities. By adopting a long-range view, banks can align disruptions with strategic objectives—building market credibility, fostering customer loyalty, and securing a leadership position in the evolving financial ecosystem (Johnson 2023).

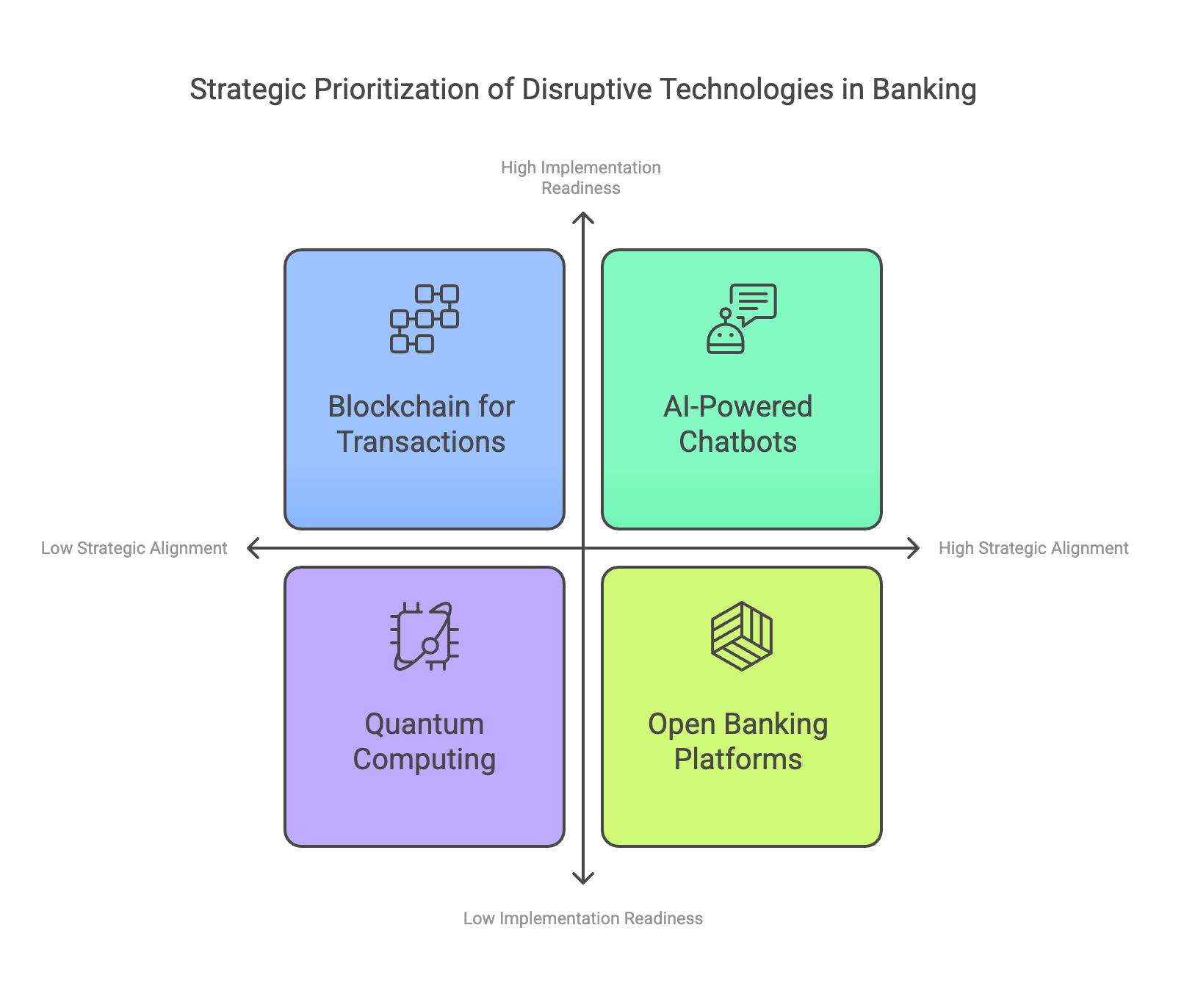

Figure 1: An example of technology prioritization in Banking. AI-powered chatbots offers high readiness and alignment.

Not all technological innovations can be classified as disruptive. Conceptually, “disruptive” refers to a profound shift in customer interactions and operational models that redefines the market landscape (Chang 2022). For instance, open banking platforms and AI-powered chatbots radically transform service accessibility, speed, and personalization. Such technologies transcend incremental enhancement, shaping new benchmarks for how customers expect to engage with financial institutions.

At the heart of disruption is the end user’s experience. Technologies that reduce service friction, improve transparency, and expand market reach often show rapid adoption and strong user advocacy (Johnson 2023). Monitoring user adoption rates, app store reviews, or net promoter scores (NPS) provides tangible evidence of the extent to which an innovation resonates with evolving customer preferences. When these metrics surge, it is an indication that the technology is reshaping user expectations.

Once a disruptive technology emerges, competing banks must react to remain relevant—whether by creating their own solutions or forming strategic partnerships (Accenture 2022). The magnitude of competitor responses, media attention, and regulatory revisions can affirm a technology’s disruptive status. This cross-industry ripple effect underscores the transformative influence an innovation wields in setting new standards for the entire banking sector.

Banking is one of the most heavily regulated industries worldwide, making regulatory shifts a significant indicator of true disruption. Disruptive innovations often prompt regulatory bodies to refine or overhaul compliance requirements to address new risks and ethical considerations, such as AI governance, data security, and consumer protection (Deloitte 2023). Banks that anticipate and proactively address these emerging rules position themselves to drive—and not just follow—the regulatory evolution.

Practically, banks can adopt a technology radar to systematically monitor and evaluate new developments. By classifying innovations into categories like “adopt,” “trial,” “assess,” or “hold,” banks can prioritize resources for the most promising areas. This structured approach allows organizations to maintain an up-to-date perspective on cryptographic breakthroughs, machine learning applications, and the progression of Web3 solutions (KPMG 2024).

Establishing a dedicated innovation council or a “scanning committee” composed of IT, compliance, risk, and business leaders ensures a balanced assessment of each disruptive technology (Accenture 2022). These committees convene regularly to weigh costs, benefits, and risk profiles against strategic goals. The collaborative nature of this review process prevents tunnel vision and encourages holistic decision-making.

Scenario planning is essential for comprehensively evaluating the potential outcomes of adopting disruptive technologies. By simulating best-case, worst-case, and moderate scenarios, banks can clarify resource requirements, identify skill gaps, and anticipate regulatory demands (Chang 2022). For instance, AI-driven fraud detection may significantly reduce losses, but it necessitates robust data governance and cybersecurity protocols.

A measured approach to rolling out emerging technologies can mitigate risk and optimize learning. Banks often begin by launching pilots in specific regions or product lines, gathering valuable performance data before broader deployment (Johnson 2023). This proof-of-concept methodology provides insights into return on investment (ROI), user acceptance, and potential pitfalls, paving the way for more informed, large-scale implementation.

Anchoring disruptive technology initiatives within agile practices supports continuous improvement. Minimal viable products (MVPs) can be released and refined based on real-time feedback, ensuring that each iteration better aligns with customer needs (Deloitte 2023). Performance dashboards, tracking user adoption, cost savings, and security incidents, empower decision-makers to pivot or scale solutions promptly.

Ultimately, a structured monitoring and assessment framework must be tied to financial decision-making. By aligning innovation budgets with the insights derived from technology radars and scenario planning, banks can efficiently allocate resources to the projects most likely to yield transformative outcomes (KPMG 2024). This disciplined approach avoids “innovation theater”—spending on technologies with little strategic value—and channels investments where they can produce meaningful long-term advantage.

4.2. AI: From Fraud Detection to Predictive Analytics

Artificial Intelligence (AI) has emerged as a transformative force in banking, streamlining high-volume processes such as fraud detection while opening new frontiers in predictive analytics. By harnessing AI’s capabilities—ranging from machine learning (ML) to natural language processing (NLP)—banks can optimize operations, personalize customer experiences, and refine risk management strategies (Deloitte 2023). The following sections explore philosophical, conceptual, and practical dimensions of AI adoption, underscoring its potential to empower financial institutions in an era of continuous disruption.

Philosophically, AI should be understood as augmenting rather than supplanting human expertise. While algorithms excel at automating routine tasks—such as sifting through large volumes of transactional data to identify potential fraud—nuanced judgment and strategic thinking remain distinctly human domains (KPMG 2022). By offloading repetitive activities to AI, banking professionals can focus on complex decision-making that demands empathy, creativity, and ethical discernment.

