Chapter 6

Engaging Key Stakeholders and Building Cross-Functional Collaboration

"Collaboration thrives when every stakeholder feels like an architect of progress, rather than a bystander to change." — Niall Cameron, former Global Head of Corporate and Institutional Digital at HSBC

Chapter 6 focuses on the human dimension of IT transformation—recognizing that the most sophisticated strategies and technologies will fall short without the enthusiastic participation and buy-in of key stakeholders. By mapping out the various players in a banking IT environment, the chapter provides concrete tactics for bridging communication gaps, establishing shared accountability, and fostering cross-functional teamwork. Real-world examples bring these concepts to life, illustrating how systematic stakeholder engagement can boost morale, minimize resistance, and accelerate progress. From setting clear, outcome-oriented metrics to using agile collaboration models, this chapter delivers a blueprint for harnessing the collective energy of an organization to bring strategic visions to fruition.

6.1. The Importance of Stakeholder Engagement

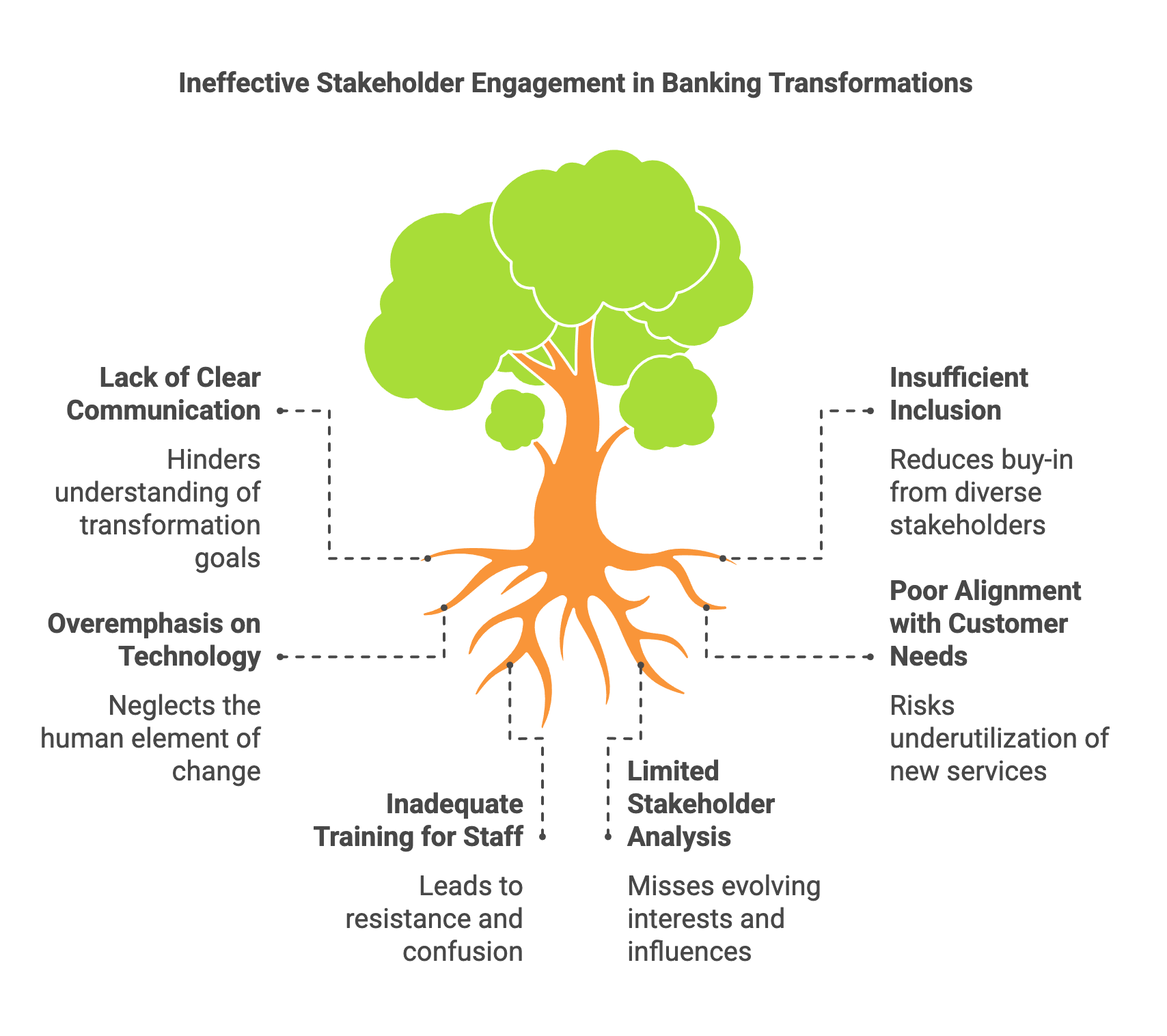

Engaging stakeholders in banking IT transformations extends beyond merely implementing advanced technologies or adhering to regulatory requirements. It encompasses a philosophical appreciation for the human dimension, a conceptual framework that recognizes the distinct priorities of various stakeholder groups, and practical methodologies for effective analysis and communication. In a sector where trust is paramount and financial well-being is at stake, the collective buy-in and sustained commitment of every individual—from executive leaders to front-line staff—ultimately determine the success of transformative initiatives (PwC 2023; Smith 2023).

Despite rapid progress in financial technology, the underlying driver of meaningful change remains human engagement. Banking institutions benefit from sophisticated digital platforms only when employees and partners are motivated to use them effectively and responsibly. As Deloitte (2024) emphasizes, any innovation that overlooks the people element risks underutilization, resistance, or even ethical lapses. In this sense, transformation in banking is never purely technological; it is inherently social, requiring robust communication, empathy, and an inclusive approach to change management.

Figure 1: Ineffective stakeholder engagement and challenges.

Because banks serve as stewards of customer finances, they shoulder significant moral and ethical obligations. Ethical lapses can quickly erode client trust and tarnish brand reputation. Inclusive stakeholder engagement—where individuals across the organization, and even customers themselves, are part of shaping new initiatives—enhances ethical accountability. This approach fortifies public trust and promotes alignment with regulatory standards. As KPMG (2024) notes, inviting diverse voices into the transformation dialogue strengthens moral integrity and ensures that strategic decisions reflect both corporate responsibility and customer-centric values.

Co-creation lies at the heart of a truly transformative culture. When employees at different levels feel that their insights matter, they are more likely to champion the initiative rather than passively comply with it. Creating a sense of shared ownership fosters proactive problem-solving and reduces fear of change. This cultural shift is particularly crucial in banking, where operational excellence depends on uniform adherence to policies and high levels of service reliability (Lee 2022). Encouraging continuous input and feedback transforms transformation from a top-down directive into a collaborative journey.

While meeting quarterly targets may provide short-term motivation, genuine stakeholder engagement seeks deeper, more sustainable buy-in. When individuals across an organization believe in the underlying purpose of transformation, they exhibit resilience during challenging phases of implementation. Their long-term commitment—grounded in a clear understanding of the initiative’s value—helps ensure that transformation efforts yield lasting benefits rather than temporary compliance (JPMorgan 2025). Philosophically, the banking sector thrives when employees see themselves as agents of progress, further anchoring transformations in a collective vision for the future.

Executives in banking often focus on ROI, market competitiveness, brand reputation, and regulatory alignment. They evaluate transformation projects through the lens of broader corporate objectives, aiming to balance innovation with caution (PwC 2023). Conceptually, gaining their buy-in requires clear metrics, robust risk assessment, and demonstrable alignment with organizational strategy.

Serving as the conduit between executive directives and operational teams, middle managers translate high-level goals into actionable tasks. They juggle day-to-day performance metrics like cost control and productivity while attempting to integrate new technologies or processes into their departments. For these stakeholders, conceptual clarity about timelines, training needs, and measurable performance improvements is paramount (Smith 2023).

