Chapter 5

Strategic Transformation Frameworks

"A solid transformation framework is like a well-written score—you need it to synchronize every moving part of the orchestra that is a modern banking operation." — Ritesh Jain, Co-Founder of Infynit, Ex-CIO at HSBC & Yes Bank

Chapter 5 translates broad strategic concepts into an actionable playbook for IT transformation in the banking sector. By bridging high-level vision with hands-on project prioritization techniques, readers learn to develop and refine a roadmap that simultaneously protects core operations while embracing cutting-edge innovations. Each section zeroes in on essential considerations, from securing executive sponsorship and allocating resources effectively, to applying robust change management strategies and measuring results with transparency. This comprehensive framework ensures that transformation efforts remain aligned with both immediate business needs and a forward-looking agenda, empowering IT professionals to orchestrate lasting, meaningful change.

5.1. Understanding Strategic Transformation in Banking IT

Strategic transformation in banking IT transcends mere project-based revamps; it involves a sustained commitment to evolving systems, cultures, and operational mindsets. As financial institutions grapple with intensified competition from fintechs, shifting regulations, and an ever-accelerating pace of technological change, they must embrace transformation as a continual process rather than a single overhaul. This section delves into the philosophical, conceptual, and practical dimensions of strategic transformation, outlining how banks can align their missions, engage stakeholders, and measure progress effectively (Deloitte 2023).

Philosophically, transformation in banking IT is not a one-off event. Instead, it represents a perpetual evolution that demands regular refinements, incremental innovations, and the reinvention of core practices. By adopting this view, banks can promote a continuous-learning mentality—one where successes and setbacks alike become catalysts for ongoing improvement (PwC 2024). Such a mindset reduces the tendency to see transformation as a “destination” and refocuses teams on perpetual adaptation.

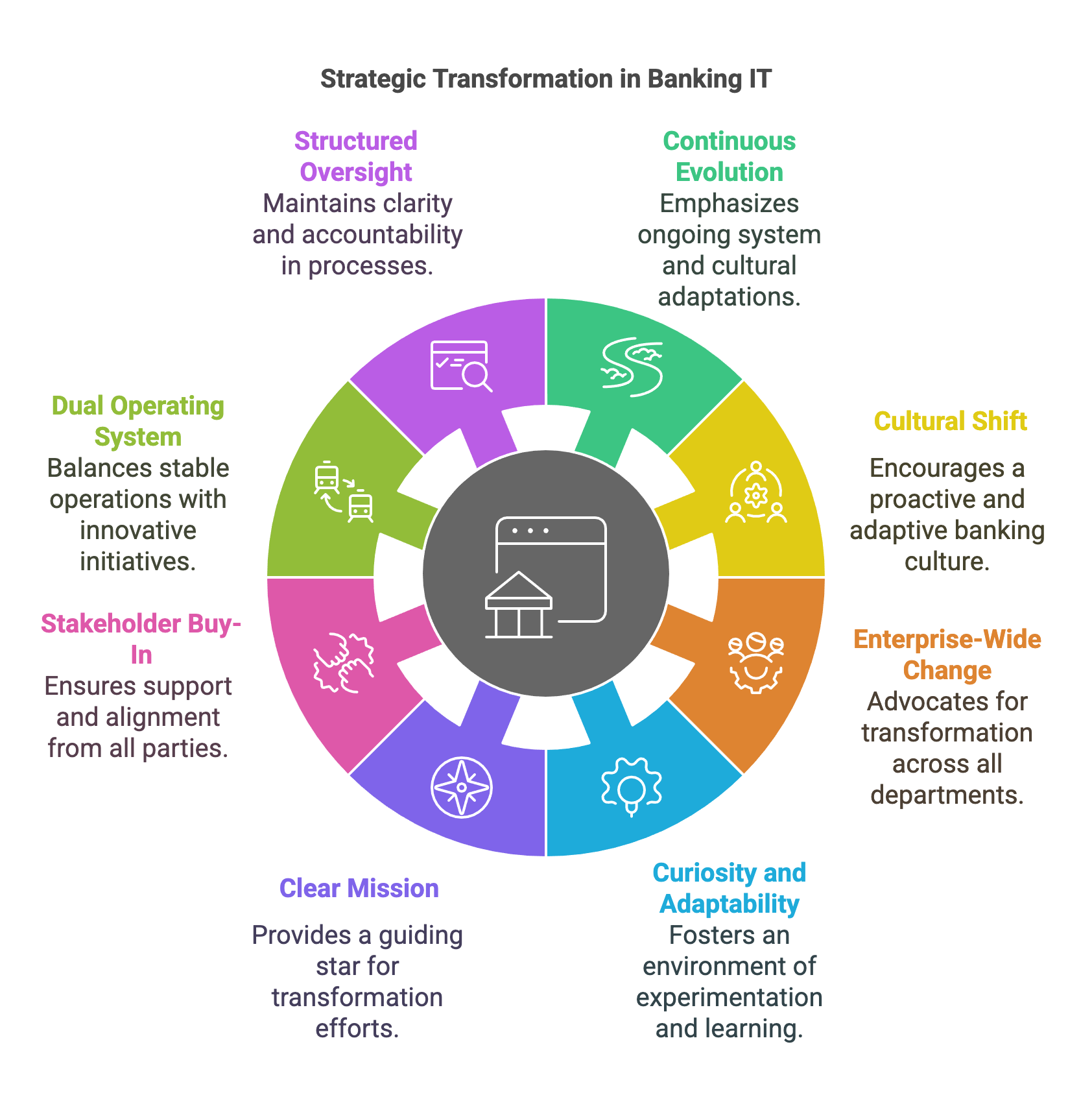

Figure 1: Key elements of strategic transformation in Banking IT.

Traditional banking culture often emphasizes consistency, especially given regulatory obligations and the need to preserve customer trust. However, the external landscape—marked by fintech disruptions and evolving consumer preferences—calls for proactive, rather than purely reactive, modernization (Accenture 2023). Philosophically, banks must therefore shift from safeguarding an unchanging status quo to embracing a culture where iterative updates, pilot projects, and agile methodologies are expected norms.

When transformation is siloed within IT, it rarely achieves its full potential. Instead, effective change should permeate all departments, from compliance to marketing, ensuring alignment around shared goals and a unified approach to innovation. This enterprise-wide mindset paves the way for cross-departmental synergy and a consistent customer experience (KPMG 2022). Philosophically, such coherence transcends operational boundaries and cultivates a language of collective progress.

A philosophical lens also highlights the significance of curiosity and adaptability. By viewing transformation as an ongoing journey, banks encourage an atmosphere where experimentation and measured risk-taking flourish. Teams feel more empowered to propose new ideas, test prototypes, and learn from failures without fear of reprisal (Johnson & Chang 2021). Over time, this iterative environment strengthens both resilience and innovative capacity.

Conceptually, a well-defined mission provides the North Star for transformation efforts, whether the goal is to become a purely digital bank or to lead in customer-centric innovation. A clear mission statement helps employees understand how day-to-day tasks align with broader strategic objectives (PwC 2024). This shared vision reduces confusion and fosters cohesive efforts across disparate project teams.

Securing buy-in from executives, employees, customers, and even regulators is critical. Conceptually, early stakeholder involvement can reveal hidden pain points, adoption barriers, or compliance hurdles, allowing for timely adjustments (Deloitte 2023). Incorporating front-line staff and customer feedback in the design phase, for instance, ensures that technology rollouts address real-world needs, not just theoretical benefits.

A frequently cited concept in academic and industry literature is the “dual operating system,” which posits that banks must simultaneously run stable operations (“run the bank”) and pursue transformative initiatives (“change the bank”). Conceptually, this ambidextrous model supports continuous reliability in core banking services while allowing separate structures or teams to explore bold innovations (Accenture 2023). Interlinking these dual spheres ensures that novel ideas can be integrated without compromising systemic stability.

No transformation effort succeeds without structured oversight. Steering committees, cross-functional councils, and designated project sponsors help maintain clarity on roles, responsibilities, and decision-making protocols (KPMG 2022). Conceptually, such frameworks balance the flexibility needed for innovation with the accountability essential for risk mitigation. They also streamline conflict resolution, ensuring alignment with overarching strategic imperatives.

From a practical standpoint, tracking metrics like Net Promoter Score (NPS), Customer Satisfaction (CSAT), or first-contact resolution rates gauges whether transformation efforts genuinely enhance the customer experience (Johnson & Chang 2021). Frequent surveys, mobile app ratings, or real-time feedback loops can validate if new digital platforms, self-service features, or improved workflows are resonating with end-users.

Financial indicators like ROI or cost savings validate the tangible impacts of transformation projects. Banks can segment results by initiative—for instance, analyzing the ROI of automating back-office tasks versus migrating to the cloud (PwC 2024). This segmentation clarifies which programs deliver the highest returns and which may require recalibration.

Measuring how quickly new products or features move from concept to launch reveals the organization’s agility. Shorter release cycles and higher innovation throughput suggest that processes are streamlined and that teams can adapt swiftly to market shifts (Accenture 2023). Regular pilot projects, hackathons, or co-creation initiatives with fintech partners can further accelerate this velocity.

Amid transformative changes, banks must still uphold robust service levels. Metrics like mean time to recover (MTTR), incident counts, or percentage uptime ensure that new solutions do not compromise stability (KPMG 2022). Embedding resilience metrics alongside innovation-oriented goals underscores the dual operating system principle, balancing the needs of ongoing operations with experimental progress.

Transformation hinges on an engaged, capable workforce ready to adopt new tools and processes. Employee engagement surveys, training program participation rates, and cross-functional project involvement indicate whether the cultural shift toward continuous improvement is taking hold (Johnson & Chang 2021). If staff members are not equipped—or motivated—to leverage new solutions, even the most advanced technologies will yield suboptimal results.