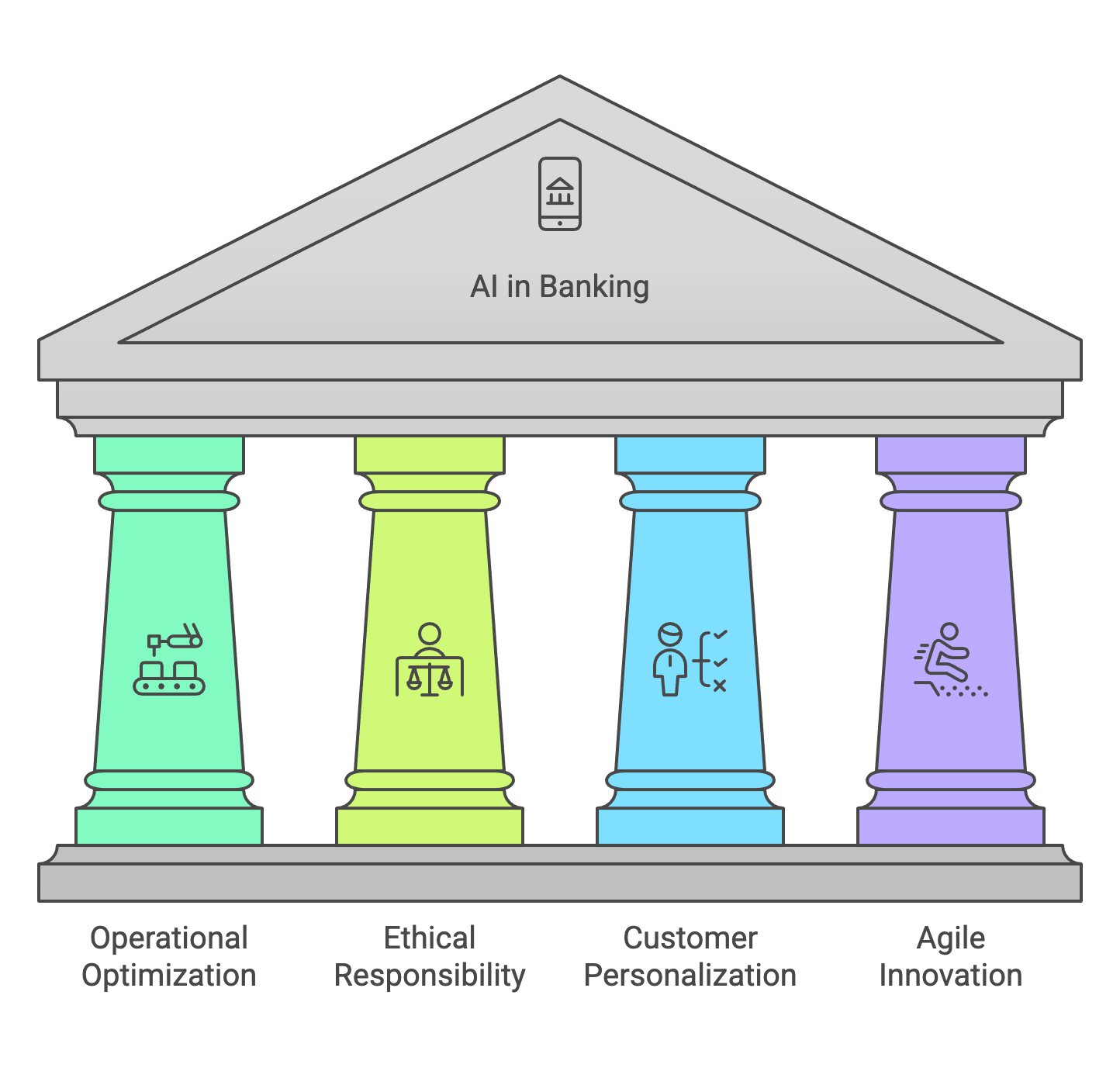

Figure 2: Key pillars of AI contributions in Banking.

In the financial sector, AI systems play a pivotal role in lending decisions, credit scoring, and personalized financial guidance. This expanded influence entails substantial ethical responsibility. Ensuring fairness, transparency, and privacy in AI-driven processes strengthens public trust in financial services (PwC 2024). Philosophically, banks that commit to inclusive AI practices—by conducting bias audits, fostering diverse development teams, and adhering to strict data protection standards—demonstrate genuine customer advocacy.

AI-powered personalization promises to transform the banking customer journey by delivering real-time, context-relevant offerings. Yet this heightened customization must align with responsible data usage and robust privacy safeguards (Li 2022). Taking a customer-centric perspective means leveraging AI to alleviate pain points—such as lengthy onboarding or convoluted service requests—while ensuring that clients retain control over their personal information.

AI’s dynamic nature resonates with a broader cultural shift toward iterative improvement. Each deployment—whether a pilot chatbot or a fraud detection model—generates insights that can refine both the technology and the institution’s policies (RBC 2023). Philosophically, this feedback-driven approach fosters a learning culture, where AI initiatives encourage curiosity, problem-solving, and openness to experimentation. By viewing AI as a co-pilot, banks become more agile in adopting subsequent waves of innovation.

Machine learning algorithms discern patterns in expansive datasets to predict future outcomes, making them indispensable in credit scoring, fraud detection, and churn analysis. Conceptually, ML techniques can be classified into:

Supervised Learning: Classification or regression tasks—e.g., predicting loan default likelihood based on historical borrower data.

Unsupervised Learning: Anomaly detection—e.g., spotting irregular spending activities that may indicate fraud.

Reinforcement Learning: Dynamic decision-making—e.g., adjusting credit limits in real time based on changing customer profiles (KPMG 2022).

Deep neural networks excel at processing unstructured data, including images, voice recordings, or extensive text documents. In banking, DL models can perform complex tasks such as biometric verification or advanced risk analytics (Deloitte 2023). Architectures like convolutional neural networks (CNNs) are adept at image analysis (e.g., identity verification), while recurrent neural networks (RNNs) and transformers handle sequential data, providing sophisticated insights into customer behavior patterns.

NLP systems facilitate interpretation and generation of human language, enabling chatbots to handle tier-1 customer inquiries, voice assistants to streamline service requests, and sentiment analysis tools to gauge customer feedback in real time (PwC 2024). State-of-the-art language models, including transformer-based architectures, allow for advanced text summarization, topic identification, and entity recognition, expanding banks’ capabilities in automated compliance checks or KYC (Know Your Customer) processes.

Effective AI operations require cohesive platforms—on-premises or cloud-based—that manage the full data-to-deployment pipeline. These ecosystems coordinate data ingestion, model training, inference, and monitoring, ensuring scalability and reliability (Li 2022). Seamless integration with core banking systems and ancillary applications is crucial for real-time decision-making and end-to-end automation.

Despite their predictive prowess, AI models—particularly deep learning systems—can function as “black boxes.” Conceptually, methods like LIME (Local Interpretable Model-Agnostic Explanations) or SHAP (SHapley Additive exPlanations) shed light on the variables influencing outcomes (RBC 2023). Interpretable AI is not only essential for regulatory compliance but also enhances stakeholder trust, clarifying why certain loan applications are approved while others are flagged as high risk.

AI models are only as accurate as the data that fuels them. Achieving high data quality requires well-defined governance protocols—covering metadata management, lineage tracking, and regular audits to eliminate inaccuracies or duplications (Deloitte 2023). Streamlined data pipelines that capture relevant transaction histories, customer profiles, and real-time interactions ensure AI-driven insights remain both reliable and actionable.

Banks must adopt structured frameworks detailing model development, validation, and operationalization. Version control, continuous retraining cycles, and performance thresholds are key to sustaining model relevance in shifting market environments (KPMG 2022). These governance measures help detect performance drift—when a model’s accuracy declines due to changes in customer behavior or external factors—and guide timely recalibration.

Regulatory mandates, ranging from data privacy laws like the General Data Protection Regulation (GDPR) to anti-discrimination regulations, necessitate rigorous oversight of AI deployments. Establishing AI ethics committees or compliance checkpoints helps ensure that algorithms do not inadvertently exclude or disadvantage specific demographic groups (PwC 2024). Addressing fairness throughout the model lifecycle mitigates reputational risks and aligns with the broader ethical obligations of financial institutions.

Among the most prominent use cases for emerging technologies in banking are chatbots, risk scoring, and personalization engines. Chatbots automate routine customer inquiries, reducing wait times and redirecting complex issues to human agents for deeper engagement. Meanwhile, risk scoring solutions leverage both internal and external datasets to refine credit assessments and identify potential fraudulent activities. Lastly, personalization engines deliver targeted product recommendations and detect cross-sell or upsell opportunities, thereby enhancing customer satisfaction and loyalty (Li 2022).

Evaluating AI initiatives against quantifiable metrics—such as fraud detection rates, reduction in loan defaults, or improvements in customer satisfaction—clarifies AI’s business value (RBC 2023). Demonstrating robust returns on investment emboldens stakeholders to sponsor further AI-focused projects and fosters a data-driven culture across the enterprise.

Effective AI deployment demands cross-functional teamwork among IT, data science, compliance, and business units. Building AI centers of excellence or fostering partnerships with specialized tech firms can address skill gaps in machine learning engineering, data analytics, and model interpretability (KPMG 2022). Ongoing training programs—ranging from data literacy workshops to advanced certifications—cultivate in-house talent and promote an innovation-ready workforce.

Operating large-scale AI models—especially deep learning architectures—requires substantial computational resources and robust infrastructure. Banks may rely on cloud services, GPU clusters, or other high-performance computing solutions to support real-time analytics (Deloitte 2023). Practical considerations include capacity planning, cost management, and failover strategies, all vital for sustaining reliable AI services during peak loads.

4.3. Blockchain and Distributed Ledger Technologies

Blockchain and other distributed ledger technologies (DLT) have the potential to radically alter established financial systems by decentralizing the way value and information move across networks. In banking, these innovations introduce a paradigm shift in how institutions conceptualize trust, data integrity, and ecosystem collaboration (Accenture 2022). The following sections explore philosophical, conceptual, and practical dimensions of blockchain’s role in modern finance, illuminating both its transformative promise and the real-world considerations that banks must address.

Philosophically, blockchain’s decentralized architecture challenges the conventional, centralized models that have long underpinned the banking sector. Instead of a single, authoritative hub, authority and transactional integrity are distributed across nodes (KPMG 2024). This shift can foster inclusivity, offering new channels for secure financial services to historically underbanked populations. By dislodging the monopoly of middlemen, decentralization realigns incentives toward openness and broader societal participation.

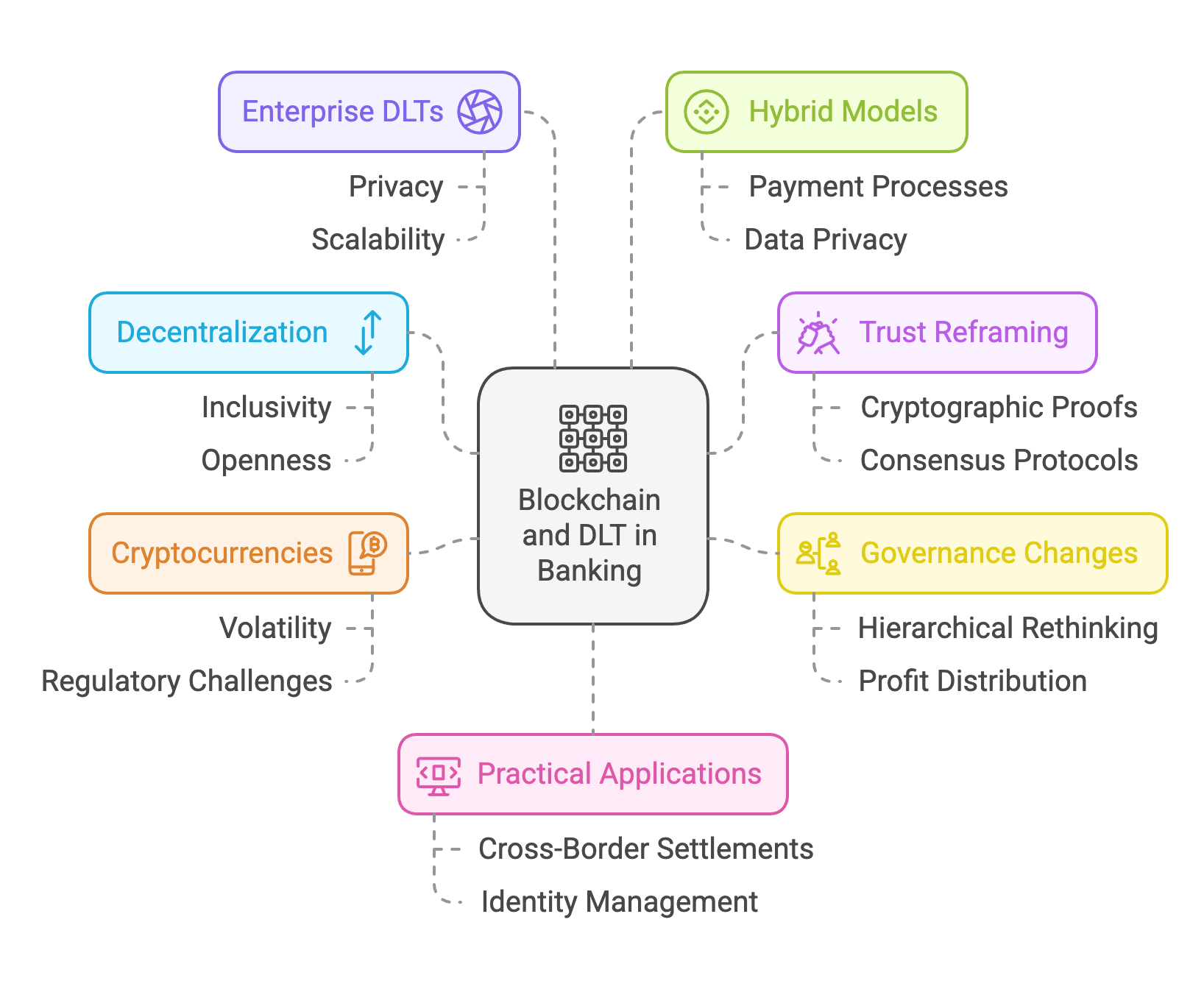

Figure 3: Scopes of Blockchain and DLT in Bank.