Tellers, customer service representatives, and operational personnel are the primary point of contact with banking customers. Their acceptance of new processes or tools directly affects service quality and customer satisfaction. They require clarity on how changes impact their daily workflows, job security, and performance evaluation criteria. Structuring transformation to address their practical concerns fosters smoother adoption and reduces resistance (Deloitte 2024).

In banking, external partners often include fintech companies, technology vendors, outsourcing providers, and regulatory bodies. They supply specialized expertise or oversight crucial to the success of transformation projects (Lee 2022). Ensuring alignment between internal priorities and partner objectives can mitigate risks of miscommunication, project delays, and compliance breaches.

While customers may not be employees, their evolving needs and feedback significantly influence banking IT transformations. Integrating customer insights into planning ensures that new services or platforms remain user-friendly, secure, and trustworthy. By conceptually embedding customer perspectives into transformation strategies, banks can stay aligned with market expectations and ethical standards (KPMG 2024).

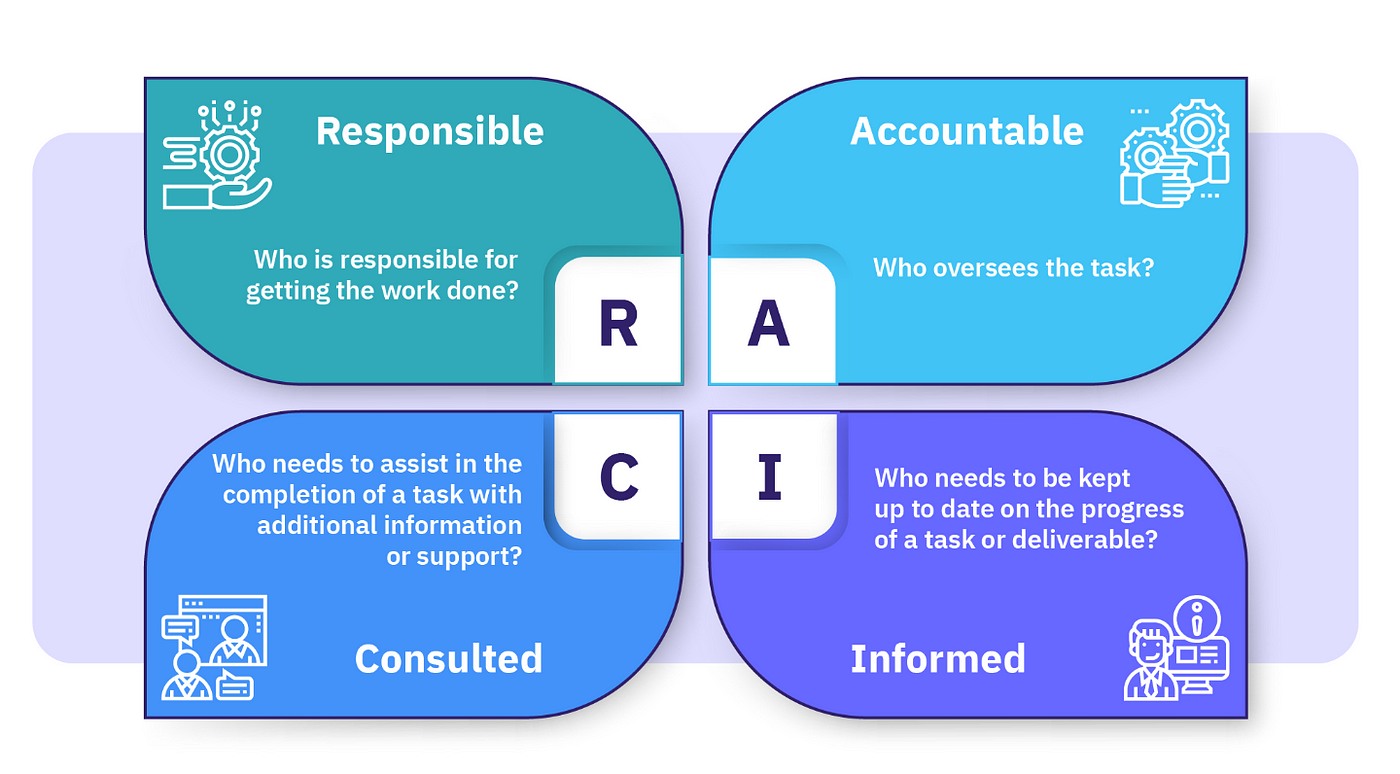

Identifying the roles, interests, and potential influence of each stakeholder group clarifies where and how to invest engagement efforts (Smith 2023). Tools such as the Power-Interest Grid categorize stakeholders based on their ability to affect outcomes (power) and their level of concern (interest). RACI (Responsible, Accountable, Consulted, Informed) charts detail who holds decision-making authority, who executes tasks, and who provides input or receives updates. Engagement Matrices further refine the approach, distinguishing the optimal engagement level for each group—ranging from collaboration and consultation to simple information sharing.

Figure 2: RACI framework for stakeholder engagement.

By understanding which individuals or entities can champion or thwart transformation, project leaders can strategically allocate resources and communication efforts. In a banking context, this often includes executives controlling budgets, regulators ensuring compliance, or departments responsible for critical operational tasks. Proactively involving these high-impact stakeholders at early stages helps prevent bottlenecks and fosters a more solid groundwork for subsequent adoption (JPMorgan 2025).

Regularly scheduled meetings, cross-functional workshops, and executive briefings form the backbone of effective stakeholder engagement. Monthly or biweekly gatherings keep diverse teams aligned on goals, while executive sessions focus on key metrics, strategic risks, and the overarching value proposition (PwC 2023). Front-line forums, on the other hand, encourage open dialogue, provide practical demonstrations of new tools, and empower employees to share feedback and concerns. Tailoring the frequency and content of these touchpoints to each audience ensures that messaging resonates and effectively informs decision-making.

Practical engagement hinges on the ability to convey relevant, clear, and concise information. Executives often respond to strategic impact and ROI-focused language, while middle managers seek concrete operational benefits or cost savings. Front-line staff need clarity about day-to-day workflow changes and how these align with performance evaluations. Regulators and external partners prioritize compliance, risk mitigation, and alignment with industry standards (Deloitte 2024). Adapting communication styles not only accelerates acceptance but also fosters collaborative synergy across the transformation’s lifecycle.

Stakeholder analysis is an ongoing process. As the transformation progresses, new stakeholders may emerge, or existing ones may shift in importance. Regularly reviewing and updating stakeholder maps ensures that engagement strategies remain effective and reflective of evolving conditions (Lee 2022). Establishing structured feedback loops enables continuous learning and adaptation, vital for sustaining momentum in a dynamic financial environment.

6.2. Building Trust and Shared Responsibility

Fostering trust and a collective sense of responsibility is essential for any banking IT transformation to move beyond surface-level changes and inspire sustainable cultural shifts. When all stakeholders—from senior executives to front-line teams—understand their role as co-owners in the change journey, a deeper level of engagement naturally emerges. The following sections explore how philosophical perspectives shape this mindset, how conceptual governance structures reinforce it, and the practical mechanisms that align individual objectives with shared outcomes.

Philosophically, meaningful transformation transcends traditional top-down instructions. Instead of merely following executive directives, employees and partners should see their input and decisions as integral to the program’s success (Deloitte 2024). By positioning each contributor as a co-owner, banking organizations encourage genuine participation, moving away from “order-taking” toward active commitment. This sense of personal investment often translates into higher-quality decision-making, stronger collaboration, and a readiness to adapt when obstacles arise.

In a financial institution, ethical considerations are inseparable from operational imperatives. Engaging diverse voices—regardless of hierarchy—ensures that decisions reflect the best interests of the organization and its customers. From a moral vantage point, inclusive involvement deters bias or departmental silos from overshadowing broader needs (KPMG 2024). By embracing perspectives from traditionally underrepresented groups or underserved communities, banks uphold principles of fairness and trustworthiness, thereby strengthening their moral and social contract with customers and regulators alike.