Finally, usage metrics for newly launched products and internal workflows illuminate real-world adoption. If a cutting-edge mobile app sees minimal user uptake, banks can investigate underlying issues—usability hurdles, insufficient marketing, or compliance concerns—and iterate accordingly (Deloitte 2023). Qualitative inputs, like customer interviews or staff feedback sessions, can provide further insights into how well transformation is meeting actual needs.

5.2. Building a Vision-Aligned Transformation Roadmap

Developing a transformation roadmap that aligns with the bank’s overarching vision is key to sustaining momentum, gaining organizational buy-in, and ensuring consistent progress. A compelling vision energizes teams beyond incremental process improvements, anchoring their efforts in a broader, value-driven mission. This section outlines philosophical, conceptual, and practical perspectives on how to craft a roadmap that unifies stakeholders, clarifies strategic priorities, and fosters disciplined execution (Deloitte 2025).

A well-defined vision can elevate transformational efforts from routine corporate initiatives to collective calls to action. By illustrating how day-to-day tasks—such as streamlining a back-office process or enhancing mobile app features—align with the bank’s higher goal (e.g., “delivering the most customer-centric digital experience”), employees at all levels feel more engaged and driven (PwC 2024). Philosophically, this sense of shared purpose transcends departmental boundaries, generating a cohesive spirit that accelerates innovation.

Even the most compelling vision falters without consistent support from the top. When senior executives and mid-level managers champion the same transformation narrative—allocating resources, eliminating silos, and encouraging cross-functional collaboration—it signals genuine institutional commitment (Accenture 2023). Philosophically, this alignment underscores that transformation is more than lip service; it requires sustained investment, patience, and visible advocacy from leadership.

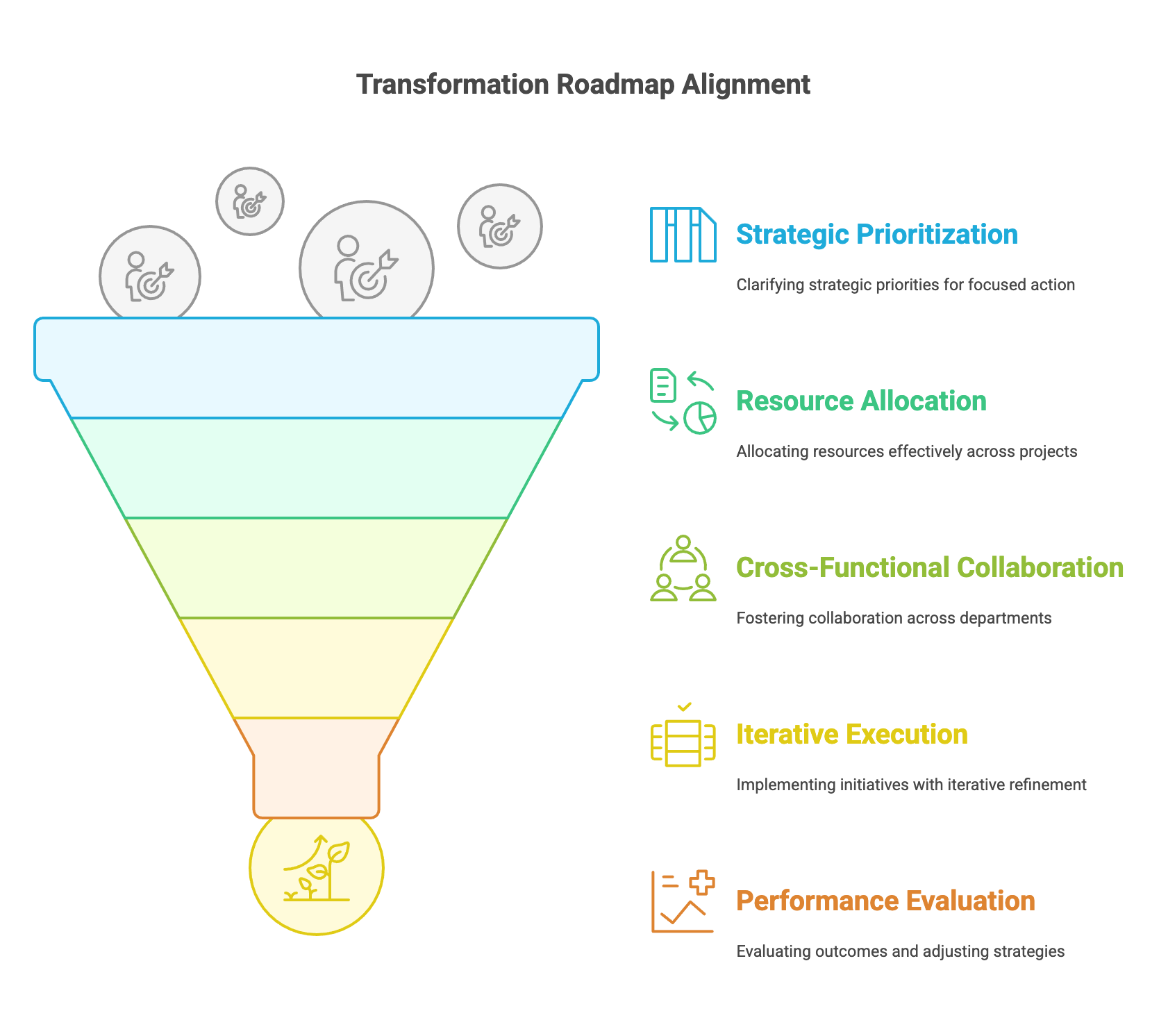

Figure 2: Transformation required prioritization, collaboration, iteration and evaluation.

Transformational initiatives often intersect with multiple departments, from IT to compliance and marketing. A unifying vision weaves these diverse functions together under a single framework for decision-making (KPMG 2025). Philosophically, it shifts mindsets away from siloed agendas, reducing turf wars and fostering integrated solutions. In doing so, the vision serves as a cultural binding agent, enabling the entire enterprise to speak with one voice when making strategic choices.

Vision statements that endure focus on long-range objectives, acknowledging that transformative change is iterative rather than momentary. By laying out a multi-year horizon, leaders reassure teams that setbacks or course corrections are natural elements of progress (Johnson & Barker 2021). Philosophically, a stable, overarching mission provides employees with clarity and assurance, even as new technologies emerge or market dynamics shift.

Conceptually, a roadmap that tightly intertwines technical and business objectives prevents misalignment and resource wastage. Whether the corporate priority is expanding into new markets or boosting client engagement, the bank’s IT projects—such as cloud migration or AI-driven personalization—should clearly drive these top-level targets (PwC 2024). This linkage ensures each initiative contributes tangible value, enhancing both operational efficiency and strategic competitiveness.

Banks can employ strategic planning tools such as the Balanced Scorecard or Strategy Maps to depict how technology investments feed into key performance areas like revenue growth, risk management, or brand differentiation (Accenture 2023). By visualizing these relationships, stakeholders gain a holistic perspective, seeing how disparate projects cumulatively bolster the bank’s mission and metrics.

In large financial institutions, multiple transformation projects often vie for limited budgets and executive bandwidth. Conceptually, a portfolio-based approach—supported by steering committees and cross-functional councils—enables robust evaluation of project proposals and fair allocation of resources (KPMG 2025). This systematic prioritization helps the bank address immediate market needs while strategically positioning for future growth.

Effective transformation usually marries front-end innovations (enhanced digital channels, personalized services) with back-end improvements (automated workflows, advanced analytics). Conceptually, viewing these dimensions in tandem reveals how operational gains can amplify customer satisfaction—while customer insights can guide more precise, cost-efficient back-office optimizations (Deloitte 2025). This symmetry underscores the essential synergy between innovative front-end experiences and robust operational foundations.

Practical roadmap design benefits from scenario planning, wherein banks model various future states: optimistic (rapid economic recovery), pessimistic (recession or major regulatory shift), and moderate (steady growth) (Johnson & Barker 2021). Each scenario provides direction on how resource commitments, technology rollouts, and project timelines might adjust based on market realities. This proactive strategy buffers against shocks and positions the institution to seize emergent opportunities.

A methodical gap analysis highlights the divide between the current operational reality (outdated systems, fragmented data silos) and the envisioned end state (modern, integrated platforms, agile processes). Practically, this process clarifies priorities, revealing which skill sets need upgrading or which infrastructure components demand immediate attention (PwC 2024). Identifying these gaps early shapes an actionable roadmap with well-defined project phases.

OKRs translate abstract transformation goals into quantifiable outcomes. For instance, an overarching objective to “improve mobile banking adoption” might break down into key results like “grow monthly active users by 40% within 12 months” and “reduce digital onboarding dropout by 25%.” Practically, this structure promotes accountability, allowing teams to track short-term achievements that feed long-term strategic aims (Accenture 2023).

In practice, roadmaps typically segment activities into near-term (6–12 months), mid-term (1–2 years), and long-term (3+ years) horizons. Each phase outlines milestones—such as pilot rollouts, system integrations, or product launches—and associated budgets (Deloitte 2025). This tiered design enables bank leaders to monitor incremental progress while maintaining the flexibility to pivot as market or regulatory conditions evolve.

Quarterly or biannual checkpoints permit dynamic adjustments to the roadmap. By establishing a governance board—often referred to as a “transformation office”—banks can continuously assess project performance, financial health, and alignment with strategic objectives (KPMG 2025). Feedback loops from these reviews help refine budgets, timelines, and technical priorities, ensuring that transformation remains on track and resilient to unforeseen disruptions.

Finally, successful transformation roadmaps strike a delicate balance between visionary goals and resource constraints. Overextending the bank’s capacity—whether financial, technical, or human capital—can lead to stalled projects and eroded stakeholder confidence (Johnson & Barker 2021). Conversely, setting modest targets may fail to capitalize on pivotal market trends. By coupling ambitious aspirations with pragmatic resource planning, banks maintain momentum without sacrificing quality or operational stability.