Blockchain technology reframes traditional notions of trust by relying on cryptographic proofs and consensus protocols rather than centralized institutions or clearinghouses (Accenture 2022). For banks, this philosophical pivot means transactions can be verified collectively and transparently. Faster settlements, reduced fraud, and heightened transparency become possible, reinforcing banks’ ethical mandate to serve the public interest with integrity and reliability (PwC 2023).

The decentralized design of blockchain also bolsters fault tolerance: if some nodes fail or are compromised, the network remains operational (Li 2023). This architectural resilience resonates with banking’s responsibility to protect systemic stability and reduce single points of failure. Philosophically, championing anti-fragility acknowledges that disruptions—whether natural disasters or cyberattacks—need not halt critical financial services when authority is dispersed across multiple, redundant nodes.

Implementing decentralized solutions compels leaders to rethink hierarchical governance, profit distribution, and even corporate culture. While blockchain’s ethos endorses transparent, often open participation, banks have traditionally prized centralized control and proprietary technology (Deloitte 2023). Bridging these opposing philosophies may require executive commitment to new partnership models, transparent data-sharing, and a willingness to adapt longstanding policies to fit a decentralized future.

Cryptocurrencies such as Bitcoin and Ethereum operate on permissionless, public blockchains, permitting open participation with minimal centralized oversight. Conceptually, they introduce volatility and regulatory complexity—particularly in areas like anti-money laundering (AML) compliance—making them less immediately suitable for mainstream banking services (KPMG 2024). Nonetheless, these public networks have spurred innovation in digital asset custody and cross-border payment rails.

Beneath cryptocurrencies lie the foundational blockchain protocols and consensus mechanisms (e.g., Proof of Work, Proof of Stake). These protocols govern how data is validated, added to the ledger, and secured cryptographically (Li 2023). Conceptually, banks can customize these protocols for specific tasks—such as automating trade finance or verifying digital identities—by integrating smart contract functionality and advanced permissioning layers.

Enterprise-focused DLT platforms (e.g., Hyperledger Fabric, R3 Corda) have been engineered with privacy, scalability, and fine-grained governance in mind. Designed to meet the strict regulatory standards of the financial sector, these permissioned solutions allow banks to define roles and data visibility while maintaining many blockchain benefits, such as immutability and collective validation (Deloitte 2023). By limiting participant access through robust identity frameworks, enterprise DLTs strike a balance between decentralization and institutional control.

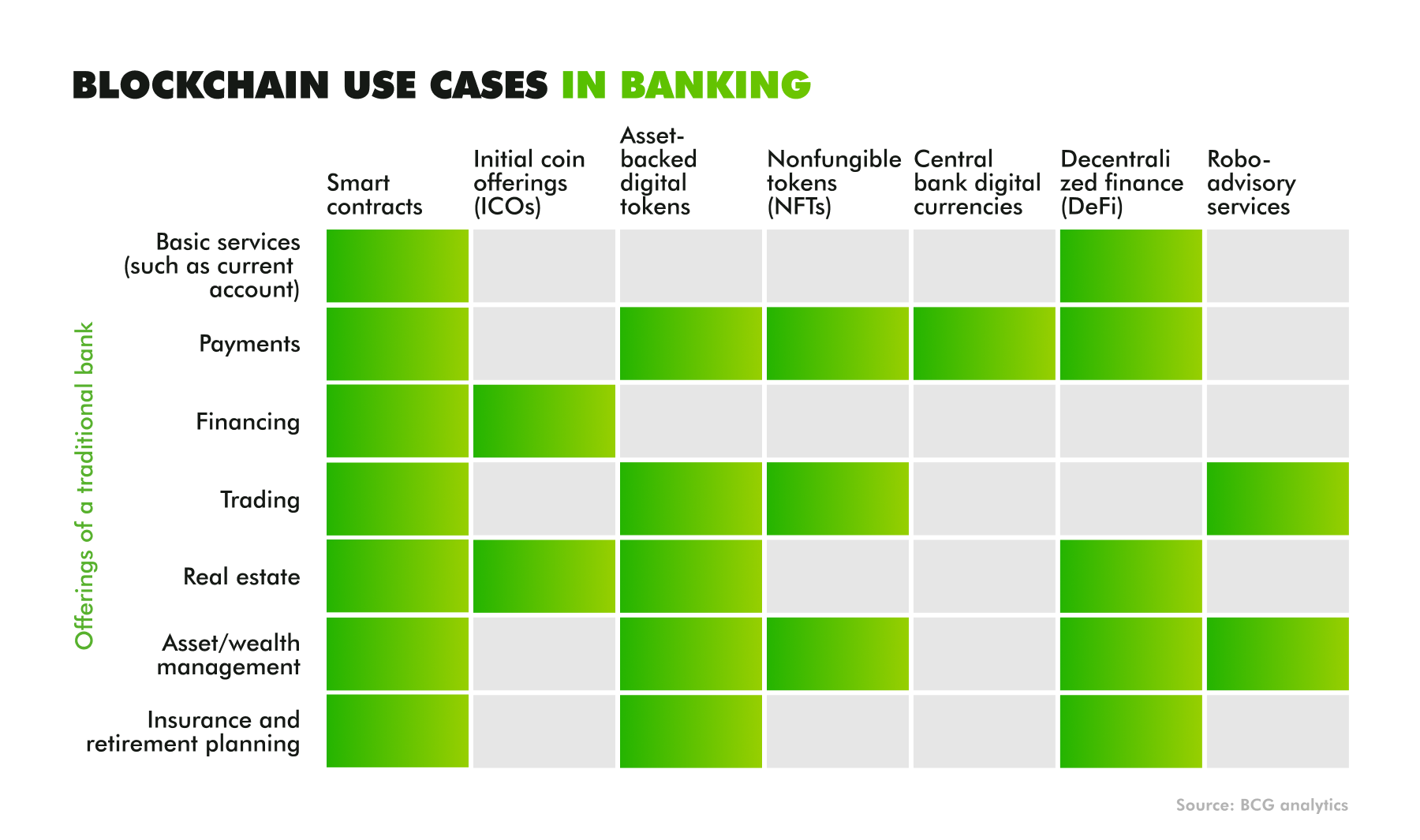

Figure 4: Some use cases of Blockchain in Banking.

Banks can pursue hybrid models that merge the transparency of public blockchains with the controlled environment of private ledgers. For instance, a payment process might leverage public chains for settlement finality and open auditing, while sensitive customer data remains on a permissioned network (Accenture 2022). Conceptually, these architectures strive to harness decentralized trust while mitigating concerns about data privacy, throughput limits, or unsupervised participant entry.

Advanced blockchain protocols enable “smart contracts”: self-executing code that triggers certain actions when predefined conditions are met (Li 2023). These can automate a range of banking operations, from syndicated loan disbursements to trade finance settlements. Meanwhile, tokenization transforms traditional or illiquid assets (real estate, invoices) into digitally tradable tokens, potentially broadening access to investment markets and enabling fractional ownership in new asset classes.

In practice, blockchain-based solutions significantly reduce cross-border settlement times—from days to near real-time—by eliminating reliance on multiple correspondent banks (PwC 2023). Banks implementing platforms like RippleNet integrate KYC and AML capabilities directly into the transaction flow, ensuring compliance. This streamlined infrastructure not only cuts fees but enhances transparency, letting both financial institutions and regulators monitor payment flows with greater precision.

Blockchain can serve as a tamper-evident registry for identity data, reducing cases of fraud in account openings and loan applications. Banks and government agencies can share cryptographically secured credentials without storing redundant copies across various databases (KPMG 2024). When leveraged responsibly, this approach simplifies customer onboarding, strengthens authentication, and prevents identity theft.

Whether it involves loan documentation, audit trails, or mortgage deeds, storing hashed references on a distributed ledger ensures the data cannot be altered unilaterally. Banks can maintain compliance by embedding immutable timestamps and linking relevant documents to on-chain records (Deloitte 2023). This secure framework expedites dispute resolution, as any modifications are transparently logged and easily verifiable.

Although blockchain fosters transparency, permissionless networks might bypass essential regulatory checks (Accenture 2022). Banks must, therefore, integrate KYC, AML, and data protection features into their DLT architectures to adhere to standards like GDPR or the Financial Action Task Force (FATF) guidelines (PwC 2023). Collaborative efforts between banks, regulators, and technology providers are crucial to establishing compliance-friendly DLT ecosystems.

Blockchain’s throughput on public networks can lag far behind traditional banking systems, creating bottlenecks for high-volume transactions. Layer-2 solutions, sidechains, or enterprise DLT platforms address these issues by improving transaction speeds and capacity (Li 2023). Banks must evaluate decentralization trade-offs carefully, choosing configurations that balance performance needs, cost-effectiveness, and regulatory mandates.

Industry consortia, such as R3 or B3i, illustrate how banks can co-develop standardized DLT protocols for use cases like trade finance and insurance. By pooling resources and expertise, these alliances accelerate the adoption of blockchain-based solutions, foster interoperability, and reduce fragmentation across the financial sector (KPMG 2024). Common governance models, shared data standards, and consistent regulatory dialogues often emerge from these joint ventures.