A co-ownership mindset flourishes in an environment of open communication. When leadership emphasizes that ideas and concerns can be raised without fear of retaliation, employees feel empowered to share innovative solutions and voice potential risks early (Lee 2022). Such an egalitarian feedback structure dismantles rigid hierarchies, enabling a culture of shared problem-solving. Instead of focusing on blame or territory, stakeholders rally around collective goals, which fosters a greater sense of unity and mutual respect.

The ultimate aim of building trust and shared responsibility is to lay a foundation for enduring change. Philosophically, if people across an organization view transformation as their own endeavor, they continue to nurture and evolve it long after initial milestones are reached (PwC 2023). This mindset safeguards against the “project fatigue” that often follows major initiatives, ensuring that process improvements, technological enhancements, and cultural evolution persist beyond the formal transformation timeline.

One of the most common governance models involves steering committees, composed typically of senior leaders and cross-functional project sponsors. Conceptually, these committees set strategic direction, resolve high-level conflicts, and approve resource allocations (Deloitte 2024). By intentionally including representatives from various functions—IT, operations, compliance, and front-line teams—such committees embody the principle of shared ownership. Decisions made in this forum inherently reflect a broader organizational perspective, boosting alignment and collective buy-in.

CoPs are less formal but equally powerful structures centered on shared interests or areas of expertise, such as artificial intelligence, blockchain, or DevOps. These communities allow employees from different departments to share knowledge, best practices, and peer support (Morgan 2021). By breaking down silos, CoPs reinforce the notion of co-ownership, highlighting that innovation and learning are communal responsibilities rather than isolated departmental tasks. This collaborative approach not only accelerates skill development but also strengthens trust across diverse teams.

Transparent governance ensures that stakeholders understand how decisions are made and why certain trade-offs occur. By leveraging project tracking tools and clear reporting lines, banking institutions can make visible the progress of key initiatives, budgets, and timelines (KPMG 2024). Such open frameworks reduce the likelihood of hidden agendas, encourage constructive debates on resource usage, and collectively address problems before they intensify. This approach not only boosts trust but also heightens accountability, as all involved parties can see the direct impact of their actions.

While top-down mandates traditionally concentrate authority with a few decision-makers, shared accountability disperses this responsibility. Conceptually, distributing tasks and oversight among committees, working groups, and CoPs prevents any single role from monopolizing vital decisions (Lee 2022). This collaborative model ensures checks and balances, mitigating risks related to power concentration and spurring a culture of joint stewardship. As a result, stakeholders become more invested in both delivering outcomes and upholding the ethical and strategic standards that guide the transformation.

A well-crafted team charter not only delineates objectives, expected contributions, and decision-making protocols, but also formalizes communication norms. By articulating each member’s role in advancing the transformation agenda, charters act as living “contracts” that ensure alignment from the outset (PwC 2023). They also serve as a daily reminder of why the transformation matters—reinforcing a sense of collective purpose and keeping the team on track with its commitments.

RACI matrices provide a succinct way to define responsibilities and approval processes. Practically, they help teams avoid confusion regarding who leads tasks, who has final say, and who must be looped in for feedback or information (Deloitte 2024). By clarifying roles, RACI charts not only streamline operations but also promote mutual respect for individual and departmental domains, reinforcing a shared ownership ethos.

To cultivate genuine co-ownership, individual performance goals must dovetail with broader transformation objectives. By introducing metrics such as innovation KPIs, customer satisfaction improvements, or cost-saving targets, banking institutions encourage employees to focus on collective results (Morgan 2021). Reward structures—whether bonuses, public recognition, or career opportunities—can then reinforce behaviors that support the larger vision. These incentives resonate strongly in a transformation context, motivating teams to prioritize collaboration and high-quality outcomes.

Regular retrospectives, milestone check-ins, and analytics reviews allow teams to assess the effectiveness of governance models, incentive structures, and charters. If collaborative efforts begin to stall or roles become misaligned, timely adjustments can be made, ensuring that trust and shared responsibility remain central tenets of the ongoing transformation (Lee 2022). These structured feedback loops highlight success stories, rectify emerging bottlenecks, and reaffirm the bank’s commitment to inclusive, agile evolution.

As teams gain experience in trust-building governance and shared accountability, their successes can inform similar initiatives across the organization. Standardizing proven frameworks—team charters, RACI matrices, transparent steering committees—establishes a consistent language and approach to transformation. Over time, these practices become embedded in the corporate culture, allowing the bank to replicate its achievements in future projects and ensuring that trust-based collaboration becomes a lasting competitive advantage (KPMG 2024).

6.3. Cross-Functional Collaboration Techniques

Cross-functional collaboration stands as a critical enabler for delivering integrated, customer-centric banking solutions. When teams transcend departmental silos, they address complex challenges through a wider lens—combining technical expertise, regulatory knowledge, customer insights, and strategic foresight. The following sections unpack the philosophical underpinnings of collaboration, conceptual frameworks that operationalize it, and practical methods to sustain alignment and agility.

Collaboration, at its philosophical core, calls for recognizing that today’s banking challenges—be they compliance hurdles or dynamic product development—are best tackled by uniting diverse perspectives (KPMG 2024). Rather than allowing individual teams to operate in isolation, cross-functional efforts promote a shift from narrow objectives to a broader focus on enterprise-wide outcomes. This holistic approach ensures that solutions integrate business viability, technological feasibility, and customer desirability.

While formal structures and processes can mandate interactions across departments, truly effective collaboration stems from a fundamental belief in collective intelligence. Encouraging open dialogues, co-creation, and shared learning fosters deeper trust and a willingness to question assumptions (Deloitte 2025). This philosophical stance recognizes that siloed thinking not only impedes innovation but can also jeopardize organizational resilience, especially in a rapidly shifting financial landscape.

By proactively including a variety of disciplines—IT, operations, marketing, risk management, and compliance—banks increase their likelihood of building ethical, transparent, and socially responsible products and services (Lee 2022). When collaboration is embraced as a moral imperative, it helps reduce blind spots, ensuring that decisions account for potential societal impacts or regulatory pitfalls. This inclusive engagement is particularly significant given the high level of societal trust placed in financial institutions.

Instituting collaboration as a norm rather than an exception strengthens the organizational culture. Over time, employees learn to value transparency, knowledge-sharing, and empathy, thereby dismantling power hierarchies that can stall progress (PwC 2023). Philosophically, collaboration then becomes a guiding principle, reinforcing mutual respect and continuous improvement at all levels—an essential foundation for sustainable transformation.

In many banking environments, Agile squads bring together multi-disciplinary specialists—developers, testers, product owners, UX designers, and data analysts—to work on a shared backlog of tasks (Patel 2021). These squads are self-organizing, use iterative sprints, and continuously adapt to evolving customer needs or compliance changes. Conceptually, this model accelerates time-to-market by reducing handoffs and facilitating real-time collaboration among experts from different domains.

Design thinking shifts the focus to understanding and empathizing with end-users. Workshops often begin by exploring customer pain points and framing well-defined problems before moving to ideation, prototyping, and iterative testing (Lee 2022). Conceptually, this process ensures that innovations resonate with actual user needs while aligning with business and regulatory realities—key for a sector as customer-sensitive as banking.

When banks face urgent, high-stakes challenges—like sudden regulatory shifts or cybersecurity threats—forming swift, task-focused “tiger teams” can be highly effective. These temporary squads draw top talent from relevant departments, bypassing traditional bureaucratic hurdles (KPMG 2024). Their concentrated efforts allow them to address problems rapidly, while clear accountability ensures decisions remain aligned with overarching strategic goals.

Large financial institutions often run multiple squads, workshops, or tiger teams concurrently, each tasked with a specific strategic objective—from AI-driven personalization to operational risk management. Conceptually, a unifying governance framework helps maintain consistency and strategic coherence across these various efforts (PwC 2023). This balance between local autonomy and enterprise-level oversight is crucial to keeping innovation agile while preventing fragmentation.

