Chapter 7

‘Navigating the Future: Sustaining Competitive Advantage’

"The banks that flourish tomorrow will be the ones that never stop learning, experimenting, and recalibrating in the face of relentless change." — Oliver Bussmann, Founder of Bussmann Advisory and former CIO at UBS

This final chapter weaves together the themes of continuous learning, innovation, and adaptability, painting a vivid picture of how banks can maintain competitive advantage in an uncertain future. By highlighting emerging technologies like AI, quantum computing, open banking, and cloud-native architectures, the chapter underscores that each wave of disruption demands forward-thinking leadership and robust cultural resilience. Readers learn the importance of sustained momentum—leveraging agile frameworks, fostering collaborative ecosystems, and measuring “future readiness” as diligently as current performance. In doing so, the chapter provides a blueprint for not merely surviving but thriving in the next era of banking.

7.1. AI’s Evolution from Narrow to AGI and ASI

Current developments in artificial intelligence (AI) have propelled banks well beyond simple rule-based automation or predictive analytics. While most AI applications in banking today remain “narrow”—focused on tasks such as fraud detection or credit scoring—technological progress points toward more advanced forms, including Artificial General Intelligence (AGI) and, in speculative futurism, Artificial Superintelligence (ASI). This section explores the philosophical implications of AI’s expanding capabilities, the conceptual frameworks for applying these evolutions within banking, and practical measures banks can adopt to harness AI responsibly and effectively.

Philosophically, narrow AI systems provide efficiency gains by excelling at well-defined tasks, such as anomaly detection or automated underwriting (Lee 2023). As AI progresses toward AGI—able to reason, learn, and adapt across multiple domains—banks may find themselves reshaping entire business models around these more versatile systems. This shift brings not only technological challenges but also fundamental questions about trust, interpretability, and responsibility for AI-driven decisions.

While AGI or the hypothetical ASI might unlock unparalleled analytical power, they also raise moral concerns related to transparency, fairness, and potential disruptions to employment (McKinsey 2022). Philosophically, responsible AI deployment in banking must prioritize accountability, data privacy, and equitable treatment of customers. As AI capabilities expand, banks carry a moral duty to ensure these advanced systems do not amplify biases or destabilize financial markets.

Even as AI systems become increasingly autonomous, the human element in banking—trust, empathy, and complex judgment—remains crucial (Deloitte 2024). Philosophically, the advent of AGI challenges institutions to redefine the complementary roles of AI and human professionals. Done well, advanced AI can augment human expertise, freeing staff to focus on higher-value interpersonal or strategic tasks. However, banks must carefully orchestrate these shifts to preserve the customer experience and workforce morale.

Speculation around ASI—where machine intellect surpasses even AGI—sparks debate on existential risks and regulatory guardrails. In banking, philosophical foresight involves more than immediate ROI; it demands anticipating disruptive scenarios and shaping an AI-driven financial ecosystem that upholds public trust (PwC 2023). By embracing ethical design principles and long-term governance strategies, banks can lead responsibly in charting AI’s transformative potential.

Conceptually, narrow AI excels at discrete tasks: anti-money laundering alerts, real-time risk monitoring, or personalized customer recommendations (KPMG 2025). These domain-specific applications have become integral to modern banking, driving operational improvements and data-driven decision-making. However, scalability often remains limited by the siloed nature of narrow AI models, making cross-departmental or ecosystem-wide integration challenging.

As AI systems evolve to handle multiple tasks and domains simultaneously, banks can explore more holistic transformation initiatives. An AGI-like engine might coordinate investment advice, orchestrate complex compliance scenarios, or dynamically optimize branch operations, all within a unified framework (Lee 2023). Conceptually, this transition involves breaking down departmental barriers, fostering data interoperability, and adopting agile governance models that adapt AI-driven insights in real time.

Figure 1: Example of value creation frameworkf for AI in Bank (Source - McKinsey).

In a future where AI can analyze unstructured data, interpret shifting regulations, and even forecast economic downturns with high fidelity, risk models become more predictive and context-aware. Conceptually, AGI-enabled banking could facilitate near-instant credit decisions, proactive fraud prevention, and adaptive portfolio strategies (McKinsey 2022). Yet, heightened capabilities also call for advanced oversight—risk teams must ensure AI-driven conclusions are transparent, auditable, and ethically sound.

While full ASI remains speculative, conceptually preparing for a paradigm where machine intelligence vastly outstrips human cognition encourages robust scenario planning (KPMG 2025). This might involve forming cross-industry alliances to set safety standards or investing in AI interpretability research to guard against black-box behaviors. Though distant, planning for potential ASI disruptions aligns banking with a forward-thinking posture that mitigates existential surprises.

Incrementally testing advanced machine learning models in domains that extend beyond narrow AI, such as portfolio optimization or sophisticated chatbots that adapt to customer nuances, proves essential for responsible innovation. Establishing controlled sandbox environments staffed by cross-functional teams—data scientists, compliance officers, and business analysts—allows for thorough validation of these emerging technologies. By detecting integration challenges, data biases, or security vulnerabilities early, banks can scale more generalized AI solutions responsibly and confidently (Deloitte 2024).

Embedding AI ethics committees and specialized oversight boards into the organizational structure helps strike a balance between innovation and risk controls. Clear guidelines for data usage and model explainability, alongside defined escalation channels for AI-driven decisions that conflict with human judgments, create a governance framework that matures as AI capabilities advance. Such an adaptable system ensures the institution maintains both accountability and agility when confronted with potential breakthroughs in AGI (PwC 2023).

Cultivating a workforce that possesses hybrid competencies in data science, regulatory compliance, and human-centered design is paramount for successfully navigating AI’s next evolutionary phase. Offering specialized training programs, hosting internal hackathons, and forging partnerships with academic research labs keep staff attuned to cutting-edge methodologies (Lee 2023). With these skills, teams can leverage high-level AI while transforming traditional silos into collaborative environments where human insight and advanced algorithms seamlessly intersect.

Incorporating AI lifecycle management—encompassing data ingestion, model training, deployment, and performance monitoring—into existing DevOps or MLOps practices fosters continual improvement. Regular audits of model outcomes and fairness, accompanied by retraining triggers when anomalies or biases emerge, preserve trust and accountability. Through such mature AI engineering practices, organizations sustain credibility and readiness, even as models approach or exceed human-level cognitive tasks (McKinsey 2022).

Routine tabletop exercises and future scenario simulations offer valuable insights into the operational impact of highly autonomous AI, including hypothetical ASI scenarios. Collaboration among risk, strategy, and IT teams positions banks to address issues of business continuity, ethics, and global regulatory conditions. By developing a roadmap that merges near-term AI deployment with long-term safeguards, institutions minimize existential threats and harness the benefits of advanced intelligence for strategic advantage.

7.2. Future-Ready Technologies

Achieving sustainable competitive advantage in banking requires adopting technologies that may currently appear on the fringe yet are poised to transform the industry. As regulatory demands, customer expectations, and fintech innovations continue to evolve, institutions capable of integrating quantum solutions, open banking frameworks, and cloud-native approaches can set themselves apart. This section explores the philosophical justification for embracing these emerging fronts, delineates their conceptual implications for banking operations and customer journeys, and offers practical strategies for pilot projects, partnerships, and organizational readiness.

In an era marked by rapid digital disruption, forward-leaning banks that treat quantum computing, open banking, and cloud-native architectures as imminent realities stand to capture significant competitive advantages (KPMG 2023). Philosophically, prioritizing these technologies before they become mainstream fosters a mindset of active exploration. Rather than waiting for industry-wide adoption to force hurried adaptations, proactive institutions continuously refine their competencies in cryptography, data sharing, and agile development.

Modern financial services require more than technological upgrades. They demand an adaptive culture poised to shift operational norms whenever market signals or breakthroughs in innovation suggest the need (Deloitte 2024). By acknowledging that the pace of technology will only accelerate, banks instill in their workforce a readiness to pivot, experiment, and abandon outdated processes. Philosophically, this perspective counters complacency, ensuring that the institution remains perennially open to new methodologies and paradigms.

What begins as cutting-edge typically becomes tomorrow’s standard. Quantum-safe encryption, for example, may appear niche today but could soon be mandated by regulators concerned about emerging cybersecurity threats (Johnson 2022). Philosophically, a dedication to future-proofing allows banks to transition smoothly into new compliance regimes and customer expectations. When institutions are already versed in advanced technologies, their transformations are measured and strategic rather than abrupt and reactive.