5.3. Prioritizing Projects and Resource Allocation

As banks navigate competing demands for capital, time, and talent, prioritizing the right initiatives becomes not just a strategic exercise but also a moral responsibility. Effective resource allocation ensures that the organization’s finite assets—financial or otherwise—are deployed in ways that advance core mission objectives and deliver genuine stakeholder value. This section examines prioritization through philosophical, conceptual, and practical lenses, offering frameworks and governance models that foster balanced, data-driven decisions (Deloitte 2025).

Philosophically, banks have an obligation to act as ethical stewards of capital entrusted by customers, shareholders, and depositors. Directing resources toward poorly conceived or non-strategic projects erodes trust, both internally—by damaging morale—and externally—through diminished market and investor confidence (KPMG 2025). By framing prioritization as a moral duty, leadership underscores the gravity of every funding choice.

Figure 3: Technology project prioritization matrix. Focus on high value and low risk.

A bank’s stated mission might center on financial inclusion, digital excellence, or customer-centric innovation. Projects that align with this mission enhance institutional integrity and avoid “shiny object syndrome” (PwC 2024). Philosophically, this alignment reaffirms the bank’s commitment to constructive progress, ensuring investments contribute meaningfully to strategic milestones rather than short-lived industry fads.

When senior leaders and project sponsors clearly communicate the rationale behind “greenlights” and “no-gos,” teams gain a deeper understanding of how initiatives advance corporate priorities (Accenture 2023). This openness reduces suspicion of favoritism or political maneuvering. By embedding transparency into the prioritization process, banks cultivate a culture of fairness and due diligence, reinforcing internal cohesion.

Prioritization framed as a moral imperative also galvanizes a “value-first” culture, prompting employees to consistently question whether their activities align with top-level goals (Garcia & Smith 2022). Teams become more vigilant about proposing initiatives that promise tangible impact, and “pet projects” with minimal ROI or strategic fit find less traction, freeing up resources for high-value endeavors.

Conceptually, MoSCoW provides a structured lens for sorting project requirements by criticality. In an agile setting, “Must-have” features are indispensable for maintaining essential functions or compliance, while “Should-have” and “Could-have” items offer incremental benefits (PwC 2024). This hierarchical approach ensures resources are first channeled toward foundational improvements before addressing supplementary goals, preventing scope creep and budget overruns.

Projects can be mapped on axes of value (customer impact, revenue potential, operational efficiency) and risk (regulatory complexity, technical feasibility). Conceptually, this matrix model highlights promising “low-hanging fruit” (high value, low risk), cautious “strategic bets” (high value, high risk), and likely “deprioritize or shelve” candidates (low value, high risk) (KPMG 2025). Such visual frameworks aid decision-makers in pursuing a balanced portfolio of initiatives.

Banks often juggle short-term ROI targets with longer-term transformative aspirations (Accenture 2023). While quick wins—like automating specific tasks—generate immediate savings or revenue boosts, foundational projects (cloud migration, advanced analytics infrastructure) may yield far-reaching benefits over time. Conceptually, prioritization frameworks help managers strike a dynamic balance, ensuring the organization thrives both now and in the future.

Priorities inevitably shift in response to evolving market conditions, regulatory mandates, or technology breakthroughs (Deloitte 2025). Conceptually, banks should treat prioritization as an ongoing dialogue rather than a fixed checklist. Regularly revisiting project proposals through established frameworks keeps the transformation agenda nimble, thus preventing resource misallocation when circumstances change.

Steering committees composed of C-suite leaders and key stakeholders (CIO, CFO, heads of major business units) play a pivotal role in high-level oversight (PwC 2024). Practically, they review project proposals, deliberate budget allocations, and resolve conflicts between competing initiatives. Their strategic vantage ensures that prioritization reflects corporate objectives rather than departmental biases or short-lived operational pressures.

A centralized PMO aggregates data on project budgets, timelines, and performance across the entire transformation pipeline (Accenture 2023). Practically, this office provides real-time visibility into resource usage, flagging bottlenecks or potential redundancies. Executives can thus make more informed decisions regarding funding reallocation or project cancellation, optimizing the overall innovation portfolio.

Governance bodies rely on quantifiable metrics—ROI projections, cost-benefit analyses, implementation risks—to compare project proposals objectively (KPMG 2025). Practically, scoring systems or weighted evaluations foster transparency, making it harder for purely political or anecdotal justifications to sway resource distribution. This data-centric approach also allows for more consistent post-project evaluations.

If a pilot project demonstrates exceptional results earlier than anticipated, steering committees and PMOs can rapidly channel additional funds or talent to accelerate scale-up (Deloitte 2025). Conversely, initiatives that underperform or encounter insurmountable roadblocks can be curtailed, preserving capital for more promising endeavors. This adaptability ensures ongoing alignment with the bank’s most urgent and profitable opportunities.

Resource shifts often affect staff roles, technology stacks, and process workflows. Steering committees and PMOs, in conjunction with HR and communications teams, manage the human side of project reprioritization (Garcia & Smith 2022). Practically, structured communication plans, training updates, and stakeholder feedback sessions help minimize confusion or resistance, maintaining organizational morale amid shifting priorities.

Governance structures typically operate on a monthly or quarterly review cadence, enabling iterative fine-tuning. With every cycle, projects are reassessed against real-world performance metrics and market intelligence (PwC 2024). This ongoing feedback loop preserves agility, allowing banks to swiftly pivot resources or scale up initiatives that demonstrate strong returns or strategic breakthroughs.

5.4. Integrating Operational Stability with Innovation Goals

In the rapidly evolving world of banking, reconciling the mandate for dependable daily operations with the pressing need for innovation is essential. Far from being conflicting objectives, operational resilience and strategic transformation form two sides of the same coin—together, they drive both customer trust and sustainable growth (Deloitte 2025). This section explores the philosophical underpinnings, conceptual frameworks, and practical tactics that help banks achieve a balanced approach, ensuring continuity in core services while fostering a fertile ground for disruptive ideas.

Philosophically, stability and innovation reinforce each other rather than compete. High uptime, robust security, and smooth operations generate customer loyalty, thereby providing the financial and reputational capital to invest in new technologies (PwC 2024). In this sense, a well-maintained operational backbone empowers rather than restricts banks’ explorations into areas like AI-based analytics, cloud architectures, or cutting-edge fintech collaborations.

Banks often frame reliability and innovation as opposing forces—one focusing on risk mitigation, the other on risk-taking. However, a shift to “both/and” thinking dismantles this false dichotomy (Accenture 2023). Philosophically, it fosters a culture where teams devoted to operational tasks work hand-in-hand with exploratory squads, minimizing silos and channeling divergent perspectives into cohesive strategies.

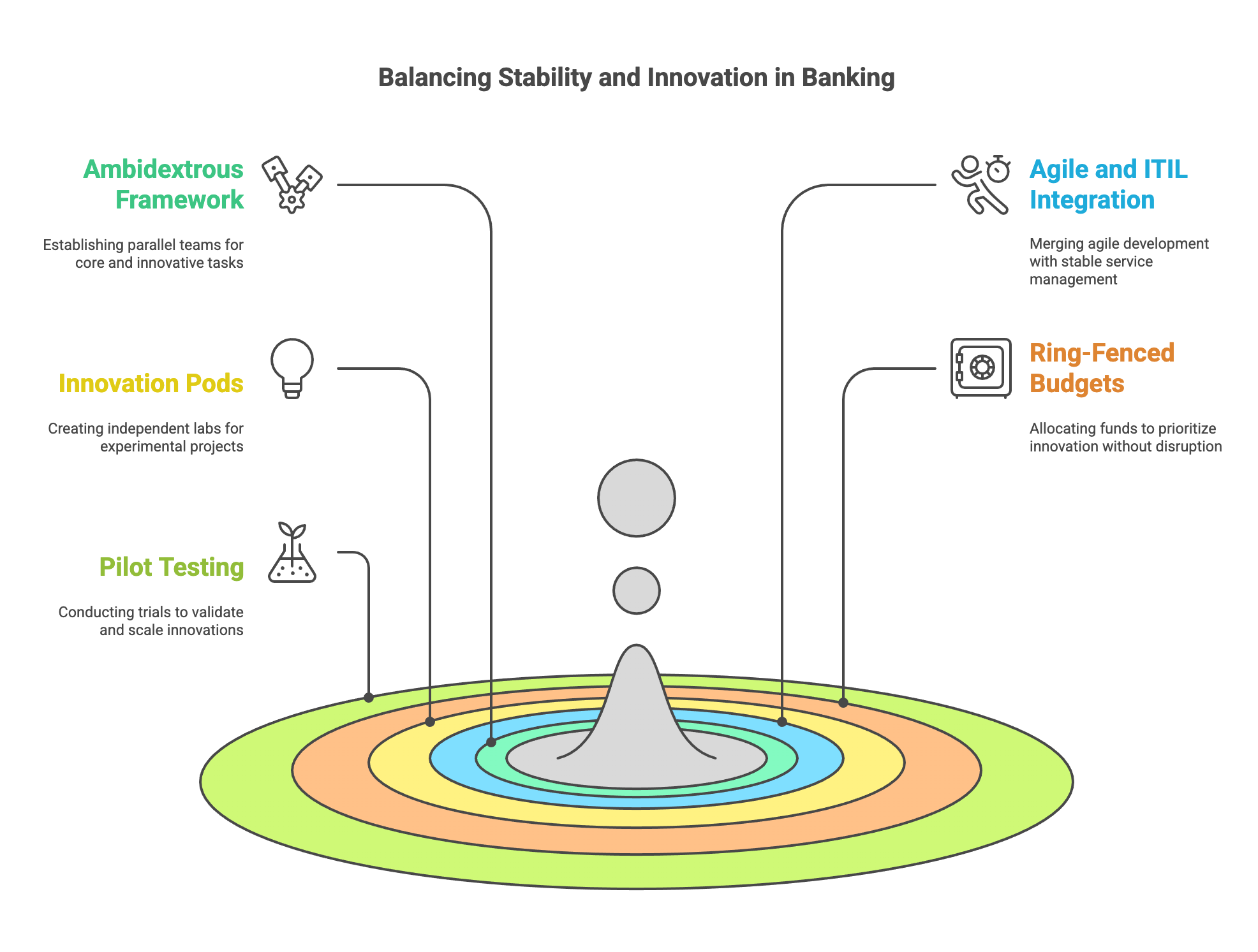

Figure 4: Ambidextrous framework is required to balance stability and innovation.