Digital tools such as Trello, Jira, or Azure DevOps visualize backlogs, task statuses, and priorities in real time. By offering a common platform accessible to all team members, these boards reduce status requests, identify workflow bottlenecks, and sustain collective accountability (Patel 2021). Clear visibility into progress fosters transparency and ensures that everyone—from junior developers to senior executives—understands current priorities.

Linking code repositories, automated testing, continuous integration, and deployment pipelines under one integrated toolchain allows teams to release new features in smaller, more frequent increments (Deloitte 2025). This pace is ideal for responding to regulatory changes or market shifts. Practically, shorter release cycles also foster a culture of experimentation and immediate feedback, vital for staying competitive in a rapidly evolving financial ecosystem.

Structured Scrum events—daily stand-ups, sprint reviews, and retrospectives—keep squads on track by clarifying goals, highlighting impediments, and celebrating small wins (PwC 2023). These ceremonies foster alignment at a granular level, minimize miscommunication, and facilitate quick decision-making, all of which are crucial for large-scale banking projects that span multiple departments and time zones.

Platforms like Slack or Microsoft Teams offer dedicated channels where different specialties—such as compliance, technology, and customer service—can share updates or seek clarifications in real time (Lee 2022). Such open channels demolish the walls between departments, enabling swift resolution of questions or conflicts and promoting a spirit of continuous learning.

While self-organizing teams drive agility, overarching governance structures—steering committees, for instance—ensure that these localized efforts remain cohesive and aligned with enterprise priorities (KPMG 2024). This governance layer handles resource allocation, resolves conflicting mandates, and keeps cross-functional collaboration anchored in the organization’s strategic objectives.

Frequent reviews and demos enable stakeholders to provide targeted feedback, validating whether solutions are on track to meet business and user requirements. This iterative approach brings issues to light quickly, enabling teams to recalibrate before small misalignments balloon into significant setbacks (Patel 2021). Over time, these loops cultivate a culture where learning, adaptation, and user-centric design become standard practice.

6.4. Effective Communication Strategies for Transformation

An effective communication strategy in banking IT transformations goes beyond distributing announcements or project updates. It involves creating continuous, two-way dialogue throughout the transformation journey—a process that fosters trust, transparency, and alignment across all stakeholder groups. The following sections explore the philosophical rationale behind ongoing engagement, the conceptual tailoring of messages to different audiences, and practical methods to maintain clarity and momentum in diverse banking environments.

Philosophically, transformation is not a static event but a fluid and adaptive process. As Deloitte (2025) notes, organizations that treat communication as a continuous engagement mechanism—rather than sporadic broadcasts—are more likely to sustain employee motivation and stakeholder alignment over time. Two-way dialogue promotes active listening, ensuring leadership not only conveys information but also absorbs insights, concerns, and feedback from the workforce and external partners.

Consistent, transparent communication builds the foundation of trust crucial for successful transformations. When leaders openly share both victories and setbacks, employees feel respected, and fears around change often subside (KPMG 2023). Trust flourishes when stakeholders believe they are receiving honest and timely updates on the initiative’s direction, risks, and progress. This sense of inclusion transforms passive observers into active contributors, invigorating the transformation with broader organizational commitment.

From an ethical standpoint, equitable access to information ensures no group or department is left in the dark. Whether addressing senior executives or front-line staff, acknowledging each stakeholder’s perspective and needs strengthens the moral fabric of the transformation (McKinsey 2023). Inclusive communication not only mitigates misinformation and resistance but also reflects a bank’s responsibility to represent the interests of customers, investors, and society at large.

Ultimately, when communication is embraced as a continuous dialogue, it embeds a culture of openness. Transparency becomes expected, not exceptional, and feedback loops become part of the organization’s DNA (Smith 2022). Over the long term, this philosophical orientation cultivates an environment in which transformation is perceived as a collective journey—one that benefits from widespread input and shared accountability.

At a conceptual level, communication strategies must address the distinctive priorities of each stakeholder group. Executives often need high-level overviews focusing on ROI, market positioning, and regulatory compliance; technical teams require more detailed information on architecture, system integrations, and timelines (PwC 2024). Meanwhile, customers or front-line employees value clarity on practical benefits—such as improved service features or streamlined workflows. Differentiating content depth and tone helps avoid information overload or, conversely, under-communicating critical details.

Despite audience-specific adaptations, maintaining a unified strategic vision is essential to prevent fragmentation. By consistently highlighting overarching goals—whether these are about enhancing customer experiences, achieving operational excellence, or driving innovation—the bank ensures that each audience understands how their role aligns with the broader purpose (Deloitte 2025). A cohesive narrative across all communication channels reinforces organizational unity and fosters a shared sense of direction.

Implementing a conceptual framework that outlines levels of detail—such as executive summaries, managerial updates, and operational specifics—helps streamline the flow of information (KPMG 2023). Leaders can thus ensure that content remains relevant to each audience’s responsibilities without burying them in extraneous detail. For example, while senior leaders might only need milestone and budget summaries, middle managers and technical teams will benefit from more granular data on day-to-day deliverables.

Large, multinational banks often contend with varying cultural expectations, regional regulations, and language barriers. Conceptually, balancing a core message with localized nuances is crucial. While the central vision remains the same, customizing examples or regulatory considerations can make communications resonate more deeply within local markets or departments (McKinsey 2023). This strategy preserves organizational consistency while respecting regional or cultural contexts.

Developing standardized email or memo templates ensures that updates across different functions or geographic locations maintain a consistent structure and tone. These templates might include sections for “Key Updates,” “Action Items,” and “Next Steps,” simplifying content creation for managers and preserving clarity for readers (Smith 2022). Standardization also helps in quickly disseminating urgent messages, particularly during critical transformation milestones or unforeseen issues.

Periodic bulletins—delivered monthly or quarterly—offer snapshots of key achievements, upcoming milestones, and lessons learned. PwC (2024) finds that showcasing success stories boosts morale and demonstrates tangible progress, while highlighting upcoming events or training opportunities keeps teams prepared. These publications can also feature “spotlights” on individuals or squads that have exemplified collaboration, promoting a culture of recognition and shared pride in the transformation’s trajectory.

Live forums, whether held in person or via digital platforms, enable two-way communication in a more immediate setting. Town halls and Q&A sessions give employees a direct channel to ask questions, raise concerns, or propose ideas (McKinsey 2023). These forums can be especially valuable when addressing sensitive topics—such as staffing changes or major system overhauls—where real-time clarification helps dispel rumors and manage anxiety.

Inserting quick surveys or polls into newsletters, intranet sites, or event follow-ups empowers staff to voice their opinions and flag emerging issues. Regularly collecting and analyzing this input ensures the transformation strategy remains adaptive and responsive (Smith 2022). Simple feedback methods, such as digital suggestion boxes or short feedback forms, can reveal critical insights from front-line employees or even customers that may otherwise remain unnoticed.

Designating “communication champions” in various departments or branches can accelerate the flow of information. These champions receive in-depth briefings, which they then localize for their teams. By serving as on-the-ground resources, they bridge gaps in understanding and gather localized feedback for the core transformation team (Deloitte 2025). This cascade approach ensures coverage across large or geographically dispersed banking organizations.

Finally, making project timelines, milestones, and accountability structures visible through shared dashboards or internal portals establishes transparency. By clarifying who is responsible for each deliverable, teams can coordinate dependencies more effectively and see how individual contributions drive the project forward (KPMG 2023). Visibility spurs collective ownership—when delays or risks emerge, the entire team can collaborate on a solution rather than waiting for directives from the top.

6.5. Metrics and Progress Tracking for Engagement

Measuring engagement in banking IT transformations is not merely an administrative exercise but a strategic imperative that influences how stakeholders perceive success and prioritize actions. By adopting well-structured, transparent metrics, organizations can nurture a culture of accountability and collaboration. This section delves into the philosophical role of metrics, conceptual frameworks for defining both quantitative and qualitative measures, and practical methods for tracking engagement to facilitate timely interventions and continuous improvement.