Quantum breakthroughs in risk modeling, open APIs bridging multiple institutions, and cloud deployments that accelerate development cycles are not isolated trends; they influence the entire global financial ecosystem (PwC 2023). Viewing these changes as collaborative opportunities—rather than zero-sum disruptions—positions banks to help shape shared standards, ethical protocols, and robust best practices. Philosophically, this broadened lens transforms financial institutions into co-creators of the future of banking, rather than passive participants.

Figure 2: Value of quantum computing use cases in Banking at $622B in 2025 (Source: McKinsey).

Quantum computing’s capacity for parallel processing has the potential to radically enhance data encryption, risk analytics, and real-time fraud detection. By implementing quantum-safe algorithms, banks can proactively shield themselves from emerging cybersecurity threats, thus staying ahead in safeguarding sensitive financial data (McKinsey 2025). On the customer front, near-instant loan approvals and more sophisticated portfolio recommendations become feasible through intricate computations performed at previously unachievable speeds, providing early adopters with a notable differentiator. Competitively, institutions that embrace quantum solutions sooner can establish higher standards for trust and performance, compelling slower-moving rivals to scramble for compliance in quantum security, risk, and performance metrics.

Open banking allows institutions to offer APIs that facilitate collaboration with fintech startups and other banks, enabling expanded product ranges—from consolidated account dashboards to integrated payment gateways (KPMG 2023). This ecosystem-based model cuts down on internal overhead and stimulates faster product innovation cycles. For customers, open banking paves the way for frictionless financial journeys, including quick cross-bank transfers, unified account overviews, and personalized product suggestions derived from aggregated data. As a result, brand loyalty and singular product strategies are no longer sufficient; banks must nurture powerful partner networks and carve out distinct value propositions to remain competitive in a transparent, interlinked financial environment.

The shift from monolithic systems to containerized, microservices-driven architectures underpins continuous integration and delivery (CI/CD), facilitating swift feature rollouts and real-time scalability (Deloitte 2024). For customers, these frequent and seamless updates translate into stable digital platforms that incorporate new functionalities at a pace comparable to digital-native market players. In terms of competitive dynamics, cloud-native development lowers traditional entry barriers and grants smaller or mid-sized institutions the agility to rival established banks. As speed and feature variety emerge as crucial differentiators, cloud-powered agility positions banks to capture greater market share and enhance customer loyalty.

Where quantum computing meets open banking and cloud-native architectures, banks can harness powerful synergies—quantum-safe data sharing across open APIs, for example, or quantum-inspired algorithms deployed in flexible, containerized environments (PwC 2023). Integrating these areas effectively demands robust oversight and a willingness to experiment with modular, composable infrastructures that can adapt to rapidly evolving standards.

Testing quantum-safe encryption protocols on selected customer transactions or applying quantum-inspired algorithms for credit risk analysis can lay the groundwork for broader quantum adoption. Collaborating with academic research hubs or specialized vendors that provide quantum simulation environments ensures secure, controlled experimentation (Johnson 2022). Successful pilot outcomes in risk modeling accuracy or cryptographic strength validate quantum-focused initiatives, positioning the bank to scale those solutions as hardware and skillsets mature.

Launching joint products through rigorously governed APIs facilitates integrated solutions such as digital wallets, budgeting tools, or investment platforms. Establishing sandbox environments allows fintech collaborators to access anonymized datasets under strict security, authentication, and rate-limit conditions (KPMG 2023). This approach fosters rapid prototyping, boosts customer engagement, and diversifies revenue streams, potentially through revenue-sharing agreements that benefit both the bank and its innovation partners.

Incrementally migrating legacy modules like payments or loan origination to container-based or serverless platforms enables modernization without jeopardizing critical operations. Embracing DevOps methodologies, including infrastructure-as-code, CI/CD pipelines, and microservices principles, bolsters both resilience and scalability (Deloitte 2024). The end result is faster deployment cycles, fewer operational disruptions, and an infrastructure that easily adapts to fluctuating customer demands or new product introductions.

Balancing accelerated innovation with stringent risk oversight can be achieved by establishing integrated steering committees or “fusion centers.” Developing an agile governance framework that connects transformation teams, enterprise architects, and compliance or risk units streamlines approvals yet preserves institutional stability (PwC 2023). This setup creates a nimble but systematic environment that prevents siloed efforts, coordinates technology strategy at the enterprise level, and fosters impactful pilot programs.

Strengthening internal competencies through specialized certifications—like quantum-safe cryptography—along with training in open API management or container orchestration, can significantly enhance organizational agility. Conducting hackathons or vendor-led workshops that blend theory with practical lab sessions ensures staff can quickly apply newfound insights (McKinsey 2025). This investment in workforce development reduces dependence on external vendors and cultivates a core group of innovators capable of guiding the bank’s evolving tech strategy.

Establishing key performance indicators (KPIs) around deployment frequency, cost efficiency, or the adoption rates of quantum-related functions and open banking APIs provides clear benchmarks for pilot project evaluations. A real-time dashboard can track these indicators, with monthly or quarterly reviews used to reassess ROI and user satisfaction. Such data-driven oversight informs strategic decisions on expanding promising trials, recalibrating underperforming ventures, and shaping a culture of continuous technological refinement and progress.

7.3. Competitive Differentiators for the Next Era of Banking

The trajectory of modern banking suggests that merely improving technical systems or releasing new products will not guarantee long-term viability. As the industry grapples with intensifying competition—both from established peers and agile fintechs—banks must cultivate differentiators that are both deeply rooted in customer-centric thinking and resilient enough to weather ongoing disruptions. This section explores the philosophical grounding of true competitive advantage, identifies emerging differentiators such as hyper-personalization and data-driven intelligence, and offers practical frameworks for rapid product development, strategic alliances, and organizational transformation.

A genuinely holistic view of competitive edge in banking recognizes that the ability to pivot quickly, engage customers meaningfully, and foster a workforce adept at change ultimately secures an institution’s relevance. While leading banks may adopt state-of-the-art technologies or launch inventive financial products, these efforts fall short if not supported by cultural buy-in and organizational adaptability (Deloitte 2023). In a world where regulatory shifts and global economic uncertainties can render once-viable strategies obsolete, agility becomes a philosophical cornerstone. Success is thus measured not only in profit margins but also in how effectively banks empathize with evolving customer needs—from digital convenience and swift resolutions to transparent fee structures and ethical lending.

A customer-centric orientation has emerged as a moral and economic imperative for banks seeking loyalty and trust in a crowded market. Serving clients goes beyond product sales or cross-selling; it entails a deep understanding of customer pain points, life goals, and financial aspirations (Smith 2022). Operationalizing this philosophy means embedding customers’ perspectives into every aspect of banking, from user interface designs and chatbot interactions to risk models and staff training programs. When organizations adopt such a perspective, they naturally align their growth ambitions with clients’ well-being, creating mutually reinforcing outcomes.

Cultural resilience is the internal shield that sustains an organization against sudden disruptions, whether triggered by crises like cybersecurity breaches, regulatory upheavals, or macroeconomic shifts (KPMG 2024). By investing in continuous learning, encouraging open communication, and normalizing proactive change management, banks cultivate a workforce that views uncertainty as an opportunity for evolution rather than a threat. This openness to experimentation—supporting small pilots, cross-functional teams, and transparent leadership engagement—underpins the cultural fluidity needed to integrate emergent technologies and strategies. In effect, a forward-thinking, adaptable culture extends beyond individual transformation projects and becomes part of the bank’s DNA.

Hyper-personalization has grown from a marketing buzzword into a tangible, data-driven strategy. Banks can now leverage machine learning algorithms and advanced analytics to tailor services—ranging from individualized mortgage rates to custom savings plans—based on real-time behavior or historical trends (PwC 2023). This approach not only engages existing customers on a deeper level but also appeals to younger, tech-savvy demographics who expect financial services to mirror the personalization they enjoy in e-commerce or streaming platforms. Ultimately, hyper-personalization fosters loyalty by demonstrating an understanding of each customer’s unique context.

Data-driven insights represent another key differentiator, with predictive and prescriptive analytics providing a foundation for more precise underwriting, fraud detection, and risk assessments. The sheer volume of transactional and behavioral data banks accumulate presents a significant competitive advantage—if properly harnessed. Managing big data responsibly, however, requires a robust governance framework that addresses privacy, compliance, and ethical considerations (McKinsey 2025). When banks successfully convert data into strategic intelligence, they can refine products or services at a pace unattainable by competitors reluctant to embrace analytics-driven transformation.

Ecosystem partnerships—often exemplified by open banking initiatives—offer significant potential to reshape traditional business models. By sharing APIs with fintechs or forging alliances with big tech providers, banks can co-create integrated solutions that enrich customer experiences (KPMG 2024). For example, digital wallets, robo-advisory platforms, and lifestyle apps that seamlessly incorporate banking functions underscore how collaborative ecosystems reduce operational overhead while expanding service diversity. In this era of heightened customer expectations, such partnerships can help banks transition from product-centric silos to broader “bank-as-a-platform” models.