Without steady operations, even the most promising innovations may implode under regulatory or market pressures. Conversely, overemphasizing conservatism can render an institution obsolete in fast-moving sectors (KPMG 2025). By blending reliability with progressive change, banks preserve their legacy strengths while evolving in tandem with shifting customer expectations and emerging technologies.

Maintaining the stability of a financial institution is also an ethical obligation—customers, employees, and regulators depend on consistent service. Yet, these stakeholders also benefit when banks adopt new solutions that enhance access, efficiency, or personalization (Johnson & Evans 2022). This moral imperative means adopting innovations responsibly, ensuring they bolster resilience rather than compromise it.

Ambidexterity in organizational theory refers to pursuing operational excellence (“exploitation”) and breakthrough innovation (“exploration”) simultaneously (PwC 2024). Conceptually, this model enables banks to fortify their core services while scouting and incubating emerging opportunities. Such dualism ensures near-term financial performance aligns with long-term competitive advantage.

Under an ambidextrous framework, banks might dedicate certain teams to mission-critical operations—managing core systems, meeting compliance mandates—while establishing parallel innovation cells or labs for exploratory projects (Accenture 2023). Coordination mechanisms, like regular cross-functional briefings or shared governance boards, help harmonize these distinct efforts and maintain organizational coherence.

To capitalize on innovation, successful pilot initiatives should have a clear path toward mainstream adoption. As prototypes mature, they shift from exploratory labs into the core business, scaling up under established operational guidelines (Johnson & Evans 2022). This structured handoff process ensures that new offerings meet reliability standards and don’t disrupt existing infrastructure or risk profiles.

Ambidexterity hinges on leadership that articulates a dual mission—championing efficiency and experimentation. Executives can reduce tensions between core and innovation teams by recognizing the value each brings (KPMG 2025). Additionally, rotational programs encourage employees to collaborate across functions, cultivating respect and common purpose around strategic goals.

Practically, banks can merge agile frameworks—well-suited for rapid ideation and iteration—with ITIL-based practices designed to ensure stable service management (PwC 2024). Agile sprints might govern the design and testing of a new mobile onboarding feature, while ITIL protocols handle incident management and change control. This synthesis aligns disruptive R&D with robust daily operations, balancing speed with reliability.

Innovation pods, or “skunkworks” labs, bring together cross-functional experts—developers, data scientists, compliance officers—to test concepts like AI-driven fraud detection or blockchain-based remittances (Accenture 2023). Operating somewhat independently shields these teams from bureaucratic slowdowns. However, defined reporting lines ensure alignment with overarching strategies, fostering a safe environment for experimentation that still remains accountable.

Ring-fenced budgets help ensure that experimental projects are not deprioritized under the weight of operational firefighting (Deloitte 2025). Funding streams tied to specific milestones—like proof-of-concept completion or pilot success metrics—keep spending in check, allowing leadership to double down on high-potential ideas or halt those that underperform.

Trialing innovations on a limited scale—be it a single region, product line, or internal function—provides a lower-risk way to validate hypotheses (Johnson & Evans 2022). If a pilot demonstrates robust ROI, user adoption, and compliance viability, scaling to the broader enterprise becomes more straightforward. Conversely, early-stage failures can be contained, yielding valuable lessons without compromising the institution’s critical operations.

A joint steering committee or transformation council can oversee both operational performance and innovation initiatives (KPMG 2025). Practically, monthly or quarterly governance sessions track budget usage, compliance issues, and project outcomes, offering executives real-time data to reallocate resources or adjust timelines. Regular communication between core operations and innovation teams also reduces friction and knowledge silos.

Lastly, implementing real-time analytics and performance dashboards enables banks to gauge uptime, customer satisfaction, risk indicators, and innovation throughput concurrently (Accenture 2023). Agile retrospectives or quarterly business reviews feed this data back into project roadmaps, guiding incremental improvements. This cyclical process upholds stable service levels while fine-tuning the innovation pipeline to meet dynamic market conditions.

5.5. Change Management and Cultural Enablement

Transforming a bank’s IT landscape involves more than implementing novel technologies or refining processes; it requires a fundamental recalibration of mindsets and behaviors. Without broad-based cultural shifts, even the most sophisticated solutions are likely to falter. This section addresses how philosophical, conceptual, and practical approaches to change management can nurture an environment where technology-driven innovation flourishes across all organizational levels (Deloitte 2025).

Philosophically, transformation in banking IT is not confined to a single department or leadership tier; rather, it must resonate with everyone from frontline staff to executive leadership (PwC 2024). When the shared objective is clear—be it to modernize digital services or foster agile collaboration—each role gains a distinct purpose within the collective vision. Consequently, individuals see their day-to-day responsibilities aligning with broader strategic ambitions, fueling widespread support.

Organizations deeply rooted in traditional methods—siloed structures, top-down directives—often encounter inertia when asked to adopt new practices like cross-functional teamwork or iterative prototyping (KPMG 2025). Philosophically, sustainable transformation hinges on replacing entrenched risk-aversion and fragmented thinking with openness, experimentation, and a commitment to continuous learning (Kotter 2021). If these shifts do not permeate mindsets, technical rollouts may provide only surface-level improvements.

Cultural change cannot be effective if employees feel excluded or their insights dismissed. Listening to feedback from diverse teams, whether through town halls or focus groups, engenders a sense of co-ownership over the transformation journey (Accenture 2023). This philosophical commitment to inclusivity not only counters resistance but also catalyzes fresh ideas from those closest to day-to-day operational realities.

Executives and managers function as role models, embodying the values and behaviors they wish to instill (Deloitte 2025). Philosophically, consistent messaging and accountability from the top send clear signals about the organization’s dedication to transformation. Celebrating adaptive mindsets, encouraging risk-taking within reasonable bounds, and promoting transparency create ripple effects that embed the new culture at every level.

Conceptually, banks can harness established change management models like Kotter’s 8-Step Process and ADKAR to structure and guide transformation efforts in a methodical way. Kotter’s approach begins with creating a sense of urgency, compelling stakeholders to recognize the immediate necessity for change, followed by forming a powerful coalition of influential leaders who can drive momentum. Next, the institution must develop a clear vision and strategy that resonates organization-wide, communicating it through multiple channels for maximum impact. Removing obstacles—whether cultural, operational, or procedural—then paves the way for short-term wins, which help bolster morale and affirm the transformation’s direction. Building on these early successes by scaling or replicating them across departments amplifies their effect, while finally, anchoring changes in culture ensures that new processes and mindsets become institutionalized, preventing regression to outdated methods.

Figure 5: Kotter’s 8-step framework for change management.