Philosophically, metrics do more than quantify progress; they create the lens through which employees, managers, and executives interpret the transformation’s trajectory. When leaders publicly highlight metrics related to cross-team collaboration, innovation pipelines, or customer experience, they effectively communicate the values the bank wishes to prioritize (Deloitte 2025). In this sense, metrics become narratives, shaping collective understanding and guiding stakeholder behavior.

Openly sharing measurement results—even when they reveal underperformance—builds trust among employees and partners. People are more inclined to engage with transformation initiatives when they see that results are tracked consistently rather than through subjective interpretations (McKinsey 2022). This open approach reduces the fear of hidden agendas and encourages proactive problem-solving, as stakeholders become invested in addressing shortcomings and celebrating achievements in real time.

The very choice of metrics—whether they emphasize cost reduction, environmental sustainability, or customer satisfaction—reflects an institution’s deeper values (KPMG 2024). For instance, focusing on Net Promoter Score (NPS) reinforces a customer-centric orientation, while tracking greenhouse gas reductions underscores sustainability commitments. Philosophically, aligning metrics with corporate principles ensures that ethical and strategic objectives remain woven into the transformation’s fabric.

Metrics exert a powerful influence on day-to-day actions. By measuring and rewarding collaboration, organizations nudge individuals and teams toward open communication, knowledge-sharing, and joint problem-solving (PwC 2023). Over time, this “what gets measured, gets done” effect can steer cultural change, embedding habits and mindsets that mirror the bank’s long-term strategic vision.

Common quantitative metrics include Return on Investment (ROI), which assesses the financial impact of transformation efforts, and Time-to-Value, which measures how quickly new systems or features deliver tangible benefits. Additionally, Throughput or Cycle Time provides insight into how efficiently cross-functional teams complete deliverables—valuable in agile banking environments (Smith 2021). These hard data points offer a clear, comparable view of transformation’s impact over time.

Engagement cannot be fully captured by numbers alone. Qualitative measures, such as employee engagement surveys, capture softer elements like morale, role clarity, and openness to change. Similarly, customer feedback—collected through satisfaction surveys or in-depth interviews—reveals how end-users perceive new products, services, or processes. Observations from retrospectives can likewise illuminate shifts in team dynamics, highlighting whether collaborative norms and communication have improved (McKinsey 2022).

A balanced scorecard combines financial measures (e.g., revenue growth, cost savings) with non-financial metrics (e.g., culture shifts, brand perception), providing a holistic assessment of transformation. Such an integrated view prevents tunnel vision on one dimension—like budget constraints or timelines—while ignoring crucial factors like employee well-being or customer loyalty (Deloitte 2025). By emphasizing balance, banks can ensure that rapid changes do not come at the expense of ethical considerations or stakeholder trust.

Metrics need to evolve in step with the transformation’s life cycle (PwC 2023). Early pilots may prioritize adoption rates and user satisfaction to validate initial concepts, whereas later stages might pivot to optimizing ROI or reinforcing operational resilience. Dynamically adjusting metrics ensures they remain practical indicators rather than static, one-size-fits-all benchmarks.

In practice, dashboards in tools like Tableau, Power BI, or custom web portals offer immediate visibility into engagement data—such as participation rates in daily stand-ups, cross-functional project contributions, or feedback cycle frequency (KPMG 2024). When a dip in collaboration metrics appears, managers can promptly investigate the root cause—be it resource constraints, communication breakdowns, or motivational issues—and intervene before the transformation’s progress is jeopardized.

A dedicated “collaboration scorecard” can break down engagement into granular components like contribution levels, response times, or quality of input. By correlating these metrics with project outcomes (such as completion rates or defect reduction), leaders can pinpoint which collaborative behaviors drive high performance. This approach not only surfaces best practices for other teams to emulate but also underscores how human factors directly link to project success (Smith 2021).

Monthly or quarterly review sessions focused explicitly on engagement metrics place people and processes at the center of discussions (McKinsey 2022). Separate from financial or technical reviews, these gatherings encourage dialogue on how effectively teams are communicating, resolving conflicts, and reaching out across departments. Consistent spotlighting of engagement underscores its importance as a determinant of sustained, high-quality transformation.

Tracking how often teams solicit and receive feedback—through daily stand-ups, sprint retrospectives, or user surveys—reveals whether iterative learning is genuinely taking place (PwC 2023). When feedback frequency correlates with improvements in speed or quality, it validates investments in open communication channels. Conversely, a drop in this metric signals a need for renewed focus on facilitating dialogue or bridging team silos.

If certain departments lag in engagement or consistently miss collaborative milestones, managers can investigate the cause—perhaps employees lack the necessary training, or cross-departmental coordination is unclear (Deloitte 2025). Interventions might include reorganizing squads, offering targeted workshops, or revisiting reward structures to encourage teamwork. The ability to spot such challenges early allows for proactive, targeted solutions rather than reactive, one-size-fits-all remedies.

Finally, sharing success stories from high-engagement teams can inspire broader adoption. If a particular squad or division excels in meeting or exceeding collaboration targets, their processes and mindsets can be documented and shared organization-wide (KPMG 2024). This structured knowledge transfer builds momentum and consolidates the cultural shifts necessary for sustaining transformation long after the initial goals are reached.

6.6. Overcoming Common Roadblocks to Collaboration

Effective collaboration remains a cornerstone of successful banking IT transformations, yet it is often thwarted by structural, behavioral, and cultural barriers. Recognizing that these challenges are surmountable through empathy, clear accountabilities, and structured conflict resolution can empower organizations to sustain momentum in complex projects. This section examines the philosophical underpinnings of typical obstacles, conceptual strategies for addressing them, and practical remedies for restoring collaborative alignment.

Collaboration challenges frequently stem from basic human responses, such as fear of job displacement or the reluctance to give up familiar routines (Deloitte 2024). When leaders appreciate these emotional drivers, they are better equipped to engage with employees in ways that mitigate anxiety and resistance. This philosophical stance prompts a shift from blaming individuals for not “embracing change” to understanding the deeper factors that cause people to feel vulnerable.

Departmental silos often arise from the perception that collaboration dilutes influence or resources. By reframing synergy as a collective victory, leaders signal that pooling expertise benefits all parties rather than diminishing any single department’s importance (KPMG 2023). Philosophically, this outlook encourages individuals to see shared achievement as a driving force, rather than fixating on competition for budgets or recognition.

Many banks are steeped in proven, decades-old processes. Such a history can create a “legacy mindset” that perceives innovation or cross-functional experimentation as a disruption (Johnson 2022). Balancing respect for proven methods with a forward-looking attitude affirms that preserving best practices need not exclude experimenting with new approaches. Philosophically, this synthesis of old and new underscores a culture of continual learning rather than wholesale replacement of past successes.

No collaboration framework works perfectly at first pass. Teams may encounter mismatched priorities, scheduling conflicts, or integration issues. A philosophical acceptance of trial and error fosters resilience, transforming missteps into opportunities for learning (PwC 2023). Instead of punishing mistakes, leaders who treat errors as instructive reinforce a growth mindset, encouraging employees to openly address and resolve frictions.

When roles, decision rights, and responsibilities are ambiguous, collaboration stalls. Without clarity, team members struggle to know who leads, who approves, and who executes (KPMG 2023). Conceptually, formalizing accountability via frameworks like RACI (Responsible, Accountable, Consulted, Informed) helps ensure that everyone understands their domain. Clear ownership cultivates confidence that someone is steering each element of the transformation.

Departments often have KPIs that reward local wins rather than cross-functional achievements. Such siloed metrics inadvertently discourage collaborative efforts. Conceptually, tying performance evaluations and bonuses to broader outcomes—like enterprise-wide ROI, customer satisfaction, or operational efficiency—realigns incentives (McKinsey 2025). This adjustment makes it more likely that employees will support each other’s objectives rather than compete for limited accolades.