Rather than overhauling legacy systems overnight, banks can start with pilot projects focusing on discrete use cases—like inter-branch settlements or loyalty points (Deloitte 2023). Early wins offer critical data on ROI, security, and user acceptance, guiding larger-scale rollouts. Incremental expansion into multi-party networks allows stakeholders to refine governance approaches, address unforeseen challenges, and iteratively build more robust ecosystems.

4.4. Evaluating Emerging Tech for Strategic Fit

As banks explore AI, blockchain, and other emerging technologies, the challenge lies in determining which solutions align best with organizational goals, risk profiles, and market opportunities. This process requires an approach that is both philosophical—reflecting on core values and regulatory obligations—and practical, ensuring that new tools deliver tangible value while upholding the safety and soundness of banking operations (Deloitte 2023). The following sections outline how banks can balance a culture of innovation with inherent risk aversion, leverage industry frameworks to time their technology investments, and implement proofs of concept (PoCs) and pilots in a controlled yet agile manner.

Philosophically, banks have long prized stability, recognizing that trust is the industry’s backbone. Nonetheless, the accelerating pace of digital transformation compels banks to embrace emerging technologies, from AI-driven analytics to permissioned blockchain networks (PwC 2024). Striking a balance between caution and opportunity mitigates the fear of potential operational or reputational harm, while seizing competitive advantages that cutting-edge solutions can afford.

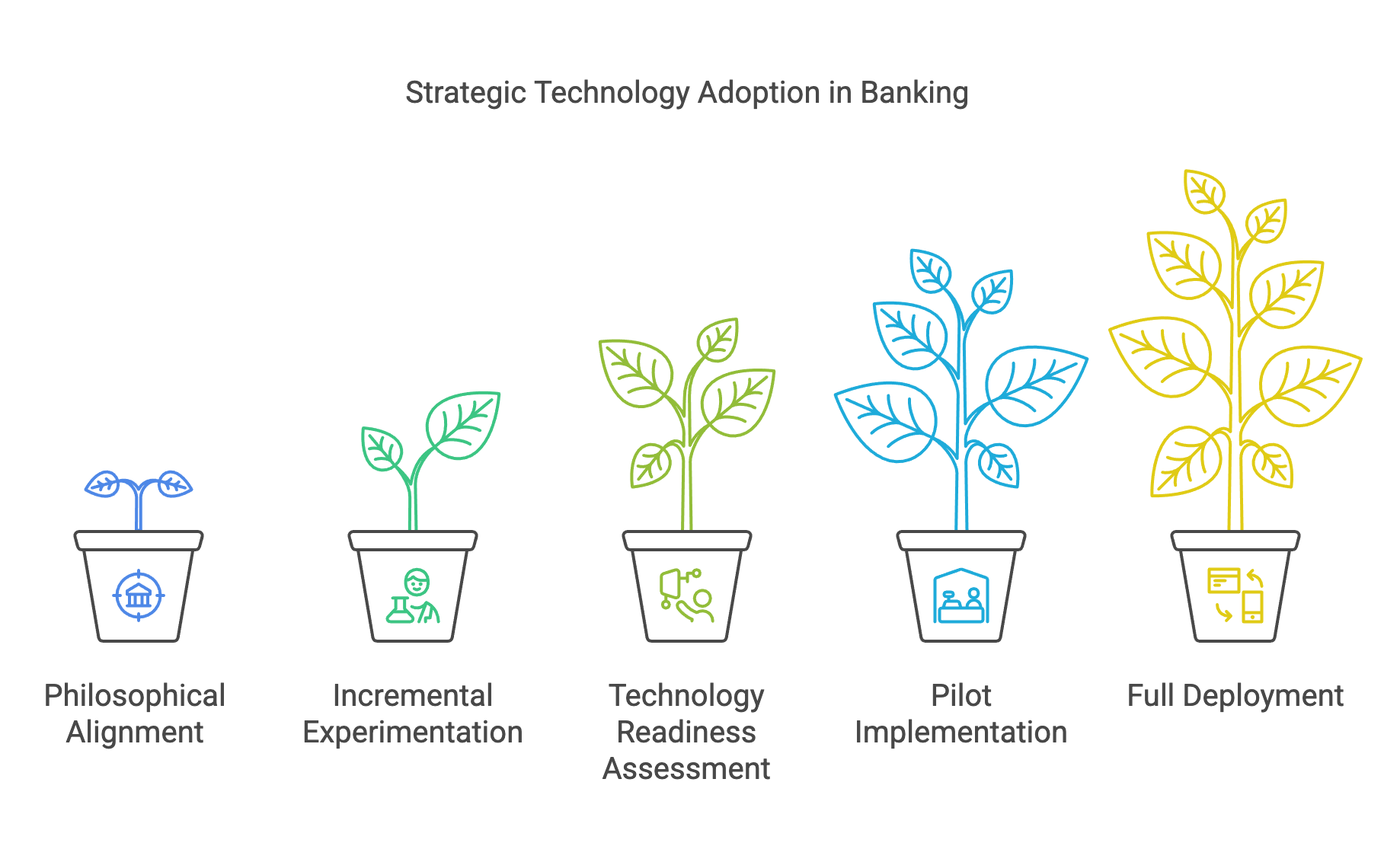

Figure 5: Strategic technology adoption - started with alignment, experimentation, readiness, pilot and deployment.

Given the heavily regulated nature of banking, new technologies carry ethical and compliance implications around customer data privacy, secure transactions, and fair lending practices (Li & Chang 2022). Rather than viewing regulation and compliance as mere checklists, banks can treat them as guiding principles to safeguard customer welfare and maintain public confidence. This philosophical lens ensures that technological innovation aligns with foundational duties—upholding security, accountability, and equitable access.

Organizations need not overhaul legacy systems overnight to stay relevant. Adopting an incremental experimentation philosophy allows them to test emerging tech in manageable stages (Deloitte 2023). By selectively introducing new solutions—like a pilot AI chatbot or a small-scale blockchain-based record management system—banks maintain operational continuity while honing their ability to respond to evolving technological landscapes. This measured approach mitigates risk and simplifies compliance oversight during each step.

Technology adoption is not solely the domain of IT or innovation teams; it involves every layer of the organization. Creating an environment of continuous upskilling and transparency around how emerging technologies fit into the bank’s broader mission encourages a culture of collective innovation (KPMG 2024). From specialized data science training programs to cross-departmental hackathons, empowering employees to propose or pilot new concepts fosters a sense of shared ownership in shaping the bank’s future.

Conceptually, Gartner’s Hype Cycle situates technologies along phases of inflated expectations, disillusionment, and eventual productivity (Accenture 2022). For banks grappling with a constant influx of innovative solutions—think quantum computing proofs or next-gen AI—this model offers a snapshot of where hype may outstrip reality. Strategists can use it to gauge whether a technology is in its early, speculative stage or nearing a plateau of practical viability, thus informing the optimal timing for pilot launches or broader rollouts.

Another vital framework is the Technology Readiness Level (TRL), which ranks innovations on a scale from basic research (TRL 1) through to fully deployed operations (TRL 9). Banks can apply TRL scoring to technologies under consideration, visualizing how close they are to large-scale deployment (PwC 2024). Solutions at the lower end of the spectrum might require ongoing research and proof-of-concept testing, while those nearing TRL 8 or 9 are ready for enterprise-grade adoption.

Integrating Hype Cycle insights with TRL data enables banks to map out realistic timelines for implementation. A solution high on the Hype Cycle but still at a low TRL may warrant closer scrutiny before investment (Li & Chang 2022). Conversely, a technology approaching the productivity plateau on the Hype Cycle and scoring well in TRL assessments may be ripe for integration into strategic roadmaps. This combined perspective balances immediate feasibility with long-term potential, aligning resources with technologies most likely to yield meaningful ROI.

By presenting emerging tech status through these frameworks, bank leaders can unify executives, regulators, and operational teams around a coherent vision. Whether reporting to a board on the readiness of a new AI credit-scoring system or updating regulators on the progress of a blockchain pilot, clear, framework-based communication reduces friction and fosters mutual understanding (KPMG 2024). This structured approach also streamlines decision-making, as stakeholders can align on precise metrics and common definitions of success.

PoCs offer a low-commitment way to validate core functionality in a controlled environment. Whether examining a new risk assessment tool or testing an NLP-driven customer service chatbot, banks can gather performance metrics—transaction throughput, accuracy, latency—without disrupting production systems (Accenture 2022). If results fall short, organizations can pivot quickly, saving resources and preventing organizational fatigue from large, unsuccessful rollouts.

Moving beyond PoCs, pilot projects insert emerging technologies into limited production scenarios, such as a specific region’s loan process or a subset of customer-facing services (Li & Chang 2022). This live environment captures operational realities, including user adoption, system integration hurdles, and compliance feedback. Pilots provide a richer tapestry of real-time data, revealing how well a technology performs under actual banking conditions and guiding any required refinements before widespread scaling.

Many financial regulators now offer sandbox programs that relax certain compliance rules to promote innovation. This structured environment enables iterative testing without jeopardizing the main banking infrastructure or exposing customers to unvetted solutions (Deloitte 2023). Working closely with regulators in these sandboxes not only reduces compliance risks but also fosters early collaboration on emerging standards, ensuring that new technologies evolve in harmony with legal obligations.

Defining success metrics from the outset is essential. Whether measuring cost reductions, processing speeds, customer satisfaction scores, or overall risk mitigation, clear KPIs serve as an objective lens for evaluating PoC and pilot outcomes (KPMG 2024). Tracking these metrics over the lifecycle of an innovation helps decision-makers weigh short-term gains, such as operational efficiencies, against long-term strategic advantages, like brand differentiation or market leadership in digital services.

To maintain the delicate balance between innovation and safety, banks should embed compliance officers and risk managers in every project stage (PwC 2024). Conducting audits, security assessments, and regulatory reviews before advancing from PoC to pilot, or pilot to full deployment, averts last-minute surprises. This close collaboration ensures that any emergent risks—cybersecurity vulnerabilities, potential bias in AI algorithms—are identified and remediated promptly, preserving customer trust and meeting regulatory expectations.

Each experimental cycle—whether a PoC, pilot, or full rollout—yields invaluable learning about technical constraints, user preferences, and regulatory nuances (Accenture 2022). Documenting these insights in “playbooks” or centralized knowledge repositories prevents teams from repeating mistakes and accelerates subsequent implementations. Over time, this institutional memory fosters an agile culture that can adapt quickly to new technologies, consistently refining the bank’s capacity for ambidextrous innovation.