Customer-centric innovation stands at the intersection of technology, design thinking, and user experience research. Rapid iterations on features like voice authentication, simplified mobile interfaces, and frictionless payment methods can significantly differentiate one bank from another. While these innovations rely on agile development and technical excellence, they also hinge on grounding every new feature in solving genuine user challenges rather than pursuing technology upgrades for their own sake (Smith 2022). When customer insights guide innovation roadmaps, banks consistently release solutions that resonate with market demands.

Finally, resilience and sustainability have emerged as crucial differentiators, especially in a global context sensitive to environmental, social, and governance (ESG) concerns. By proactively managing climate risks, adhering to strict compliance standards, and committing to responsible lending, banks can attract ethically minded investors and customers (PwC 2023). Strengthening resilience extends beyond operational uptime or disaster recovery; it encompasses robust scenario planning for various technological or economic shifts, ensuring that essential financial services remain stable even under extreme circumstances.

Banks looking to translate these differentiators into measurable outcomes can employ an array of practical frameworks. Rapid product development, for instance, leans heavily on agile or DevOps approaches where minimal viable products (MVPs) are trialed in controlled environments and refined through continuous feedback. Pilot launches in regulatory sandboxes enable banks to test compliance boundaries without exposing the broader organization to unacceptable risk (Deloitte 2023). This systematic approach to experimentation fosters a culture where innovation is iterative, transparent, and adaptable.

Data analytics maturity models help financial institutions evolve from basic descriptive analytics to advanced predictive and prescriptive capabilities. Initially, banks can focus on improving data quality, establishing enterprise-wide governance, and building foundational reporting. Over time, they can integrate more sophisticated machine learning techniques—enabling real-time risk assessments or hyper-personalized customer journeys (McKinsey 2025). A structured path for analytics maturity not only delivers immediate ROI but also positions the bank to capitalize on emerging AI developments.

Collaborations with fintechs or technology giants can significantly broaden a bank’s product portfolio and reach. Successful alliances demand clear governance frameworks covering everything from intellectual property rights to shared compliance responsibilities. Developing integration blueprints—like standardized API specifications—ensures that external solutions align seamlessly with core banking systems (KPMG 2024). These partnerships yield co-created offerings that meet niche customer needs while distributing development costs and risks across multiple stakeholders.

To maintain strategic coherence, banks can adopt structured portfolio management, maintaining a transparent pipeline of conceptual, pilot, and scaling initiatives. Measurable KPIs—such as time-to-market for new features or net promoter scores (NPS) tracking customer satisfaction—offer insight into how effectively the institution is innovating relative to market demands (PwC 2023). Equally vital is the cultivation of talent. Continuous learning programs and training in analytics, cloud technologies, or user experience design can strengthen teams tasked with executing an evolving set of transformation projects (Smith 2022).

Finally, a proactive stance on resilience ensures that new differentiators do not falter under stress. Regular drills test system capacities for handling surges in transaction volumes or cyberattacks, minimizing vulnerabilities (Deloitte 2023). Scenario planning helps leaders anticipate how quantum computing, digital currencies, or other radical shifts might alter the competitive landscape. By cultivating a forward-leaning posture, banks remain prepared for developments that may swiftly redefine what “competitive differentiator” means.

7.4. The Role of Leadership and Organizational Culture

Technological breakthroughs—from AI to quantum computing—represent only one facet of the transformative potential in banking. Lasting change demands forward-looking leadership and an organizational culture capable of assimilating, adapting, and capitalizing on these innovations. This section illuminates the philosophical necessity of leadership as the guiding force behind technology integration, outlines core conceptual attributes of effective leadership in finance, and suggests practical methods to nurture a culture of continuous innovation and ethical responsibility.

Although banks may invest heavily in advanced platforms—ranging from blockchain-based settlement systems to quantum-safe cryptography—these solutions deliver limited value without visionary leaders who integrate new capabilities into cohesive strategies (Deloitte 2024). Philosophically, technology should serve as a catalyst rather than the end goal, with leadership providing the narrative and organizational will to harness these tools for sustainable growth and market relevance.

Even in a digitized era, human judgment and creativity remain central to strategic decisions and customer relationships (KPMG 2023). Leadership, therefore, must champion the role of people as the ultimate arbiters of innovation. When employees feel valued, informed, and aligned with the bank’s mission, they can translate emerging technologies into customer-driven solutions—strengthening trust and loyalty in a competitive landscape.

A successful transformation cannot be a one-off project with a definitive end date (McKinsey 2025). Forward-thinking leaders embed adaptability deep within the organizational DNA, championing feedback loops, pilot projects, and iterative learning. Philosophically, they nurture an environment in which every department expects ongoing change and collectively refines processes and offerings over time.

Finally, leadership must uphold moral imperatives—such as data privacy, financial inclusion, and responsible lending—especially as technology magnifies the bank’s impact (Smith 2022). As new tools streamline processes or enable novel services, leadership must guide the institution toward ethical deployments. This approach not only builds societal trust but also mitigates reputational risks, ensuring cutting-edge innovations enhance rather than undermine stakeholder confidence.

Leaders who articulate ambitious goals and connect them to transformative action motivate teams across business lines (Deloitte 2024). By clearly expressing how, for instance, AI-driven underwriting will redefine customer experience, leadership keeps the collective pursuit focused on meaningful outcomes rather than ad-hoc technological upgrades. Conceptually, a unified vision aligns departmental efforts and surfaces synergy opportunities between diverse teams.

In banking, prudent risk management is foundational. Yet leadership must also embrace experimentation—authorizing pilot programs, R&D allocations, or minimal viable products (MVPs) that push boundaries (KPMG 2023). Conceptually, balancing caution with exploration means establishing guardrails—such as budgetary limits and regulatory check-ins—while supporting innovation in safer, contained environments (e.g., sandboxes).

Empathetic leaders actively solicit employee feedback, conduct regular user experience research, and remain attuned to shifting societal expectations (Smith 2022). This empathetic approach fosters collaboration, breaking silos and engendering trust among employees, partners, and customers. Conceptually, empathy drives user-centric design, ensuring that the bank’s innovations genuinely solve real-world problems.

Because market dynamics can shift rapidly, successful leaders practice agile governance—responding to macroeconomic changes, new regulations, or unexpected competitor moves through flexible resource allocation (McKinsey 2025). Conceptually, iterative review processes, short planning cycles, and data-driven insights foster quick pivots. By systematically monitoring performance metrics, leadership can identify underperforming initiatives and reallocate talent or budget accordingly.

Ultimately, leadership must cement a culture that continually pursues operational excellence, cross-departmental synergy, and data-backed experimentation (Deloitte 2024). Conceptually, this culture is the bedrock that allows even the most innovative strategies to flourish, as employees at every level understand the importance of ongoing learning and collaboration in achieving competitive differentiation.

A structured curriculum that includes workshops on agile project management, scenario planning, design thinking, and compliance equips leaders to meet emerging challenges with confidence (KPMG 2023). Offering rotational programs that place rising managers in different departments—IT, operations, and product development—broadens their perspective on cross-functional dynamics and prepares them to spearhead integrated transformation initiatives.

Partnering emerging leaders with experienced mentors who have navigated significant organizational change provides practical insights into overcoming internal resistance (Smith 2022). Through such real-world guidance, mentees learn to champion pilot projects, refine risk mitigation strategies, and secure employee buy-in, all while cultivating a more resilient and forward-thinking leadership style.

Building collaboration into performance metrics—such as bonuses or promotions tied to cross-departmental product launches—highlights the institution’s commitment to collective achievement (McKinsey 2025). Publicly acknowledging teams that excel in user-centric innovation or cost-saving process optimizations further reinforces positive behaviors, fostering an environment where knowledge-sharing and continuous improvement become the norm.

Structured gatherings that bring together executive and middle-management figures create essential platforms for exchanging best practices, debating market trends, and revisiting portfolio priorities (Deloitte 2024). Maintaining ongoing dialogue across leadership levels aligns strategic objectives and allows for timely recalibrations in response to shifting conditions—a crucial capability for sustaining competitive edge.

Focused onboarding processes underscore the bank’s culture of perpetual adaptation, clarifying how each role contributes to customer-centric innovation (KPMG 2023). Supplementing these orientations with follow-up trainings helps prevent outdated thinking from reemerging, reinforcing the institution’s pledge to agile, ethically driven evolution at every level of the organization.