Sometimes, employees resist new collaboration frameworks simply because they lack the necessary skills. Whether it’s agile methodologies, design thinking, or digital communication platforms, insufficient training can translate into uncertainty and apprehension (Johnson 2022). Conceptually, building targeted upskilling programs—through workshops, coaching, or certifications—instills confidence and reduces friction among cross-functional teams.

Even well-designed projects can fail without consistent, visible support from senior leaders. Confusion can ensue when managers do not communicate priorities or resource allocations clearly (PwC 2023). Conceptually, strong leadership presence—through regular updates, transparent decision-making, and direct involvement in resolving issues—signals that collaboration is a top-tier priority, not merely lip service.

Finally, identifying root causes early—via stakeholder interviews, confidential surveys, or performance data analytics—lets leaders preempt emerging roadblocks. This conceptual focus on prevention contrasts with crisis-driven reactions, saving both time and morale. By establishing procedures for early detection, the bank can swiftly address small-scale issues before they escalate into major stumbling blocks (Deloitte 2024).

When cross-functional tension surfaces, employing methods like interest-based negotiation or facilitated workshops can transform disagreement into constructive dialogue. Practically, designating neutral facilitators or adopting established frameworks (e.g., the Harvard Negotiation Project’s “win-win” approach) provides a systematic way to move from impasse to understanding (McKinsey 2025). Such an approach diffuses blame, paving the way for joint problem-solving.

Encouraging teams to articulate constraints, goals, and trade-offs fosters sustainable resolutions. Techniques like BATNA (Best Alternative To a Negotiated Agreement) clarify each party’s fallback plan, discouraging entrenched stances (KPMG 2023). Practically, structured negotiation ensures that solutions do not merely favor the most vocal department but result in equitable, mutually beneficial agreements.

Borrowing from agile principles, regular retrospectives allow teams to reflect on collaboration successes and failures. These sessions enable real-time course corrections by pinpointing communication lapses, misaligned objectives, or project bottlenecks. Practically, scheduling these loops—weekly, biweekly, or after project milestones—normalizes a culture of honest, continuous improvement (Johnson 2022).

Organizing targeted sessions where departments collectively tackle shared goals (like reducing customer onboarding time) helps unify stakeholders around tangible outcomes (PwC 2023). With a clear agenda, time limits, and recognized facilitators, these workshops harness diverse insights while preventing discussions from devolving into aimless debates. This hands-on, solution-focused format reignites enthusiasm and underscores the practical value of collaboration.

In cases where lower-level teams cannot bridge differences, steering committees or executive sponsors should step in with decisive direction. Practically, this may mean reallocating resources, clarifying project scope, or removing roadblocks (Deloitte 2024). By serving as an arbiter of last resort, senior leadership reassures teams that intractable disputes will not undermine the entire transformation effort.

Finally, leadership can track metrics such as the frequency of cross-departmental meetings, shared deliverables, or satisfaction survey results to gauge collaboration’s pulse. When early-warning signs—like declining participation or increased conflict—emerge, prompt interventions prevent deeper rifts (McKinsey 2025). This data-driven vigilance ensures that the organization’s collaborative capacity remains robust and adaptive.

6.7. Real-World Case Studies: Collaboration in Action

Illustrating the concrete benefits of stakeholder engagement and cross-functional synergy, real-world case studies provide compelling evidence that collaborative strategies can drive transformational success in banking IT initiatives. While each scenario unfolds in a unique context—with its own mix of cultural, technological, and regulatory challenges—certain consistent themes emerge. These include the importance of inclusive leadership, well-defined roles, and transparent communication. The following section explores the philosophical essence of successful transformations, the conceptual common denominators across different projects, and practical lessons learned from specific examples.

Real-world stories of banking transformations underscore that collaboration transcends technical alignment; it ignites a shared purpose and deep sense of ownership. Teams from IT, operations, and compliance who celebrate joint milestones begin to see each other not as separate units but as partners in a collective journey (Deloitte 2024). Philosophically, this emotional investment fosters resilience when challenges surface, converting initial skeptics into passionate advocates for change.

When employees witness tangible improvements—like faster loan approvals or more intuitive digital platforms—they recognize the moral value of contributing to a shared goal (KPMG 2023). This genuine buy-in amplifies synergy, as individuals see how their daily tasks connect to broader objectives. Philosophically, the organization evolves into a community of purpose, where each department’s specialized contributions support a unified mission.

Case studies often reveal that well-integrated teams permanently alter internal dynamics, replacing entrenched silos with an ethos of openness and continuous learning (PwC 2023). By making stakeholder engagement a core operational principle rather than an afterthought, banks create cultures where teams habitually consult and trust one another. This shift extends beyond a single project and often redefines how the institution approaches innovation, risk, and customer engagement.

Across diverse case studies, one constant is the presence of leaders who empower rather than micromanage (McKinsey 2025). They grant teams autonomy to experiment while providing strategic guardrails that align with corporate goals. This approach mitigates turf wars and boosts engagement by making each function—from marketing to IT—a valued contributor to the bank’s overarching mission.

Whether focusing on digital onboarding or core system modernization, successful initiatives emphasize explicit governance structures—steering committees, domain leads, and clearly mapped out responsibilities (PwC 2023). Conceptually, RACI matrices are frequently employed, ensuring that accountability and consultation paths are transparent. This clarity allows teams to move swiftly without getting bogged down in decision bottlenecks.

In many documented successes, leaders measure both technical results (system uptime, transaction speed) and collaboration indicators (cross-department meeting participation, shared deliverables). Conceptually, this balanced scorecard approach recognizes that thriving projects hinge on both operational excellence and healthy human dynamics (Deloitte 2024). By combining these dimensions, organizations track not only immediate deliverables but also the strength and sustainability of their collaborative culture.

Case analyses consistently highlight the role of planned communication—weekly or biweekly updates, stakeholder newsletters, and monthly review sessions—that keep everyone informed and aligned (KPMG 2023). Conceptually, consistent and transparent communication prevents minor misunderstandings from escalating into larger disputes, reinforcing trust and reducing the risk of project derailment.

Below are four illustrative scenarios demonstrating how banks have leveraged cross-functional teamwork to achieve distinct goals. While each case addresses different business needs, they share the fundamental tenets of inclusive governance, precise role definitions, and frequent dialogue.

Finally, successful collaborative efforts typically seed frameworks and playbooks that become institutional memory—accelerating future transformations (Smith 2022). Philosophically, these cases highlight that collective success is not a one-off event but a sustainable practice, weaving a collaborative spirit into the bank’s organizational DNA.

Scenario 1: Digital Onboarding Transformation

Timeline: Six-month phased rollout, beginning with a pilot in one branch or business segment.

Resource Requirements:

A cross-functional squad comprising IT developers, marketing analysts, compliance officers, and a pilot user group of customers.

Funding for user acceptance testing and agile sprint ceremonies.

Communication Approach:

Weekly stand-ups within the squad; monthly executive briefings for sponsor-level alignment.

A dedicated Slack or Microsoft Teams channel for real-time feedback and problem resolution.

Lessons Learned:

Early user feedback unearthed unforeseen UX issues, helping the team refine onboarding steps before scaling.

Inclusion of compliance and risk teams from the outset minimized regulatory delays and friction at launch.

Scenario 2: AI-Driven Fraud Detection

Timeline: A three-month proof of concept, followed by a three-to-six-month controlled deployment phase.

Resource Requirements:

Data scientists, IT security professionals, line-of-business stakeholders, and an external AI vendor for advanced model tuning.

Budget for analytics infrastructure and continuous monitoring tools.

Communication Approach:

A cross-department “fraud detection council” meeting biweekly to review model performance, false positives, and emerging threats.

Clear escalation procedures for resolving immediate security risks.

Lessons Learned:

Transparent performance metrics—like a 40% reduction in false positives—built cross-functional trust.

Ongoing knowledge sharing between data scientists and front-line teams ensured the AI model evolved beyond any single department’s expertise.

Scenario 3: Core System Modernization

Timeline: Eighteen-month roadmap, divided into multiple sprints, each targeting a distinct core system module (payments, customer data, loan processing).