4.5. Designing Implementation Strategies

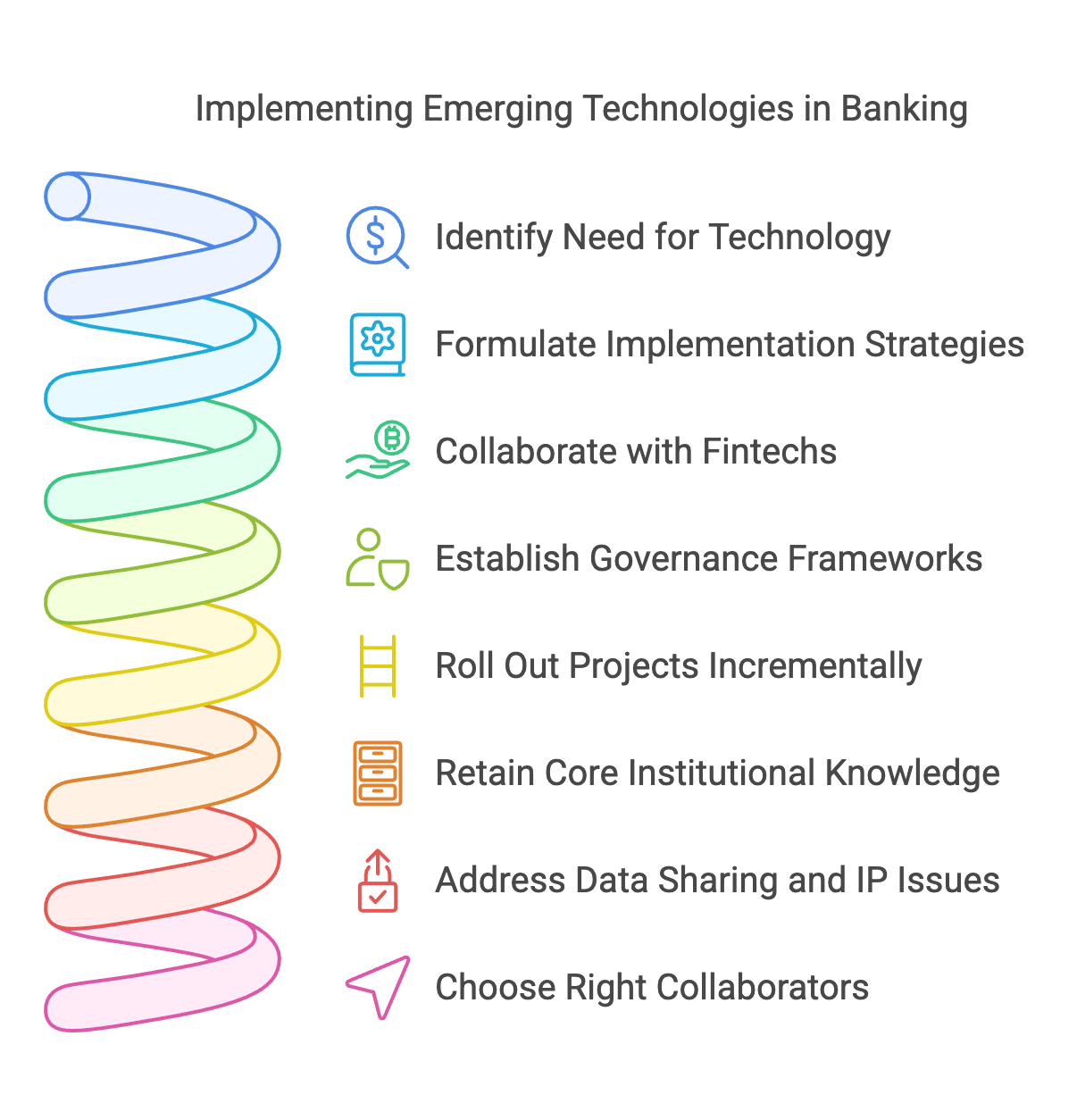

Building on the need to evaluate and adopt emerging technologies carefully, banks must also formulate robust implementation strategies that ensure effective integration, scalability, and compliance. By embracing open collaboration with fintechs and tech giants, establishing rigorous governance frameworks, and rolling out projects incrementally, financial institutions can better navigate the complexities of innovation. The following sections delve into the philosophical, conceptual, and practical dimensions of orchestrating these transformative initiatives (Deloitte 2023).

From a philosophical vantage, collaboration is not just about partnering for a particular project or product—it is about entering an ecosystem where co-creation thrives. Banks that leverage open APIs, participate in consortia, or forge alliances with fintech startups tap into a wider pool of creative ideas and specialized expertise (PwC 2024). Reframing traditional competitors or vendors as synergistic allies fosters a more dynamic, customer-centric banking landscape, where mutual learning accelerates innovation.

Figure 6: Technology implementation guide in general.

Even as banks open their doors to external influences, retaining core institutional knowledge remains paramount. Proprietary data analytics models, unique customer insights, and tried-and-true risk methodologies constitute critical elements of a bank’s competitive advantage (Accenture 2023). By maintaining custody of these strategic assets, banks preserve their brand identity and ensure that any collaborative efforts complement—rather than supplant—their core capabilities.

Collaborative ventures often hinge on delicate questions of data sharing, intellectual property (IP) rights, and equitable value distribution. Philosophically, banks that champion fairness, transparency, and ethical dealings are more likely to attract trustworthy partners and loyal customers (KPMG 2024). They also enhance their reputations as responsible corporate citizens. Clear guidelines on data usage, privacy, and shared benefits help solidify these alliances, creating a stable foundation for future joint projects.

While partnerships can fast-track product releases, a long-term orientation safeguards against purely transactional relationships. Cultivating deep, ongoing collaborations provides an avenue for continual knowledge transfer and joint problem-solving (Smith & Zhao 2022). This broader ecosystem perspective, anchored in reciprocal learning, allows banks to adapt more fluidly as new technologies—be it quantum computing or advanced AI—enter the market.

To manage the complexity of multi-party technology projects, banks need structured governance models. Steering committees, executive sponsors, and cross-functional squads can oversee scope, budget, and timelines (Deloitte 2023). Clearly defined escalation pathways ensure that compliance hurdles or shifting market realities are addressed quickly, keeping innovation on track without compromising risk management or regulatory mandates.

Choosing the right collaborators demands a thorough assessment of technical expertise, cultural fit, regulatory track record, and financial resilience (KPMG 2024). In-depth due diligence might include examining a potential partner’s security posture, their product roadmaps, and their stance on emerging regulatory frameworks such as the General Data Protection Regulation (GDPR). Aligning on shared values and strategic goals sets the stage for more productive, enduring relationships.

Before committing substantial resources, banks should articulate clear success metrics that correlate with broader corporate objectives. Metrics might track user adoption rates, time-to-market for new offerings, return on investment (ROI), or operational cost savings (Accenture 2023). By mapping these key performance indicators (KPIs) to strategic ambitions—such as bolstering customer satisfaction or expanding market share—institutions maintain focus on high-impact endeavors.

Involving compliance officers and risk managers from project inception minimizes the likelihood of post-deployment roadblocks (PwC 2024). Whether integrating a new AI tool for fraud detection or launching a blockchain-based cross-border payments platform, legal and regulatory perspectives should inform each phase’s design. Proactive oversight preserves trust among stakeholders, reassures regulators, and instills confidence in new banking solutions.

Partnerships and outsourcing arrangements hinge on service-level agreements (SLAs) that govern performance benchmarks, roles, and responsibilities. Conceptually, flexible contracting frameworks enable banks to pivot rapidly if market conditions shift or if a technology fails to meet expectations (Smith & Zhao 2022). This adaptability prevents banks from becoming locked into unproductive ventures, ensuring they can reallocate resources to more promising opportunities.

Rather than executing a massive, high-risk transformation all at once, banks can segment projects into phased rollouts (Deloitte 2023). Each phase tackles a specific functionality—such as an initial application programming interface (API) module or a limited customer pilot—and undergoes thorough testing before expanding further. This incremental strategy not only mitigates disruptions but also allows teams to refine processes in response to user feedback and performance metrics.

Implementing new technology typically involves weaving it into existing core systems, databases, and operational workflows. Producing detailed integration diagrams, data flow charts, and role-based access rules helps developers and operations teams anticipate complexities upfront (Accenture 2023). Clarity here reduces rework, shortens integration timelines, and prevents technical bottlenecks that can derail otherwise promising innovations.

Many emerging technologies, especially those in nascent stages like quantum computing or advanced cryptographic platforms, may not deliver full value within a single financial quarter or year (KPMG 2024). Crafting multi-year roadmaps, subject to periodic review, ensures that banks remain agile to external changes—from new compliance requirements to breakthroughs in AI. These roadmaps guide budgeting cycles, resource allocation, and cross-department coordination, laying the foundation for iterative evolution.

Security must be an intrinsic part of every development phase. Implementing zero-trust principles, robust encryption, regular penetration testing, and ongoing security audits can prevent breaches and data leaks (PwC 2024). A “security by design” approach fosters resilience against cyber threats, particularly vital in an industry that handles sensitive financial transactions and personally identifiable information.

Complex technologies can fail to deliver if end-users lack proper training or remain resistant to change (Smith & Zhao 2022). Structured onboarding sessions, interactive tutorials, and user acceptance testing (UAT) promote smoother adoption. Including employees early on in the design and testing phases can also build a sense of ownership and reduce friction when the new solution goes live.

Continual improvement hinges on real-time data collection and feedback loops (Accenture 2023). Dashboards that monitor system performance, user satisfaction, fraud detection rates, or cost savings offer evidence-based insights for timely adjustments. This systematic approach to monitoring also boosts transparency among partners, sponsors, and regulatory bodies, reinforcing collective confidence in the technology’s trajectory.

Finally, design choices made today should anticipate tomorrow’s requirements—whether that involves more concurrent users, new product expansions, or evolving compliance mandates (Deloitte 2023). Adopting modular or API-driven architectures and flexible cloud infrastructures makes it easier to accommodate future growth without constant re-engineering. By planning for scalability, banks can adapt rapidly to shifting market conditions and seize emerging opportunities as they arise.