Implementing 360-degree feedback systems that gather input from subordinates, colleagues, and superiors reveals how leadership styles influence employee engagement, collaborative dynamics, and operational results. These data-driven insights guide further development programs, succession planning, and targeted support for departments slow to adopt innovative mindsets—ensuring leadership remains a driving force behind sustainable transformation.

7.5. Sustaining the Transformation Momentum

As banks navigate digital, regulatory, and competitive pressures, the most successful institutions view transformation not as a one-time endeavor, but as an ongoing commitment. Regardless of how innovative a newly launched initiative may be, it must be regularly evaluated, refined, and expanded to keep pace with emerging trends and shifting customer expectations. This section delves into the philosophical conviction that transformation is an unending journey, the conceptual models that embed continuous improvement, and the practical measures banks can adopt to sustain and scale their progress over time.

Philosophically, true transformation in banking extends beyond finite project timelines and deliverables; it represents a sustained shift in culture, operations, and strategic thinking (Deloitte 2024). By recognizing that change is perpetual, banks empower teams to proactively seek efficiencies, explore new technologies, and adapt to evolving regulatory landscapes. In this mindset, the completion of one initiative is simply the catalyst for the next wave of innovation.

Rolling out an enhanced digital product or automating select processes can yield immediate wins, but such efforts risk becoming one-off successes unless anchored by a deeper, organization-wide ethos of continuous improvement (PwC 2025). Philosophically, banking leaders must treat each successful project as a foundation for further refinement, motivating teams to stay alert to market shifts and customer feedback rather than pausing once initial objectives are met.

When employees perceive transformation as a never-ending or poorly structured endeavor, engagement can dwindle. Highlighting each initiative’s purpose—be it boosting customer satisfaction, enhancing compliance, or improving operational efficiency—ensures people see tangible benefits and maintain enthusiasm (KPMG 2023). Celebrating milestones, however incremental, helps balance the relentless pace of change with moments of collective achievement.

Banks serve as custodians of public trust; continuous adaptation aligns with the moral obligation to safeguard financial well-being and uphold societal confidence. By embracing an ever-evolving model of transformation, institutions demonstrate foresight, integrity, and commitment to meeting community needs in the face of economic, regulatory, or technological volatility (Smith 2022). This ethos transcends corporate initiatives and reflects an enduring responsibility toward customers and stakeholders.

Retrospectives conducted after project milestones or system upgrades capture both quantitative and qualitative lessons, ensuring that successes are repeatable and mistakes are not repeated (Morgan 2021). Conceptually, these forums solicit feedback from cross-functional teams—including IT, compliance, and front-line staff—to form a holistic understanding of what worked and where improvement is needed. By documenting and sharing these insights, banks foster institutional learning rather than allowing critical knowledge to vanish once initiatives end.

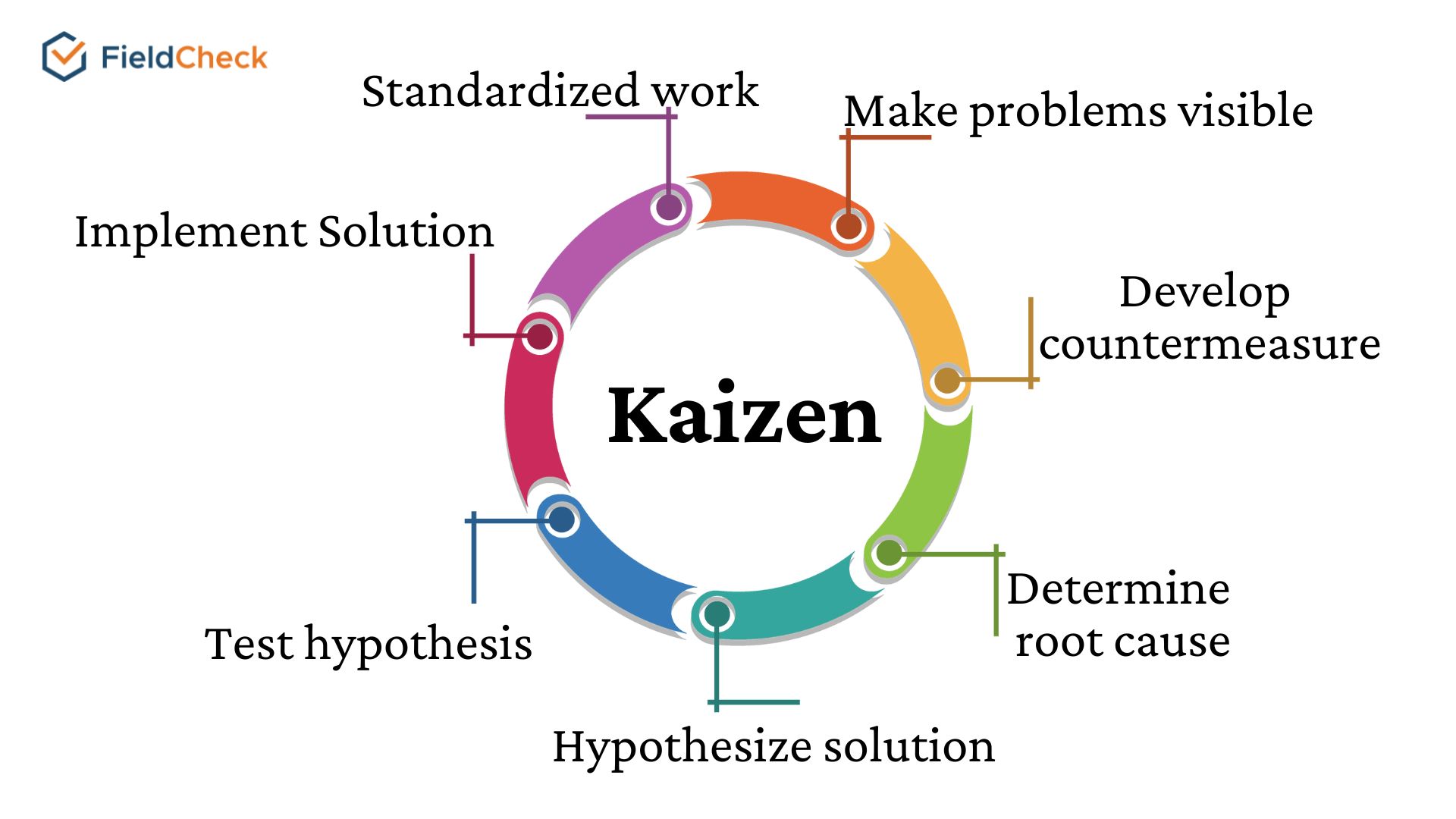

Figure 3: Kaizen framework for continuous improvement.