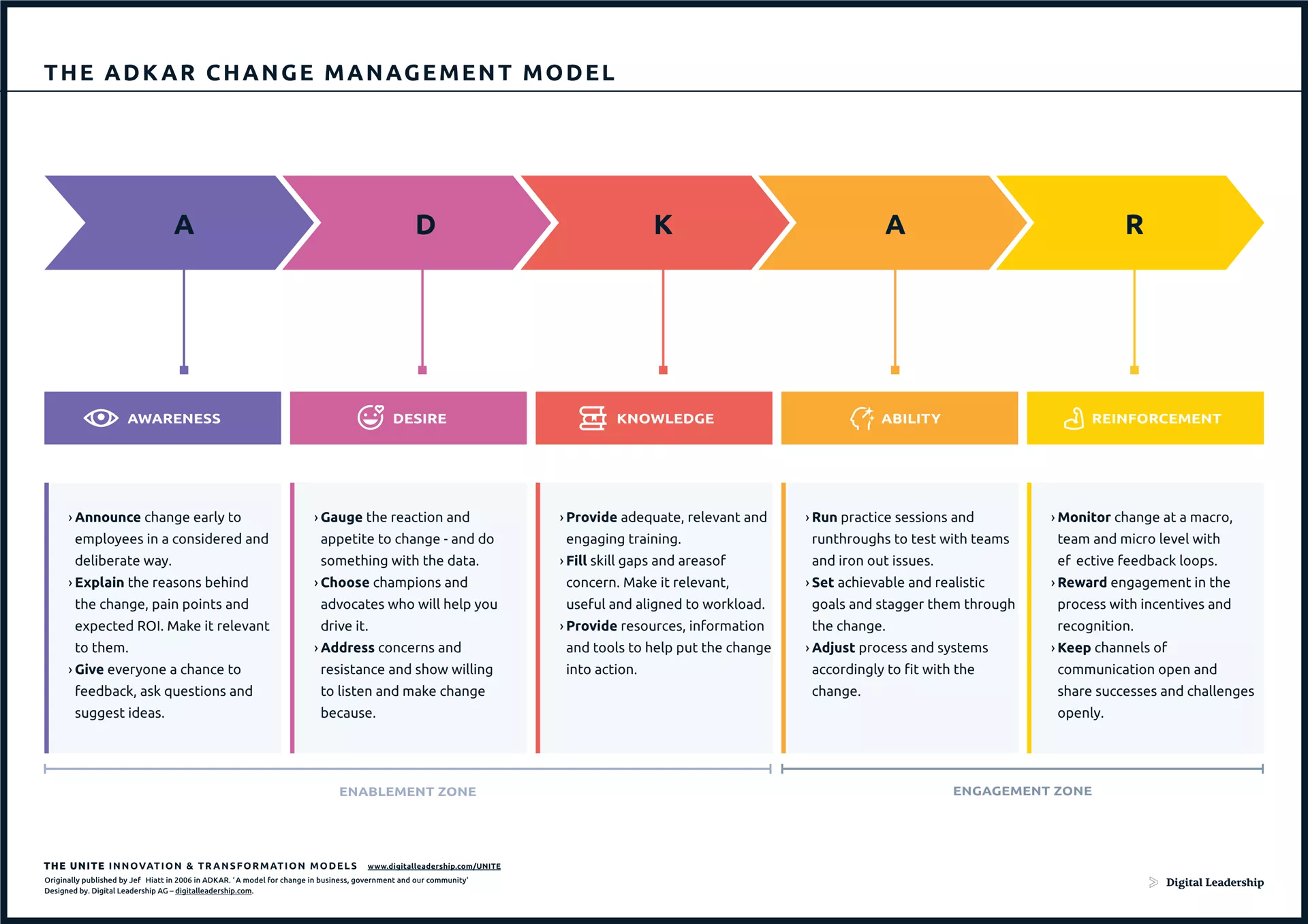

ADKAR, an acronym for Awareness, Desire, Knowledge, Ability, and Reinforcement, provides a structured lens for understanding how individuals transition through change, offering clear milestones that guide the collective transformation journey. Banks employing ADKAR first work to build Awareness of why the change is necessary—emphasizing potential benefits and risks—then cultivate personal Desire among staff by aligning motivations with the bank’s strategic and cultural goals. Knowledge, including training and resources, clarifies how to carry out the new behaviors or processes, while Ability speaks to hands-on proficiency, often reinforced through mentoring, trials, and user-friendly tools. Lastly, Reinforcement mechanisms, such as performance metrics (Hiatt 2022), recognition programs, and continuous feedback loops, help embed these changes into daily routines, preventing regression and consolidating the transformation’s impact.

Figure 6:

Combining Kotter’s sequential guidance with ADKAR’s focus on individual readiness offers a well-rounded approach to large-scale transformation (Accenture 2023). This conceptual blending helps banks outline milestones, track progress, and address both team-level and organizational dynamics. By embracing these frameworks, leaders systematically minimize common pitfalls—such as unclear objectives or overlooked stakeholder groups.

Tailored training initiatives can bridge knowledge gaps, whether that involves upskilling frontline employees on digital tools or teaching middle managers agile project management techniques (KPMG 2025). Online learning modules, in-person seminars, and simulation-based workshops help create a uniform knowledge base across diverse roles. By building competency, banks ensure staff can confidently execute new processes and maximize the value of technological investments.

Frequent updates—via newsletters, internal social platforms, or all-hands meetings—keep teams informed of ongoing wins, challenges, and next steps (PwC 2024). This multi-channel approach demystifies transformation by presenting tangible indicators of success, such as pilot project metrics or customer satisfaction trends. Equally important, open forums that solicit employee questions and ideas encourage two-way dialogue, enhancing collective trust.

Changing employee behavior often requires positive reinforcement. Performance reviews and bonus structures that emphasize collaboration, innovation, and risk-managed experimentation incentivize the behaviors essential for long-term transformation (Accenture 2023). Spotlighting successful pilots or praising teams who pivot effectively after encountering obstacles can embed new cultural norms more rapidly.

Identifying “change champions” across branches, departments, or regions personalizes the transformation journey, giving coworkers a tangible resource for questions or support (Kotter 2021). These champions relay ground-level insights to leadership, ensuring decision-making remains attuned to operational realities. By leveraging their informal networks, champions can also accelerate buy-in among more skeptical colleagues.

Implementing cultural change in stages—beginning with a smaller pilot group or one department—allows leaders to refine communication tactics, training content, and reward systems before full-scale deployment (Hiatt 2022). Early successes in these targeted areas foster proof-of-concept momentum, easing resistance when the transformation eventually expands throughout the bank.

Leaders should track metrics such as employee engagement scores, adoption rates of new tools, and departmental cross-collaboration frequency (Deloitte 2025). Regular reviews of these indicators enable proactive interventions—like revisiting training curricula or adjusting incentive mechanisms—thereby safeguarding progress. Over time, cumulative improvements in morale, efficiency, and innovation rates confirm that cultural shifts have taken root.

5.6. Measuring and Communicating Progress

Banking transformations, particularly those involving IT modernization and innovation, rely on clear metrics and open communication to maintain stakeholder confidence, drive engagement, and ensure strategic alignment (Deloitte 2025). By valuing transparency in reporting and carefully choosing key performance indicators (KPIs) that span operational stability and forward-looking initiatives, banks can sustain momentum and demonstrate accountability. The following sections delve into the philosophical, conceptual, and practical dimensions of measuring and communicating progress.

Philosophically, sharing progress—whether celebrating milestones or acknowledging setbacks—fosters a culture rooted in honesty and inclusivity. Leadership that openly reports performance metrics signals respect for employees’ dedication and intelligence (Accenture 2023). This openness inspires trust and reduces speculation or fear, encouraging team members to voice concerns, propose improvements, or experiment with new solutions.

Figure 7: Sopeces of strategic IT transformation metrics.

Publicly showcasing transformation outcomes—be it a successful pilot launch, a notable boost in customer satisfaction scores, or cost-saving milestones—boosts morale and energizes staff (KPMG 2025). These visible “wins” transform abstract goals into tangible achievements, reinforcing the belief that collective efforts are yielding real progress. Philosophically, celebrating small but consistent steps supports a culture that thrives even under the long timelines of major change initiatives.

Transparent metrics clarify how each department or individual contributes to overarching goals, reducing finger-pointing when targets are missed (PwC 2024). When each participant understands and accepts their role, it fosters a sense of collective ownership. Philosophically, an environment shaped by mutual accountability promotes a unified pursuit of strategic objectives rather than isolated departmental ambitions.

In financial services, trust is paramount—customers, regulators, investors, and internal teams must feel secure in the bank’s direction (Smith & Chan 2022). Regular, candid updates build confidence in the institution’s integrity and ethical standards, securing buy-in across diverse stakeholder groups. This trust, once established, forms a stable foundation for navigating challenges in a dynamic market.

Conceptually, transformation metrics must address two axes: operational reliability (system uptime, customer response times, cost savings) and innovation output (pilot success rates, AI-enabled offerings, time-to-market). This bifocal approach ensures that the day-to-day user experience remains uncompromised, even as the institution pursues game-changing initiatives (Accenture 2023).

When categorizing transformation metrics by objective, it helps to separate them into two main buckets—operational metrics and strategic/innovative metrics—so that banks can simultaneously track day-to-day reliability and long-term growth potential. Operational metrics generally focus on the foundational aspects of service delivery. For instance, uptime and incident management measurements shine a light on reliability and responsiveness, indicating how consistently customers can access core banking functions and how rapidly the institution addresses system disruptions. Meanwhile, cost optimization metrics assess the return on investment (ROI) from infrastructure enhancements or automation efforts, linking expense reductions to potential reinvestments in new initiatives. By quantifying these elements, banks ensure that the pillars supporting their services (e.g., system performance, efficiency, and operational resilience) remain strong as they explore more innovative ventures.

On the strategic side, metrics emphasize creativity, market positioning, and forward-looking development. Innovation throughput tracks tangible outputs such as the number of new product launches, proof-of-concept (PoC) completions, or even patent filings, providing a direct gauge of how successfully the bank translates ideas into practical offerings. Additionally, market differentiation metrics—like brand perception assessments, Net Promoter Scores (NPS), or the presence of unique features—offer insight into how effectively the institution stands out in a competitive landscape (KPMG 2025). By monitoring these strategic indicators alongside operational KPIs, banks can cultivate a balanced view of their transformation progress: they safeguard core services while simultaneously nurturing innovation that drives long-term value.

Each KPI should align with overarching bank strategies—like deepening digital engagement or scaling a new lending platform. By making these links explicit, employees and managers see how their efforts push the institution closer to its vision (PwC 2024). This clarity prevents siloed KPIs that fail to reflect broader objectives, ensuring cohesive execution across the enterprise.

To gain a holistic view, banks should balance metrics that show past performance (e.g., quarterly profit margins) with those predicting future success (e.g., pilot adoption rates). Leading indicators enable earlier course corrections, while lagging indicators validate the long-term sustainability of chosen strategies (Smith & Chan 2022). This complementary mix helps leadership respond proactively to emerging trends or challenges.

As business priorities evolve—perhaps due to new regulations or emergent technologies—some KPIs may need redefinition. Conceptually, maintaining flexible metric frameworks prevents stagnation, allowing for rapid calibration if certain indicators lose relevance or new strategic aims arise (Deloitte 2025).

In practice, banks can use platforms like Power BI, Tableau, or custom-built portals to collate and visualize KPI data. Executives and project teams gain real-time insights, from operational health metrics (system alerts, number of incidents) to innovation metrics (PoC velocity, user feedback scores) (Accenture 2023). Consistent monitoring reduces the risk of surprises and enables swift interventions when issues surface.

Monthly or quarterly review sessions—featuring IT leaders, product managers, and C-suite sponsors—provide structured opportunities to evaluate KPI progress (KPMG 2025). These gatherings can confirm that resource allocations remain aligned with strategic goals, adjust timelines if unexpected delays occur, or pivot investments toward more promising avenues. Regular touchpoints embed accountability and responsiveness into the organization’s DNA.