4.6. Risk Management and Regulatory Considerations

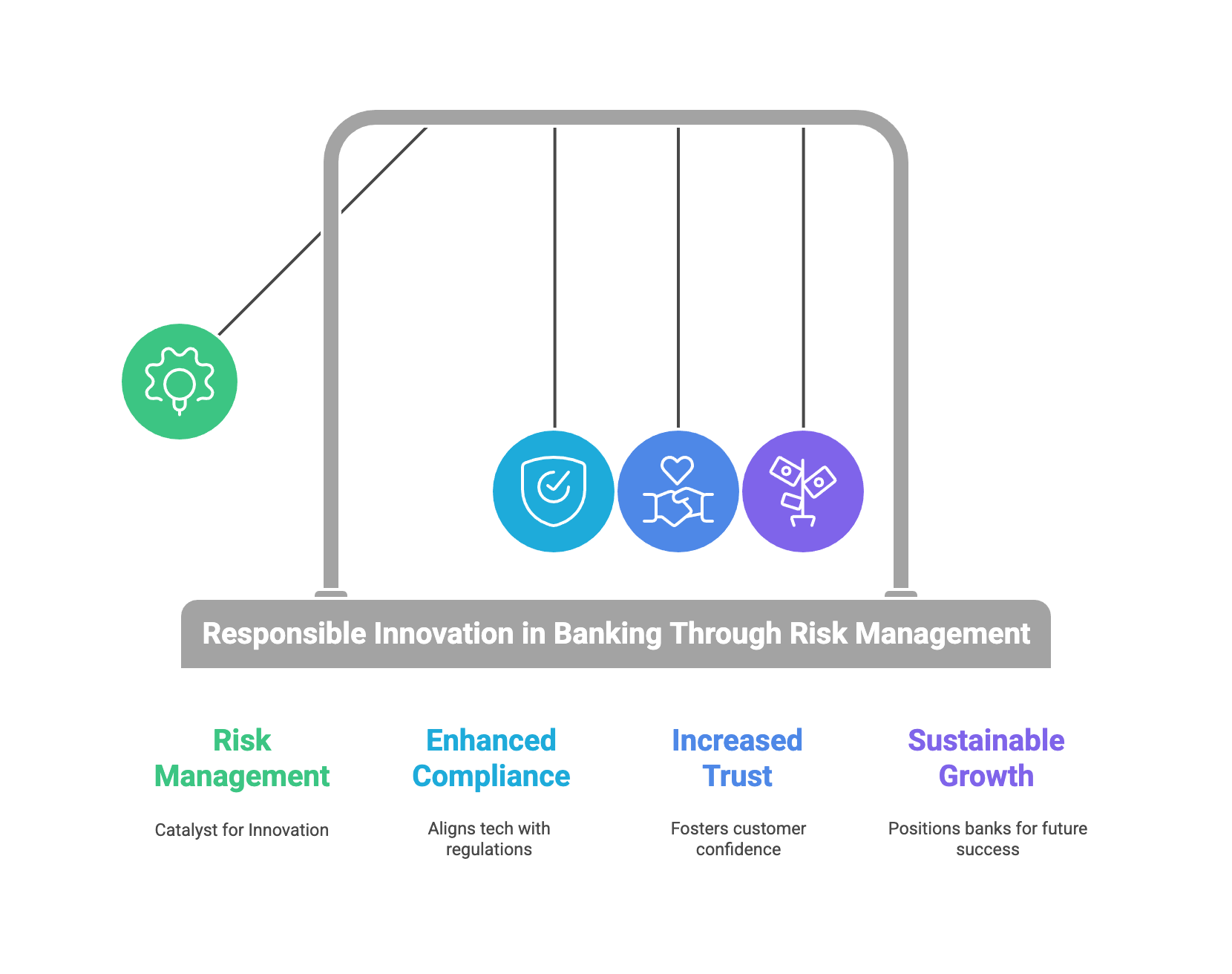

The integration of disruptive technologies such as AI and blockchain into banking operations inevitably raises concerns around compliance, security, and ethical standards. While the financial sector has traditionally taken a conservative stance toward risk, today’s rapidly evolving digital landscape demands a more dynamic philosophy—one that sees risk management not only as a safeguard but also as a catalyst for responsible innovation (Deloitte 2023). By aligning new tech deployments with regulatory frameworks and embedding robust monitoring mechanisms, banks can uphold public trust, ensure business continuity, and strategically position themselves for sustainable growth.

Figure 7: Responsible innovation required alignment with risk management in Banking.

Philosophically, banks can reposition risk management as an engine for controlled experimentation and prudent advancement. Rather than stifling creativity, thorough risk assessments bring potential vulnerabilities to light early in the innovation cycle (PwC 2024). This proactive stance refines product designs, strengthens security protocols, and ultimately fosters customer-centric solutions. In turn, it helps cultivate an environment where market opportunities and operational safeguards coexist harmoniously.

Banks serve as stewards of public trust, tasked with protecting deposits, personal data, and systemic financial stability (KPMG 2024). A risk management philosophy anchored in ethical responsibility ensures that technology adoption respects customers’ rights to privacy and equitable treatment. This moral lens reinforces accountability and nurtures confidence in financial institutions—a critical asset in a climate where rapid digital shifts can unsettle traditional notions of security and reliability.

In contrast to short-sighted risk strategies that chase immediate profits, a more expansive outlook underscores how methodical decision-making sustains resilience and market credibility over time (Li & Chang 2022). By incorporating broader social and environmental factors into risk assessments, banks fortify themselves against external shocks—economic downturns, cyber threats, or reputational crises—and foster a culture of prudent, forward-thinking innovation.

Responsible exploration of emerging technologies, including AI, blockchain, and quantum computing, begins with clear risk appetite statements that delineate acceptable boundaries (Smith & Zhao 2022). Balancing the allure of disruptive change with necessary regulatory safeguards prevents banks from venturing into precarious territory that could compromise both customer interests and brand reputation. Such discipline aligns with a philosophical commitment to sustainable growth.

Conceptually, every application of new technology must align with prevailing banking regulations—from Basel III capital requirements to local data protection mandates. Early mapping of these regulations to potential use cases (e.g., AI-based underwriting or blockchain-facilitated settlements) allows banks to anticipate compliance hurdles (Deloitte 2023). Gaps between an innovation’s capabilities and regulatory expectations can be systematically addressed, minimizing costly project delays or reworks.

With emerging regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), banks must demonstrate rigor in their data handling processes. Privacy-by-design principles entail structuring data flows, retention policies, and user consent protocols in a way that upholds stringent privacy norms (PwC 2024). Beyond legal obligations, meticulous data stewardship fosters higher levels of customer trust and brand loyalty.

Technologies like AI and blockchain often introduce new entry points for malicious actors, demanding a rigorous approach to threat modeling. Frameworks such as STRIDE (Spoofing, Tampering, Repudiation, Information Disclosure, Denial of Service, Elevation of Privilege) or DREAD (Damage, Reproducibility, Exploitability, Affected Users, Discoverability) help categorize potential vulnerabilities (KPMG 2024). Armed with such analyses, security teams can prioritize prevention and detection strategies, reinforcing the institution’s digital fortifications.

Not all implementations pose equal risk. Banks should distinguish between mission-critical systems (e.g., real-time payment rails) and lower-stakes initiatives (e.g., AI-driven customer feedback analytics) when allocating risk management resources (Li & Chang 2022). Tailored oversight ensures that the most consequential systems undergo more stringent reviews, while smaller-scale pilots remain agile enough to explore new ideas without undue bureaucratic friction.

Increasingly, banks can deploy regulatory technology (RegTech) tools to automate compliance tasks—such as real-time transaction monitoring or digital reporting to regulators. By embedding RegTech solutions into emerging tech workflows, institutions streamline the compliance process and reduce errors (Smith & Zhao 2022). This synergy empowers teams to focus on higher-level innovation rather than manual, repetitive checks.

On a practical level, maintaining visibility across complex digital ecosystems calls for sophisticated monitoring solutions. Security Information and Event Management (SIEM) systems, advanced fraud analytics, and anomaly detection platforms can flag irregularities in real time (Deloitte 2023). Rapid alerts bolster both internal governance and external confidence, demonstrating swift, decisive responses to potential threats.

When leveraging AI for credit scoring, fraud detection, or chatbot interactions, banks must preemptively address biases, model explainability, and data usage boundaries. Implementing formal AI ethics committees or governance boards enforces consistent standards and transparent review processes (PwC 2024). This structured oversight prevents detrimental outcomes—such as discriminatory lending practices—and fosters trust among regulators and the public.

Detailed audit logs, recording every system change, user action, or AI-driven decision, lie at the core of robust accountability. In the event of a data breach or an incorrect model output, well-maintained logs facilitate quick root-cause analysis (KPMG 2024). They also underpin compliance with regulations that demand proof of due diligence, reinforcing an institution’s reputation for responsible management.

Despite best efforts, breaches, AI malfunctions, or system outages may still occur. Establishing incident response protocols and disaster recovery plans—including tabletop exercises and backup infrastructures—positions banks to minimize damage (Li & Chang 2022). Regular drills not only ensure smooth coordination across operational units but also demonstrate a mature, proactive stance to external auditors and stakeholders.

Effective risk management extends to the human element. Banks should provide targeted training on data protection, emerging regulatory changes, and operational best practices for employees at every level (Smith & Zhao 2022). By embedding compliance knowledge into day-to-day workflows, institutions reduce inadvertent errors and nurture a shared sense of responsibility.

Regulators, shareholders, and customers all benefit from clear, consistent updates about the bank’s approach to risk management—particularly as new technologies are introduced (Deloitte 2023). Public disclosures, press releases, or internal town halls can clarify how AI, blockchain, or other innovations align with the institution’s ethical and compliance commitments. This openness underlines the bank’s dedication to integrity, bolstering confidence across its entire ecosystem.