Resource Requirements:

A steering committee representing IT, operations, risk management, and key product lines to prioritize upgrades.

Staff training and simulation environments to minimize live system disruptions.

Communication Approach:

Monthly “town hall” events to apprise staff of upcoming changes, training schedules, and potential impacts.

Sprint retrospectives to capture lessons learned and refine the approach for subsequent modules.

Lessons Learned:

Incremental modernization using microservices helped avoid extended downtime, boosting internal buy-in.

Pre-defined rollback protocols for each sprint alleviated anxiety around adopting new system components.

Scenario 4: Open Banking Partnership

Timeline: Nine-month integration with rolling feature releases to expand external fintech’s access to the bank’s APIs.

Resource Requirements:

Dedicated integration squads, security testing teams, marketing liaisons for customer rollouts, and joint technical architecture reviews.

Investment in robust API management and monitoring tools.

Communication Approach:

Real-time dashboard tracking API calls, error rates, and new user enrollments, accessible by both the bank and fintech partner.

Joint daily stand-ups during critical integration phases.

Lessons Learned:

Shared accountability for service uptime and user experience nurtured genuine partnership rather than a client-vendor dynamic.

Phased integration eased employees into new collaboration rhythms with an external entity.

Ultimately, the lessons distilled from these scenarios become an invaluable resource—often compiled into a transformation playbook or knowledge repository for future undertakings (Smith 2022). By capturing successes and shortcomings in communication, role allocation, training, and metrics, banks accumulate a living asset that accelerates subsequent transformation initiatives. This sustained learning loop cements a culture where collaboration is not just an event-driven imperative but a default mode of operation.

6.8. Sustaining Momentum and Continuous Engagement

Transformations in banking are not defined by a single project’s completion date. Rather, they represent a continuous cycle of adaptation and evolution, guided by engaged stakeholders at all levels. By embedding reflection, learning, and ownership into the organizational fabric, financial institutions can ensure that the gains from any transformation endure over time. This section explores the philosophical rationale for ongoing adaptability, the conceptual mechanisms that foster continuous improvement, and the practical structures that maintain forward momentum long after the initial milestones are reached.

In a market environment characterized by shifting regulations, fintech disruptors, and evolving customer preferences, banks benefit from treating transformation as an ongoing journey. Instead of celebrating a singular “done-and-dusted” achievement, organizations that embrace perpetual change develop strategic resilience (Deloitte 2024). Philosophically, this mindset keeps them vigilant for emerging opportunities and threats, ensuring they remain agile and competitive.

When every part of the bank—from frontline tellers to executive leaders—feels responsible for maintaining and enhancing transformation gains, efforts are less likely to stall. Distributed ownership combats transformation fatigue and keeps teams motivated even after initial project goals have been met (KPMG 2023). Philosophically, this model aligns day-to-day activities with broader organizational strategies, instilling a sense of shared pride and communal accountability.

To sustain engagement, a learning-oriented culture that values experimentation and constructive feedback is paramount. When teams understand that there is always potential for refinement—be it in customer processes, internal workflows, or technological solutions—they remain proactive in seeking incremental innovations (Smith 2022). Philosophically, this perspective positions the bank as a “learning organization,” consistently evolving its capabilities to meet changing market demands.

Finally, effective long-term transformation balances operational stability with continual renewal. Banks must not disrupt core operations that uphold customer trust, yet they also cannot afford to stagnate. This equilibrium recognizes that transformation success hinges on a cadence of careful, iterative adjustments (McKinsey 2025). Philosophically, this stance respects both the institution’s heritage and its imperative for future growth.

Conceptually, regularly scheduled retrospectives—whether monthly or quarterly—enable teams to revisit past actions, analyze outcomes, and document improvements (Deloitte 2024). By creating formal feedback loops, banks prevent recurring mistakes and institutionalize knowledge that can be shared across departments. Such deliberate reflection processes ensure that operational adjustments are grounded in real-world insights rather than assumptions.

Periodic reviews at the leadership level maintain alignment between day-to-day initiatives and broader strategic objectives. These checkpoint sessions provide a platform for escalating issues, re-prioritizing resource allocations, and reaffirming goals (KPMG 2023). Conceptually, they also help decision-makers gauge whether the current course of action remains optimal, triggering quick pivots where necessary.

Whether focusing on agile methodologies, design thinking principles, or hands-on technology training, consistent upskilling equips teams to adapt to emerging challenges and tools (Smith 2022). Conceptually, this approach enhances the bank’s collective competence, ensuring that employees have the skill sets needed to actualize transformative goals. By budgeting for workshops, certifications, and practice-based learning sessions, banks invest in the long-term resilience of their workforce.

Cross-functional workshops or hackathons break down silos by uniting diverse skill sets around a shared problem or innovation opportunity. Bringing together technologists, operations experts, risk managers, and customer-facing staff fosters creative “cross-pollination,” generating ideas that might not emerge within departmental confines (PwC 2023). Conceptually, repeated exposure to multidisciplinary teamwork embeds collaboration in the organizational ethos.

Capturing lessons learned—through retrospective reports or best-practice case studies—forms an evolving knowledge repository for ongoing reference (McKinsey 2025). Conceptually, this institutional memory prevents reinvention of the wheel, enabling successive waves of transformation to commence from a more advanced starting point. Over time, these documented successes and pitfalls serve as guiding lights for new projects and teams.

One practical approach is to maintain or repurpose existing steering groups even after a major project concludes. These committees continue monitoring key performance indicators (KPIs) and spearhead any necessary refinements, ensuring that accountability remains intact (KPMG 2023). By preserving an oversight mechanism, banks avoid the “out of sight, out of mind” phenomenon that can follow project closeouts.

Designating “transformation champions” in various departments creates a network of advocates who keep cross-functional communication channels open (Smith 2022). Practically, these champions serve as accessible touchpoints for feedback, ensuring that localized challenges or ideas filter up to decision-makers. They also mentor new hires or less-experienced colleagues, spreading institutional knowledge to sustain transformation gains.

Incorporating collaboration metrics—like shared project deliverables or cross-departmental achievements—into performance evaluations and bonus structures ensures that teamwork remains a priority (PwC 2023). Practically, recognizing collaborative accomplishments through spot bonuses, formal awards, or career development opportunities underscores the organization’s commitment to collective success. Employees who facilitate cross-functional efforts see tangible rewards for their contributions.

Regularly updated dashboards showing improvements in service times, cost reductions, or employee engagement help maintain morale and momentum (McKinsey 2025). By making these results visible across the organization, leaders reinforce the positive outcomes of sustained collaboration. Practically, data transparency encourages ongoing involvement and signals that the transformation is an enduring institutional focus, not a fleeting project.

As new technologies like AI, blockchain, or quantum computing mature, governance structures must flex without dismantling existing collaborative norms (Deloitte 2024). Practically, this could involve periodically revisiting team charters and KPIs to integrate advanced tools while preserving organizational coherence. Keeping transformation frameworks nimble ensures that the bank remains future-proof and innovation-ready.

Finally, marking significant achievements—such as exceeding key targets or launching a successful new product—reinforces the benefits of continued engagement. Whether through small ceremonies, peer-nominated awards, or executive acknowledgments, celebrating these wins fosters a sense of collective pride (KPMG 2023). Practically, such recognition also helps teams reflect on the lessons learned, solidifying a cycle of growth and evolution that underpins long-term transformation.

6.9. Conclusion

In conclusion, a bank’s ability to transform hinges on more than just cutting-edge technologies or well-crafted strategies; it depends on how effectively individuals and teams unite around a shared vision. Fostering a spirit of co-creation and transparent communication builds the trust and synergy necessary for long-term success. IT leaders should prioritize inclusive engagement practices and robust collaboration frameworks, ensuring that diverse voices are heard and aligned on common objectives. Now is the moment for IT professionals to transform stakeholder relationships into engines of innovation, catalyzing impactful change that resonates throughout the organization and beyond.