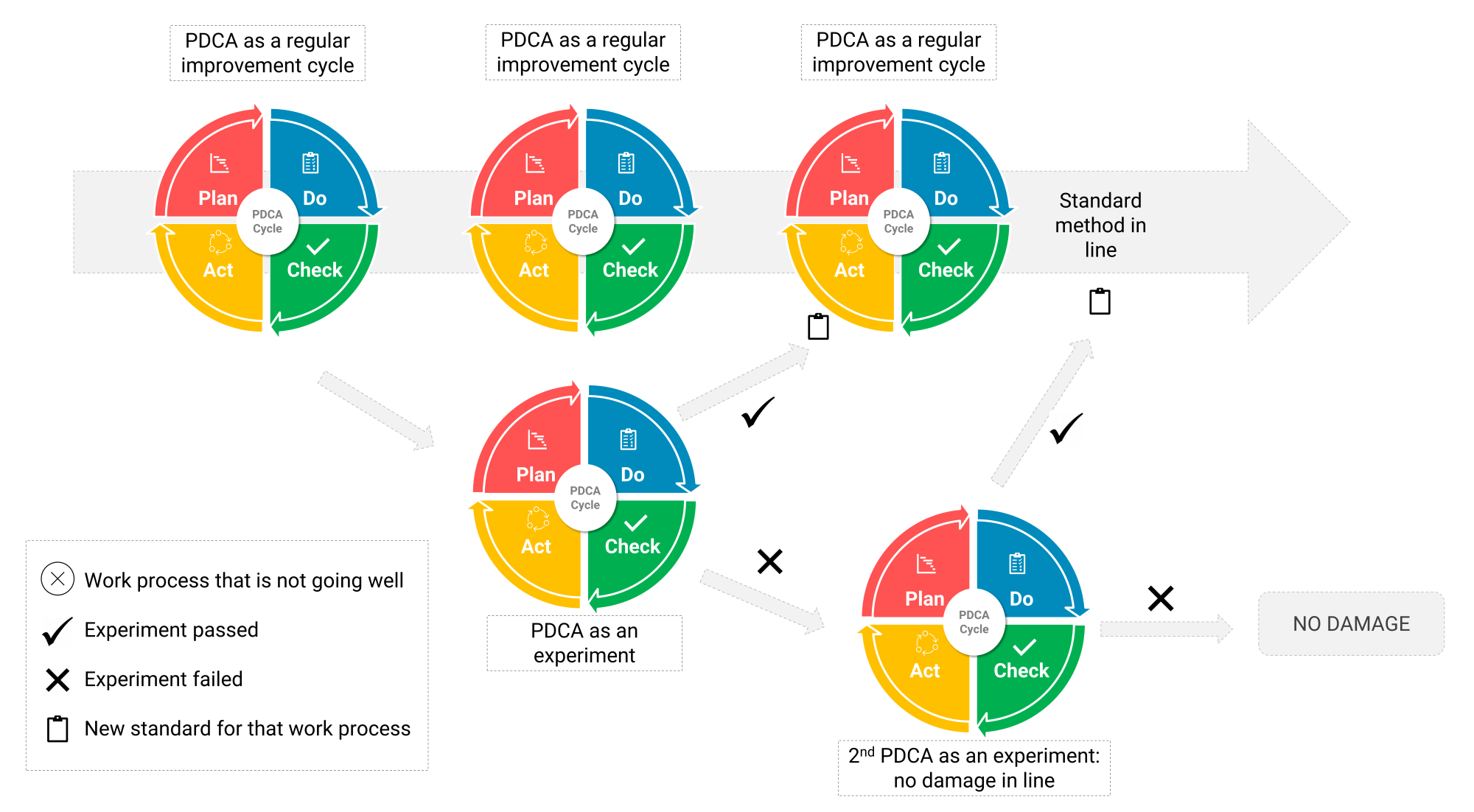

Models like Kaizen and PDCA (Plan–Do–Check–Act) emphasize iterative enhancements to processes and products (PwC 2025). When embedded into daily operations, these frameworks encourage employees to seek marginal gains—such as refining an onboarding script or optimizing system latency. Over time, incremental wins accumulate into major benefits, raising service quality and operational efficiency.

Simply collecting feedback does little unless insights are operationalized. Conceptually, storing lessons in a centralized repository accessible to all departments helps each project team build on its predecessors’ experiences (Deloitte 2024). In this way, an idea validated in one digital product can inform improvements in another line of business, reducing duplication and fostering a culture of cross-pollination.

While Kaizen or PDCA cycles focus on incremental gains, banks also need channels for more disruptive, breakthrough innovations—such as adopting quantum-safe cryptography or launching open banking alliances (Smith 2022). Conceptually, an integrated approach that supports both continuous optimization and significant leaps forward ensures the institution avoids stagnation or undue risk aversion. By carving out “innovation labs” or specialized teams for high-risk projects, organizations encourage forward-thinking breakthroughs to coexist alongside day-to-day refinements.

Figure 4: PDCA (Plan-Do-Act-Check) framework for continuous improvement.

A transformation office or cross-functional steering committee can monitor progress, review key performance indicators (KPIs), and reallocate resources in response to market changes. By conducting monthly or quarterly checkpoints, leadership stays informed about whether initiatives are meeting targets (KPMG 2023). When these committees detect issues—like slower-than-anticipated customer adoption—they can swiftly adjust strategies or escalate concerns to the relevant stakeholders.

As emerging technologies (e.g., advanced DevOps toolchains or API-based partnerships) come to the fore, existing project management or vendor engagement models may need revision. Through iterative review sessions, banks can assess whether current frameworks remain effective or require adaptation (Morgan 2021). This agile approach ensures alignment with industry best practices and positions the institution to capitalize on breakthroughs such as AI-driven analytics or real-time regulatory reporting.

Maintaining the momentum of transformation calls for ongoing investment in cutting-edge solutions and pilot programs. Once a new system stabilizes or a process reaches maturity, resources and leadership attention should pivot toward fresh exploratory projects—be they blockchain-based settlement platforms or contextual banking features (Deloitte 2024). By reserving dedicated funds and R&D teams for these ventures, banks build a robust pipeline of potential disruptors rather than resting on their accomplishments.

A balanced scorecard remains crucial for tracking both operational performance (time-to-market, error rates) and cultural or employee engagement metrics (PwC 2025). Real-time dashboards highlight emerging risks, including declines in morale or dips in utilization of newly introduced services. By intervening promptly—such as reallocating budgets or offering specialized training—banks can course-correct small setbacks before they escalate.

Regularly sharing updates via newsletters, internal social channels, or town halls helps publicize milestones, promote learnings, and reaffirm strategic objectives. Demonstrated benefits—like enhanced customer satisfaction or reduced operational expenditures—reinforce employee support (Smith 2022). Public acknowledgment of teams that spearhead continuous improvement fosters a sense of collective pride and healthy competition.

Finally, incentivizing employees who champion efficiency gains, novel customer experiences, or cost reductions sustains momentum and nurtures enduring change. This may include formal commendations during leadership forums, dedicated budgets for pilot initiatives, or career development opportunities (KPMG 2023). Over time, these measures establish an organizational ethos of constant evolution, wherein personnel at every level feel empowered to contribute to the bank’s future trajectory.

7.6. Future-Proofing Through Regulatory and Risk Management

Regulatory shifts and risk mitigation are often seen as constraints in the banking sector—necessary safeguards that can hinder agility and innovation. Yet, when approached as strategic levers, these elements can fuel competitive advantage, shaping industry norms and accelerating a bank’s ability to introduce new products and services with confidence. This section examines the philosophical rationale for treating compliance and risk management as catalysts for progress, outlines conceptual structures that integrate regulatory roadmaps with innovation pipelines, and concludes with practical measures to future-proof banks against evolving mandates and market realities.

Philosophically, viewing regulations and compliance demands—such as open banking directives or data protection rules—not merely as burdens but as opportunities can reframe a bank’s internal dialogue. Rather than scrambling to meet mandates, institutions can leverage these requirements to enhance customer transparency, reinforce trust, and build loyalty (Deloitte 2024). By proactively embracing compliance standards, banks can also diversify offerings, expand into new markets, and differentiate themselves in a crowded landscape.

A healthy respect for risk management underpins robust strategic planning. Early identification of potential vulnerabilities—be they cybersecurity threats or liquidity concerns—enables firms to pivot and explore innovative solutions without fear of hidden liabilities (KPMG 2023). Philosophically, risk awareness serves as an engine of foresight, empowering leadership teams to pursue breakthroughs while maintaining a stable foundation. This balance of prudence and ambition fosters confidence in new ventures, be it AI-driven lending or complex capital market products.

Because banking activities fundamentally shape economies and individual lives, compliance with ethical and regulatory standards extends beyond a technical exercise. Philosophically, institutions carry a moral obligation to ensure financial stability and protect the public’s well-being (Johnson 2022). Upholding robust compliance practices and strong risk governance signals integrity, forging a deeper bond of trust with clients, regulators, and the broader community—a trust that can translate into reputational and competitive advantages.

By anticipating and preparing for regulations—such as revised Basel requirements or data protection updates—banks can position themselves as thought leaders and first movers (McKinsey 2025). Philosophically, this proactive approach transforms compliance from a defensive posture into a core strategic pillar. Institutions that deftly navigate regulatory changes or even help shape forthcoming policies can gain industry-wide credibility, attract partnerships, and secure early access to market segments or product innovations.

Conceptually, banks should synchronize compliance timelines with innovation lifecycles. For instance, while developing an AI-driven underwriting platform, the institution must simultaneously ensure data privacy standards and anti-discrimination guidelines are met (PwC 2023). Aligning these tracks prevents costly rework when products fail to meet regulatory thresholds. Cross-functional teams that include risk, legal, and technology specialists can steer projects from ideation to launch, spotting conflicts or gaps early.

Adopting a compliance-by-design ethos parallels common security-by-design practices, embedding requirements such as Know Your Customer (KYC), Anti-Money Laundering (AML), and data encryption directly into solution architectures (Deloitte 2024). This conceptual model ensures regulatory considerations are addressed at each development milestone—requirements gathering, prototyping, testing—rather than appended at project’s end. Early integration mitigates last-minute hurdles and expedites time-to-market.

Regulations often evolve in response to emerging technologies or shifting economic conditions. Conceptually, maintaining close watch on regulatory consultations and potential legislative changes gives banks time to adapt and even influence outcomes. By participating in industry coalitions or think tanks, institutions can lobby for practical guidelines and shape frameworks that accommodate both innovation and consumer safeguards (KPMG 2023). Such proactive positioning reduces the risk of disruptive compliance deadlines.