If user adoption of a newly launched digital platform lags behind targets, the review cycle offers a transparent setting to explore root causes (PwC 2024). Teams may propose reconfiguring user interfaces, stepping up marketing efforts, or partnering with third-party fintech providers. Swift, data-driven decisions at these pivot points protect long-term ROI and maintain stakeholder confidence.

Publicly acknowledging successes—like a successful cloud migration or exceeding cost-reduction forecasts—boosts morale (Smith & Chan 2022). Recognition can take many forms: spotlighting teams in an internal newsletter, awarding incentives, or inviting them to demo their achievements at an all-hands meeting. Such celebrations reinforce the cultural values of innovation, collaboration, and excellence.

Beyond internal audiences, certain dashboard highlights or transformation achievements may also be relevant to customers, regulators, or shareholders (Deloitte 2025). Sharing curated updates in annual reports, investor calls, or press releases fosters transparency and demonstrates proactive governance, ultimately reinforcing trust in the bank’s leadership and long-term strategy.

If the bank pivots toward open banking solutions or environmental, social, and governance (ESG) initiatives, the KPI set should expand or reorient accordingly. Having flexible dashboards and agile governance structures enables a seamless transition to fresh metrics—like partner ecosystem growth or carbon footprint reductions—ensuring the transformation remains relevant and impactful (Accenture 2023).

5.7. Real-World Implementations and Lessons Learned

Transforming banking IT can be a high-stakes endeavor, with each initiative potentially reshaping core operations, customer experiences, and regulatory relationships. While some transformation programs achieve their goals efficiently, others stumble due to misaligned objectives, resource constraints, or cultural pushback (KPMG 2025). In either case, the lessons gleaned serve as critical input for future projects, reinforcing the idea that strategic change is an ongoing, iterative process. The following sections outline how philosophical, conceptual, and practical perspectives converge to guide real-world transformation efforts in banking.

Philosophically, every transformation—successful or not—offers insights that shape subsequent strategies. By honestly acknowledging both accomplishments and pitfalls, organizations foster a culture where experimentation, recalibration, and incremental improvement become the norm (Accenture 2023). This mindset rejects the notion of failure as an endpoint, reframing missteps as catalysts for deeper learning and refined execution.

When banks candidly share details about what went right—and where difficulties arose—teams across the organization can adopt a learning mindset (Deloitte 2025). Rather than hiding mistakes, an environment of openness dispels fear and encourages creative problem-solving. Philosophically, such transparency acknowledges that transformation is rarely linear or flawless, thereby normalizing iterative improvements.

Because banking operations directly influence customers’ financial well-being, transformation initiatives bear ethical weight (PwC 2024). Every improvement in efficiency or security, for instance, can enhance public trust and stability within the broader financial ecosystem. From this philosophical standpoint, continuous progress is not merely an internal objective—it is part of the bank’s obligation to society.

Leaders who treat setbacks as learning opportunities model a culture that embraces risk in a measured, responsible manner (Johnson & Barker 2022). By refraining from blame and instead focusing on how to adapt, executives instill resilience and curiosity throughout the institution. This “growth mindset” ensures that strategic pivots are seen as logical evolutions rather than signs of failure.

A pivotal component of successful banking IT transformations is committed leadership, in which executives take an active, visible role in guiding the change effort. When top-level managers consistently advocate for the project, allocate sufficient resources, and maintain clear lines of communication, they galvanize teams at all levels to remain focused on shared objectives. Another essential factor is focused scope: by establishing clearly defined, attainable goals, banks can mitigate scope creep—one of the biggest threats to lengthy, complex undertakings. Realistic targets keep teams aligned and motivated, helping the project maintain momentum rather than getting bogged down in endless revisions or ambitious expansions. Additionally, stakeholder alignment underpins broader project relevance and minimizes friction: by engaging regulators, customers, and employees early in the planning process, banks can preempt misunderstandings and ensure that initiatives address genuine market or compliance needs (Deloitte 2025).

However, not all transformation attempts go smoothly, and certain pitfalls often hinder progress. One of the most common issues is misaligned goals, where initiatives conflict with the bank’s overarching corporate strategy. When project objectives deviate from the institution’s broader mission, or when management fails to unify these aspirations, progress stalls due to competing priorities and lukewarm support. Inadequate resources also pose a significant stumbling block, particularly in heavily regulated domains that demand rigorous compliance and risk management practices (KPMG 2025). Underfunding, understaffing, and inadequate expertise can quickly derail even the most well-intentioned plans. Finally, resistance to change within the organization can undermine novel processes or tools if employees are reluctant to adapt. Siloed mindsets and cultural inertia can negate the benefits of otherwise robust designs, underscoring how crucial it is for leaders to proactively manage and engage the human side of transformation.

Various studies, including those published in industry journals and by major consulting firms, indicate that up to 70% of large-scale transformations fail or underdeliver (Accenture 2023). Within the banking sector, research underscores the importance of balancing core reliability and innovative ambitions. Transformation frameworks like Kotter’s 8-step model or ADKAR emphasize iterative approaches, stakeholder engagement, and robust governance as critical success factors.

Banks that embed feedback loops and flexible governance—adapting project scopes or timelines in response to ongoing learnings—demonstrate superior resilience (PwC 2024). Whether scaling back an initiative due to unexpected regulatory requirements or accelerating a pilot after strong early adoption, iterative methodologies allow for agile course corrections without undermining the overarching transformation vision.

By examining real-world scenarios in which banks have applied structured methodologies—from hybrid agile-stage-gate systems to ADKAR-driven change management—leaders gain a clear roadmap for coordinating diverse IT initiatives, mitigating risks, and achieving cohesive, scalable transformation outcomes.

Case Study 1: Large-Scale Core System Overhaul

Scenario: A regional bank replaced a three-decade-old core banking platform in a phased manner.

Framework Utilized: A hybrid agile-stage-gate model allowed incremental rollouts and thorough risk assessments.

Outcome: Operational disruptions remained minimal, and compliance obligations were consistently met.

Key Lesson: Gradual deployment and close coordination with regulatory and compliance teams mitigated systemic risks (KPMG 2025).

Case Study 2: AI Adoption for Personalized Services

Scenario: A global institution deployed AI-driven recommendation engines for personalized product suggestions in mobile apps.

Framework Utilized: Agile squads delivered iterative feature updates, guided by ADKAR for change management.

Outcome: Increased cross-selling rates and elevated customer satisfaction scores.

Key Lesson: Engaging legal and marketing stakeholders early streamlined privacy compliance and brand consistency (Accenture 2023).

Case Study 3: Open Banking Ecosystem Collaboration

Scenario: A midsized bank partnered with fintech startups, creating an API-based digital payments platform.

Framework Utilized: A vendor selection process governed by MoSCoW prioritization and risk-value analysis, with a steering committee overseeing resource allocation.

Outcome: Faster product launches and improved customer feedback, although legacy infrastructure constraints surfaced.

Key Lesson: Upgrading core systems concurrently with ecosystem expansions prevents bottlenecks and preserves user experience (PwC 2024).

Case Study 4: Cybersecurity Overhaul After Data Breach

Scenario: Following a major breach, a bank implemented fortified identity access management and network segmentation measures.

Framework Utilized: ITIL for structured incident response, paired with agile sprints for swift security feature deployment.

Outcome: Restored consumer trust, reduced vulnerability windows, and enhanced long-term threat detection.

Key Lesson: Transparent customer and regulator communication converted crisis management into an opportunity to reinforce security culture (Johnson & Barker 2022).

Reviewing these case studies reveals the value of consistent governance, robust KPIs, and regular communication in unifying IT efforts across the enterprise. Whether through agile processes, ITIL frameworks, or portfolio management offices, banks that operate systematically can replicate successes across multiple initiatives (Deloitte 2025). Documenting lessons learned and incorporating them into institutional knowledge repositories further strengthens the organization’s capacity for ongoing innovation.

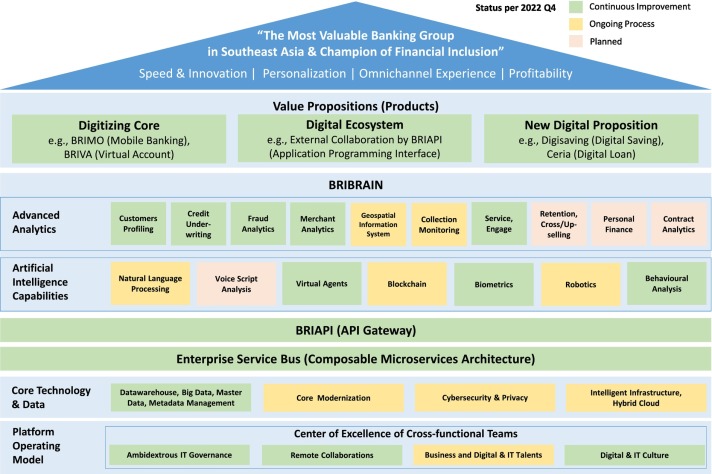

Bank BRI’s ambidexterity framework highlights how successful digital transformation requires a balanced approach to IT governance, encompassing both exploratory (innovation-oriented) and exploitative (efficiency-oriented) mechanisms. Through a detailed case study, researchers identified seven key governance mechanisms—board and executive oversight, strategy and architecture, talent and culture, data and information, development and operation, internal and external collaborations, and risk and audit—that collectively drive digital transformation success. These mechanisms were found to impact digital transformation dimensions (digital strategy, alignment, IT assets, capabilities, and culture of innovation) and, in turn, organizational performance measures (operational excellence, customer experience, industry presence, and financial returns). By illustrating how these ambidextrous governance mechanisms operate in BRI’s context, the study provides practical insights into implementing a balanced governance approach that fosters successful digital transformation and leads to significant performance achievements (Rahmat et al., 2024).