6.9.1. Further Learning with GenAI

These 20 prompts delve into the multifaceted aspects of stakeholder engagement and cross-functional collaboration in banking IT, guiding users through conflict resolution, communication strategies, and cultural transformations essential for sustained success.

Explain how to conduct a comprehensive stakeholder analysis for a major IT transformation in banking, detailing the tools and criteria used to identify roles, influence levels, and interest areas.

Discuss strategies for winning executive sponsorship for cross-functional collaboration, focusing on ROI demonstrations, risk mitigation, and showcasing how collaborative efforts advance the bank’s strategic agenda.

Propose a series of governance structures and cultural interventions that discourage territorial behaviors among departments, fostering a more integrated and collaborative mindset across the bank.

Outline best practices for scaling Agile methodologies—like Scrum or Kanban—beyond pilot projects to enterprise-wide usage, including how to maintain alignment, visibility, and consistent prioritization of tasks.

Provide a roadmap for using design thinking workshops to drive cross-functional innovation, focusing on the planning, facilitation, and outcome integration phases.

Examine the most effective conflict resolution frameworks (e.g., interest-based negotiation, mediation) for situations where banking IT and business teams clash on project scope or resource allocation.

Discuss quantitative and qualitative metrics—like project throughput, knowledge-sharing frequency, team satisfaction—that can reliably indicate whether cross-functional efforts are succeeding in a banking IT context.

Explain how to translate technical jargon into concise, compelling narratives for non-technical stakeholders, such as board members or frontline banking staff, ensuring clarity without oversimplification.

Offer strategies for maintaining consistent stakeholder engagement in a global banking institution, where teams may be spread across multiple time zones and cultures.

Explore how iterative feedback mechanisms—like sprint reviews, demos, and beta releases—can enhance stakeholder alignment and project outcomes in a fast-paced banking environment.

Examine how banks can collaborate effectively with external vendors, fintech startups, and regulators, detailing contract structures, shared risk models, and communication protocols that keep projects on track.

Describe processes and mindset shifts needed for creating a culture where every stakeholder (from executives to end-users) acknowledges their role in an IT transformation’s success or failure.

Discuss the concept of forming specialized, short-term squads of cross-functional experts—often called ‘tiger teams’—to tackle critical issues or high-stakes innovation initiatives. How should they be formed, led, and evaluated?

Analyze how empathy-based techniques, such as user journey mapping and team-building exercises, can break down communication barriers and enhance trust among diverse stakeholder groups.

Detail how integrated collaboration tools (Slack, Microsoft Teams, Jira, Confluence) and real-time dashboards can unify stakeholder communication, reduce friction, and speed up decision-making in banking IT transformations.

Explain the psychological and organizational sources of resistance to change in a banking environment. Propose a structured approach—drawing on models like ADKAR or Kotter’s Steps—to proactively address and minimize pushback.

Discuss how to grant autonomy to cross-functional teams while ensuring they remain aligned with overarching business goals, strategic timelines, and compliance requirements.

Evaluate a notable success story where a bank’s cross-functional collaboration led to a breakthrough solution—such as a new digital product or major operational overhaul—and distill key lessons learned.

Outline methods to involve frontline employees—such as call center agents or branch personnel—in the transformation process, making them advocates rather than reluctant adopters of new systems.

Discuss how to maintain engagement and momentum after the initial euphoria of a project launch has faded, ensuring that new practices, tools, and cultural norms are integrated into the bank’s everyday operations.

By exploring these prompts, IT professionals can unlock advanced insights and actionable methods to cultivate seamless collaboration, secure stakeholder buy-in, and drive transformative impact within their organizations.

6.9.2. Workshop Assignments

These five workshops provide hands-on, real-world scenarios that help IT professionals develop structured methods for stakeholder analysis, conflict resolution, agile collaboration, strategic communication, and measuring collaborative success.

Workshop Assignment 1: Stakeholder Mapping and Engagement Planning

Objective: In this exercise, participants identify all relevant stakeholders for a hypothetical IT transformation (e.g., implementing a new digital lending platform). They then classify each stakeholder group by influence, interest, and preferred communication style. By the end, teams create an actionable engagement plan—outlining communication frequency, messaging angles, and success indicators—to ensure each stakeholder’s needs and concerns are addressed.

Expected Deliverables:

A stakeholder matrix mapping out roles, levels of influence, and interests

A communication and engagement plan tailored to each stakeholder group

A list of potential risks and mitigation strategies related to stakeholder misalignment

Guidance:

Encourage participants to incorporate real examples from their own institutions

Stress the importance of regularly revisiting and updating the stakeholder matrix

Include different communication methods (e.g., executive briefings, town halls, dashboard summaries)

Workshop Assignment 2: Conflict Resolution Simulation

Objective: Through role-play scenarios, participants tackle a hypothetical conflict between IT and operations regarding scope creep and resource allocation in a critical transformation project. Using structured frameworks—like interest-based negotiation—teams practice resolving disputes, aligning objectives, and forging win-win outcomes that maintain project momentum.

Expected Deliverables:

A documented conflict scenario resolution plan

A short debrief on negotiation tactics employed and lessons learned

Proposed process enhancements for preventing similar conflicts in the future

Guidance:

Assign participants specific roles to recreate organizational dynamics

Encourage active listening, empathy, and iterative compromise during negotiations

Prompt reflection on how to embed conflict resolution mechanisms into ongoing governance structures

Workshop Assignment 3: Cross-Functional ‘Sprint’ Collaboration

Objective: Teams assemble in a time-boxed sprint to design a minimal viable product (MVP) for a new customer-facing banking service (e.g., a digital onboarding portal). Comprising various roles—IT developers, compliance specialists, marketing staff—participants practice agile ceremonies like daily stand-ups, sprint reviews, and retrospectives, focusing on continuous feedback and collective ownership.

Expected Deliverables:

A rudimentary MVP or prototype showcasing the proposed banking service

A sprint backlog capturing tasks, priorities, and ownership

A retrospective summary identifying collaboration successes and challenges

Guidance:

Encourage open, rapid communication to mimic a real agile environment

Reinforce the importance of user feedback and pivoting based on new insights

Emphasize shared accountability, discouraging finger-pointing if hurdles arise

Workshop Assignment 4: Communicating Transformation Impact

Objective: Participants craft a multi-tiered communication strategy designed to update executives, middle managers, front-line teams, and customers on a bank-wide IT transformation’s progress. They also create sample materials—like a short video briefing for executives, an FAQ for front-line staff, and a social media teaser for customers—demonstrating the cohesive messaging across different channels.

Expected Deliverables:

A structured communication plan outlining audiences, frequency, and formats

Draft communication assets (e.g., email templates, teaser videos, internal newsletters)

A stakeholder feedback loop strategy ensuring two-way dialogue

Guidance:

Emphasize clarity, consistency, and resonance with each audience’s unique needs

Encourage creativity in format (visual aids, storytelling, success metrics)

Reinforce the value of continuous feedback to refine messaging throughout the transformation lifecycle

Workshop Assignment 5: Measuring Collaboration Success

Objective: Participants develop a balanced scorecard to evaluate the effectiveness of cross-functional collaboration in a banking IT project. By mixing quantitative data (project velocity, defect rates, stakeholder attendance) with qualitative insights (team satisfaction, level of shared responsibility), they build a holistic view of collaboration performance and identify areas for improvement.

Expected Deliverables:

A balanced scorecard incorporating both operational and cultural KPIs

Proposed data collection methods and review intervals (weekly, monthly, quarterly)

A plan for evolving the scorecard over time as project priorities and team dynamics shift

Guidance:

Encourage discussions on the right mix of metric types (leading vs. lagging indicators)

Stress data integrity and the importance of open feedback

Include a pilot phase to validate the scorecard and adjust metrics as needed

By engaging in these immersive exercises, participants will strengthen their ability to foster genuine teamwork, accelerate transformation initiatives, and achieve sustainable, people-driven results in banking IT.

Comments