When new mandates emerge, thorough cost-benefit analyses illuminate whether compliance investments might yield operational efficiencies or unlock new revenue channels. For instance, capital requirement changes could incentivize banks to diversify their product mix or engage in strategic partnerships (Johnson 2022). Conceptually, these assessments inform leadership decisions on resource deployment—whether to accelerate certain pilot programs or form alliances to share compliance overheads.

In practice, a governance model that ties compliance councils to innovation steering committees keeps the entire organization aligned. Conceptually, this dual structure monitors evolving rules, provides risk updates, and guides project teams through formal sign-offs. By jointly overseeing both compliance mandates and innovation agendas, governance bodies prevent a scenario where novel ideas outpace the regulatory safety net, or conversely, where rigid adherence to older rules stifles progress (McKinsey 2025).

With advancements in automation, data analytics, and AI-based anomaly detection, RegTech offerings can significantly reduce manual compliance tasks. From automated suspicious activity monitoring (AML) to real-time transaction reporting, these tools cut down on human errors and speed up due diligence (KPMG 2023). Adopting RegTech enables compliance officers to shift focus from rote administrative tasks toward strategic analysis, ensuring a more holistic view of regulatory risks and opportunities.

Placing compliance specialists alongside product owners and developers in agile squads ensures that regulations are considered at every sprint and milestone. This integrated approach streamlines approval processes, as potential issues are addressed incrementally rather than at the end of a project (Deloitte 2024). Agile compliance teams can also adapt quickly to new mandates or unexpected findings, refining specifications without derailing timelines.

Shaping regulation is often more effective than reacting to it. Banks that engage proactively in forums, participate in regulatory sandbox programs, or join industry associations can share technological insights with legislators, leading to more balanced, innovation-friendly mandates (PwC 2023). This collaboration helps policymakers appreciate real-world technical constraints, while banks gain early visibility into forthcoming regulatory directions—an invaluable advantage in strategic planning.

Conducting simulations for potential regulatory or risk events—like sudden liquidity constraints or new data sovereignty laws—prepares banks to pivot rapidly. These exercises highlight operational gaps, resource constraints, or system vulnerabilities before they escalate into compliance crises (Johnson 2022). Regular scenario testing also reinforces a risk-aware culture, encouraging staff at all levels to remain vigilant.

Comprehensive training programs for employees—from IT and customer service to risk management—ensure that compliance principles pervade daily activities (McKinsey 2025). Embedding concise modules into onboarding or running periodic refresher courses keeps regulations top-of-mind. A well-informed workforce can spot anomalies sooner, propose risk-mitigating process improvements, and maintain consistent vigilance.

Tracking metrics such as the number of regulatory incidents, average time for AML checks, or audit pass rates offers a tangible read on compliance effectiveness (KPMG 2023). By presenting real-time dashboards or monthly scorecards to leadership, banks can identify underperforming areas, reallocate resources, or intensify training. Such data-driven approaches ensure that compliance functions remain agile and supportive of broader strategic goals.

7.7. Case Studies and Scenarios

Predicting the future of banking requires more than theoretical models; real-world case studies and scenario planning offer invaluable insights into how institutions can thrive amid volatility. By examining pioneering organizations—whether established banks, fintech disruptors, or tech conglomerates—leaders gain both inspiration and cautionary lessons. This section explores the philosophical underpinnings of learning from industry forerunners, conceptual approaches to scenario analysis, and practical checklists that enable banks to pivot, partner, and seize emerging opportunities.

Philosophically, case studies illuminate how certain institutions have survived—or even flourished—despite rapid shifts in technology, consumer expectations, and economic pressures (Deloitte 2024). Understanding the human elements behind these organizations—such as executive vision, risk tolerance, or cultural reinvention—provides a powerful template for adaptation. Failures can be equally instructive, revealing pitfalls like overreliance on legacy systems or misaligned incentives that erode transformative efforts.

While it is tempting to replicate the strategies of successful peers, pure mimicry can limit differentiation. Philosophically, best practices must be translated to local contexts, regulatory requirements, and corporate ethos (KPMG 2025). This adaptive mindset preserves authenticity, letting banks borrow proven methods while injecting their own strengths—whether a unique brand identity, specialized product offerings, or a particular geographic focus.

Organizations that flourish during disruptive phases often share a philosophical mindset: regardless of size or heritage, they remain humble, curious, and open to continuous experimentation (PwC 2023). This attitude is most visible in how they respond to early warning signals—be they evolving consumer preferences, sudden regulatory announcements, or emergent technologies. By embracing disruption as a natural part of progress, these institutions develop resilient cultures that learn and iterate before crises escalate.

The most enduring case studies highlight a broader purpose than short-term profit. Philosophically, these pioneers acknowledge the socio-economic influence of banking, striving for financial inclusivity, responsible data handling, and transparent pricing (Smith 2022). By aligning commercial interests with ethical imperatives, banks can differentiate themselves through trust and credibility, building relationships that transcend transactional loyalties.

The idealized future might feature widespread implementation of AI for personal finance management, seamless open banking standards facilitating cross-border operations, and robust quantum-safe infrastructures mitigating cyber threats (McKinsey 2025). Conceptually, in such a scenario, banks achieve near-real-time personalization, forging partnerships with fintechs to deliver integrated, global customer experiences. Revenue streams multiply as institutions expand beyond traditional offerings into ecosystem-driven services.

Conversely, economic recessions, punitive regulatory clampdowns on digital currencies, or sweeping cybersecurity breaches may stall innovation and strain legacy systems (KPMG 2025). Major global events—such as data leaks or liquidity crises—could erode consumer confidence overnight. Conceptually, prudent preparation includes robust business continuity strategies, strong liquidity buffers, and flexible IT architectures capable of rapid reconfiguration when systemic risks materialize.

Realistically, most banks will experience incremental technology adoption—such as partial cloud migrations and selective open banking alliances—punctuated by occasional disruptions tied to regional economic shifts or new data protection mandates. Conceptually, institutions that balance near-term operational optimization with readiness for mid-level crises (data legislation changes, local recessions) remain well-positioned. These banks pursue continuous improvement while strategically investing in emerging opportunities.

Whether forecasting competitor moves or gauging regulatory landscapes, a structured framework systematically charts drivers (technology breakthroughs, regulatory shifts, consumer demands) and uncertainties (timelines, cost fluctuations). Conceptually, mapping potential outcomes—like changes in revenue mix or brand loyalty—enables data-driven decision-making. Scenario planning provides clarity on when to pivot resources, adapt product lines, or deepen strategic partnerships.

Technological leaps, macroeconomic developments, and shifts in consumer behavior seldom occur in isolation. Conceptually, robust scenario analyses link multiple domains—risk management, compliance overhead, brand health—to identify cascading impacts. For instance, adopting AI-based credit assessment could simultaneously reduce default rates, invite regulatory scrutiny, and demand new skill sets in data science.

Banks can maintain agility by establishing rapid prototyping capabilities, such as MVP pipelines and DevOps toolchains, which enable swift iteration of ideas. Forming cross-functional “tiger teams” for crisis response—whether tackling policy changes or cybersecurity breaches—further bolsters preparedness. Real-time KPI tracking, focused on time-to-market and user adoption, ensures proactive course corrections. These measures aim to let banks quickly realign strategies in response to emerging market opportunities or unexpected threats (PwC 2023).

Collaboration hinges on clear governance structures, including steering committees and well-defined risk-sharing agreements. Robust API strategies guarantee secure, standardized data integration and facilitate streamlined operations. Aligning KPIs for joint offerings—covering feature usage, cross-platform retention, and compliance—promotes synergy between partners’ strengths while reducing duplicative efforts. The overall objective is to accelerate innovation cycles and time-to-market, creating ecosystems that amplify value for both partners (Smith 2022).

Continuous market intelligence, tracking AI breakthroughs, digital currency trends, and consumer finance app adoption, informs scenario-based product roadmaps that outline short-term pilots, medium-term expansions, and long-term bets. Ensuring technical readiness through cloud infrastructure, data analytics expertise, and robust compliance measures allows banks to rapidly transition from concept to production. The end goal is to secure early-mover advantages and cultivate deeper customer loyalty before competitors can catch up (Deloitte 2024).

Regular scenario planning workshops at the leadership and operational tiers foster a proactive response to evolving conditions. Ongoing skill development in AI, machine learning, cloud computing, data ethics, and compliance helps maintain a future-ready workforce. Innovation funds or contingency budgets support emerging ideas uncovered by scenario analyses, allowing the bank to scale effectively during boom cycles or endure downturns without losing strategic momentum (McKinsey 2025).