Figure 8: Design of ambidextrous framework from Bank BRI combining API and AI capabilities.

Banks that formalize their experiences—through post-project retrospectives, training modules, or “playbooks”—embed best practices into the organizational fabric (KPMG 2025). Such institutional memory accelerates subsequent projects, as new teams benefit from documented successes and pitfalls, drastically reducing the likelihood of repeated mistakes. This cyclical process fosters a learning-oriented culture where each project iterates on—and surpasses—the achievements of its predecessors.

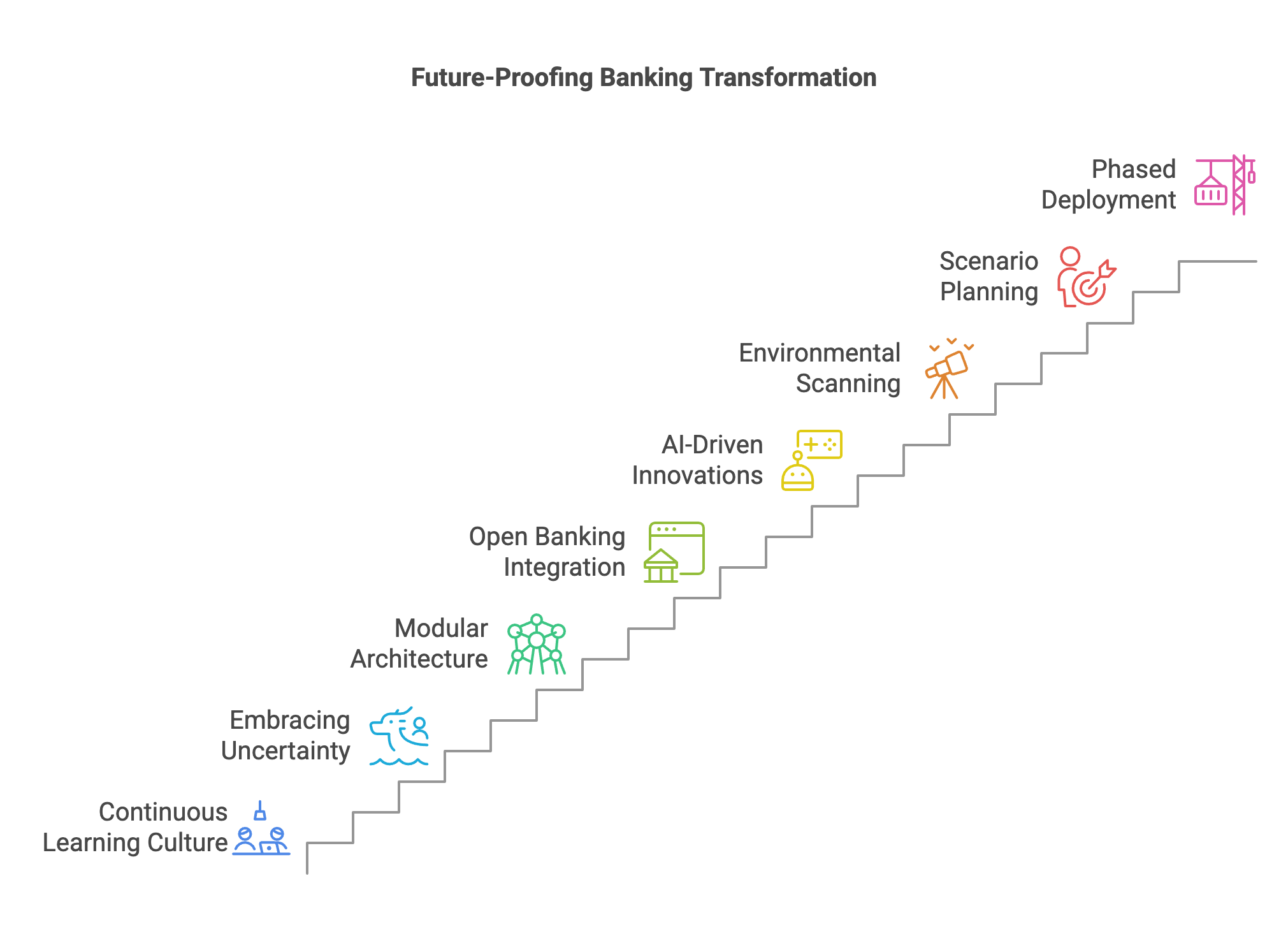

5.8. Future-Proofing the Transformation Framework

No transformation strategy remains static in a rapidly changing banking environment marked by regulatory fluctuations, evolving customer expectations, and disruptive technologies. To remain competitive, banks must view strategic transformation not as a one-time overhaul but as an ongoing, iterative process. This section explores philosophical, conceptual, and practical approaches to continually refine and adapt transformation frameworks, ensuring they remain relevant and resilient over time (Deloitte 2025).

Philosophically, banks must treat transformation as perpetually “in progress,” given the sector’s volatile landscape—ranging from new regulatory mandates to fintech partnerships that can redefine service models (Accenture 2023). Rather than viewing the implementation of new systems or processes as an endpoint, forward-looking institutions continuously scan for emerging risks and opportunities, adjusting strategies in real time to maintain alignment with shifting market conditions.

Figure 9: Future-proofing Banking transformation steps.

A culture that prizes ongoing learning and collaborative innovation sees no single best practice as final. By routinely revisiting assumptions, analyzing failures, and sharing insights, teams remain flexible and ready to evolve (KPMG 2025). Philosophically, this fosters an organization-wide mindset wherein change is greeted as a pathway to advancement, not a disruptive force to be feared.

Leaders who embrace uncertainties—whether stemming from economic volatility or technological breakthroughs—encourage teams to experiment and proactively challenge entrenched norms (PwC 2024). By distributing decision-making authority and recognizing informed risk-taking, executives empower employees at every level to contribute ideas, spot weaknesses early, and drive iterative improvements.

Because banks directly influence clients’ financial well-being, the industry carries heightened ethical obligations to maintain integrity, transparency, and stability (Smith & Zhao 2022). Transformations that continually update processes and systems—in response to new cybersecurity threats or to better serve underbanked communities, for instance—demonstrate moral commitment to safeguarding trust and promoting financial inclusion.

Conceptually, banks can future-proof transformation frameworks by adopting a modular architecture—both technically and organizationally (Deloitte 2025). This approach supports the “ambidexterity” model, whereby stable, core systems co-exist with innovation pods dedicated to explorations in AI, blockchain, or emerging digital services. By segmenting these areas, institutions can seamlessly integrate new functionalities without upending established operations.

The rise of open banking pushes banks to expose services via APIs and collaborate with third-party fintechs (Accenture 2023). Conceptually, frameworks must anticipate evolving regulatory positions on data sharing and consent management, ensuring that new partnerships or product offerings can be adopted quickly while preserving robust compliance mechanisms and privacy safeguards.

Strategic frameworks should integrate ongoing AI enhancements—ranging from fraud detection to hyper-personalized customer journeys (KPMG 2025). Such initiatives require continuous data governance, model retraining, and ethical oversight to prevent bias or security vulnerabilities. By embedding AI solutions into a broader, iterative transformation process, banks ensure AI-driven innovations remain effective and compliant over time.

Regular environmental scanning—through technology radars, Gartner’s Hype Cycle, or dedicated research units—keeps banks alert to potential disruptors like quantum cryptography or decentralized finance protocols (PwC 2024). Conceptually, including these signals in strategic roadmaps prevents obsolescence, guiding resource allocation to areas most likely to shape the next wave of financial services.

Regular roadmap reviews—conducted monthly or quarterly—enable banks to realign projects, budgets, and team structures with emerging conditions. By adopting agile governance boards, executives can greenlight or halt pilot projects as data unfolds, fostering a dynamic approach that keeps the transformation framework both efficient and adaptable (Smith & Zhao 2022).

Practically, scenario planning can simulate best-case, worst-case, and “wild card” outcomes involving economic fluctuations or major regulatory changes (KPMG 2025). Crafting contingency strategies for each scenario ensures that the transformation journey does not stall when facing unforeseen challenges. Instead, decision-makers have pre-approved tactics and resource pools ready for rapid deployment.

Dashboards and regular retrospectives allow leaders to track KPIs—from user adoption and customer satisfaction to operational uptime and cost metrics—on an ongoing basis (Accenture 2023). Quick iterations in response to anomalous indicators—like a surge in help desk tickets post-launch—enable fast course corrections, bolstering stakeholder confidence and operational stability.

Establishing dedicated innovation labs or rotating squads of experts from IT, compliance, marketing, and data science fosters an environment conducive to rapid experimentation. By partnering with external tech firms or participating in hackathons, banks integrate fresh perspectives and accelerate prototype testing (PwC 2024). Successful pilots can then rejoin mainstream operations, reinforcing the dual approach of ambidexterity.

Documenting lessons learned from pilots, proofs of concept, and scaled deployments preserves institutional memory (Deloitte 2025). Hosting periodic “lessons learned” workshops or storing best practices on collaborative platforms ensures future projects start with accumulated experience, reducing repetitive mistakes and expediting development cycles.

When rolling out new capabilities—be it a mobile banking upgrade or an AI-based credit scoring tool—banks can adopt phased deployments. This approach pilots innovations with a limited user base or regional subset, refining functionality and resolving issues before broader releases. Gradual scale-up secures alignment with compliance protocols and smoothens the transition for end-users (Smith & Zhao 2022).

5.9. Conclusion

In conclusion, a carefully structured transformation framework is pivotal for any bank that aims to stay competitive in a rapidly shifting landscape. By articulating a compelling vision, prioritizing projects judiciously, and instituting cultural and governance mechanisms, IT leaders can transcend mere operational tasks to drive business-wide innovation. The real power lies in sustained execution: consistent measurement, open communication, and iterative refinements help ensure the roadmap remains agile and relevant. Now is the moment for IT professionals to adopt a systematic, forward-thinking approach—one that galvanizes teams, aligns with corporate objectives, and sets the stage for breakthroughs in banking technology and service delivery.