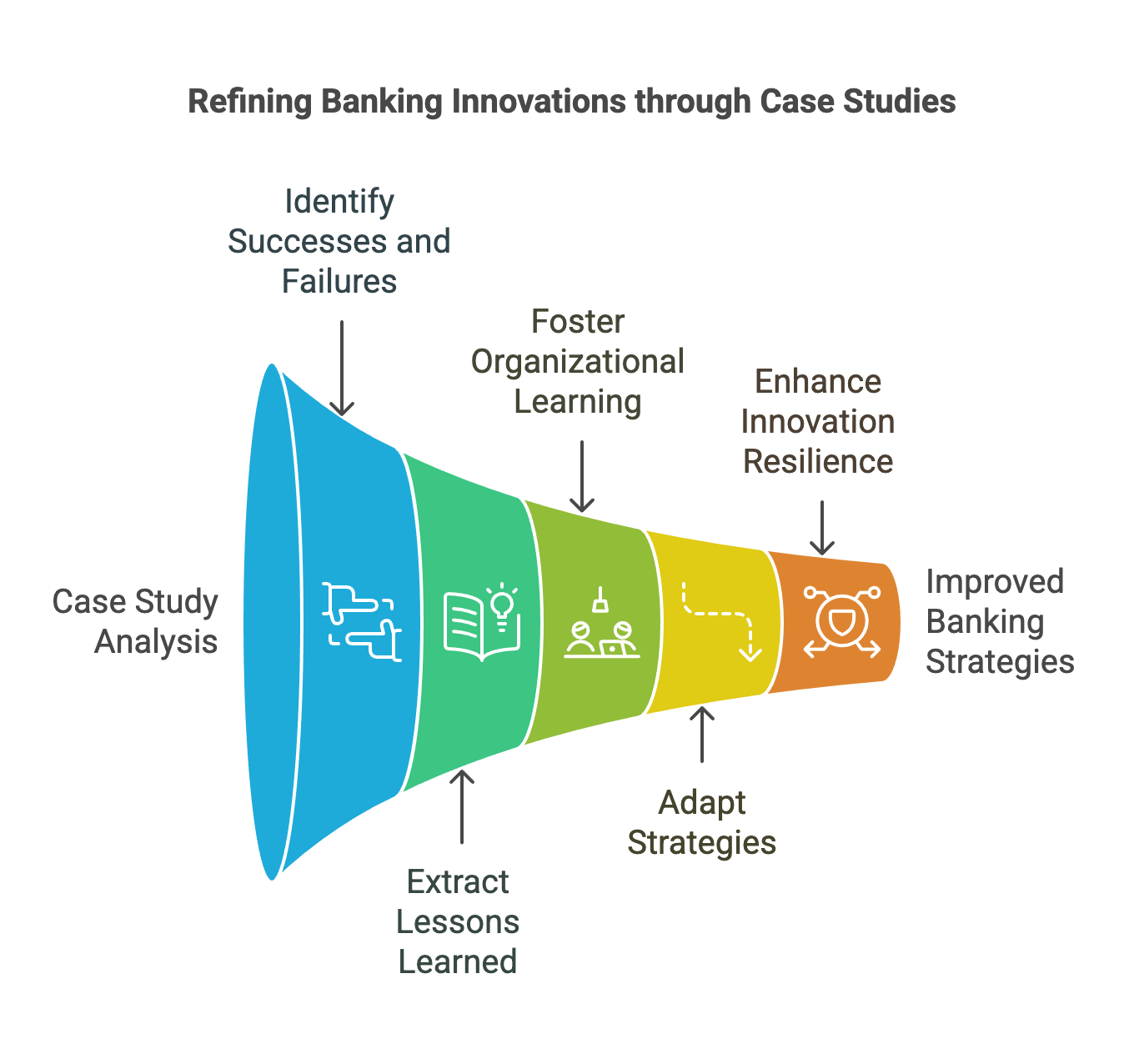

4.7. Real-World Case Studies: Successes and Failures

Real-world case studies provide invaluable insights into how banks navigate the complexities of emerging technologies, from AI-driven fraud detection systems to blockchain-based settlements. By examining both triumphs and disappointments, financial institutions can refine their innovation strategies and strengthen organizational resilience. The following sections discuss the philosophical, conceptual, and practical angles of learning from case studies and illustrate how these lessons influence future tech adoption (Deloitte 2023).

Philosophically, a culture that openly acknowledges both accomplishments and failures fosters transparency and continuous improvement. Where successful projects—involving new AI underwriting tools or digital customer onboarding platforms—earn recognition, less successful endeavors warrant honest introspection (KPMG 2024). When banks highlight not only what went right but also what derailed, employees at every level benefit from these shared lessons and feel empowered to suggest refinements.

Figure 8: Case study analysis is critical feedbacks to improve banking strategies.

A learning-oriented philosophy replaces finger-pointing with constructive, data-driven retrospectives (PwC 2024). Leaders who normalize candid discussions about project missteps encourage critical self-reflection. Rather than burying failed initiatives, banks can treat them as fertile ground for insights on risk assessment, collaboration breakdowns, or flawed assumptions. This shift promotes agility and a willingness to adapt quickly based on real-world experience.

Each case study—be it a success or a cautionary tale—can challenge entrenched ways of thinking. A triumphant blockchain pilot might showcase the importance of robust vendor selection and cross-departmental alignment, whereas a failed chatbot launch may underscore the dangers of inadequate user testing (Smith & Li 2022). In both scenarios, organizations reevaluate internal processes, stakeholder engagement models, and outdated methodologies, forging a corporate culture that learns and evolves continuously.

In banking, failures can have far-reaching consequences: customer losses, reputational harm, or regulatory penalties. A philosophical commitment to accountability recognizes that a bank’s obligation extends beyond shareholders to include employees, customers, and the broader public (Accenture 2023). By interpreting both positive and negative case studies through an ethical lens, institutions reaffirm their dedication to responsible innovation that safeguards trust and well-being.

Case studies frequently point to the pivotal role of executive champions who provide both strategic vision and resource allocation. Such top-down support not only funds technology pilots but also facilitates cross-departmental cooperation (Deloitte 2023). When senior leaders consistently advocate for an innovation—be it AI-based credit scoring or a DLT consortium—the bank’s broader organization aligns behind a shared objective.

Successful initiatives often have clear success metrics mapped to overarching business goals, such as reducing loan default rates or accelerating time-to-market for new services (KPMG 2024). Conversely, when projects lack well-defined KPIs, they risk budget overruns or stakeholder apathy. Quantifiable targets—operational cost savings, compliance enhancements—help keep teams accountable and project momentum high.

A shortage of technical, regulatory, or domain-specific expertise can doom even the most visionary concepts. In contrast, a cross-functional roster—melding IT specialists, risk analysts, compliance officers, and product owners—consistently emerges as a success factor (Smith & Li 2022). RACI (Responsible, Accountable, Consulted, Informed) matrices or agile squads can clarify responsibilities, reducing confusion and duplication of effort.

Transparent, frequent communication underpins many success stories. Whether it is providing real-time project updates, hosting internal demos, or engaging with regulators, consistent stakeholder touchpoints reduce project drift (Accenture 2023). Even promising initiatives can fail if frontline staff, compliance officers, or external stakeholders are kept in the dark, unable to offer feedback or address red flags early on.

Strong governance models that allow for iterative pivots and risk-based controls frequently appear in standout case studies. Rigid processes can stifle creativity, while poorly structured governance invites chaos (PwC 2024). By implementing a balance—agile sprints coupled with formal risk reviews—banks nurture innovation without compromising on regulatory or operational integrity.

Many failed projects share a common thread: misaligned partnerships or subpar vendor performance. Successful banks conduct rigorous due diligence—assessing financial stability, technical expertise, and shared strategic goals—before signing contracts (Smith & Li 2022). Structured RFPs, pilot demonstrations, and reference checks reduce the risk of vendor-related setbacks, ensuring smoother project execution.

Case studies of well-publicized failures reveal shortcomings in anticipating regulatory, cybersecurity, or operational risks (KPMG 2024). Employing frameworks like threat modeling or scenario stress tests enables teams to expose vulnerabilities before large-scale rollouts. Integrating compliance officers and risk managers early helps identify hidden pitfalls and fosters a proactive risk culture.

Iterative rollout strategies—scrum, Kanban, or combined stage-gate methods—regularly distinguish successes from stalled or abandoned projects (Deloitte 2023). Early prototypes and pilot releases gather real-time feedback, allowing teams to pivot swiftly if needed. This iterative approach reduces the likelihood of costly rework while ensuring that end-user needs remain at the forefront of development.

Technological shifts often outpace traditional training programs. Successful banks invest in ongoing education—data science workshops, vendor-led seminars, or internal knowledge swaps—to keep staff current on new tools and regulations (Accenture 2023). They also maintain robust succession planning to ensure that institutional expertise is not lost when key individuals move on.

Several case studies illustrate the perils of “big bang” implementations, where solutions are deployed system-wide all at once. Smaller, targeted releases—whether limited to a region or product line—minimize operational disruptions and allow for swift refinements (PwC 2024). Once these limited pilots prove successful, scaling becomes more manageable, anchored in empirical results rather than assumptions.

Finally, organizations benefit most from case studies when they systematically document successes and failures. Conducting post-project evaluations—complete with root-cause analyses—prevents the same mistakes from recurring (Smith & Li 2022). Maintaining an accessible repository or “playbook” of these lessons also helps future teams avoid re-inventing the wheel, further accelerating innovation cycles.

4.8. The Future of Disruptive Tech in Banking

As the pace of technological innovation accelerates, banks must prepare for a world in which AI, blockchain, quantum computing, and decentralized finance (DeFi) routinely challenge long-established operational paradigms (Deloitte 2023). This final section highlights how banks can remain vigilant and adaptive, both in philosophy and practice, to ensure they stay ahead of radical developments in financial services. By combining perpetual scanning for new capabilities with robust organizational processes, institutions can pioneer cutting-edge solutions while safeguarding trust and compliance.

Philosophically, innovation in banking is not an occasional upheaval but an ongoing process of renewal. New waves of technology—currently dominated by AI and blockchain—will soon be overtaken by quantum computing, decentralized finance, and other breakthroughs yet to be defined (KPMG 2024). Rather than resisting this inevitability, banks can proactively scan the horizon, thus preventing complacency and obsolescence.

Figure 9: Disruptive tech areas (AI, Blockchain and Quantum Computing) in future Bank.

Quantum computing’s potential to break classical encryption or decentralized protocols that bypass traditional intermediaries require conceptual boldness. Banks must assess these radical possibilities from a stance of preparedness rather than fear (PwC 2024). By leaning into the uncertainty, forward-thinking institutions can set themselves apart as market leaders—positioned to implement bold ideas that redefine financial products and services.

While future-oriented approaches are vital, banks cannot abandon the fundamentals of trust, security, and regulatory compliance that anchor their reputations (Accenture 2023). Philosophically, the path forward involves weaving proven strengths—like risk management expertise—into emergent innovations, ensuring that disruptive change is anchored in reliability and societal benefit.

Disruptive technologies also carry far-reaching social implications, from job displacement to privacy concerns. Recognizing these ethical dimensions fosters a responsible adoption strategy that seeks not only profit but also community well-being (Li & Song 2022). Banks that engage stakeholders in constructive dialogue about data rights, algorithmic bias, and equitable access can use technology to enhance social impact rather than exacerbate inequalities.

The fusion of AI analytics with blockchain’s decentralized ledger opens the door to “smart contract” ecosystems capable of automated lending, settlements, and identity validation (Accenture 2023). In this convergent model, human oversight shifts to strategic or ethical decision-making, as routine tasks become self-executing and transparent. Such changes could dramatically lower operational costs and expand banking services to previously underbanked regions.

As quantum computing matures, the encryption methods banks rely on—RSA, ECC—may be rendered vulnerable in short order (Li & Song 2022). Conceptually, transitioning to post-quantum cryptographic standards becomes a strategic imperative. Early movers who adopt quantum-safe techniques position themselves to protect sensitive financial data and maintain trust with customers wary of future cyber threats.

DeFi protocols, which allow peer-to-peer financial services without centralized intermediaries, pose both an opportunity and a challenge. By harnessing programmable finance, banks could offer more flexible, real-time lending and asset management options. However, integrating DeFi into regulated environments demands careful design to avoid reputational and compliance risks (Deloitte 2023). Banks may create hybrid models that combine decentralized frameworks with institutional safeguards.