Compiling internal case studies on successful pivots or partnerships clarifies success factors and cautions against recurring pitfalls. Periodic updates to organizational playbooks ensure alignment with regulatory shifts, market realities, and advancements in technology. Emphasizing knowledge sharing—through internal conferences, wikis, or seminars—transforms individual achievements into collective wisdom. This approach integrates best practices into daily operations, weaving resilience and adaptability into the bank’s broader strategic framework (KPMG 2025).

7.8. Measuring Long-Term Success and Preparing for the Unknown

In an era of accelerating disruption—where emerging technologies, shifting regulations, and unforeseen global events routinely challenge established norms—the true mark of a bank’s resilience lies in its readiness to adapt. Planning for what is known is only part of the equation; enduring success also hinges on cultivating an organizational mindset prepared to pivot when the unexpected occurs. This section examines the philosophical importance of embracing uncertainty, proposes conceptual metrics that capture “futures readiness,” and details practical measures like scenario simulations and innovation health checks that keep the bank agile for tomorrow’s challenges.

Philosophically, resilience is tested in the face of disruptions that go beyond what a five-year plan or even advanced analytics can predict (McKinsey 2025). Recognizing that not all risks can be enumerated shifts the focus from static plans to dynamic capabilities—such as agility, rapid learning loops, and collaborative problem-solving. This acceptance of unpredictability heightens the organization’s vigilance for early warning signals and its capacity to improvise solutions under time pressure.

A single overhaul of legacy systems or introduction of a new product line may score short-term wins, yet ongoing evolution is essential for sustained competitiveness (Deloitte 2024). Rather than treating transformation as a box to tick, banks should embed adaptive behaviors throughout every level. Philosophically, this approach rejects complacency and encourages employees to expect, embrace, and even welcome continuous change as part of daily operations.

Because banks serve not only their customers but the broader economic system, anticipating future disruptions carries moral weight. Inadequate preparation could compromise financial stability, personal livelihoods, or community welfare (PwC 2023). Philosophically, thinking ahead and building robust, forward-facing infrastructure demonstrates responsible stewardship—ensuring that the bank’s evolution remains in step with societal and regulatory expectations.

While near-term metrics like quarterly profits or cost-to-income ratios reflect operational health, genuine longevity depends on preparing for evolving market conditions (KPMG 2023). Whether that means exploring quantum-safe cryptography, anticipating new compliance frameworks, or retraining staff in AI-driven risk modeling, a forward-looking posture weaves innovation and resilience into the bank’s very identity.

Conceptually, “futures readiness” gauges how swiftly and effectively a bank can respond to emerging conditions, whether driven by regulatory changes, competitive technology breakthroughs, or shifts in the broader economy (McKinsey 2025). By measuring tangible factors such as the time required to reallocate resources or initiate pilot projects, banks transform agility from a theoretical notion into a concrete metric. Other useful indicators include the innovation pipeline volume—encompassing proofs of concept, experiments, or advanced prototypes under development—staff training completion rates, which track certification in critical skills like DevOps, blockchain, and AI, and hackathon outputs, quantifying the number of viable ideas generated, tested, or incubated in-house.

Financial metrics—profit margins, Net Interest Margin (NIM), or Return on Equity (ROE)—remain indispensable, but pairing them with “innovation-centric” measures delivers a more holistic view (KPMG 2023). Conceptually, this balanced approach ensures short-term profitability does not overshadow the strategic investment in emerging capabilities. By reporting both sets of KPIs side by side, leadership highlights a commitment to near-term performance and long-term evolution.

Frameworks that quantify organizational competence in areas like AI-driven customer analytics, cloud-native development, or open banking partnerships enable banks to chart their journey toward advanced proficiency (Deloitte 2024). Regular assessments expose gaps in infrastructure, skills, or processes—prompting targeted interventions or strategic alliances. Conceptually, bridging these gaps steadily moves the bank closer to market-leading maturity.

Beyond raw metrics, banks can track how well the internal environment nurtures creativity and experimentation (PwC 2023). Employee surveys could reveal comfort with risk-taking, cross-functional collaboration, or shared accountability for failures. Combined with project-level data (like the ratio of initiatives that go from pilot to full deployment), these indicators reflect both the cultural capacity for innovation and real-world outcomes.

Conducting monthly or quarterly checkpoints, along with in-depth annual evaluations, allows an executive steering committee or transformation office to measure progress on futures readiness metrics—such as time-to-pivot and pilot success rates—while monitoring for external disruptions. These reviews ensure that objectives remain aligned with changing market realities and enable strategic adjustments to technology roadmaps, resource allocations, and risk postures (Deloitte 2024).

Institutions can organize structured drills that simulate sudden economic downturns, regulatory upheavals, or disruptive technological developments. Cross-functional “tiger teams” then propose contingency plans and identify weaknesses in governance or IT infrastructure (McKinsey 2025). This process sharpens institutional reflexes, promotes cohesive responses under pressure, and highlights areas that require immediate corrective action or more significant investment.

Banks benefit from periodic evaluations of new project portfolios, examining everything from ideation and MVP development to full-scale deployment. A dedicated innovation council or PMO gathers insights on user adoption, pilot-to-product conversion rates, and factors leading to project discontinuation (KPMG 2023). By offering a transparent view of the institution’s capacity to produce market-ready ideas, these health checks guide decisions about which initiatives deserve increased resources or strategic redirection.

Regularly assessing the bank’s talent pool, infrastructure maturity, and budget allocations ensures readiness for upcoming demands, whether that means AI-driven lending solutions or blockchain-based settlement platforms. This involves running skill gap analyses, evaluating IT capabilities, and earmarking financial reserves specifically for research and development (PwC 2023). Identifying deficiencies early enables timely hires, retraining efforts, and strategic fintech partnerships, minimizing the impact of market shifts.

Leadership and board committees must remain flexible by forming new working groups to address emerging concerns—such as quantum readiness or ESG compliance—while dissolving outdated oversight mechanisms. Governance charters that permit the rapid creation or discontinuation of committees allow for responsiveness to shifting priorities (KPMG 2023). Such adaptability reinforces robust oversight that evolves in tandem with external dynamics, ensuring alignment between high-level strategies and operational practices.

7.9. Anticipating Impacts of Indonesia Joining BRICS

Indonesia’s prospective entry into BRICS (Brazil, Russia, India, China, South Africa) carries implications that extend well beyond trade alliances; it has the potential to transform the landscape of the nation’s financial sector. Government-owned banks, in particular, occupy a pivotal position: they must balance commercial objectives with developmental mandates while preparing for new patterns of capital flow, trade expansion, and strategic alliances. This section outlines how these banks can brace for the complexities and opportunities arising from BRICS membership, leveraging regulatory guidance from the Financial Services Authority (OJK), the Ministry of State-Owned Enterprises, and global best practices to ensure resilience and inclusivity.

As principal financial agents for the Indonesian government, these banks have a wider social obligation. Potential BRICS membership can catalyze increased bilateral and multilateral partnerships in areas such as infrastructure financing, commodity exports, and emerging digital technologies (Deloitte 2023). Yet, because stability in a reconfigured global market environment can no longer rely solely on traditional risk assumptions, a flexible, futures-oriented mindset becomes paramount. These banks must remain proactive, envisioning new ways to serve national priorities—such as SME empowerment, affordable housing, or public welfare projects—while safeguarding balance sheets and regulatory compliance.

Striking a balance between caution and innovation underpins this responsibility. Strong governance mechanisms and robust risk assessments must coexist with willingness to explore novel cross-border collaborations. Philosophically, state-owned banks should neither retreat from potentially transformative partnerships nor proceed blindly without evaluating geopolitical and commercial ramifications. Viewing change as an opportunity, they can seize prospects for growth in export financing, syndicated loans, and digital banking services that align with the nation’s macroeconomic objectives (KPMG 2025).

Central to managing the BRICS realignment is the creation of “readiness” metrics tailored to each bank’s scale, product portfolio, and risk appetite. Monitoring shifts in bilateral trade volumes, cross-currency positions, and inbound foreign investments from BRICS countries transforms geopolitical uncertainty into observable data points (Smith 2022). These indicators allow government-owned banks to forecast exposure to new economic corridors, regulatory frameworks, or political tensions.

In addition, diversifying services and credit portfolios based on anticipated changes in sectors like infrastructure, commodities, or digital finance offers a strategic hedge. For instance, deeper engagement in trade finance with BRICS partners may not only capture new revenue streams but also buffer institutions against localized economic slowdowns. Meanwhile, variable regulatory regimes among BRICS members necessitate region-specific compliance protocols and advanced KYC/AML techniques—underscoring the need for upgraded analytics and automated risk management solutions (McKinsey 2025).