5.9.1. Further Learning with GenAI

These comprehensive prompts guide IT professionals through every aspect of strategic transformation in banking, tackling alignment with corporate vision, balancing operational stability with innovation, and measuring real-world impact. Each prompt incorporates multi-dimensional considerations—such as culture, risk, regulation, and stakeholder engagement—to stimulate comprehensive, high-level insights.

Explain how to construct and maintain an IT transformation strategy that remains tightly aligned with overarching corporate goals in a banking environment characterized by diverse departmental agendas, budget constraints, and evolving regulatory pressures. Include methods for reconciling conflicting priorities, establishing quantifiable success metrics, and ensuring cross-functional ownership.

Delve into the practical application of ambidexterity in banking IT, detailing specific organizational structures, processes, or reward systems that encourage reliable day-to-day operations while also nurturing radical innovation. Highlight how these frameworks can be adapted to different bank sizes and risk appetites.

Critically evaluate OKRs, Balanced Scorecards, and other strategic planning tools when building a long-term transformation roadmap for a mid-sized regional bank. Consider aspects such as ease of adoption, scalability, regulatory alignment, and the capacity for iterative refinement in response to market shifts.

Outline a comprehensive methodology for prioritizing and allocating resources to IT projects within a heavily regulated banking context. Include discussion on quantitative (ROI, risk-scoring) and qualitative (compliance impact, stakeholder buy-in) measures, as well as how to manage shifting regulatory deadlines.

Design a multi-tiered communication strategy that effectively addresses the information needs of frontline IT staff, middle managers, and the executive suite during a major transformation initiative. Elaborate on frequency, content depth, and the channels best suited for different stakeholder groups.

Examine best practices for running pilot projects or sandbox experiments to validate emerging technologies—such as AI-based lending or blockchain settlements—while safeguarding mission-critical banking systems. Propose risk mitigation tactics and governance models that expedite innovation without compromising stability.

Analyze successful implementations where banks merged Agile development cycles with ITIL-driven service management. Identify the structural, cultural, and leadership factors that made these integrations work, and propose solutions for overcoming common pitfalls like siloed teams and conflicting KPIs.

Discuss the role of dedicated change management professionals in large-scale banking IT transformations, focusing on strategies to combat resistance at executive, managerial, and frontline levels. Include insights on diagnosing root causes of resistance and tailoring interventions accordingly.

Explore the ethical considerations involved in a major IT overhaul in a bank—ranging from data privacy and algorithmic fairness to workforce displacement and retraining. Propose a structured approach to managing these ethical and human capital challenges while preserving institutional reputation.

Devise a measurement framework that captures innovation throughput (e.g., number of pilots, successful new service launches) alongside traditional operational KPIs (system uptime, incident resolution). Detail how to analyze and communicate these metrics so that both innovation and stability get due attention.

Examine the unique cultural traits within traditional banking institutions that can either accelerate or stifle transformative initiatives. Offer actionable leadership interventions—ranging from new incentive structures to transparent feedback loops—that help cultivate a continuous-improvement mindset.

Develop a phased roadmap for migrating a multinational bank’s legacy on-premises infrastructure to a cloud-based ecosystem. Address region-specific regulatory variances, data sovereignty concerns, cross-border network performance, and strategies for decommissioning outdated systems in parallel.

Discuss how collaboration with fintech startups or technology vendors can be systematically integrated into a bank’s overarching transformation plan. Cover aspects such as shared KPIs, joint pilot environments, regulatory joint approvals, and governance structures for minimizing partnership risks.

Recommend a tiered approach to workforce development that merges technical skill-building (e.g., cloud architectures, data analytics) with adaptive soft skills (e.g., design thinking, agile collaboration). Describe how to maintain momentum and measure impact across geographically dispersed teams.

Explain how scenario planning can be embedded into a bank’s ongoing strategic transformation to address uncertainties from shifting regulations, global economic factors, or technological breakthroughs. Include details on how often scenarios should be reviewed and how outcomes translate into actionable roadmaps.

Detail a tactical blueprint for gaining and retaining C-suite support throughout a multi-year IT transformation. Focus on articulating near-term wins, quantifiable risk mitigation, and a compelling narrative that aligns with the CEO’s or board’s strategic vision.

Propose a knowledge management framework that ensures insights and lessons gleaned from one transformation initiative (successful or otherwise) are systematically captured and applied to future projects. Discuss processes, tools, and cultural habits that encourage continuous learning at scale.

Conduct a forensic analysis of a failed or stalled banking IT transformation, identifying root causes such as unclear scope, lack of executive backing, and misaligned resource allocation. Suggest preemptive strategies and governance mechanisms that other banks can deploy to avoid similar pitfalls.

Outline how banks can adopt innovative budgeting techniques—such as rolling forecasts, zero-based budgeting, or innovation funds—to maintain flexibility while driving strategic transformation. Explore the balance between long-term capital expenditures for infrastructure and short-term operating expenses for quick experimentation.

Evaluate how banks can systematically incorporate nascent technologies—like AI-driven anti-money-laundering tools or decentralized finance solutions—into a stable yet adaptive transformation framework. Emphasize strategies for scaling successful pilots, governing risk, and aligning each new adoption phase with measurable business outcomes.

These prompts incorporate strategic, operational, cultural, ethical, and regulatory dimensions, setting the stage for truly advanced, nuanced discussions on executing a transformation framework in banking IT. By exploring each area thoroughly, you can unlock a holistic understanding of the challenges and opportunities inherent in driving transformative change.

5.9.2. Workshop Assignments

These five workshops offer hands-on experiences—from crafting a unifying vision to designing balanced performance dashboards—that ensure IT teams can seamlessly blend strategic goals with daily operations.

Workshop Assignment 1: Vision Mapping Exercise

Objective: Participants collaboratively craft a vision statement that reflects the bank’s transformation aspirations, ensuring it resonates with both operational teams and executive stakeholders. By exploring current market trends, competitor strategies, and internal performance data, they distill a guiding vision that underpins the transformation framework.

Expected Deliverables:

A concise, action-oriented vision statement

Supporting rationale that connects the vision to overall corporate objectives

A list of potential obstacles to achieving the vision and how to mitigate them

Guidance:

Encourage open discussion that includes representatives from multiple departments (IT, finance, compliance)

Use group brainstorming or facilitated ideation sessions to capture diverse perspectives

Emphasize alignment with real data points—customer feedback, market share, performance metrics

Workshop Assignment 2: Project Prioritization Simulation

Objective: Teams engage in a mock budgeting and prioritization exercise, evaluating a portfolio of hypothetical IT projects—ranging from core system upgrades to experimental AI pilots. Through a structured process (e.g., MoSCoW or value/risk grids), participants learn how to allocate limited resources while balancing operational imperatives and strategic innovation.

Expected Deliverables:

A prioritized project list with justifications for each choice

Documentation of the prioritization framework applied

Feedback notes from peers acting as different stakeholders (finance head, compliance officer, etc.)

Guidance:

Provide realistic constraints such as regulatory deadlines or restricted budgets

Urge teams to articulate quantitative and qualitative criteria (ROI, risk level, strategic fit)

Conclude with a reflection session on how these methods can be adapted to real-world scenarios

Workshop Assignment 3: Ambidexterity Model Workshop

Objective: Participants analyze their organization’s structure to identify where “run” (maintenance) and “change” (innovation) functions currently live. They propose adjustments—like new cross-functional squads or a dedicated innovation lab—to better balance operational stability with future-facing initiatives.

Expected Deliverables:

A visual map of current vs. proposed organizational structures (e.g., teams, reporting lines)

A set of recommendations for bridging gaps and removing bottlenecks

An action plan for gradually implementing these structural or process changes

Guidance:

Encourage a candid assessment of existing silos, bottlenecks, and resource allocations

Use real metrics (e.g., time-to-fix vs. time-to-release) to illustrate the current imbalance

Discuss potential cultural and leadership challenges in adopting a more flexible structure

Workshop Assignment 4: Change Management Simulation

Objective: Participants role-play a transformation scenario where a major shift—like migrating legacy systems to the cloud—is announced. They must devise communication strategies, training plans, and leadership engagement tactics to manage resistance, foster enthusiasm, and maintain project momentum.

Expected Deliverables:

A change management plan detailing communication stages and stakeholder mappings

Sample training modules or communication artifacts (emails, presentation slides, FAQs)

A risk log with mitigation strategies for likely points of resistance

Guidance:

Assign different roles (IT managers, frontline staff, C-suite sponsors) to emulate diverse viewpoints

Encourage iterative feedback, refining the approach to address cultural nuances

Highlight the importance of quick wins and continual reinforcement through leadership alignment

Workshop Assignment 5: Metrics and Dashboards Hackathon

Objective: Participants collaborate in a short “hackathon” to design dashboards or scorecards that track both operational KPIs (uptime, cost per transaction) and strategic KPIs (new product adoption, innovation ROI). By testing different visualization tools and data sources, they discover how real-time metrics can guide decision-making throughout the transformation lifecycle.

Expected Deliverables:

A prototype dashboard or scorecard reflecting a balanced KPI set

Documentation detailing the data inputs, update frequency, and intended audience

A brief demo or explanation of how the dashboard drives transparency and accountability

Guidance:

Offer a variety of data visualization platforms (e.g., Power BI, Tableau, open-source options)

Encourage alignment with actual transformation milestones or pilot projects

End with a discussion on how frequently stakeholders should review and act on these metrics

By tackling these collaborative exercises, participants not only refine critical transformation skills but also cultivate the strategic mindset needed to orchestrate impactful, long-term change in banking IT.

Comments