As the Internet of Things (IoT) and big data analytics converge, financial services are poised to become increasingly contextual and personalized. Real-time behavioral data can enable features like auto-adjusting mortgage rates or instantaneous micro-investments, deeply embedding banking services into daily life (KPMG 2024). This vision requires scalable data infrastructures, robust privacy measures, and transparent AI-driven decisioning to preserve trust.

Looking ahead, individuals may store and control their personal identity data on distributed ledgers, granting access to banks only as needed. Such self-sovereign identity systems shift power from institutions to end-users, reshaping KYC (Know Your Customer) norms and further decentralizing trust (PwC 2024). Banks that adapt to this model can streamline onboarding while respecting user autonomy.

In practice, banks can maintain “technology refresh” cycles—quarterly or semi-annual sessions for re-assessing major tech developments (Deloitte 2023). These standing reviews ensure that strategic roadmaps remain agile and can pivot swiftly if quantum breakthroughs or DeFi protocols accelerate faster than anticipated.

Keeping workforce skills current is crucial in fields where cryptography, AI algorithms, or digital identity frameworks rapidly evolve (Accenture 2023). Formal training programs, innovation labs, and internal “tech academies” allow employees to gain practical experience with new tools. Cross-functional squads can then blend these cutting-edge capabilities with deep banking know-how.

By collaborating with consortia like R3 or Hyperledger, banks collectively develop standards and share pilot findings (KPMG 2024). Involvement in open-source projects, hackathons, and regulator-led sandboxes provides safe environments for exploring unconventional ideas. This approach mitigates risk while accelerating collective learning across the financial sector.

Practical experimentation with quantum-safe encryption, AI-blockchain hybrids, or DeFi-based lending protocols can begin on a small scale. Pilot projects or limited market trials yield critical insights into customer acceptance, technical feasibility, and regulatory compliance (PwC 2024). Banks can then refine these technologies before wider rollouts, reducing the likelihood of large-scale failures.

Disruptive tech initiatives often span multiple departments, partner firms, and even industries. Implementing governance structures that can flexibly incorporate external collaborations—tech giants, startups, research institutions—ensures swift alignment on security standards, data sharing, and IP rights (Li & Song 2022). Clear contractual frameworks and open APIs minimize friction, letting banks launch or adapt new services faster.

Amid potential threats like quantum decryption or decentralized fraud, banks require forward-focused risk assessments. Tools ranging from advanced intrusion detection to post-quantum key management protocols help fortify digital assets (Deloitte 2023). By continuously updating cybersecurity strategies and compliance measures, banks retain the public trust that underpins all financial activity.

4.9. Conclusion

In conclusion, navigating disruptive technologies demands both vision and pragmatism. By carefully evaluating the strategic fit of AI, Blockchain, and other emerging tools, IT leaders can innovate responsibly while upholding security and compliance. It’s essential to establish clear governance structures, partner intelligently with fintechs and technology providers, and cultivate an internal culture that embraces experimentation and continuous learning. Now is the time for IT professionals to drive forward-looking tech agendas, demonstrating how thoughtful adoption of disruptive innovations can catalyze growth and future-proof the organization.

4.9.1. Further Learning with GenAI

These comprehensive prompts delve into the multifaceted considerations of adopting disruptive technologies—AI, Blockchain, and beyond—in banking, exploring everything from regulatory adherence and risk management to implementation strategies and ROI.

Explore how AI applications such as chatbots, fraud analytics, and algorithmic trading are reshaping the customer experience and risk management landscape in banking, including potential regulatory challenges.

Provide a decision-making framework for distinguishing between hype-driven and genuinely disruptive technologies in the finance sector, emphasizing stakeholder alignment and ROI considerations.

Examine how blockchain solutions for cross-border payments can reduce settlement times and fees. Discuss the operational complexities, from legacy integration to compliance with varying regional regulations.

Compare proof-of-concept (PoC) vs. pilot project approaches for implementing a new AI-driven credit scoring system. Which governance, risk management, and performance metrics are crucial at each stage?

Discuss how banks can cultivate a culture that balances risk aversion with the need for innovation, particularly when experimenting with emerging technologies like quantum computing and decentralized finance.

Detail the specific skills—ranging from data science and cryptography to agile project management—that IT teams must acquire to implement AI and blockchain successfully in a banking environment.

Outline best practices for building ethically responsible AI tools in banking, focusing on bias detection, explainability, and data privacy compliance.

Evaluate how distributed ledger technologies can improve trade finance processes, from reducing paperwork to enhancing real-time visibility. Address possible friction points, like interoperability and stakeholder buy-in.

Design a roadmap for integrating AI-based predictive analytics into an existing core banking system without compromising uptime or violating security protocols.

Explain how to measure the impact of a newly introduced blockchain solution on both customer satisfaction and operational efficiency, considering short-term vs. long-term KPIs.

Assess the role of fintech partnerships in accelerating the adoption of disruptive tech in traditional banks. What operational, cultural, and regulatory barriers must be navigated?

Analyze the potential of quantum computing in banking, focusing on how it could revolutionize risk analysis, cryptography, and high-speed trading. What are the main challenges to mainstream adoption?

Propose a strategic communication plan for a bank’s IT department to secure C-suite and board-level buy-in for a major AI-driven transformation project.

Discuss how to future-proof an organization’s technology stack and governance models so they can adapt quickly to the next wave of disruptions after AI and Blockchain.

Investigate the intersection of decentralized finance (DeFi) with mainstream banking. Which models might banks adopt, and how can they maintain compliance in a decentralized ecosystem?

Critically evaluate a failed blockchain pilot at a major financial institution. Identify root causes—like insufficient stakeholder alignment or over-reliance on hype—and extract lessons for future attempts.

Propose a layered risk management framework that reconciles the unpredictability of disruptive tech with the bank’s need for unwavering reliability and compliance.

Examine the challenges of scaling AI solutions globally across multiple jurisdictions, each with distinct data governance and regulatory requirements.

Outline a process for incrementally introducing ‘explainable AI’ methods into an existing fraud detection system, detailing the steps to ensure transparency without sacrificing performance.

Compare different blockchain consensus mechanisms (e.g., Proof of Work, Proof of Stake, Permissioned Voting) and their suitability for enterprise banking solutions, balancing efficiency, security, and governance.

Engaging with these prompts equips IT professionals with the insights and frameworks they need to confidently navigate emerging innovations and drive meaningful transformation within their organizations.

4.9.2. Workshop Assignments

These five collaborative workshops guide participants in applying real-world strategies and frameworks—ranging from technology radars to comprehensive roadmaps—that enable effective adoption of disruptive technologies in banking.

Workshop Assignment 1: Technology Radar Creation

Objective: Participants collaborate to build a “technology radar” for their organization, identifying and categorizing emerging technologies—AI, Blockchain, quantum computing, decentralized finance—by their maturity and potential impact. The radar serves as a visual guide to help teams decide which innovations to explore immediately, test in a pilot, or monitor for future adoption.

Expected Deliverables:

A collaboratively developed technology radar matrix

Brief rationale statements for why each technology is placed in a specific category (e.g., “adopt,” “trial,” “assess,” “hold”)

A short presentation outlining priority recommendations for IT leadership

Guidance:

Use group brainstorming or research from credible tech analysts (e.g., Gartner, Forrester)

Encourage debate on technology hype vs. real-world applicability

Emphasize alignment with current business strategy, risk appetite, and compliance needs

Workshop Assignment 2: AI Use Case Exploration

Objective: Teams select a banking challenge—fraud detection, customer onboarding, loan underwriting—and design a conceptual AI solution. By walking through data sources, model selection, and potential ethical risks, participants gain hands-on experience balancing innovation with regulatory and operational constraints.

Expected Deliverables:

A short AI project proposal detailing the use case, objectives, and expected outcomes

An assessment of data requirements, including privacy and compliance considerations

A risk mitigation plan addressing algorithmic bias, model drift, and auditability

Guidance:

Encourage participants to consider real-world data limitations and potential biases

Incorporate structured feedback loops (e.g., pilot phases) for model tuning

Emphasize clear success metrics, such as accuracy, ROI, or customer satisfaction

Workshop Assignment 3: Blockchain Feasibility Study

Objective: Participants investigate a potential blockchain application—such as cross-border payments, trade finance, or identity management—and conduct a feasibility study. The exercise involves stakeholder identification, cost-benefit analysis, and high-level architectural planning, culminating in recommendations for pilot or proof-of-concept execution.

Expected Deliverables:

A feasibility report outlining technical, financial, and regulatory considerations

A preliminary architecture diagram or process flow for the proposed blockchain solution

Clear recommendations on whether to proceed, pivot, or halt the initiative

Guidance:

Prompt teams to compare blockchain alternatives (public, private, consortium networks)

Factor in interoperability with legacy systems and partner platforms

Encourage reflections on the project’s long-term scalability and alignment with corporate strategy

Workshop Assignment 4: Risk Management Simulation

Objective: Through a scenario-based activity, participants enact the roll-out of a disruptive technology under various stress tests—regulatory audits, sudden market shifts, or security breaches. This simulation teaches the importance of proactive risk assessment, flexible governance, and rapid response protocols when integrating novel solutions in a high-stakes environment.

Expected Deliverables:

A risk registry highlighting potential disruptions and corresponding mitigation plans

A simulation walkthrough showing how the team addresses each stress test in real-time

Lessons learned document for refining future risk management strategies

Guidance:

Use realistic triggers (e.g., new compliance rules, data breach attempts) to test readiness

Encourage quick decision-making and iterative adaptation of the deployment plan

Conclude with a debrief on whether the chosen technology remains viable post-crisis

Workshop Assignment 5: Future-Forward Strategy Roadmap

Objective: Participants synthesize insights from the chapter—technology scanning, AI/Blockchain pilots, risk considerations—to create a multi-year strategy roadmap. This roadmap shows how the organization can evolve from current operational states to ambitious future goals, ensuring ongoing alignment with market trends and regulatory landscapes.

Expected Deliverables:

A multi-phase strategy document highlighting key milestones and dependencies

Budgetary estimates, resource allocations, and training needs for each phase

Plans for continuous stakeholder engagement, including review cycles and update mechanisms

Guidance:

Encourage the integration of lessons from prior workshop assignments (e.g., technology radar, feasibility studies)

Include contingencies for pivoting if market or regulatory conditions change

Emphasize metrics for measuring progress, such as adoption rates, ROI, or compliance achievements

By completing these interactive sessions, IT professionals will sharpen their strategic thinking, risk-management skills, and innovation capabilities, ensuring they can confidently navigate and leverage emerging tech to drive tangible business impact.

Comments