Regular scenario drills focused on BRICS-specific possibilities—tariff realignments, novel capital controls, or heightened competition from foreign state-owned banks—help refine strategic agility (Deloitte 2023). By mapping out best-case, worst-case, and moderate scenarios, government-owned banks can adjust their capital adequacy plans, liquidity reserves, and internal structures to weather unforeseen shocks or exploit emergent openings.

Establishing periodic executive committees or leadership councils that examine BRICS-related developments ensures agile decision-making. Meeting quarterly or biannually, these forums can track evolving FDI trends, currency fluctuations, and trade policies, then reallocate resources or reprioritize projects as necessary (KPMG 2025). This arrangement guarantees that ongoing transformation initiatives remain aligned with real-time shifts in external conditions.

Government-owned banks can jointly launch pilot programs with financial institutions in other BRICS nations to test cross-currency hedging instruments, digital payment platforms, or alternative financing models. By employing sandbox environments governed by reciprocal compliance standards, they reduce regulatory friction while encouraging innovation (Smith 2022). Participation in such initiatives not only underscores Indonesia’s regional leadership but also fortifies crucial relationships with counterpart entities.

Operating in more diverse economic and cultural terrains necessitates talent adept in international finance, multi-currency lending, and cross-border compliance. Structured rotations, specialized training, or secondment programs in partner BRICS nations can nurture this expertise (PwC 2024). A skilled and culturally aware workforce ensures that government-owned banks can seize emerging opportunities effectively while upholding strict governance standards.

In light of potential currency volatilities or sectoral shocks linked to BRICS realignments, robust capital buffers and broadened funding channels become imperative. Reexamining risk appetites, credit policies, and internal auditing practices allows banks to adapt swiftly to evolving exposures (McKinsey 2025). Agile governance frameworks—encompassing cross-functional risk committees and timely escalation protocols—reinforce the ability to maintain stability amid global turbulence.

Finally, clear communication with regulators, stakeholders, and employees about BRICS-focused initiatives cultivates confidence and strategic alignment. Publishing periodic updates—covering progress on collaborative pilots, newly identified risks, and revised growth targets—assures accountability (Deloitte 2023). Establishing knowledge-sharing platforms and seminar series further embeds a learning culture, ensuring that insights from cross-border ventures permeate the organizational fabric and enhance collective readiness.

Indonesia’s move toward BRICS membership stands to redefine the global reach of its government-owned banks, presenting both unprecedented access to new markets and heightened vulnerabilities. By carefully blending national developmental objectives with flexible strategic thinking, these institutions can convert geopolitical shifts into sustained advantages. Relying on robust data metrics, scenario analyses, and deeply embedded risk governance frameworks, government-owned banks can serve as anchors of economic resilience and engines of innovation. In doing so, they reinforce their commitment not only to shareholders but to Indonesia’s broader social and economic agenda, showcasing the role of state-financed banking in shaping a stable, prosperous future on the global stage.

7.10. Conclusion

In conclusion, the pathway to long-term success in banking IT is paved by perpetual innovation and the readiness to pivot whenever new challenges or opportunities arise. By merging strategic foresight with robust cultural foundations, leaders ensure their organizations remain nimble in the face of technological breakthroughs, regulatory shifts, and evolving customer demands. Now is not the time to pause—it’s the time to boldly invest in future possibilities, secure strong partnerships, and maintain the curiosity that propels continuous transformation. IT professionals are called to champion this forward-looking ethos, embedding a cycle of renewal and resilience that will keep their institutions competitive for years to come.

7.10.1. Further Learning with GenAI

These 20 prompts cover advanced strategies for banking IT leaders seeking to maintain a forward-looking posture, with deep dives into emerging technologies, risk management, scenario planning, and innovation-driven metrics. Each prompt blends technical, strategic, and organizational considerations to ensure robust, comprehensive insights.

Examine the strategic, technical, and operational steps a traditional bank must take to integrate quantum computing into its service offerings. Include considerations of cryptographic resilience, hardware partnerships, regulatory compliance, workforce training, and incremental pilot phases that minimize operational risk.

Propose a multi-layer strategy that takes a bank’s existing open banking interfaces beyond regulatory compliance into an active ecosystem of partner integrations, data analytics, and revenue-generating services. Discuss cultural shifts, technical architecture, monetization models, and potential cybersecurity pitfalls.

Map out a phased approach to rearchitecting a bank’s core systems for cloud-native operation—detailing containerization strategies, microservices governance, and automated CI/CD pipelines—while safeguarding mission-critical reliability, ensuring compliance with data sovereignty rules, and managing third-party cloud vendor risks.

Outline a comprehensive framework for scenario planning that helps a bank anticipate and adapt to disruptive events such as AI-based neobanks, global economic downturns, and regulatory overhauls. Include methods for continuous scanning, stakeholder engagement, data-driven forecasting, and agile resource reallocation.

Describe how banking IT leadership can systematically cultivate the next generation of visionary leaders by embedding innovation mindsets, soft skills (e.g., adaptability, empathy, strategic thinking), and technical competencies (e.g., DevOps, data science) into targeted training, mentorship, and rotational programs.

Discuss how to implement a living innovation framework that regularly feeds emerging ideas into pilot projects, scales successful experiments, and retires underperforming initiatives quickly. Address funding mechanisms, governance structures, and methods for aligning these innovation cycles with long-term corporate goals.

Explore how big data, AI, and behavioral analytics can power hyper-personalized banking services—from tailored product recommendations to location-based offers—while addressing data privacy regulations, ethical considerations, and evolving customer expectations in a mobile-first marketplace.

Analyze best practices for co-developing financial products and platforms with fintech startups, big tech players, and industry consortia. Detail how to structure co-innovation agreements, manage IP rights, navigate multi-jurisdictional regulations, and maintain brand integrity through each partnership phase.

Detail a robust cybersecurity strategy that anticipates quantum-safe encryption, AI-driven fraud, and evolving data privacy regulations. Propose methods—like penetration testing, zero-trust architectures, and continuous compliance monitoring—to ensure a bank’s defense posture remains effective amid ongoing disruptions.

Articulate a framework for quantifying and attributing ROI to forward-looking initiatives such as quantum pilots, open banking ecosystems, or advanced analytics. Include how to segment short-term gains (efficiency, risk reduction) from long-term impacts (market share, new revenue streams), ensuring transparent reporting to executives and shareholders.

Examine strategies for retraining and upskilling staff accustomed to legacy technologies—like COBOL, mainframe batch processing—to excel in cloud-native, AI, and DevOps environments. Highlight motivational tactics, certification paths, and methods for overcoming cultural resistance or fear of job displacement.

Propose a plan for multinational banks to manage disparate regulations in areas such as open banking, data residency, and digital identity across multiple jurisdictions. Outline how technology can streamline compliance, and recommend negotiation tactics or consortium engagements to drive standardization.

Investigate the feasibility of transforming core banking platforms into modular, API-driven systems that can quickly integrate with emerging tech—such as blockchain settlements or AI-driven underwriting. Include architectural principles, vendor selection criteria, and strategies for incremental rollout that minimize risk.

Critically assess how AI ethics—covering algorithmic fairness, transparency, and accountable decision-making—can be embedded into a bank’s product development lifecycle. Offer concrete guidelines for data governance, bias audits, customer consent, and regulatory communication to uphold public trust in automated lending and advisory solutions.

Detail the leadership practices, incentive structures, and internal communication channels required to ensure that a newly transformed bank doesn’t revert to risk-averse habits. Address how to maintain experimentation budgets, celebrate small ‘failures,’ and preserve agile values amid daily business pressures.

Analyze how advanced data analytics, real-time monitoring, and AI-driven pattern recognition can transform risk assessment and fraud detection in the banking sector. Propose a layered approach that unifies insights from cybersecurity, compliance, and customer behavior, while enabling rapid model updates to stay ahead of emerging threats.

Examine potential roles for traditional banks in a DeFi-dominated future, detailing how centralized institutions might leverage decentralized protocols for liquidity, asset tokenization, or cross-border lending while managing counterparty risk, regulatory scrutiny, and integration with legacy systems.

Propose an adaptive governance model—possibly involving rolling strategic reviews, cross-functional innovation councils, and real-time performance dashboards—that can proactively adjust to market signals and tech disruptions, ensuring the bank’s strategic direction remains fluid yet coherent.

Explore how multiple disruptions (quantum computing, AI, DeFi, open banking) might converge to reshape the traditional banking value chain. Propose new business models—like banking-as-a-service (BaaS), specialized digital marketplaces, or platform banking—and outline potential monetization strategies for each.

Forecast how customer experience might evolve in the coming decade—through augmented reality, voice-based transactions, or autonomous finance agents—and suggest how banks can prepare now, including the technology stack, skill sets, and cultural shifts needed to deliver frictionless, personalized services.